The Italian Minister of Economy and Finance, Giancarlo Giorgetti, expressed his concerns about the threat posed by American stablecoins, emphasizing that they could represent a greater danger than Donald Trump's tariffs. According to him, these dollar-backed cryptos risk disrupting Europe's financial stability.

Stablecoins

Europe believed it had locked down cryptocurrencies with MiCA. ESMA sets the record straight: too many gateways, too many risks. When tokens cough, finance could catch a cold.

Tether, the leader of USDT, is preparing a new American stablecoin aimed at financial institutions. This strategic project emerges as Washington moves towards a regulatory framework for these dollar-backed digital currencies.

Paul Atkins takes the stage, Gensler exits through the back door, and Trumpian stablecoins dance on the blurry line between regulation and personal ambition. It's a true crypto western.

Imagine a president, builder of skyscrapers and scandals, minting money at will based on the laws he writes. The USD1 is not just a stablecoin; it is the gateway to finance without safety nets.

Tether surpasses Canada and becomes the 7th largest buyer of US Treasury bonds. What are the implications for the crypto market?

Popular in words, forgotten in actions: bitcoin fascinates but does not convince. 4% of the earth's population believes in it, the others watch, perplexed, this digital gold without bars.

Brussels wields MiCA, Binance complies: nine stablecoins face regulatory guillotine. The ailing European crypto market witnesses the burial of USDT and others.

Kraken removes USDT from its platform in Europe and is considering a USD stablecoin. Discover this upheaval in the crypto market!

Crypto: Tether strikes back after JPMorgan's predictions of a massive Bitcoin sell-off. Should we be worried? Analysis.

Can Tether still sleep peacefully? USDC rises to $56.3 billion, wipes out its losses, and makes its way to the table of the big players. Stablecoins are reinventing cash... and the battle is fierce.

Tron, the outsider no one expected, overshadowed Bitcoin in 2024, riding a tsunami of stablecoins and memecoins, turning the blockchain into a true transaction fair.

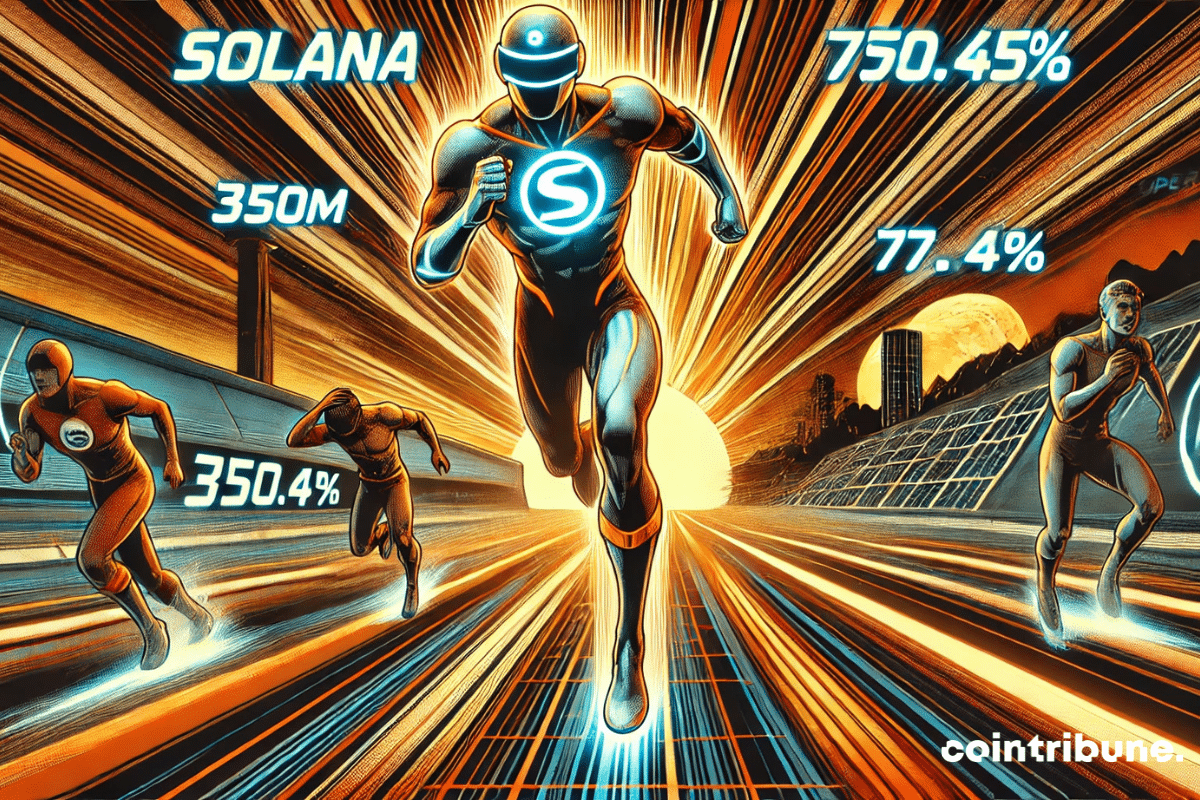

The Solana blockchain recently recorded a 73% increase in its stablecoin supply, reaching $11.1 billion, following the launch of the memecoin $Trump on January 18, 2025. The launch of this memecoin led to a significant increase in activity on the network, with over 200,000 new users joining the blockchain.

Once silent, crypto wallets are stirring: 36 million digital souls are exploring the blockchain, shaking up banks and traditions. The monetary revolution, like a rising tide, seems inexorable.

When Solana plays with billions, memes lurking, and stablecoins in abundance, the giants waver. Crypto turns heads and algorithms.

Amidst the swirling background of stablecoins, Ripple orchestrates a symphony of boldness: RLUSD, millions issued, solidified reserves, and vague promises... A storm in the crypto world, and this is just the beginning.

In 2025, venture capital in the crypto sector will continue to grow. According to experts, venture capital investors will focus on three burgeoning areas in the cryptocurrency industry, likely attracting nearly 18 billion dollars in investments.

Bitcoin could aim for $120,000 as early as January 2025 thanks to record reserves of $45 billion on Binance. Discover the details!

Bitcoin is stagnant, investors are softly dozing. But beware: Trump in January could very well add some spice to this lukewarm crypto soup.

Binance's vaults are welcoming massive deposits. Whales, silent strategists, weave their web of stablecoins for a promising bullish dance.

The crypto market continues to show signs of growth and adoption, particularly with the significant increase in demand for stablecoins on Ethereum's layer 2 networks. According to a recent report, Ethereum's layer 2 networks now hold over 13.5 billion dollars in stablecoins, a new historical record.

The cryptocurrency market has recently been shaken by a major news: a massive influx of 148 billion dollars in stablecoins. This situation raises crucial questions for Bitcoin (BTC) investors and could have significant implications for the future of the world's most famous cryptocurrency.

MiCA in conductor mode: two stablecoins land in Europe, but banks are playing a risky tune.

The Bank of France, like a warrior of old, demands order over the chaos of cryptocurrencies, calling for Esma for support.

The popularity of stablecoins is skyrocketing, and their influence on the U.S. Treasury bond market is not going unnoticed. These digital assets, pegged to fiat currencies, attract investors seeking stability in a volatile crypto market. Could this record demand for Treasury securities signal a deeper trend in the adoption of…

"Decentralized finance, Trump’s new craze! The sale of WLFI promises mountains and wonders to investors… or not."

According to recent movements, the crypto company Ripple may soon unveil its stablecoin RLUSD. Details in this article!

According to Matt Hougan from Bitwise, Ethereum is still the leader of blockchains despite its challenges. More details in this article!

Bernstein predicts DeFi returns exceeding 5%! A strong signal for the crypto market with the imminent drop in U.S. rates.

While DEXes are experiencing a slight decline, Ethereum continues to shine. Discover the reasons for this exceptional performance.