In a crypto market where volatility is the norm, Bitcoin has just reached an unexpected milestone. It is now less unstable than the S&P 500 and the Nasdaq. This discreet yet significant shift, revealed by Galaxy Digital, challenges a decade of perception of an asset deemed too risky for traditional portfolios. More than just a technical indicator, this signal could mark a lasting status change for the first cryptocurrency.

Theme Trading

While Wall Street soars amid easing tensions between Washington and Beijing, Bitcoin has dropped below $102,400 on May 12. An unexpected decline that contrasts with the prevailing optimism and institutional momentum of recent weeks. Why hasn't BTC benefited from the market euphoria? With just hours before the release of the U.S. CPI, investors are questioning whether this is simply profit-taking or an early sign of deeper macroeconomic stress.

In the span of a few hours, the crypto market was hit by a brief correction. While bitcoin seemed firmly established above $100,000, a sudden reversal changed the trend, sweeping away the bullish momentum. Over $700 million in positions were liquidated, which brought BTC below $101,000. This rapid and unexpected drop destabilized investors, once again confirming the vulnerability of a market where confidence can shift in an instant.

Ethereum, powered by the Pectra update, is surprising. In just five days, the crypto ETH jumps by 42%. It surpasses Coca-Cola and Alibaba in market capitalization. This meteoric rise shakes traditional markets. Today, the time is no longer for the anonymous ambitions of established values. It is about the emergence of a decentralized network that is redefining the financial hierarchy.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

A flagship asset of the 21st century, bitcoin fascinates as much as it divides. While its price already defies traditional financial standards, some experts predict a surge towards one million dollars. Long considered marginal, these projections are now gaining traction in economic influence circles. Financial institutions, renowned investors, and regulatory figures are sketching a future where BTC could become an essential store of value in a world shaken by inflation, monetary distrust, and a rapidly accelerating institutional adoption.

The crypto market surged on May 8, 2025, driven by a spectacular rise in Ethereum. In just a few hours, the asset jumped 22% to surpass $2,200, triggering a strong reaction throughout the crypto ecosystem. This rapid surge is a reminder of the market's reactive power and reignites speculation around the world's second-largest cryptocurrency.

The stock market reacts positively to the Fed's decision to keep interest rates unchanged. Discover the key figures in this article!

A stunning crypto operation on the memecoin Melania brings in $99.6 million for 24 traders. Spotlight on this case that intrigues investors!

There are psychological thresholds in life, such as turning 30, weighing 100 kilograms, or for cryptocurrency ETH, reaching 1900 dollars. The first seems trivial, the second causes concern, and the last sends shivers through the markets. Yet, all of them provoke turmoil. While the crypto market appears to be dozing, Ethereum chose this precise moment to breach that barrier. A wake-up call? A jolt? Perhaps both. But one thing is certain: in a universe dominated by Bitcoin, Ethereum has decided to remind everyone that it is much more than just a mere number two.

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

eToro will raise $500 million and targets a $4 billion valuation. We tell you everything about this IPO that is shaking up the crypto sector.

The crypto market sometimes holds surprises that shake up the usual references. This is the case with XRP, whose derivatives have just experienced a spectacular surge: +62.99% in volume over 24 hours, or $4.52 billion according to Coinglass. This is a significant jump that contrasts with the decrease in open interest, suggesting a speculative enthusiasm tinged with caution. This imbalance between excitement and restraint intrigues industry players and fuels speculation about the evolution of the Ripple ecosystem.

In the crypto market, opportunities do not announce themselves. They explode. At a time when every pump can generate exceptional gains in just a few hours, missing these movements often means missing the essence. However, detecting and capturing these impulses in real-time is a true challenge, even for a seasoned trader. Hence the interest in automating one's strategy with Runbot and the SuperTrend indicator.

While uncertainty looms over global markets, a clear signal is emerging at the level of bitcoin: on-chain activity is surging. With nearly one million active addresses in 24 hours, a high not seen in six months, attention is shifting back to the fundamentals of the network. BTC, after peaking at $97,000, is oscillating around $94,000. This surge in activity is intriguing: is it a lasting effect or just a fleeting frenzy? Traders are sharpening their analyses and watching for the next impulse.

While the crypto market digests the post-halving calm, a technical setup is quietly attracting attention: the XRP/BTC pair could surge by 30%. Far from a simple bullish scenario, this signal is based on a marked tightening of the Bollinger Bands, often a precursor to sharp movements. For traders, this type of compression is never trivial. It often heralds a resurgence of volatility, in either direction. This time, all indicators are converging towards a possible spike.

The ETH/BTC ratio is dangerously close to the critical level that triggered a spectacular rise in Ethereum in 2019. Technical indicators and proposals from Vitalik Buterin are fueling hopes for a major turnaround.

As the symbolic threshold of 100,000 dollars approaches, Bitcoin enters a turbulent zone. Behind the spectacular rise, long-term holders are recording unrealized gains of nearly 350%, a level historically associated with massive profit-taking. This critical signal comes as the market remains vulnerable, hindered by ongoing technical tensions and a demand that struggles to keep pace with potential supply.

The countdown has begun. Indeed, Bitcoin could reach a new all-time high much sooner than we imagine. A recent analysis by Timothy Peterson, a recognized economist in the Bitcoin network, predicts a surge to $135,000 within the next 100 days. The origin of this projection: the drop in the VIX index, a symbol of a renewed appetite for risk, and an aligned macroeconomic context. This could reignite the bullish ambitions of a market in search of solid catalysts.

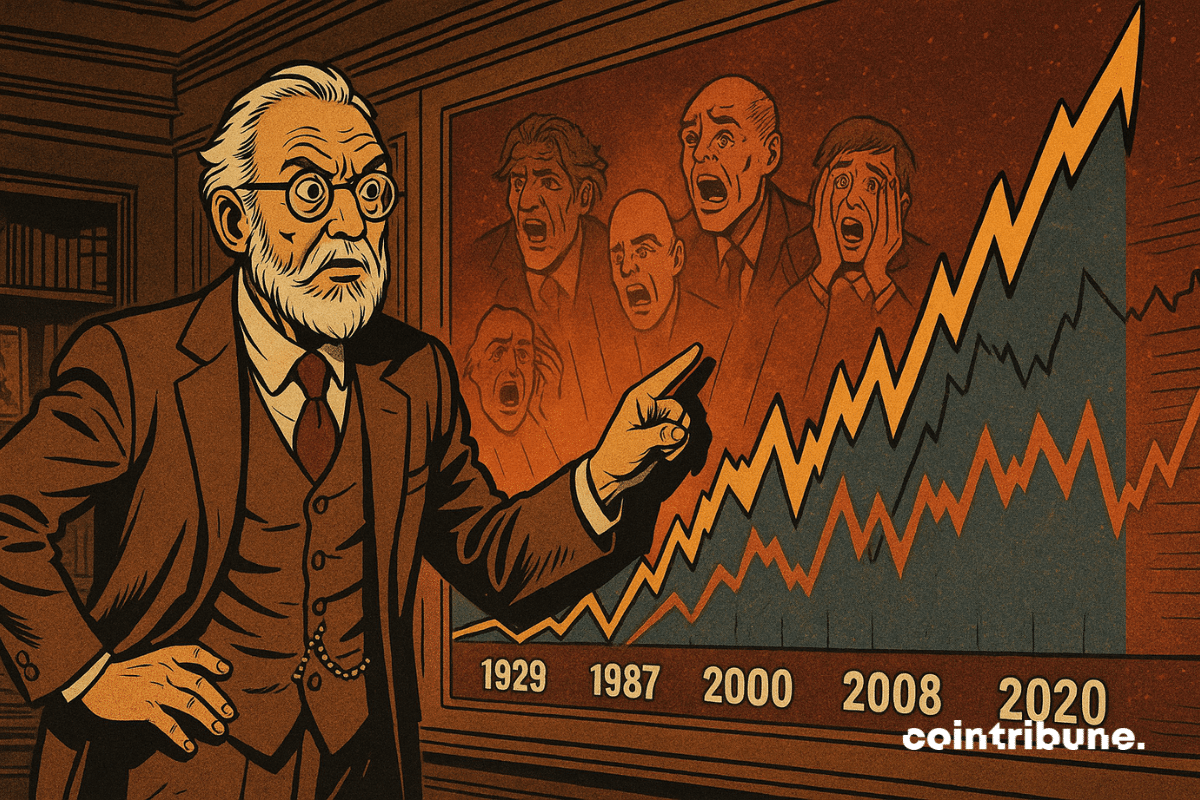

What if the markets were following a tempo that escapes economic logic? While the U.S. GDP is declining, the S&P 500 is rebounding after a sharp drop of nearly 20%. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists are wondering: does this sudden correction fit into a global tradition? To understand it, they delve back into a century of stock market crash history.

In the span of two months, Pi Network has lost nearly 90% of its value. The cryptocurrency fell from $2.99 to a low of $0.40. This collapse could have marked the end of the hype, but a recent rebound is rekindling interest. While some see it as just a temporary surge, others suggest it could be the beginning of a turnaround. As the project is poised to reach a key milestone, the price movement in the coming days could reshape the trajectory of this controversial cryptocurrency.

Global stock markets are plunging with significant losses on Wall Street and internationally. This drop, exacerbated by economic uncertainty, falling oil prices, and the trade war between the United States and China, raises questions about the short-term outlook for financial markets.

While uncertainty persists in the crypto market, Ethereum stands out with a dynamic that draws attention. Boosted by a massive return of institutional capital, solid on-chain indicators, and a favorable technical setup, the asset appears ready to challenge the resistance of $2,000. In the face of ongoing volatility, ETH is regaining a central place in investment strategies, driven by converging signals that market operators cannot ignore.

As Bitcoin breaks through new psychological thresholds, it reshapes the landscape of digital economic cycles. A consensus is now emerging among experts: support around $90,000 could become a sustainable strategic base. Between validation from on-chain data and projections from recognized valuation models, this hypothesis is gaining traction and fueling market expectations, already buoyed by the rise of institutional adoption.

Stock Market: Stock markets fluctuate under the effect of tariff tensions. Discover what this means for investors.

Despite a bleak market climate, Ethereum is sending a strong signal: 449,000 ETH have been transferred in one day to accumulation addresses, an all-time record. This strategic movement, observed amid falling prices, reveals a persistent confidence among some long-term investors. Contrary to the prevailing sentiment, this operation raises questions about a possible cycle change, as volatility remains high and economic uncertainties continue to weigh on the entire crypto sector.

The British fintech Revolut shows exceptional performance in 2024, doubling its profits to $1.3 billion. This spectacular growth is explained by the influx of 15 million new users and the explosion of crypto trading following the rise of the markets.

While Web3 projects compete with announcements, Pi Network surprises with a marked surge in its token. Within 24 hours, its price rises by 5%, accompanied by a trading volume increase of 66%. This resurgence of interest coincides with a long-awaited milestone: the launch of the migration to the mainnet. For a project often deemed enigmatic, this shift to a fully operational blockchain environment redefines expectations around its credibility and roadmap.

Bitcoin flirts with new highs and shakes the market. By crossing the $94,000 mark, the cryptocurrency triggered a series of liquidations worth hundreds of millions of dollars, causing bearish positions to wobble. In a climate filled with macroeconomic uncertainties, this surge fuels speculation about a leap toward $100,000. The euphoria of bullish investors faces the nervousness of short sellers in a market where every move seems dictated by fear, tension... and instinct.

With Trump, we are witnessing the transition from a trade war to a total economic war between the United States and China.