These last days, several cryptos show a remarkable dynamism. This is the case of AVAX, the native crypto of the Avalanche company. This one saw its valuation explode by 79% in a week. Here's how this result was possible.

Trading Exchange RSS

BlackRock wants to make its Bitcoin spot ETF more accessible to Wall Street banks. The asset manager has indeed revised the functioning of its index fund to allow banking giants to participate in the Bitcoin market without violating the regulations they are subject to.

While making bitcoin (BTC) a legal currency in its territory, El Salvador worked to provide financial instruments favorable to this policy. The country has made progress in this direction, with the Digital Assets Commission (CNAD) approving the issuance of the world's first bitcoin (BTC) bonds.

Recently, the National Vulnerability Database (NVD) identified a critical vulnerability in Bitcoin Ordinals. However, Bitcoin Core developer Luke Dashjr denies any involvement in this matter. Details!

Driven by Bitcoin and Ethereum, cryptocurrencies are gaining momentum in Europe. According to a recent Bloomberg report, the old continent invested over $43 million in crypto funds last week. This enthusiasm contrasts with American and Asian skepticism.

Senator Elizabeth Warren has introduced a bill that would impose heavy regulations on the crypto industry. While the bill aims to combat money laundering, it raises concerns about its potential impact on innovation and privacy.

The International Federation of Association Football (FIFA) is actively preparing for the 2026 World Cup, which is scheduled to take place in approximately 3 years. The global governing body of football plans to launch a collection of Non-Fungible Tokens (NFTs), the acquisition of which will grant the first 100 crypto users access to the final match.

Week after week, the crypto sector continues to innovate and redefine the boundaries of finance and technology with boldness and creativity. In this weekly recap, we will delve into the most significant news of the past week, from the unexpected resilience of Bitcoin in the face of pessimistic predictions from the ECB, to the soaring rise of XRP, and the latest legal developments regarding Binance.

A striking bullish signal suggests a skyrocketing rise in the price of the BNB crypto, promising exciting prospects.

Michael Saylor conducted a survey on X to find out where Bitcoiners intend to sell a portion of their bitcoins.

Mike Novogratz, the CEO of Galaxy Digital, was until now known for being a critic of Ripple's XRP. The expert has, however, changed his mind regarding the relevance of this cryptocurrency, publicly admitting that he was wrong.

While the price of Ethereum has dropped by over 5% this Monday, some strategic investors see it as a golden opportunity to accumulate more ETH at advantageous costs.

In an ever-changing financial and technological environment, companies are constantly seeking to innovate and push back the boundaries of what's possible. Rayn, an international company based in France, stands out for its innovative use of blockchain and artificial intelligence. Following an interview with their CEO, Mr. Gaël Itier, we were able to gather his vision of the company, its upcoming projects and explore how the project is navigating the tricky landscape of financial regulation.

Saudi Arabia, like some other Gulf countries including the United Arab Emirates (UAE), has recently been allowed to join the BRICS. With one of its influential members, Russia, the Saudi Kingdom has discussed strategic issues, including the exit from the dollar. But not only that.

It's official, China is number 1. And by a long shot. The international monetary order is going to change. Bitcoin is waiting for its moment.

The controversy surrounding the Bitcoin network's congestion caused by Ordinals has taken a new turn. The technical loophole exploited for their creation has just been assigned the identifier CVE-2023-50428.

Bitcoin no longer finds buyers in El Salvador. Currently, the country has only about 109,000 people holding BTC. The government in place must revisit its strategies to revise these numbers upwards and gain legitimacy. Zoom in!

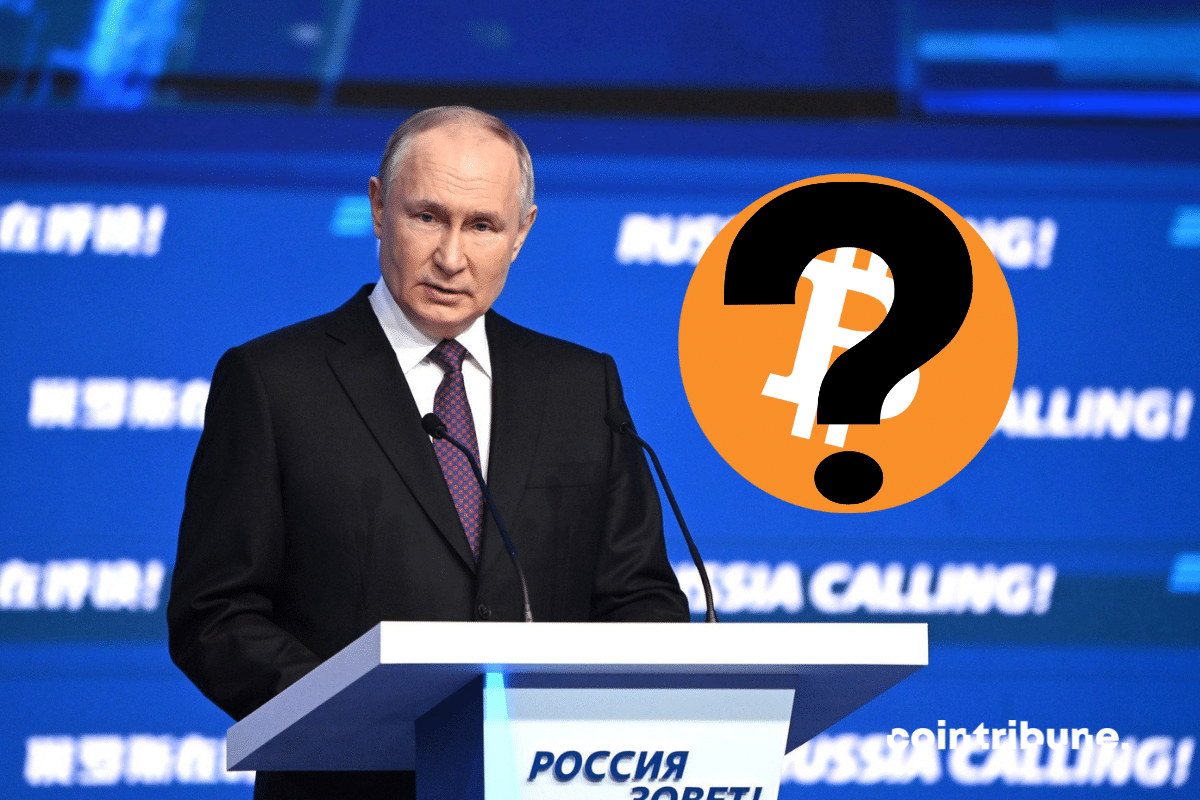

Did the Russian president just suggest the use of bitcoin for international transactions?

The online brokerage firm Robinhood, known for its zero fees and intuitive interface, has just announced the expansion of its cryptocurrency trading services to the European market. Users from the Old Continent will now be able to buy, sell, and hold Bitcoin, Ethereum, and Solana without any commissions.

Already criticized for its high level of centralization, Ethereum is disappointing many by censoring several transactions not validated by the OFAC.

Every crypto enthusiast has some interest in the concept of tokenizing real assets. The idea is not new in itself. But its emergence marks a profound revolution in the crypto ecosystem. Because it introduces an innovative perspective, regarding the relationship between the digital and the real. In this article, we explore the underlying mechanisms of tokenizing real assets. This, by highlighting the way this technology increases not only accessibility and liquidity. But above all, strengthens the legitimacy of the blockchain-based industry by integrating elements from the real world into its digital fabric.

Every economic ecosystem has a circle of people pulling the strings in some way to influence decisions. This is the mission of lobbyists, and there are many in the American crypto industry. Recent data shows a clear increase in funds injected by them to promote crypto activities.

Since January 2023, bitcoin (BTC) has experienced several breakthroughs that have caused its value to skyrocket. The asset has repeatedly reached the $30,000 mark. A resistance level that it vigorously broke through to reach the $40,000 mark, double its price at the beginning of the year. The asset is currently trading around $43,655 after a 4.52% increase in the last 24 hours. Bitcoin (BTC) is showing a level of dynamism that we haven't seen in several months. However, in this context, some financiers believe that all the hype surrounding the flagship cryptocurrency is biased. Let's see in the following lines what this is all about.

The Bitcoin network is experiencing unprecedented congestion in recent days, caused by a massive influx of transactions related to BRC20 tokens. Nearly 300,000 transactions are waiting to be confirmed, saturating miner memory and driving fees to record levels.

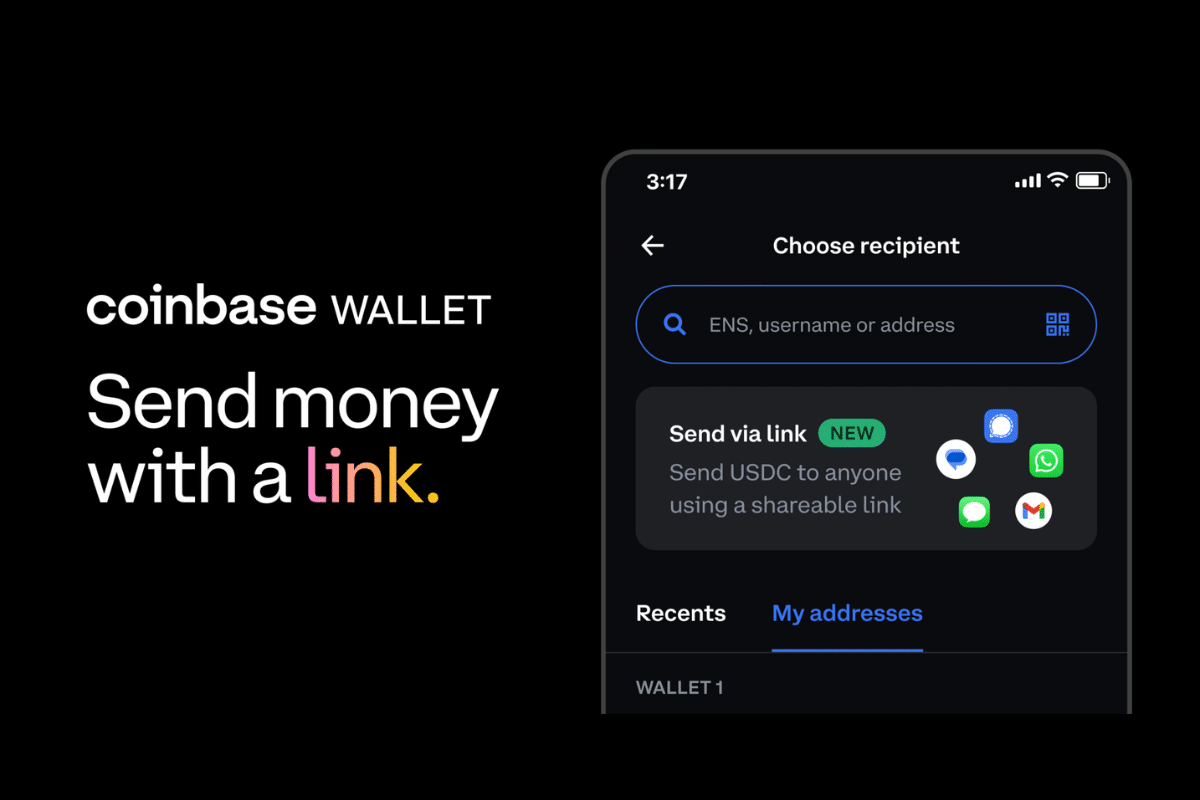

"Coinbase is revolutionizing crypto payments on social networks. Discover how this new service works in this article."

Transaction fees in bitcoin have skyrocketed in recent days due to what is known as "mempool congestion".

The transfer of the cryptocurrencies earned from this drop will occur in mid-January.

While investors and crypto traders are busy taking advantage of the current rise in the price of bitcoin, Elon Musk is choosing a different path. The billionaire, who has ambitions of colonizing the moon, has decided to make a massive investment in artificial intelligence. X AI, the company he has created for this purpose, has just launched an extraordinary fundraising campaign of 1 billion dollars. Its goal? To revolutionize artificial intelligence. Let's talk about it.

While Bitcoin started 2023 with an explosive surge of over 140% since January, Ethereum remains lagging behind. However, despite solid fundamentals, ETH is still trading 54% below its all-time high. Undervalued, it could soon catch up and take off.

Bitcoin is back in the top 10 most valued assets in the world. The throne is in sight.