olana is preparing to replace TowerBFT with Alpenglow, a new consensus model aimed at faster finality, stronger security, and performance closer to traditional financial markets.

Solana (SOL)

Embezzle 2 million, end up in prison, become a hero despite yourself... In crypto, even robbers become influencers. What if stealing was boosting business better than an airdrop?

U.S. Solana exchange-traded funds (ETFs) have witnessed another setback in the buildup to their mainstream debut. According to recent reports, the U.S. Securities and Exchange Commission has suspended discussions over a possible SOL ETF approval, with the decision timeline extended to October 16.

Solana has crossed $205, fueling speculation about a target of $250. Between favorable on-chain indicators and declining DEX volumes, find out whether this rally can last or will fade against the headwinds of the crypto market.

Solana continues to dominate the decentralized exchange (DEX) ecosystem, outpacing other veteran networks such as Ethereum. Platforms such as Jupiter are also witnessing active engagement, with four new private AMMs debuting on the network. This trend follows the recent emergence of token launchpads, which have helped drive overall trading activities.

The crypto market is heating up with Solana and Chainlink leading the way. We bring you all the details in this article.

Digital assets have transcended the corridors of financing, entering the realm of space exploration. In a recent update, Jeff Bezos’s Blue Origin has joined forces with American firm Shift4 Payments to offer crypto payment services for expeditions to outer space.

A beverage brand on Nasdaq trades bubbles for BONK: $25M in a Solana memecoin, crazy bet or financial genius crypto-circus style?

The future of stablecoins is taking shape in this colorful and often unpredictable world of cryptos. Records are breaking one after another, driven by massive adoption and piling innovations. And while some see it as a simple fad, others bet that this wave will not stop anytime soon. The numbers speak for themselves... and they have rarely been so eloquent.

Blackrock may be preparing to expand its crypto ETF lineup with spot funds for XRP and Solana, according to ETF expert Nate Geraci. The prediction comes as institutional interest in alternative crypto assets heats up and the race for market share intensifies.

The meme coins built on Solana, notably PENGU and SPX, are starting a stabilization phase after a sharp correction. Technical and market data suggest a possible recovery, supported by the gradual return of capital.

The competition to build Solana treasuries is intensifying, as public companies bet big on staking returns. This week, three firms disclosed major Solana purchases totaling millions of dollars.

Solana attracts an unprecedented wave of institutional capital, redefining its role on the crypto chessboard. According to CoinGecko data, publicly traded companies are injecting several hundred million dollars into SOL, methodically strengthening their presence. Far from a mere speculative movement, these massive purchases are integrated into long-term strategies, driven by volumes and accumulation methods rarely seen. This strong signal confirms Solana's growing place in institutional portfolios.

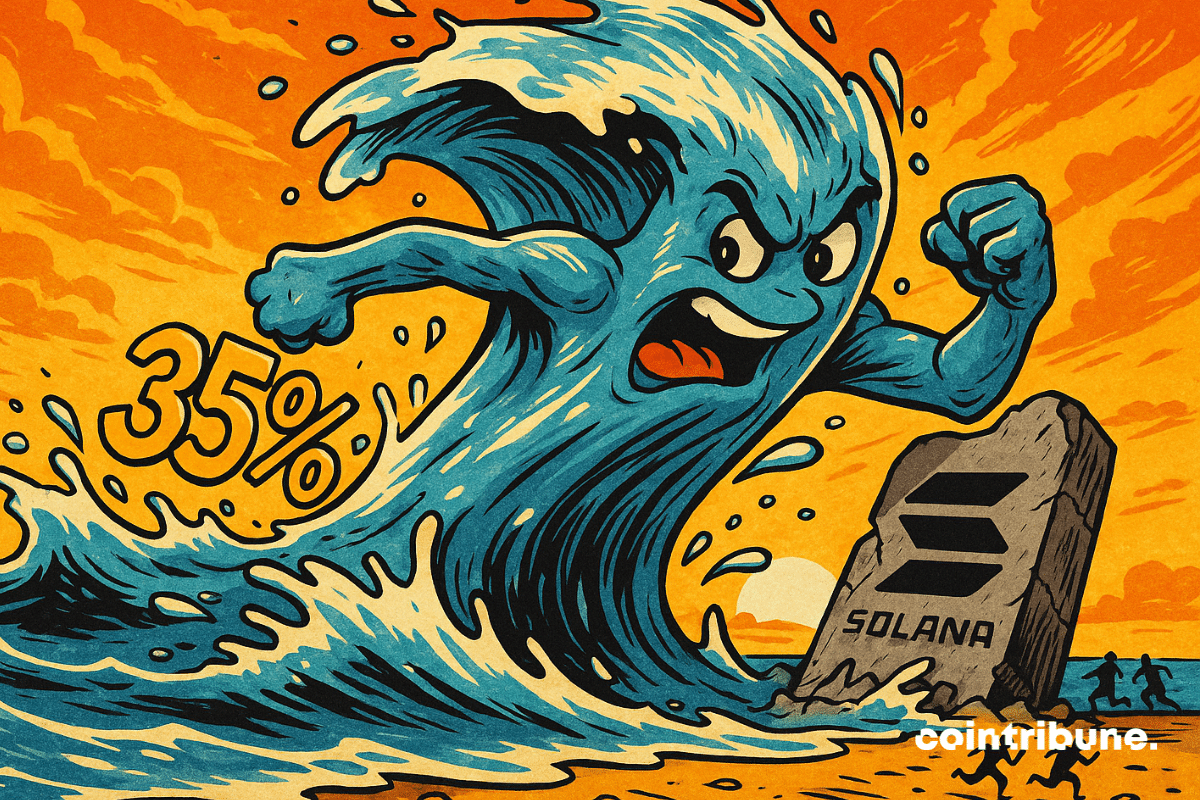

Hyperliquid overtook Solana in July, capturing 35% of blockchain revenue and hitting $2.66B in trading volume amid rapid user growth.

When Solana slips Web3 into your pocket, Apple and Google look glum. The trendy crypto Seeker promises a cage-free phone, but with dApps, tokens, and open war.

Solana dethroned, Zora is making waves, Pump.fun is frowning: in the dance of cryptos, the thrones wobble and the platforms waltz to the rhythm of tokens.

Solana’s co-founder Anatoly Yakovenko called meme coins and NFTs “digital slop,” sparking a debate on their real value and impact on the crypto market.

Solana’s core development team is preparing to significantly raise the network's computational capacity with a new proposal. The Solana compute unit limit increase aims to meet the growing demands of high-performance decentralized applications (dApps).

Cryptocurrency adoption has witnessed remarkable growth in 2025, with individuals and even large institutions pivoting towards digital asset ownership. Interestingly, data shows that the recent wave of crypto embrace is largely driven by digital payment and artificial intelligence.

Altcoins suddenly plunge after a frenzied rally. Ethereum and XRP drop, but Bitcoin remains calm. Temporary correction or the beginning of a real reversal in crypto? Suspense.

Solana shines, MoonPay joins the dance of liquid staking with a yield of 8.49%. But behind the simplicity, there is fierce competition and colossal stakes for crypto.

Solana brushes against $200 and attracts all eyes. A rare graphical signal suggests a leap to $6,000. Is this the beginning of a crypto super cycle? Find out why SOL could change everything very soon.

While Bitcoin slumbers, the whales stir and Ethereum prances. The altcoin dance begins, with institutions as conductors... How long will the music last?

PENGU, the NFT of Pudgy Penguins on Solana, explodes after a record sweep of CryptoPunks. All the details in this article.

Solana challenges Ethereum on its own turf: speed, efficiency, and explosive adoption. 21Shares announces a historic shift in the crypto market. Discover why SOL could become the must-have asset of 2025 and what this means for investors.

The market for tokenized real-world assets (RWA) is experiencing a spectacular redistribution in 2025. Solana has shown a growth of 218% since January, eclipsing the progress of Ethereum which is limited to 81%. Could this rise redefine the hierarchy of blockchains in this strategic sector?

Pump.fun raises 500 million in a flash, while denying liking presales. Behind the bots, rug pulls are piling up. But who is really pulling the strings of the great crypto circus?

Ethereum is sprinting in Web3: zkEVM, secret clients, and proofs in 10 seconds… Meanwhile, rivals are taking a nap and Vitalik is adjusting his stopwatch.

Ahead of its initial coin offering (ICO), Pump.fun has secured its first-ever purchase by acquiring a Solana-based wallet tracker, Kolscan. According to the company, this latest rollout features an aggregated ranking of key opinion leaders (KOLs) based on their trading performance, allowing users to closely observe and analyze the strategies of top investors within the Solana network.

As Bitcoin gallops ahead, altcoins are sharpening their weapons in the shadows... What if the king soon fell from his throne? Guaranteed suspense in the crypto arena.