The CFTC has approved spot cryptocurrency trading on U.S. exchanges, opening a new era of regulated digital asset markets under federal oversight.

Trading Exchange RSS

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Alphabet is back in focus after a Bloomberg report indicated rising investor confidence in its in-house semiconductor strategy. Interest in the company’s tensor processing units (TPUs) is reshaping expectations for future revenue and altering market sentiment. Many investors now see the chip program as a potential long-term growth driver, not just a tool used within Google Cloud.

After weeks of volatility, Bitcoin is showing signs of settling, with analysts noting cautious optimism and the possibility of a year-end rally.

The GENIUS Act brings long-awaited clarity to U.S. stablecoins but deepens the regulatory divide with Europe, creating fragmented liquidity pools and raising concerns about cross-border stability and settlement friction.

Supported by record inflows into spot ETFs and favorable technical setup, Ethereum quietly outperforms bitcoin. As flows shift and retail interest rises again, a turning point is happening. Is the trend changing permanently?

The International Monetary Fund steps out of its usual reserve and publishes a detailed guide on stablecoins. As the market exceeds 300 billion dollars, the institution believes that regulation alone will not be enough. What strategy does it really advocate?

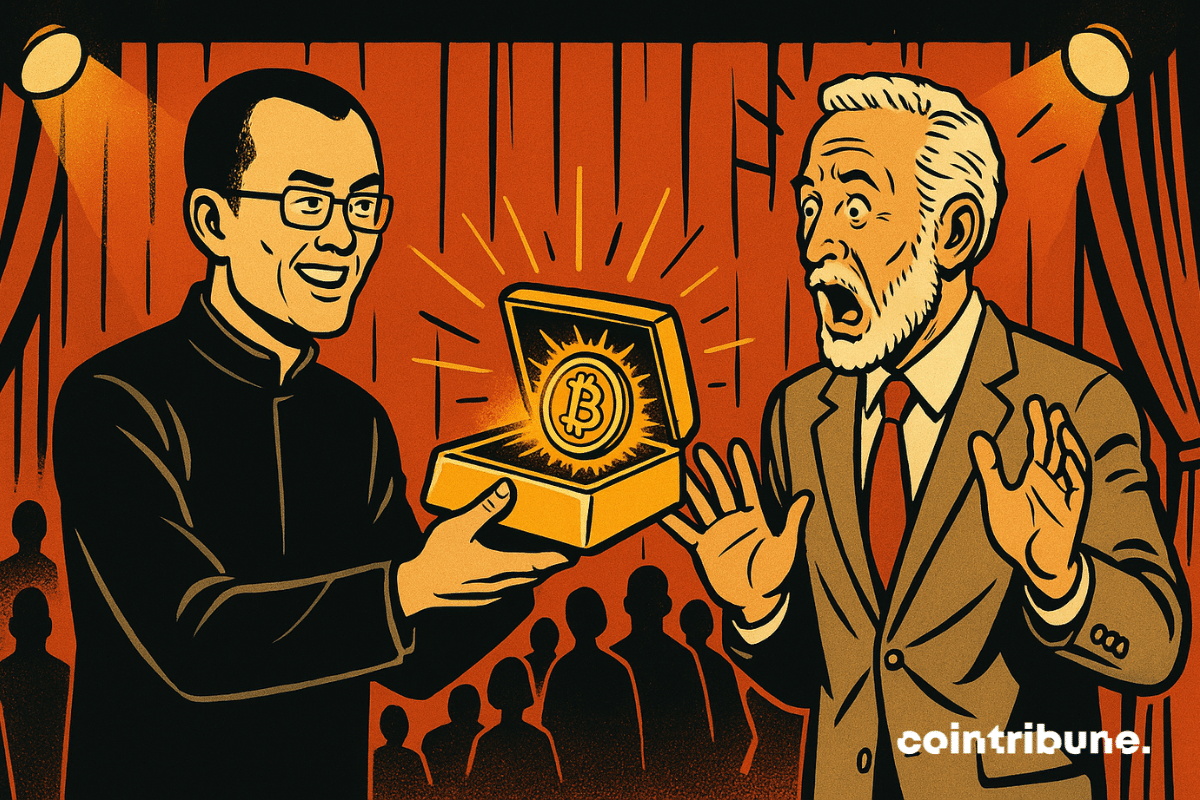

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied: "I don't know." A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

The European Union wants to entrust ESMA with a key role in crypto supervision. With MiCA, an ambitious reform is taking shape, balancing enhanced security and concerns about innovation. This extension of powers could change everything for investors and platforms. Essential details to know.

The sharp rejection of the $93,500 threshold this Thursday cooled the enthusiasm of a market seeking bullish confirmation. This level was expected as a symbolic pivot before a key Federal Reserve deadline. Far from a simple technical pullback, this retreat triggers doubts about BTC's ability to start a sustainable rally, in a climate where every economic figure weighs on monetary expectations.

Grayscale's Chainlink ETF recorded $41 million in inflows on its first day, an impressive figure at first glance. Yet, experts are already talking about disappointment. Why does this launch, despite being solid, fail to convince? Analysis of a "blockbuster" that did not live up to its promises.

While Bitcoin is leading a new rally, Solana sends a much more puzzling signal: capital is exiting ETFs but continues to flow on the blockchain. On one side, 21Shares sees its TSOL crypto ETF lose $42M. On the other, over $321M redeploy directly on-chain on Solana. An apparent contradiction that says a lot about the real state of the market.

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

As speculative frenzy once again takes hold of the cryptocurrency market, the SEC decides to put a firm brake on excesses. By targeting the most aggressive leveraged crypto ETFs, the regulator sends a clear signal: the era of "x5" products sold to the general public without genuine safeguards is reaching its limits. Between the desire to regulate innovation and the necessity to protect investors, a new red line is being drawn in the crypto ecosystem.

Connecticut has just taken strong action against three giants of digital finance. Kalshi, Robinhood, and Crypto.com find themselves in the authorities' sights for offering unlicensed sports betting. An offensive that could reshape the emerging online prediction market.

Crypto mergers and acquisitions reached $8.6 billion in 2025, with Coinbase, Ripple, and Kraken among the major firms expanding their operations.

Polymarket has entered a new phase of expansion as its US relaunch begins after years away from the domestic market. According to recent reports, the platform is moving quickly to bring waitlisted users into its updated app, starting with sports event contracts. Regulatory clearance arrived earlier this year, opening the door for a compliant return.

Former SEC Chair Gary Gensler rehashed debate over digital assets in a Bloomberg interview, saying Bitcoin stands apart from the rest of the crypto market. He warned that most tokens still act as speculative bets with little support behind their valuations, setting a cautious tone for investors.

Larry Fink, CEO of BlackRock, acknowledged a change of stance on bitcoin. Long critical of cryptos, he now says he has revised his strategy. At the DealBook Summit organized by the New York Times, he mentioned a notable evolution in his perception of the asset. A symbolic shift, which also reflects the gradual adjustment of the institutional view on cryptos.

When Ethereum no longer inspires companies, BitMine feasts, the small ones die... and the crypto market wonders: is it a pause or the end of recess?

Bitcoin is changing dimension. For the first time since its creation, it is establishing itself as a pillar of institutional allocation. According to a joint analysis by Glassnode and Fanara Digital, $732 billion of new capital has been injected since the 2022 low, an absolute record surpassing all previous cycles combined. This massive flow does not reflect mere temporary euphoria but signals a structural market shift. Bitcoin is no longer merely speculative; it becomes a strategic asset in institutional portfolios.

Strategy, the Bitcoin giant, has suddenly slowed its purchases: only 130 BTC in December 2025, compared to 134,000 in 2024. A worrying turnaround or a brilliant tactic? After a last massive purchase of 8,178 BTC in November, the market wonders: should we fear a collapse or prepare for a historic rebound?

The Ethereum Fusaka update is finally active, marking a historic turning point for the blockchain. With faster transactions, reduced fees, and unprecedented scalability, this evolution could redefine the future of crypto. Discover in detail the immediate changes and their impacts on the Ethereum ecosystem.

As Bitcoin passes through a new turbulence zone, Michael Saylor finds himself at the heart of a decisive showdown with MSCI. Threat of exclusion from indices, pressure from institutional investors, and massive exposure to the king asset: his bet on Bitcoin is more tested than ever.

Driven by the inflow of institutional capital, the crypto market seemed to stabilize. However, a wave of liquidations on derivative products highlights its fragility. According to Glassnode, these liquidations have nearly tripled, a consequence of excessive leverage now under strain.

Binance redistributes roles: Yi He takes the stage. Should crypto investors rethink their strategy? Details here!

US regulators are easing rules for crypto, giving firms a supervised path to launch new blockchain products in 2026.

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

Bet on the victory of a candidate or a token from your crypto wallet? Trust Wallet believes in it strongly... If you don't win, at least you will have guessed the news.

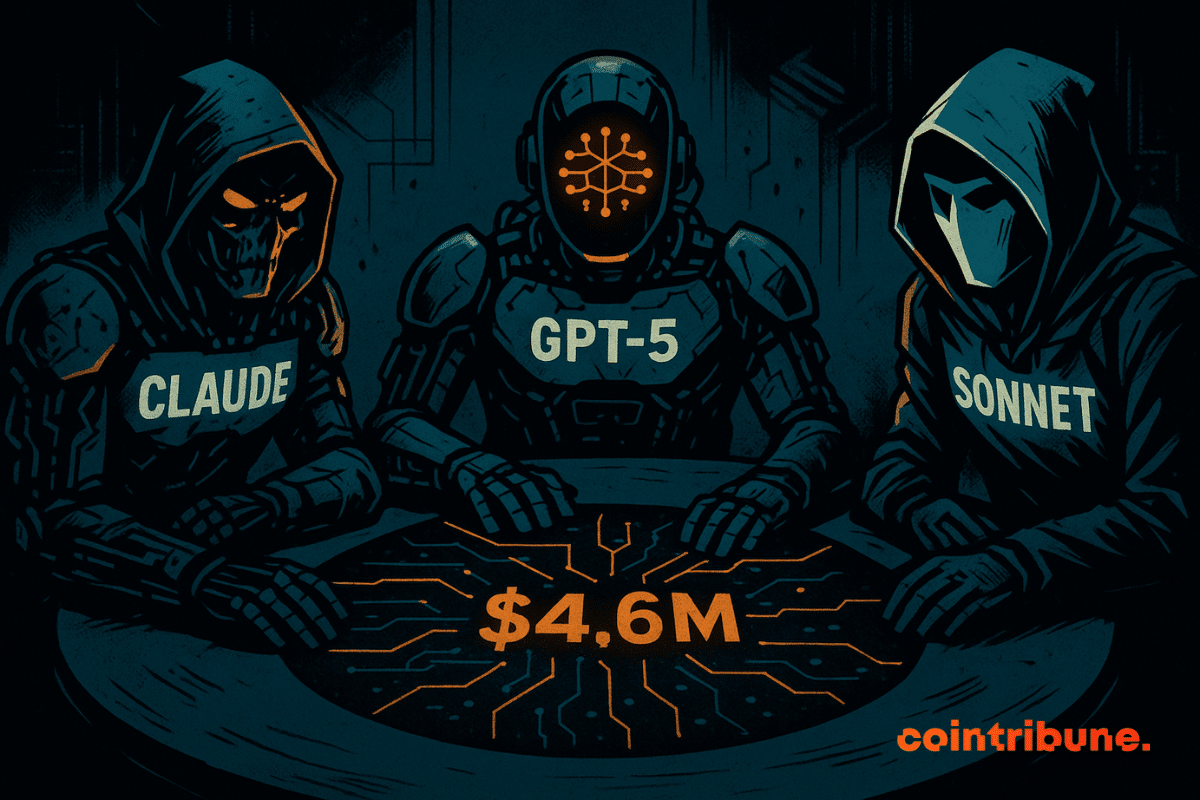

Once reserved for human hackers, crypto scheming has found its master: AI, which digs the hole... directly into decentralized wallets, without asking for permission!