"en" is already the language code for English. Please provide the text you would like to be translated.

Trading Exchange RSS

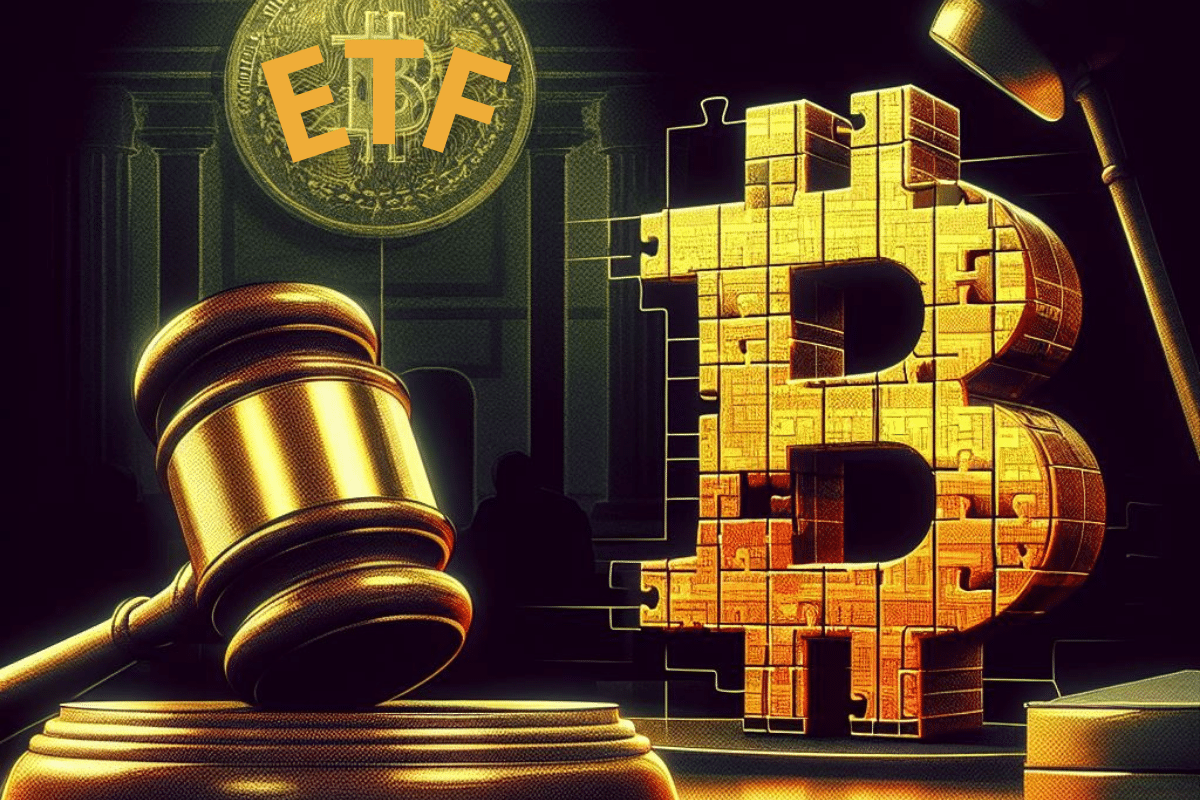

ETF Bitcoin spot approved! The first ARKB ETF by 21Shares will make its stock market debut on Cboe on January 11th.

What do BlackRock, Invesco Galaxy, WisdomTree, and Fidelity have in common? Obviously, at first glance, they are all companies in the finance sector, each with its own specificities. But those who have been following the trends in the crypto industry in recent months know that each of these companies has, in one way or another, engaged in this industry. Good news for the latter, which sees its financial influence expanding, confirming somewhat its relevance in terms of investment. However, what seems to be a sustained adoption of crypto by institutions in the finance ecosystem does not hide significant systemic risks. It is these risks that we will be interested in in this article.

The denial tweet from Gensler has been captured and transformed into a digital artwork, recorded as an ordinal on the Bitcoin blockchain.

In general, the year 2023 has been particularly dynamic for the crypto industry. Specifically, the crypto payments segment is no exception as it has achieved exceptional performance throughout that year. This is at least what a recent study by crypto firm CoinGate indicates.

Ripple transferred 100 million XRP to intermediary accounts. A preparation for the approval of the Bitcoin ETF?

Fox Corp partners with the Polygon blockchain and launches "Verify", a revolutionary open-source protocol to authenticate the origin of media content and fight against misinformation. Explanations.

"Bitcoin ETF approvals are imminent (and this time, it's serious). Eric Balchunas shares this excellent news on his X account."

The false approval of the Bitcoin ETF has pushed BTC above $47,000. This situation has benefited Ethereum and other altcoins.

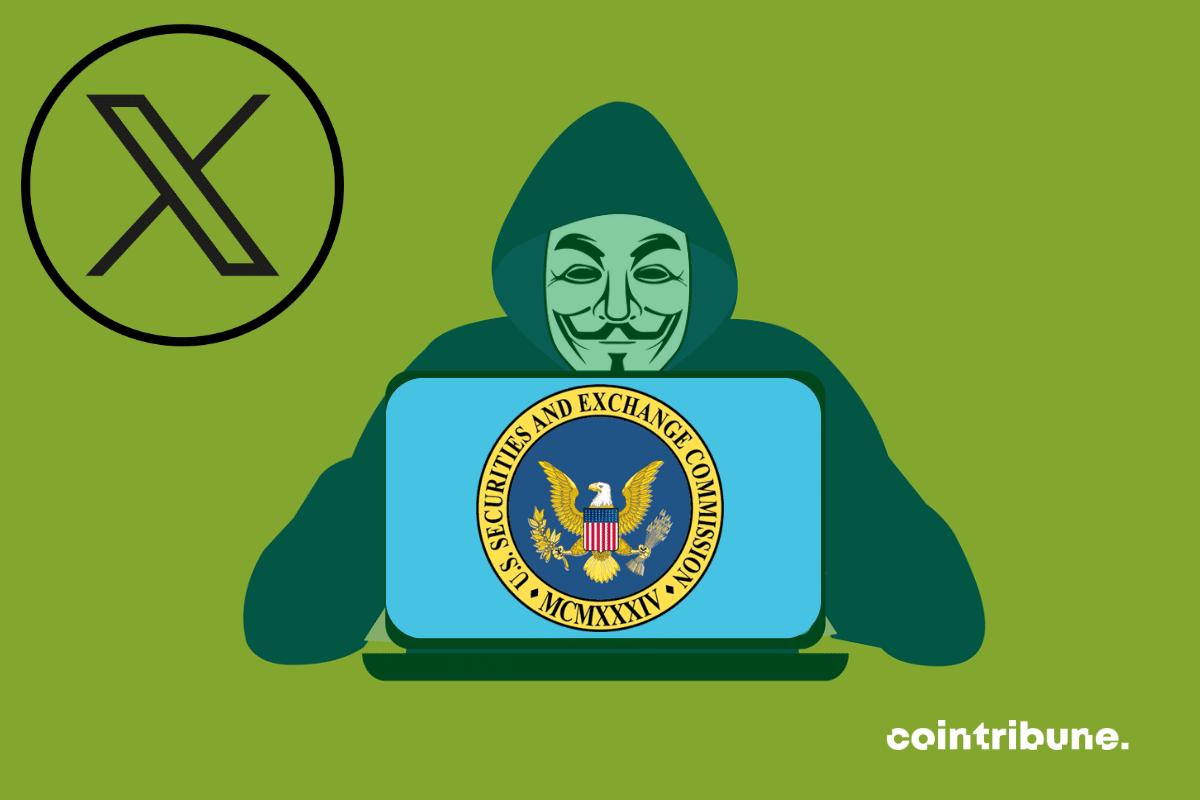

The SEC's Twitter account has been hacked on the eve of its announcements regarding the Bitcoin ETF. A collection of hilarious reactions.

Yesterday, the United States Securities and Exchange Commission released information stating that Bitcoin ETFs had been approved. However, according to recent news, this announcement turns out to be false, even though it was disseminated on the official X account of the financial watchdog. Two hypotheses emerge: either the SEC’s account…

After registering a decrease of -10% last week, Bitcoin has regained its strength, reaching $47,000. Let's examine together the future outlook for the BTC price.

The imminent approval by the SEC of the first Bitcoin cash ETF in the United States could usher in a new era for cryptocurrencies. According to Steve McClurg, Chief Investment Officer at Valkyrie Funds, Ethereum and Ripple ETFs could quickly follow.

Here is a selection of figures putting the year 2023 into perspective for bitcoin. Fifteen years already...

With AI tools like ChatGPT, scammers can now scam you on dating sites and social networks.

As the hashrate has soared by 102% in 2023 and the halving is approaching, bitcoin miners continue to strengthen their operations.

The American bank JP Morgan believes that the Chinese yuan could take over the crown of hegemony in the financial markets from the dollar. In 2023, the currency of the Middle Kingdom has continued to gain importance. This situation benefits the BRICS, of which China is one of the most influential members.

The CFTC has published a detailed report on DeFi, highlighting the lack of accountability and AML/CFT compliance in the crypto space.

Jay Clayton, the former chairman of the SEC, expresses his belief in the imminent approval of Bitcoin ETFs. Details in this article.

Throughout 2023, Ripple, the crypto company behind XRP, maintained a growth rate among the most notable in the crypto ecosystem. The question now is whether in 2024, Ripple could continue to make headlines in terms of performance and adoption. This remains possible under certain conditions.

Standard Chartered Bank expects Bitcoin to reach $100,000 this year and $200,000 next year.

The race for Bitcoin ETFs has reached its climax, but Gary Gensler, the big boss of the U.S. Securities and Exchange Commission (SEC), has just issued a serious warning. Yesterday, via his Twitter account, he shared some crucial advice for those considering investing in crypto assets. Stay tuned to find out everything!

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

According to recent news, the Bitcoin blockchain has been the subject of a transaction that raises questions. An individual whose identity is not known is said to have injected $66,000 to encrypt data on the blockchain that supports the flagship cryptocurrency.

As the fateful date of January 10 approaches rapidly, over one billion dollars in Bitcoin have been abruptly withdrawn from the Kraken exchange platform in recent days. These unusually massive transactions, exceeding 900 BTC, have aroused curiosity and sparked numerous speculations within the crypto community.

With 1.5 million active crypto users per day by early 2024, Tron remains the leader in this criterion, ahead of Ethereum which dominates in terms of TVL.

Whale investors, who hold massive amounts of crypto, continue to buy Bitcoin despite the correction phase.

The SEC is expected to make a long-awaited decision this week on Bitcoin spot ETF applications. Approval seems very close, but is still being awaited. In the event of a green light, ETFs could start trading as early as the following business day.

The SEC's decision on bitcoin ETFs is imminent. Is it an opportunity to sell the news? Or not...

In response to financial advice he considers 'terrible', Buterin offers golden advice, applicable in the world of crypto.