"""You are translator in the blockchain field"""

Technical analysis (TA)

"""You are translator in the blockchain field."""

A major transformation is shaking up Ethereum, making the global supply of crypto ETH deflationary. Decoding it!

Cardano suffered a decline of around -37% this summer 2023. Let's take a look at the prospects for the ADA price.

Bitcoin dropped by around -3% on Monday, September 11. Let's take a look at the prospects for the $BTC price.

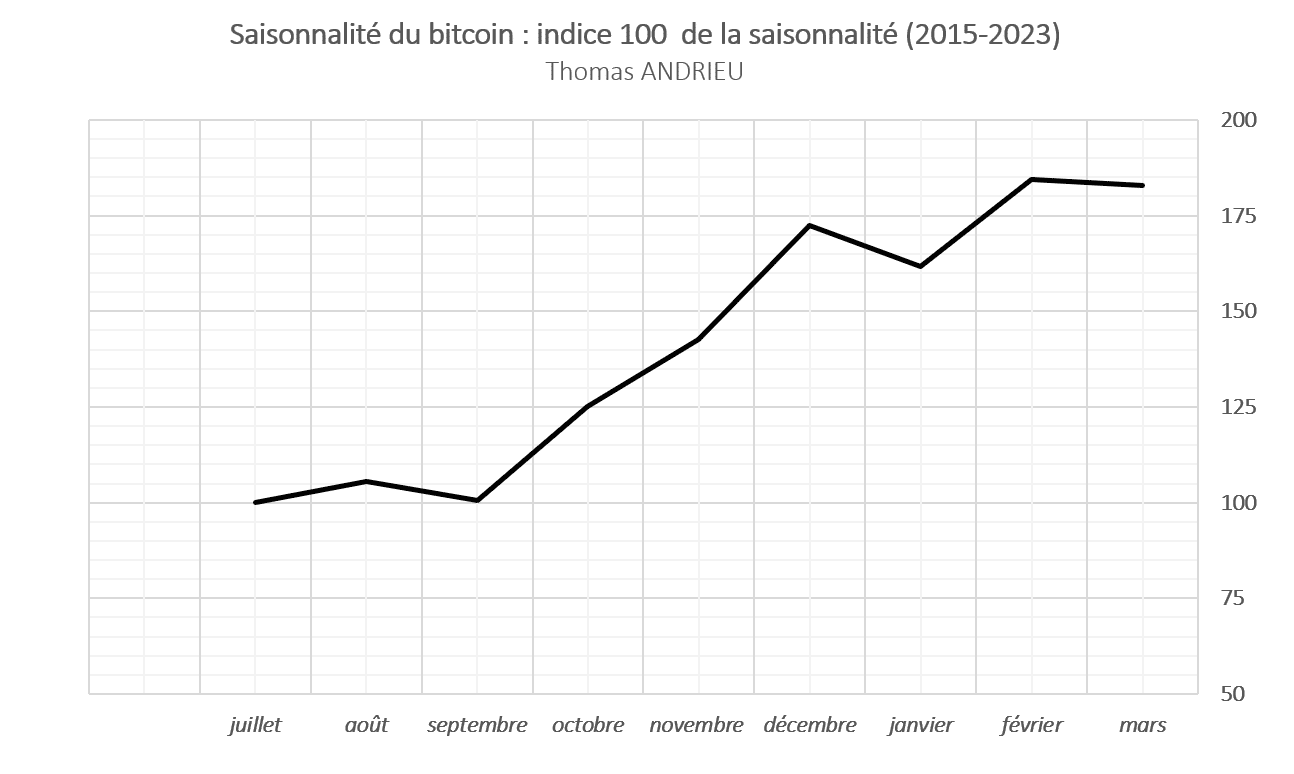

Over the last 8 years, September has been the second-worst month in terms of bitcoin (BTC) performance. On average, bitcoin falls by 5% in September. Conversely, September is often a good opportunity. The end of the year often marks a powerful "Christmas effect", which is usually accompanied by a rise in cryptocurrency. But if studying the past sheds light on probabilities, it's worth looking at the indicators available on the bitcoin price.

After suffering a drop of almost -10%, Ethereum came back to perform at over 5% at the start of the week. Let's take a look at the prospects for ETH.

While the Binance platform is facing numerous difficulties, the BNB price has not remained unaffected. Let's take a look at the prospects ahead for the leading exchange cryptocurrency.

Over the week of August 14, the bitcoin price fell by almost 12%. This turnaround was all the more dramatic as major thresholds that could have inspired long-term confidence were broken. The price of bitcoin fell below the $26,000 mark. It had stabilized above this level since March 2023. In our previous analysis in July, we pointed out that “the $26,000 area appears to be a major zone at present, and the absence of a recovery in volatility on traditional indices will probably determine the next move”.

After several weeks testing the $30K zone, bitcoin has come to register a drop of over 10%. Let's explore the outlook for the leading cryptocurrency.

The previous week was marked by a sharp decline in the crypto market. The leader in terms of market capitalization, BTC, recorded a 10% drop, closing the week at around $26500. What if this drop represented a buying opportunity for bitcoin (BTC), as a bullish recovery seems imminent? That's precisely what the RSI and Hash Ribbons suggest.

Fundstrat co-founder Tom Lee has predicted that the price of Bitcoin (BTC) could explode to $150k under certain conditions. If the U.S. SEC approves Bitcoin ETFs, the parent cryptocurrency could see its price cross the $150k mark. Among other key factors favoring this trend, he also states the interaction of cryptos with the general monetary climate.

After marking a new annual ATH in mid-July, the bitcoin price came to stabilize around the $29-30K mark. Since then, fluctuations on the leading cryptocurrency have stagnated, suggesting some movement ahead on the market.

After a prolonged phase of consolidation, notable movements seem ready to manifest themselves in the price of BTC. The Hash Ribbon indicator is currently displaying a buy signal, marking the end of the bitcoin (BTC) miners' capitulation. Could this be the catalyst for the next bull market?

Litecoin (LTC) has recorded a 10% drop since its recent halving event, which occurred just 9 days ago. While this drop may seem surprising, it is actually in line with historical trends. Litecoin may not experience a bull-run before Bitcoin's Halving in 2024.

Recently, the leading cryptocurrency has displayed a considerably low level of volatility. This contrasts with its generally volatile nature relative to other assets. However, some traders and analysts see this low volatility as a precursor to a possible explosive rise in Bitcoin (BTC).

Another technical indicator gives a bullish signal, suggesting promising long-term prospects for the leading cryptocurrency. It suggests an imminent long-term rise, although bitcoin (BTC) may first revisit $28k before taking off.

While Litecoin's Halving is generating interest this week, the flagship cryptocurrency, BTC, is showing a bullish configuration. One renowned trader claims that a rise towards $52k is inevitable for bitcoin (BTC), based on the SSA (Senko Span A), a component of the Ichimoku indicator.

After a month-long range, the bitcoin price has come to make new lows since its annual ATH. What's the outlook for the leading cryptocurrency?

After a worrying technical break, Chainlink's share price performed at +60%. What prospects lie ahead for the benchmark blockchain oracle?

The leading cryptocurrency continues to establish a consolidation phase around the $30,000 mark. The expected announcement of the FED's interest rate decision on Wednesday should bring further movement to the market. Although investors anticipate an imminent bullish rally, a slight correction in bitcoin (BTC) could emerge.

After rejecting the $2.1K mark, the Ethereum price twice unsuccessfully tested the psychological $2,000 threshold.

Yesterday's release of the US inflation rate suggests an imminent rise for the queen of cryptos. Bitcoin (BTC) seems headed inevitably for $50,000.

Recent news seems favorable for cryptos. Indeed, a former SEC official's opinion that the Bitcoin ETF should be approved is seen as positive for the crypto market. Is the next Bitcoin (BTC) bull-run imminent?

With the US CPI due for release on July 12, Bitcoin (BTC) and Ether (ETH) are stabilizing, raising investor expectations. The previous month, these two cryptocurrencies soared in response to this economic indicator. Could this trend be repeated this month?

BTC continues to hold in the $30,000 to $31,000 range. Large investors seem to remain optimistic and continue to accumulate. The long-term price trend for bitcoin (BTC) remains bullish, although a new DIP cannot be ruled out. Short-term selling could be attractive.

Over the past week, Litecoin has risen by more than 30%. The LTC price tested $116, marking a new annual ATH.

Ether (ETH) could get off to an explosive bullish start this month, in a context that seems favorable to a bullish recovery. If confirmed, this crypto could reach $2500.

According to this crypto analyst, bitcoin (BTC) could see an explosion in value in July. He points to a pattern reminiscent of the asset's price structure in 2020. Departing from the traditional four-year cycle theory, this analyst sees things from a different angle. But only time will tell if this month will be as fruitful as November 2020 for BTC.

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?