Chainlink’s new framework connects SWIFT messaging to blockchain, allowing tokenised funds and corporate workflows to operate smoothly on-chain.

Theme Tokenization

The tokenization of real assets (RWA - Real World Assets) represents one of the most promising sectors of the crypto ecosystem in 2025-2026. The integration of recognized assets on the blockchain through RWAs constitutes a significant innovation that is a central narrative of the 2024-2025 crypto season. In this dynamic context, Real Finance (REAL) positions itself as a major player by developing a complete infrastructure to facilitate the integration of real-world assets into the Web3 ecosystem.

Tokenized real estate takes on a new dimension with RealT, an innovative platform that disrupts traditional rental investment codes. By fractionating American real estate properties into digital tokens on blockchain, this company based in Florida and Delaware opens the doors of international real estate to all investors, regardless of their financial capacity.

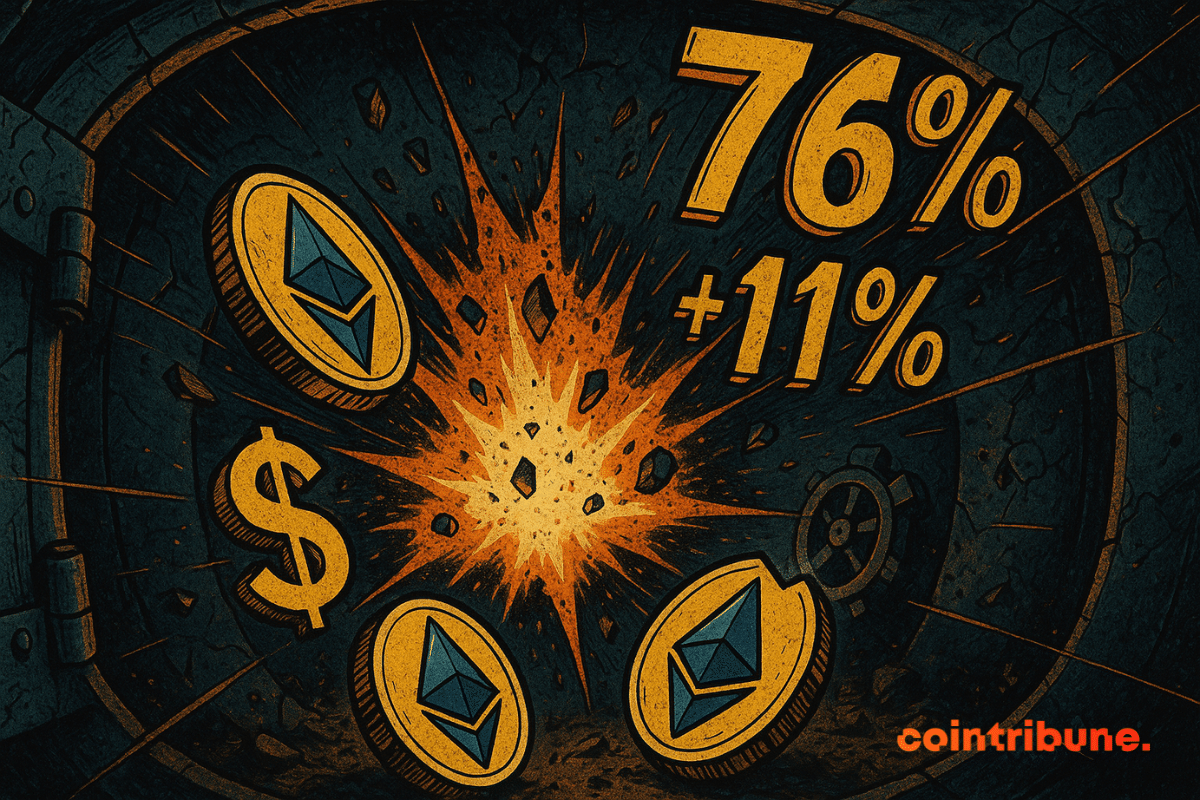

Boom of RWA in crypto: +11% in one week. Focus on this revolution led by Ethereum and BlackRock.

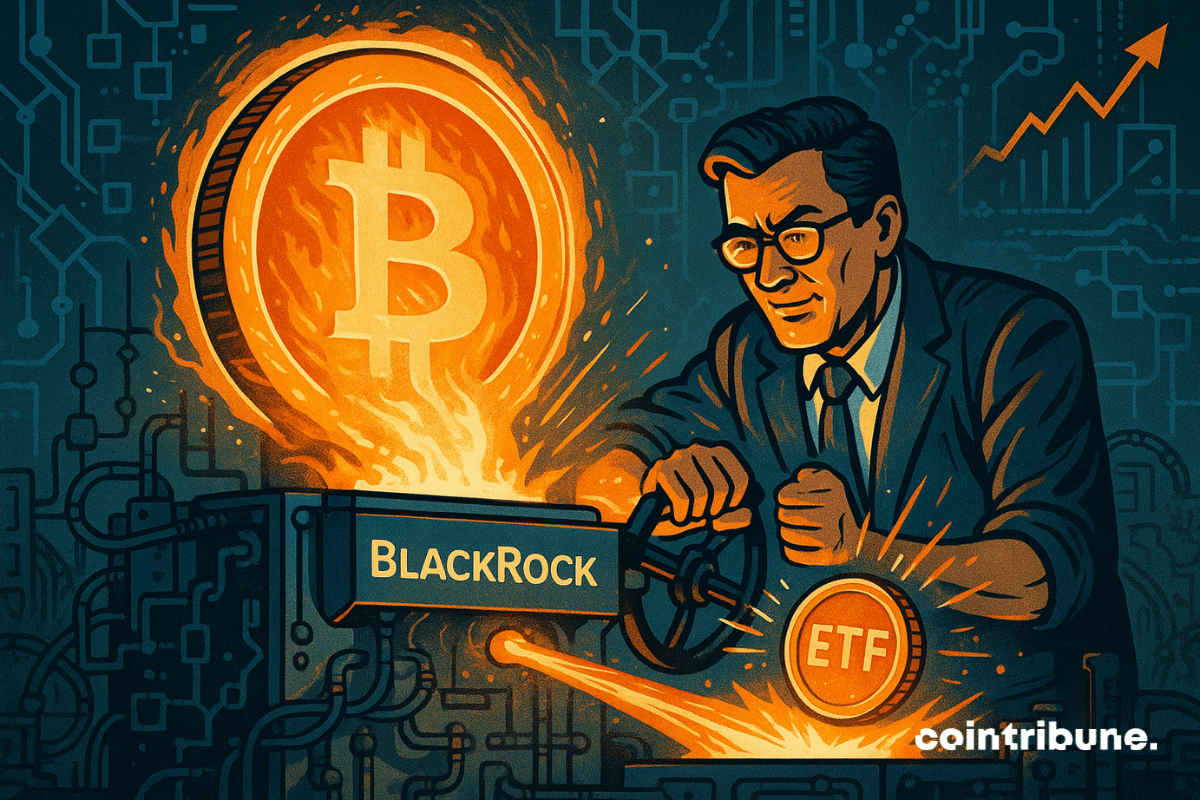

BlackRock, which has already cashed in with its bitcoin ETF, now dreams of putting its ETFs into blockchain tokens. Markets wonder: digital revolution or financial snake oil?

Real World Assets (RWA) represent one of the most promising evolutions of the crypto ecosystem. By tokenizing traditional physical assets, this sector builds concrete bridges between decentralized finance and the real economy, opening new investment opportunities accessible to all.

Nasdaq has officially filed a request with the SEC to authorize trading of shares and ETPs in tokenized form. A breakthrough that could disrupt Wall Street and accelerate the integration of blockchain into traditional financial markets.

Trust Wallet has added tokenized U.S. stocks and ETFs, allowing users to trade real-world assets directly from their wallets.

Tokenization is gaining momentum in global finance, with many top financial institutions racing to explore the niche. Japan Post Bank is the latest to join after declaring its intentions to introduce a tokenized asset network in fiscal year 2026.

The market for tokenized gold has reached new all-time highs, crossing $2.57 billion in market cap, as spot gold itself approaches its April peak. The rally shows renewed demand for gold-backed crypto tokens as investors seek safe haven assets amid global uncertainty.

REAL positions itself as the first Layer 1 blockchain specialized in the tokenization of real-world assets (RWA), with business validators integrated into the consensus and over 500 million dollars of assets already in preparation. This unique technical approach could revolutionize the institutional adoption of RWAs.

American Senator Cynthia Lummis officially introduced the 21st Century Mortgage Act, a groundbreaking legislation that would require government-sponsored enterprises to consider digital assets when assessing eligibility for single-family mortgage loans.

The asset tokenizer Brickken and the decentralized credit protocol Credefi announced, on July 28, 2025, a strategic partnership marking a major breakthrough in the convergence between regulated tokenization and decentralized finance. From now on, holders of shares or bonds tokenized via Brickken can use these securities as collateral to borrow USDC directly on Credefi, through a permissionless, peer-to-peer, and non-custodial mechanism.

The tokenization of real assets (RWA) is no longer a laboratory experiment: it is a global undertaking that, quietly, is rewriting the way we own a building, a government bond, or a corporate debt. The idea is simple: to represent an economic right (rent, coupon, dividend) by a token registered on a blockchain, exchangeable at any time and, above all, programmable. But behind the apparent simplicity hides a legal, technical and financial mechanism that is refined month after month.

There has been a lot of talk about RWAs in the last two years. Among them, real estate ticks all the boxes for a “mainstream” asset: predictable cash flows (rents), a tangible underlying asset, and the possibility to buy fractions rather than a whole property. The promise is simple: turning…

Tokenized finance has just reached a decisive milestone. Ondo Finance, a pioneer in the tokenization of real-world assets (RWA), has been officially cited in a strategic White House report. A first for an actor coming from DeFi, now recognized in the highest spheres of American power. This recognition could well accelerate the global rise of RWA. And what if this was only the beginning?

eToro is taking a big step into real-world asset (RWA) tokenization. The company announced plans to launch tokenized versions of the 100 most popular US-listed stocks and ETFs as ERC-20 tokens on the Ethereum blockchain.

Imagine borrowing 10,000 euros without going through a bank, without a credit file, without an interview with a consultant. Just you, your crypto assets, and an algorithm that decides in a few seconds. This is exactly what the lending markets of decentralized finance (DeFi) offer.

When Bitcoin flirts with unprecedented highs, the spotlight once again shines on the crypto universe. This spectacular rebound, fueled by ETFs and growing institutional adoption, coincides with the emergence of another phenomenon: the tokenization of real-world assets (Real World Assets or RWA). These hybrid instruments, halfway between traditional finance and Web3, attract a new wave of investors seeking stability and diversification.

The market for tokenized real-world assets (RWA) is experiencing a spectacular redistribution in 2025. Solana has shown a growth of 218% since January, eclipsing the progress of Ethereum which is limited to 81%. Could this rise redefine the hierarchy of blockchains in this strategic sector?

When Dubai marries traditional finance with tokens, it is not a desert mirage, but a very real… and perfectly regulated fund, please!

Tokenization is growing fast, with major firms investing and new platforms launching. This trend could soon impact cryptocurrency prices.

According to data from Token Terminal, over $6 billion worth of tokenized assets now live on the Ethereum blockchain. That’s not theoretical DeFi liquidity, but real-world funds, from some powerful names in global finance.

The world of tokenized real world assets (Real World Assets - RWA) is undergoing transformation as it gradually aligns with the real economy. In this context, Credefi has experienced continuous evolution, moving from an experimental project to a functional infrastructure. With the launch of Credefi 3.0, the platform reaches a new milestone: it fully integrates modules designed to connect decentralized finance and tangible assets. All tools are now available online.

Robinhood’s rollout of tokenized shares “linked” to OpenAI set off a large debate last week. A broader discussion in crypto markets about the future of tokenized private equity, and whether retail investors actually want it.

Ethereum is stumbling, ETFs are exploding, big holders are accumulating, and retail is asleep. What if Ethereum's crypto is quietly preparing for a major upheaval? Here's a behind-the-scenes look.

At a time when DeFi is reinventing uses through groundbreaking innovations, certain trends are literally exploding. In this technological cacophony, RWA — these tokenized real-world assets — are tracing a stunning trajectory: +260% by 2025, for a market of 23 billion dollars. Behind this figure lies a promise: that of tangible, stable returns, grounded in the real economy. A remedy for crypto volatility, a bridge to the traditional world. "Real yield is the new grail," insiders are already whispering. And at the heart of this rise in power, Credefi is quietly laying out its game.

For a long time reserved for bitcoin, the role of strategic treasury asset is now expanding to other cryptos. Upexi, listed on Nasdaq, is a concrete illustration of this: it has strengthened its treasury with 735,692 SOL, valued at over 105 million dollars. And that's not all: the company also announces the tokenization of its shares on the Solana blockchain.

While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.

Tokens we thought were safe, a report that strikes, the BIS takes aim at stablecoins. Crypto-mania or toxic bubble? The global finance reassesses its strategies... under high tension.