Former SEC Chair Gary Gensler rehashed debate over digital assets in a Bloomberg interview, saying Bitcoin stands apart from the rest of the crypto market. He warned that most tokens still act as speculative bets with little support behind their valuations, setting a cautious tone for investors.

Theme Stablecoin

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

The news may seem trivial at first glance, but it marks a strategic turning point for Sony. After conquering trade shows worldwide with PlayStation, the group now wants to leave its mark on a rapidly evolving sector: crypto payments. Behind the scenes, Sony Bank is accelerating, preparing a regulatory offensive, and laying the foundations for a future stablecoin, an initiative that could transform the way millions of players consume their digital content.

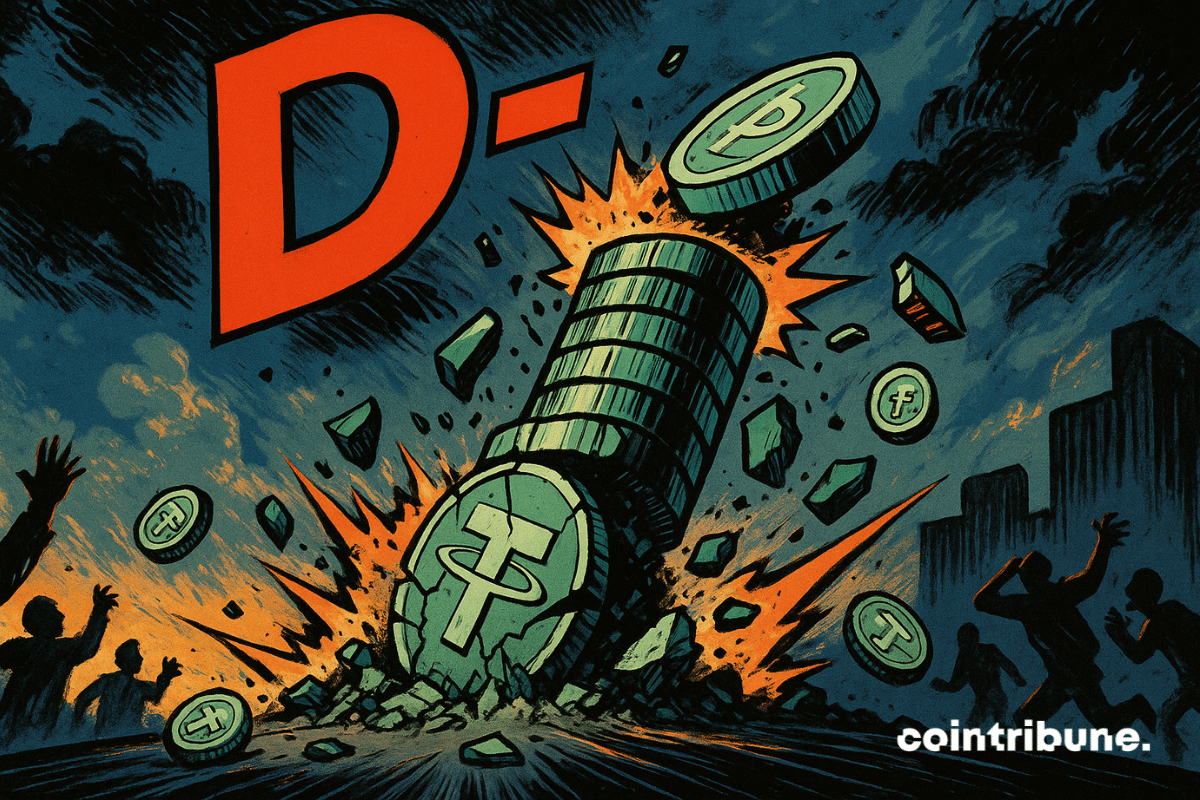

The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

China has just made a big move: the central bank is further tightening its crackdown on crypto and stablecoins, calling them a major threat. Why this radical decision? What impacts for the global market and investors?

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

Ripple USD has entered a new phase of market growth as it surpasses the one-billion supply mark on Ethereum. RLUSD’s fast expansion has strengthened its position among major stablecoins, showing steady demand across trading platforms, wallets, and payment services. For an asset less than a year old, this milestone represents a notable achievement for the dollar-pegged stablecoin.

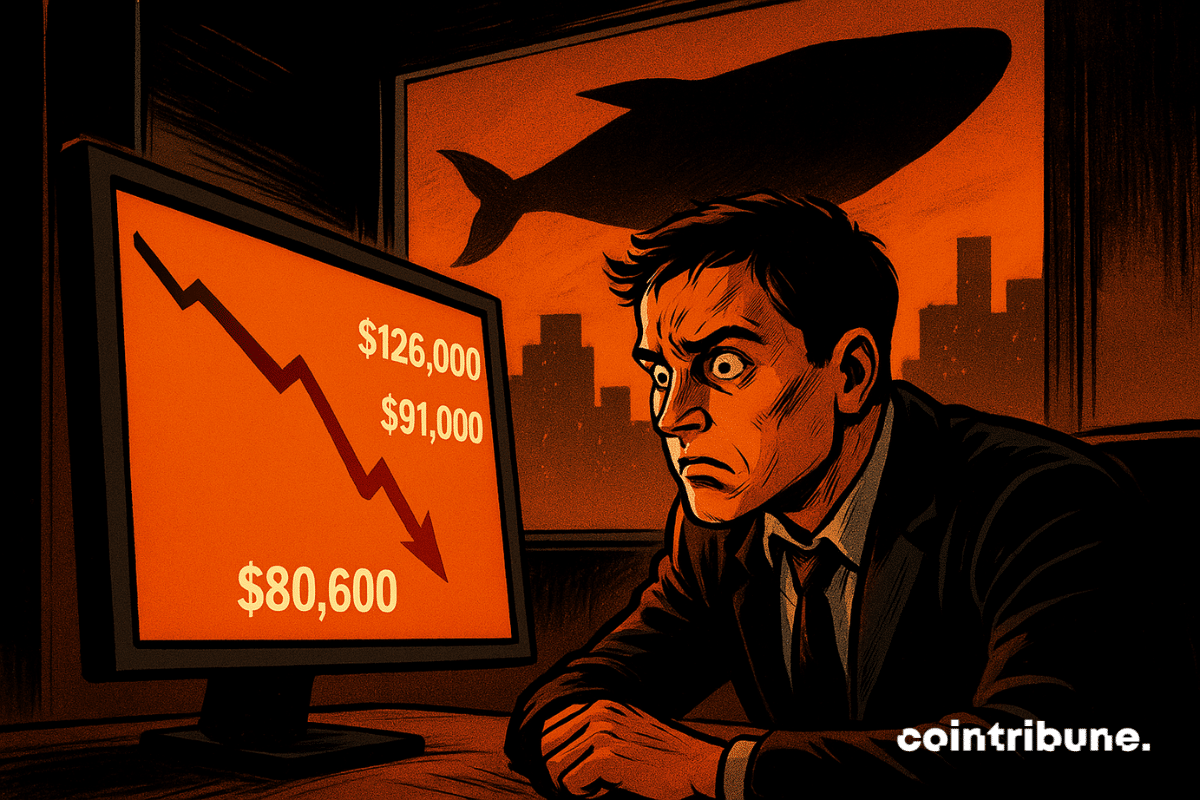

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

QCAD has become Canada’s first fully compliant CAD stablecoin, offering stable value, faster payments, and greater access to digital financial services.

While stablecoins worry many central banks, the ECB adopts a surprisingly measured tone. In its latest financial stability review published on November 20, it considers these assets to represent "only a limited risk" to the eurozone. A reassuring position, which the institution justifies by still marginal adoption and an already existing regulatory framework. However, behind this apparent calm, the ECB calls for vigilance given the rapid market evolution and emerging cross-border risks.

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Bitcoin as a global payment rail? For BlackRock, this is clearly not the core issue. For now, clients of the world’s largest asset manager mainly play the digital gold card, not the everyday currency one.

Aave announces a new savings app offering up to 9% APY, real-time interest tracking, and higher yields than traditional banks.

Tokenized gold hits $3.9B with gold-based tokens XAUT and PAXG leading the market while stablecoin supply continues to grow.

Aave Labs has taken a significant step toward regulated on-chain finance in Europe. The company has received authorization under the EU’s Markets in Crypto-Assets (MiCA) framework, allowing euro-to-stablecoin conversions at no cost. This places Aave among the first major DeFi projects cleared to offer compliant payment services across the European Economic Area.

As Beijing tightens the grip on stablecoins, Alibaba chooses another path: that of the deposit token backed by banks. This is not a technical detail, it is a full-scale test of the limits of the Chinese model: zero tolerance for private onshore stablecoins, but calculated openness for regulated tokens, useful for exports.

Cash App is preparing one of its biggest updates yet as parent company Block sets a timeline to add stablecoin operations to the platform. New tools for both Bitcoin and digital dollar payments are being prepared for rollout, with early 2026 cited as the target window. Essentially, Block is pushing to expand access to digital payments while keeping Bitcoin at the center of its ecosystem.

A muted end to 2025 may be laying the groundwork for a stronger crypto breakout in 2026. Bitwise chief investment officer Matt Hougan says the absence of a late-year rally strengthens his view that next year will bring the next major upswing for digital assets.

Visa is taking another major step in digital payments with a new pilot program that allows U.S. businesses to send stablecoin payouts directly to crypto wallets. Announced at the Web Summit in Lisbon, the initiative connects traditional bank accounts to blockchain-based transfers, aiming to speed up cross-border payments and support the expanding freelance economy.

Coinbase’s planned $2 billion acquisition of BVNK, a stablecoin infrastructure firm, has collapsed, ending what could have been one of the largest deals in crypto history. The decision, reached during the due diligence stage, was mutual, according to statements from both companies.

Brazil has taken a significant step toward bringing stablecoin activity under its traditional financial system. New regulations issued by the Banco Central do Brasil (BCB) grant stablecoin transactions the same legal treatment as foreign-exchange operations and subject crypto companies to a licensing regime similar to that of banks.

Institutional adoption of digital cash is gaining momentum, marking what BNY describes as a major structural shift in global finance. The bank projects that the combined market for stablecoins, tokenized deposits, and digital money-market funds (MMFs) could reach $3.6 trillion by 2030. Stablecoins are expected to account for about 41.6% of that total, with tokenized deposits and digital MMFs making up the remainder.

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

When crypto plays central banker, the Fed sweats under its suit. Stablecoins, hidden treasures, and plummeting rates: guess who really runs the world?

Stablecoins are becoming the preferred cryptocurrency for illicit transactions, outpacing Bitcoin and drawing increasing scrutiny from regulators.

What if the promise of financial inclusion hides a major systemic risk? Popular in crisis-hit countries, stablecoins have become the preferred tool for millions of citizens to escape hyperinflation. However, behind this massive adoption, a growing concern: by channeling savings towards the digital dollar, these assets could weaken the most vulnerable economies. As their usage explodes, a dilemma arises: are stablecoins a bulwark for the people or a silent threat to states?

Trump, crowned president of mental mining, dreams of a bitcoin empire while Beijing prepares its tokens... A crypto-crusade to follow between tweets, stablecoins, and the digital yuan under surveillance.

Is Bitcoin losing ground where it was supposed to triumph? Cathie Wood, CEO of ARK Invest and a leading figure in crypto investment, has just lowered her most ambitious target for BTC. The reason is the rise of stablecoins in emerging economies, where they are establishing themselves as a new store of value. A strong strategic adjustment that questions the real role Bitcoin will play against these dollar-backed alternatives.