The Iraqi government will ban all cash withdrawals and transactions in US dollars starting from January 1, 2024.

Trading Exchange RSS

Following the FTX incident, Binance opted for transparency to maintain the trust of its hundreds of millions of users. Thus, in November 2022, the crypto giant engaged Mazars, an international auditing firm, to facilitate access to reliable data concerning customers' holdings in BTC, ETH, USDT, and more. In early October, Binance released its 11th Proof-of-Reserves (PoR) report. Details follow.

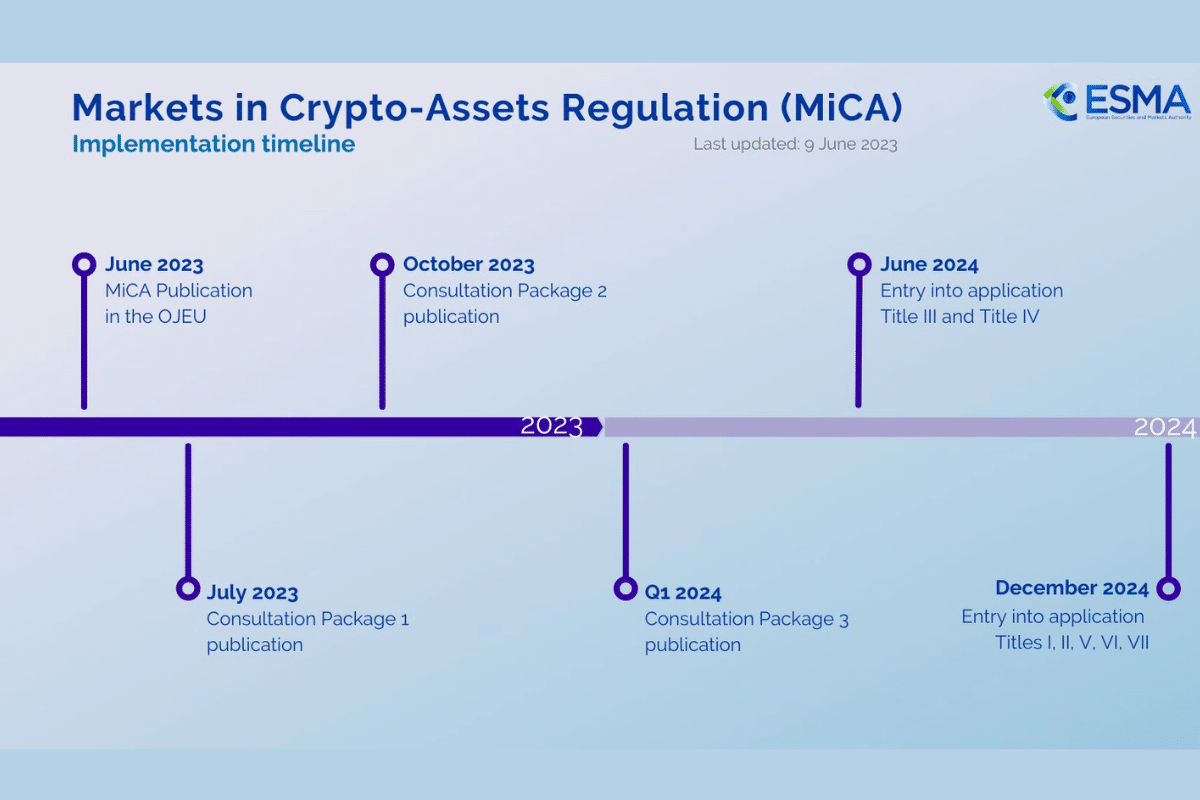

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.

One Step Forward, Two Steps Back: SEC Approves Bitcoin/Ethereum Futures ETFs, but Remains Cautious on Bitcoin Spot ETFs. Crypto Community, Financial Institutions, and U.S. Officials Grow Impatient. When Will Gary Gensler's Team Decide on Bitcoin Spot ETFs? A Former BlackRock Executive Shares Insights.

In an interview with Bitcoin Magazine, a candidate in the U.S. presidential election once again expressed his support for Bitcoin.

No cryptocurrency transaction should go unnoticed by the Bank for International Settlements (BIS), as they develop a suitable system to track cryptocurrency exchange flows throughout the European territory. Several European central banks have joined them in this initiative. Let's take a closer look!

Accusations against SBF, the former CEO of crypto exchange FTX, continue to make headlines. And one thing is certain, the case won't calm down anytime soon, especially when Michael Lewis adds fuel to the fire. According to his statements, it seems that the relationship between Binance and FTX has never been smooth. Why?

The crypto community continues to closely monitor the legal battle between Ripple and the SEC. The reason is simple: the outcome of this legal saga will be crucial for the cryptocurrency market. And precisely, some news could change the game definitively. At the very least, it hints at a victory for Ripple against the SEC.

Before November 2022, no one expected the American crypto exchange FTX, valued at over $32 billion, to meet such a tragic end. Colossal losses for the company, its creditors, and its founder Sam Bankman-Fried, investments worth thousands, if not hundreds of thousands, of dollars lost for its creditors (including individuals and institutions), plummeting cryptocurrency prices (Bitcoin, Ethereum, etc.). The toll is heavy. Now that the fallen young CEO of FTX is summoned to court to answer for his actions, we share some details that will send shivers down your spine.

An expert recently insinuated that the Binance exchange may have contributed to the downfall of the high-profile FTX exchange, a story that has been making headlines. This allegation has sent shockwaves through the crypto community, prompting responses from John Deaton, Ripple's lawyer, and Changpeng Zhao (CZ), the founder of Binance.

Global financial regulators are increasingly concerned about the rapid growth of the cryptocurrency market. The International Monetary Fund (IMF) has just proposed a matrix for assessing national-level cryptocurrency-related risks to countries worldwide. This was on September 29th. Details follow.

Since Grayscale's recent victory over the SEC, the potential approval of a Bitcoin ETF has piqued the hopes of the crypto community. A recent rumor on the matter seems to fan these hopes even further. However, it remains to be confirmed.

Vitalik Buterin, who had recently engaged in extensive discussions about the possibility of integrating even more features into Ethereum, has once again made waves in the cryptosphere. In his view, Ethereum staking pool operator DAOs could be the source of a major systemic crisis. Let's take a closer look!

Did Binance exacerbate the situation as FTX showed signs of fragility? That's what Nir Lahav and his group believe, and they didn't hesitate to file a class-action lawsuit accusing CZ and Binance of contributing to their competitor's downfall through their November tweets.

A New Twist in the FTX Saga! Less than 24 hours before the start of his trial, Sam Bankman-Fried, the former CEO of the crypto exchange, is once again implicated in a suspicious affair. The fallen crypto king allegedly considered preventing Donald Trump from running in the presidential elections. And SBF was reportedly willing to dig deep into his pockets to buy the American statesman, according to the latest revelations.

October starts off on a high note for cryptocurrency enthusiasts. We're referring to the sudden rally that is currently propelling Bitcoin and Ethereum to new highs. Dubbed 'Uptober,' this unexpected surge is triggering optimistic forecasts within the crypto community. Leading up to it, the market has seen over $70 million in liquidated crypto shorts in just a matter of hours.

From the surprising cyberattack faced by Huobi, to the mounting pressure on the SEC regarding the approval of the Bitcoin ETF, and the bold initiative by NASA to use blockchain to authenticate its moon landings – the week has been full of twists and turns. And that's just a glimpse. Let's dive into these stories and more to start this new week with a clear view of the crypto horizon!

VanEck anticipates that its request for the deployment of an Ethereum ETF futures will receive approval from the SEC in the near future. This prediction is accompanied by an extensive charm offensive aimed at the crypto community. Recently, VanEck has made a commitment to donate a portion of its profits derived from its ETH ETFs to Ethereum. Details!

The European Union is to fork out nearly €1 million (in fiat or crypto?) to assess the environmental impacts of cryptocurrencies and bitcoin mining activities. Does this mean that Brussels prefers strict regulation of these activities to the ban? In any case, crypto-enthusiasts will be sure to follow the progress of this study, especially the publication of the first reports. The fate of bitcoin mining and crypto activities in Europe will in fact depend on it.

In a frantic race of crypto ETFs, Valkyrie Investments, already renowned for its Bitcoin Mining ETF, has once again eclipsed its competitors. The firm proudly presents the first Ethereum ETF in the US, reinforcing its pioneering status in the sector.

For several months now, PayPal has chosen to enter the world of cryptocurrency and blockchain. The major player in online payments has been launching innovative initiatives to establish itself in the crypto market. The latest crypto developments involve patent applications that would allow PayPal to dive deeper into the world of NFTs and blockchains.

During a congressional hearing, SEC Chairman Gary Gensler reaffirmed that Bitcoin is not a security. However, he refrained from categorizing it as a commodity, leaving doubts about the exact classification of this flagship cryptocurrency.

It's truly the end! Binance and PaySafe are now heading in opposite directions. But after the contract expiration, the cryptocurrency giant is struggling to find new banking partners in France. However, it appears that the crypto exchange may have found a solution to its problems.

The crypto arena is on the verge of a revolution. According to Bloomberg analysts, the first Ethereum Spot ETFs could make their debut in the U.S. market as early as next week.

No, it's not over yet! The ongoing dispute between Binance and the SEC seems far from reaching a resolution. However, it appears that BAM Trading and BAM Management, two entities of the crypto company, have been granted an extension to respond to court orders.

Tourmentée par des dizaines de milliers de sanctions infligées par l’Occident, la Russie, bourreau de l’Ukraine, n’a de choix que de se tourner vers les cryptomonnaies et les technologies connexes. Rouble numérique, plateforme nationale d’échange de devises numériques, DAO… forment actuellement un bouquet d’alternatives pour rehausser une économie russe en plein plongeon. Sauf que les États-Unis n’ont pas l’intention de lui faciliter les choses, même avec les cryptos. Washington n’hésiterait pas à faire pression sur Binance pour couper le pont entre les Russes et les actifs numériques. Détails !

While major international banks and other financial institutions have been embracing blockchain technology and cryptocurrencies for several months, HSBC had been content to observe, or even ignore them. But the saying goes, 'better late than never.' Thus, the $3 trillion asset banking giant has decided to make up for lost time. An alliance with the blockchain payment processor FC Pay has been established. The goal is to allow HSBC customers to pay their bills with cryptocurrencies like Shiba Inu, XRP, and more.

With over 100 million users, Binance easily claims the title of the world's largest cryptocurrency exchange. If CZ's exchange were to fall victim to the initiatives of U.S. regulators, others (Kraken, Coinbase, and the like) would melt away like snow in the sun. And apparently, the U.S. Department of Justice is preparing to launch an assault on this crypto behemoth with feet of clay.

In a climate of heightened anticipation, the crypto community eagerly awaits the SEC's verdict on Bitcoin spot ETFs. Several U.S. lawmakers, recognizing the significance of the matter, are actively urging the SEC to approve these ETFs without further delay.

It has been several months since the ECB unveiled its digital euro project, an announcement that continues to reverberate in the financial markets. A recent statement by Christine Lagarde, President of the ECB, has garnered particular attention from the crypto community. According to the ECB President, the digital euro (to be distinguished from a cryptocurrency) will not be anonymous. This revelation raises deep questions about privacy protection, and many analysts are also pondering the potential implications of this digital euro project on cryptocurrencies.