"""You are translator in the blockchain field"""

Trading Exchange RSS

Like a rocket, bitcoin is gradually approaching its All Time High from November 2021: 69,000 dollars. Currently, the flagship crypto oscillates between 41,000 and 42,000 euros. But this allows some analysts to predict a frenzied race towards other summits.

In recent weeks, all eyes have been on Ripple (XRP). In the ecosystem, most investors are anticipating an imminent explosion in the crypto's value, due to the developments in the ongoing lawsuit between Ripple and the SEC. Indeed, as discussions continue between the two parties, the XRP market is buzzing. XRP activity has reached a record high not seen since August. Details here.

The inimitable Max Keiser has restarted the rumor. Qatar is about to invest 500 billion in bitcoin. Just that…

Thanks to the use of blockchain and artificial intelligence, Rayn offers an innovative and novel formula for all its customers.

Bitcoin (BTC) is now cited as one of the most important assets in the global financial ecosystem. The latest figures show that this flagship cryptocurrency is so dynamic that it has managed to rank among the top 10 most strategic financial assets in the world, displacing some well-known financial giants.

Gold and Bitcoin are surging. While one mainly benefits from geopolitical tensions, the other gains from anticipation regarding ETFs and the halving event.

While the price of gold has reached a new record above $2,100 per ounce this week, the performance of the precious metal far surpasses that of Bitcoin. Whereas gold is entering unknown territory with a relatively stable dollar, Bitcoin still has to rebound more than 60% to surpass its previous peak.

Week after week, the crypto sector continues to innovate and redefine the boundaries of finance and technology with audacity and creativity. In this weekly recap, we will explore the most significant news of the past week.

This weekend, the price of Bitcoin (BTC) crossed the symbolic threshold of $40,000, reaching $40,846 on Sunday evening. This is its highest level since April 28, 2022. Fueled by optimism, the flagship cryptocurrency is beginning its return to the heights after over a year of turmoil.

Binance played the role of a catalyst for the rise of LUNC. The crypto exploded by 60% following an announcement from the exchange.

Like an ant, this institutional investor has alternated buying Ethereum at opportune times and has been rewarded handsomely. Indeed, since September, when ETH was trading between $1,500 and $1,600 per coin, this whale was able to amass a tidy sum of over 41,000 ETH. Imagine how much that is worth today, with ether valued at over $2,200.

For several years, cryptocurrencies have been experiencing a special growth that is reshaping the global financial ecosystem. This dynamic, which is in line with the times, was until recently largely hindered by the absence of regulation in the crypto sector. This situation posed risks of anarchy and led to certain catastrophic events in recent months. To address these concerns, the European Union (EU) has taken the lead by introducing its regulation on crypto-assets markets (MiCA). At a time when several analysts anticipate a bull run in the cryptocurrency market, many specialists believe that the MiCA law will be one of the catalysts for this momentum. Let us analyze this in light of the potential of unprecedented crypto regulation, soon to be fully operational.

Canadians would be disappointed with cryptocurrencies. According to the latest statistics, a significant number of them have regretted their investments in this digital asset. Details !

The fact that Changpeng Zhao (CZ) is facing the full force of U.S. law has not prevented him from sharing a poignant testimony about Bitcoin (BTC). The former CEO of Binance recounts how his decision, a decade ago, to invest his entire being into the flagship cryptocurrency, completely changed his life. However, he does not call on users to emulate him.

Major Jason Lowery of the US Space Force has just sent a passionate open letter to the Defense Innovation Board, an advisory body to the US Department of Defense, regarding Bitcoin. His aim: to convince the Pentagon to consider this cryptocurrency as a national strategic issue.

Bitcoin is on its way to the moon. Its recent performances have sparked unprecedented enthusiasm, leading to a dramatic increase in the number of addresses with a non-zero balance. Details !

As Solana, the “Ethereum killer”, reemerges after a tumultuous period, its spectacular progress against its historical rival reignites the debate: are we witnessing the beginnings of a paradigm shift in the crypto universe?

The Machiavellian origin of the petrodollar is no more. Henry Kissinger has passed away at the age of 100.

Is the future of Bitcoin in the hands of small investors? Indeed, 74% of holders have less than 0.01 BTC.

The Ripple vs SEC trial could soon come to an end. The two parties have met to discuss the terms of a settlement.

Elon Musk, the billionaire with quick wit, has just thrown his feelings in the face of advertisers who have interrupted their advertising campaigns on X. Feeling subjected to a kind of blackmail, the irritated entrepreneur throws away the cloak of political correctness and let loose. “Go fuck yourselves!” he shouted at the companies trying to “blackmail X”. It was on November 29th, during a conference organized by the New York Times in New York.

Everything is going according to plan for Standard Chartered Bank, which reiterated its April forecast that Bitcoin would reach $100,000 by the end of 2024.

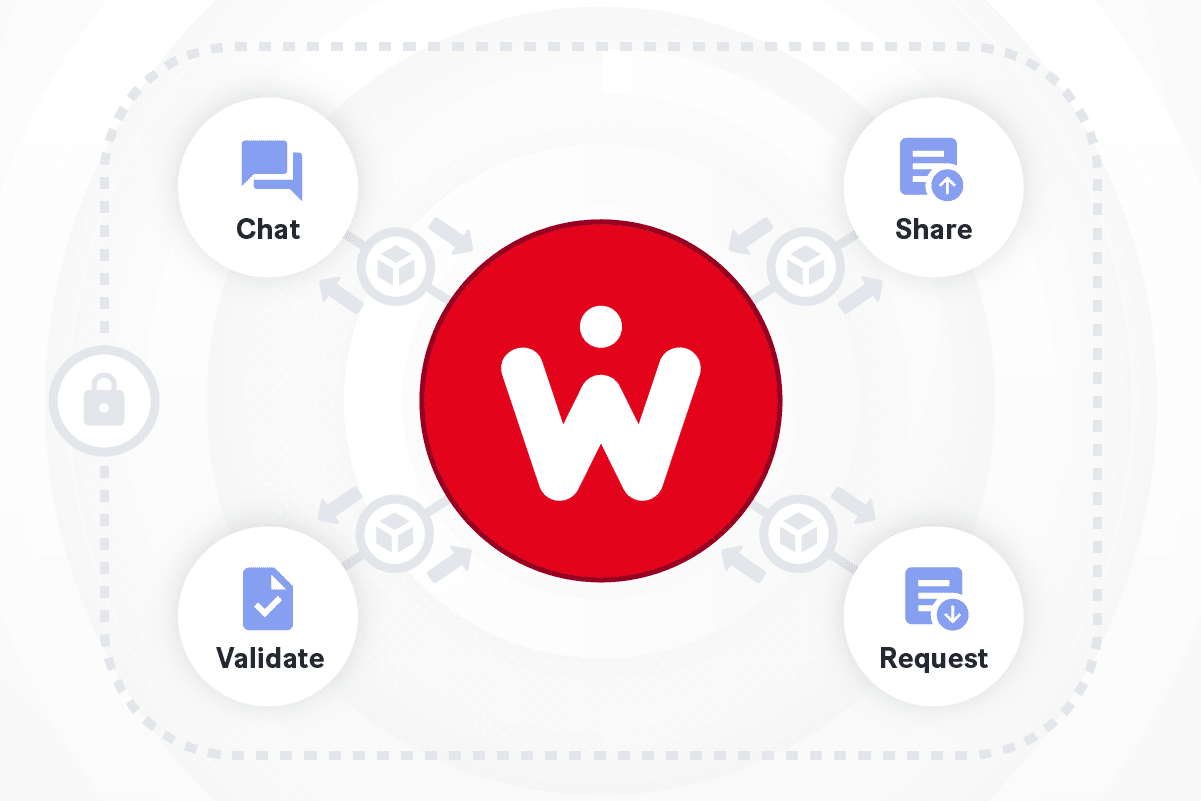

With the resurgence of the crypto market, supported by the approaching Bitcoin halving, investors are targeting the most interesting projects. The WECAN initiative, led by Swiss crypto company Wecan Group, is certainly one of them. As evidence, it has attracted a wave of savvy investors in an oversubscribed pre-sale at 115%, surpassing $1.8 million. Focus on the unique characteristics of the WECAN token, which will surely make it one of the top utility tokens of 2024.

"""You are translator in the blockchain field."""

Things are heating up between Venezuela and Guyana right now. The reason? Nicolás Maduro wants to reclaim Essequibo, a territory awarded to the British in 1899 following a “partial” decision by the judges of the time. Burdened by massive inflation, Venezuela needs to find other alternatives to get its economy back on track. And if that means the annexation of 2/3 of Guyana, where there are oil and other mineral resources, so be it.

A mysterious "whale" has been buying bitcoins without counting since the beginning of the month. This is an unmistakable sign.

While Chinese growth is faltering, Beijing is not hesitating to open the floodgates of fiscal and monetary stimulus in order to try to boost its battered economy. With credit easing, early distribution of local borrowing quotas, and massive issuance of government bonds, the Middle Kingdom is multiplying unprecedented expansionary measures. Objective: to regain vigorous growth by 2024.

A major transformation is shaking up Ethereum, making the global supply of crypto ETH deflationary. Decoding it!

Accused of promoting risky investments with Binance, Ronaldo finds himself the subject of a class action lawsuit. Details here!