When crypto shakes Wall Street: Standard Chartered fears that stablecoins siphon off bank deposits. Subdued panic in glass towers and bankers' cafes.

Stablecoins

Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

XRP Ledger continues to show strong on-chain activity while Ripple leadership outlines where the crypto market may head next. New network data points to steady usage, low costs, and large transaction volumes. At the same time, Ripple executives are setting expectations for how institutions may engage with crypto in the coming years.

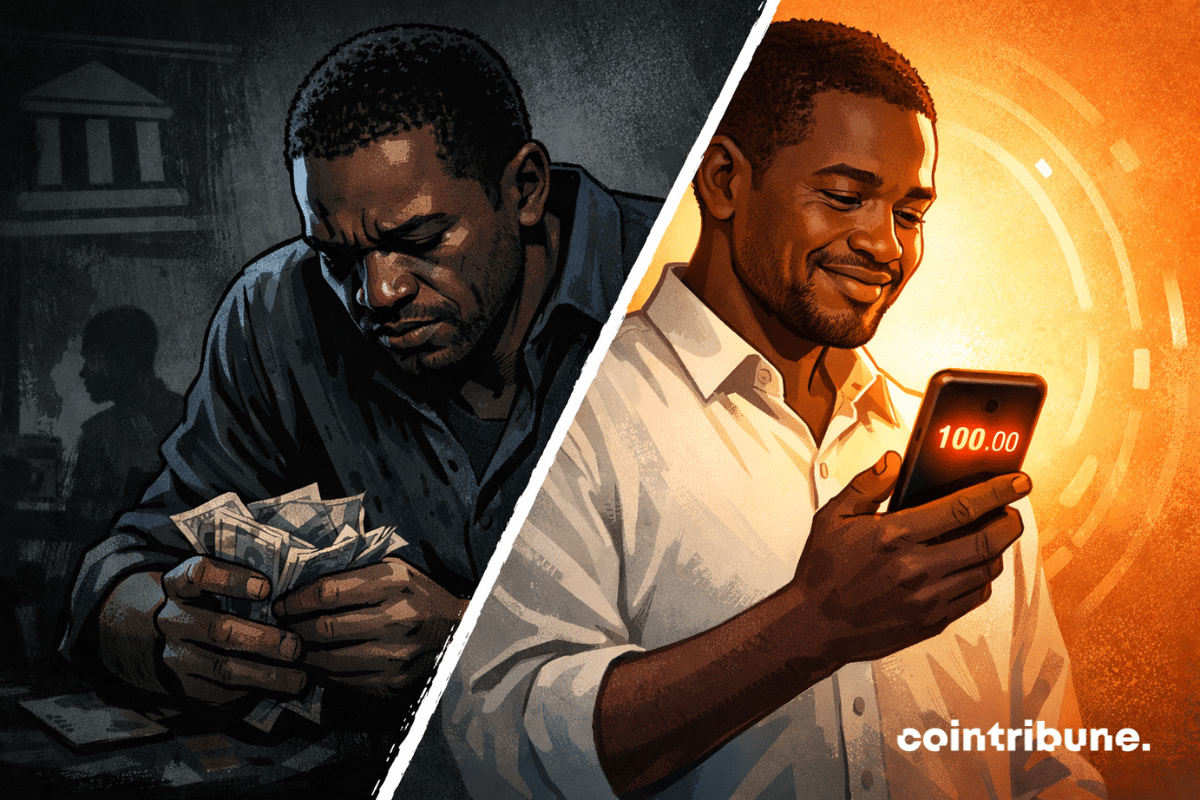

Stablecoin adoption is rising across Africa as individuals and businesses search for faster cross-border payments and protection from rising prices. Speaking at the World Economic Forum in Davos, economist Vera Songwe said stablecoins are filling gaps left by costly remittance systems and weak local currencies. Growing usage is also drawing closer attention from regulators across the continent.

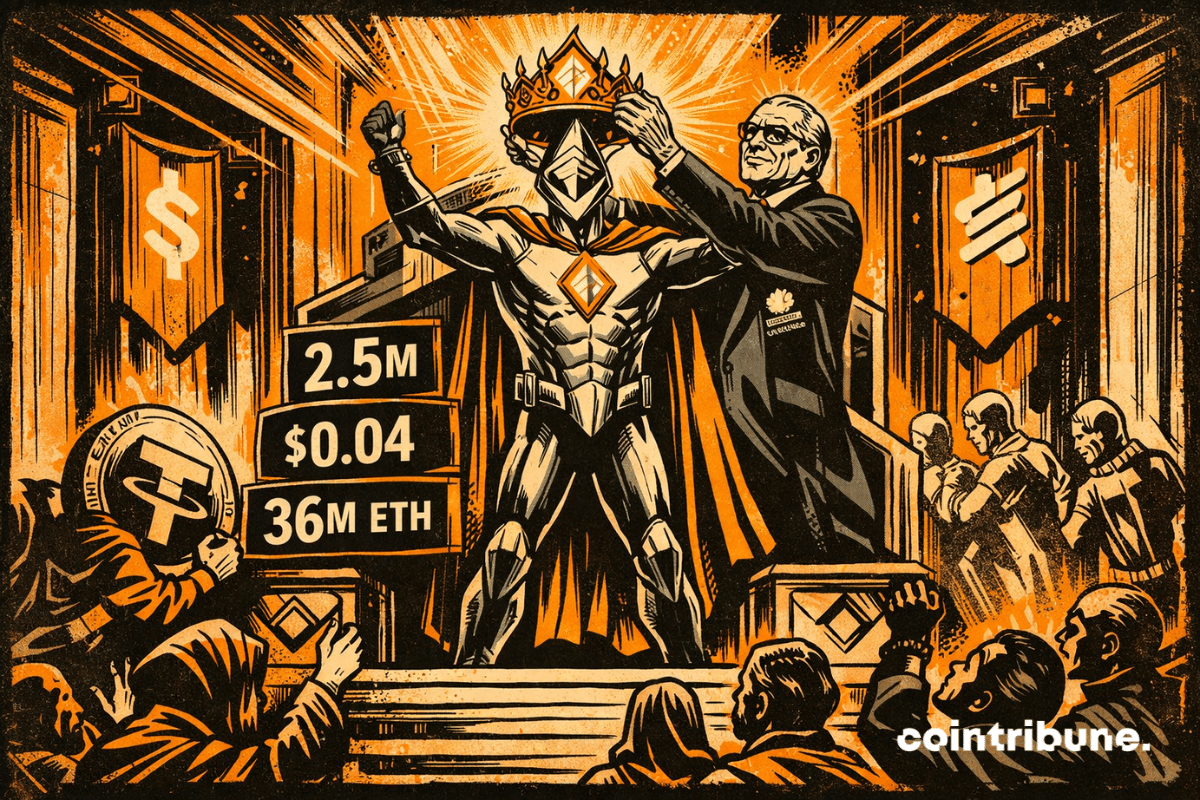

Ethereum is rejoicing, its counters are exploding! Except that 80% of the activity might be clever spam. Progress? Or just hackers who learned how to do sales?

Bankers were pretending to ignore crypto; now they dive in completely, renaming stablecoins as "infrastructures." PwC rejoices: the future is already tokenized.

Saga, a Layer-1 blockchain protocol, has paused its Ethereum-compatible SagaEVM chainlet after a $7 million exploit triggered unauthorized fund transfers. The attack involved assets being bridged out of the network and swapped into Ether. Although the affected chainlet remains offline, Saga says the broader network continues to operate normally.

In Davos, the head of Circle promises that stablecoins will not blow up banks. What if crypto became the secret weapon... of AI? Allaire swears no, or almost.

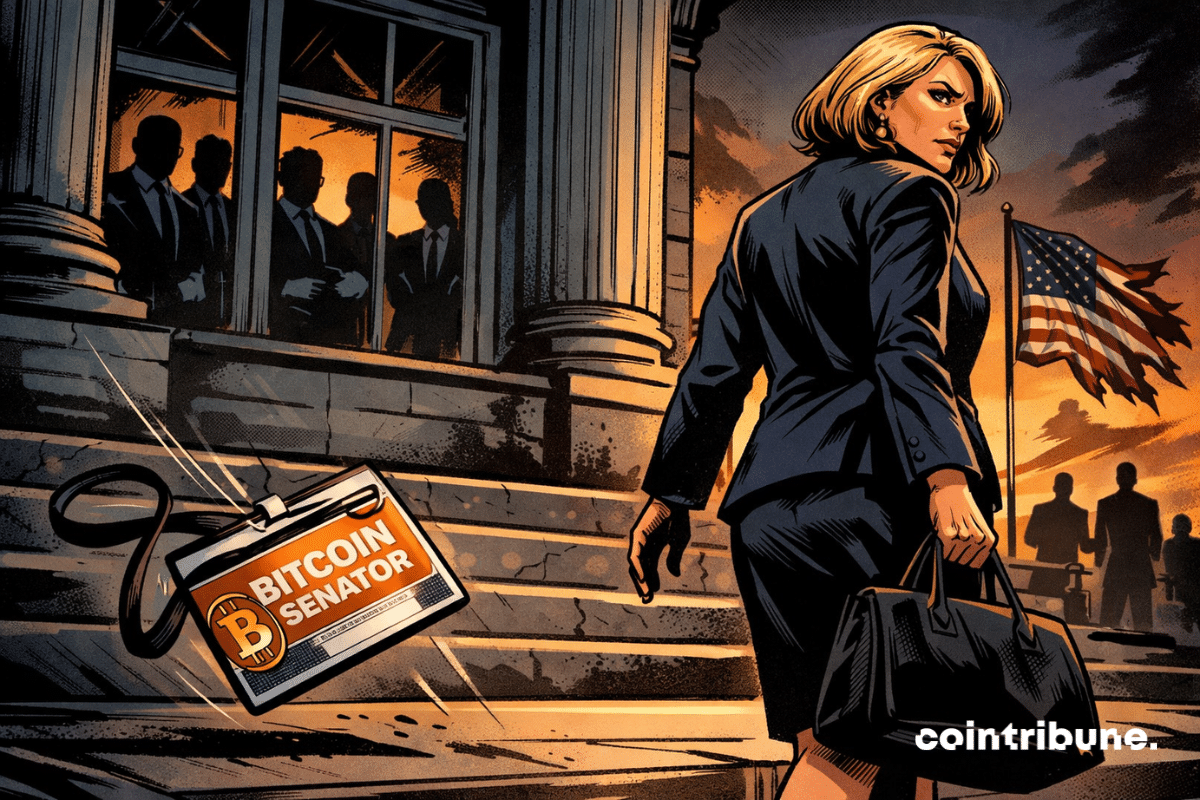

Under regulatory pressure, the American crypto sector closely watched the CLARITY Act, intended to establish a clear legal framework for these assets. However, the bill was abruptly paused in Congress after Coinbase dramatically withdrew its support. Presented as a structural reform, the latest version of the project triggered sharp criticism, accused of threatening innovation. A political setback that reignites tensions between legislators and actors of an ecosystem still seeking recognition.

As the year 2026 is just beginning, Ethereum is already breaking transaction records and showing negligible fees. Analysis!

In Washington, crypto puts the Senate in a tailspin: Coinbase says no, the law collapses, and banks fear that open code will become uncontrollable.

Polygon sacrifices 30% of its team to dominate crypto payments. We give you all the details in this article.

U.S. lawmakers have put a major crypto market structure bill on hold after strong pushback from Coinbase. Fresh criticism from the exchange’s chief executive raised doubts about whether the proposal could move forward without changes. As a result, Senate Banking Committee members delayed a planned markup while reassessing industry and regulatory concerns tied to the draft.

What if the next threat to traditional banks did not come from an economic crisis, but from a simple innovation in stablecoins? Brian Moynihan, CEO of Bank of America, warns that the rise of yield-bearing stablecoins could trigger a massive outflow of bank deposits, thus disrupting the balance of the American financial system. This worrying scenario for traditional institutions could see their role as lenders severely affected by this new form of digital competition.

A new piece is added to the crypto puzzle: World Liberty Financial, supported by Trump’s entourage, wants to turn the stablecoin USD1 into the locomotive of decentralized finance.

A new advertising campaign tied to crypto policy has stirred debate in Washington as lawmakers prepare to review a major market structure bill. Ads airing on Fox News urge viewers to pressure senators to support legislation that excludes decentralized finance provisions. The timing of the campaign coincides with key Senate activity on crypto regulation.

Rising global sanctions and increased state involvement drove illicit cryptocurrency activity to record levels in 2025. Data indicates that sanctioned entities were the primary source of these flows, even though illegal use continued to account for only a small portion of total crypto transactions. Analysts describe the shift as a response to mounting geopolitical pressure rather than a breakdown in compliance.

JPMorgan plays the bankers of the future: its JPM Coin infiltrates Canton, the blockchain of the big players. It smells like crypto fragrance on Wall Street, with more control than utopia.

At Visa, it's no longer a toss-up with crypto: 91 million later, the card becomes the new favorite toy of decentralized financiers. To be continued…

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

While stablecoins have gained more than $100 billion in 2025 to peak at $307 billion according to DefiLlama, India is taking the opposite direction. The Indian central bank (RBI) states that only a sovereign digital currency guarantees monetary stability. In a global landscape where CBDCs struggle to impose themselves, New Delhi erects the e-rupee as a bulwark against the privatization of money.

Stablecoins continue to gain a stronger foothold across global crypto markets. This growth now appears not only in supply figures but also in transaction activity across blockchains. In Europe, momentum is building around euro-linked tokens, while USDC continues to expand across multiple networks. Recent data points to a shift toward transaction-driven expansion rather than passive issuance.

The Bitcoin Queen hangs up. Exhausted but clear-headed, Lummis leaves a void. Regulators, traders, and crypto lobbyists wonder: who will now whisper in the ears of senators?

Coinbase Institutional sees in 2026 much more than a simple market rebound: a strategic shift. In a 70-page report published in mid-December, the platform anticipates a deep integration of cryptos at the heart of global finance. While this year has been marked by volatility and persistent regulatory uncertainties, Coinbase is betting on a new emerging phase where regulation, institutional adoption, and new uses will sustainably reshape the crypto landscape.

Six years after launching its own private blockchain, JPMorgan Chase is radically changing strategy. The bank has just transferred its digital deposit token, the JPM Coin, to Base, Coinbase's public network. A major turning point for an institution that until now had exclusively relied on its closed ecosystem Kinexys.

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

The world's largest crypto exchange platform strengthens its ties with the Trump family. Binance has massively integrated USD1, the stablecoin from World Liberty Financial, into its infrastructure. A rapprochement that comes just weeks after the presidential pardon granted to its founder.

The UK is moving quickly to strengthen its position in digital finance as part of its 2026 growth plan. Pound-pegged stablecoins are now the central play in a regulatory push to keep the country competitive as Europe develops new rules. Clear timelines, new testing routes, and pressure from nearby markets are pushing the region toward a more structured stablecoin system.

Circle, the issuer of the famous USDC, takes a decisive step by developing USDCx, a stablecoin designed to offer banking privacy to companies and institutions. Developed in partnership with Aleo, this project answers a growing demand: how to benefit from blockchain without exposing transactions to the public?

The crypto market is booming: Polygon activates an update that could transform the entire ecosystem. All the details in this article!