XRP, this rebellious insurgent, rises from the ashes while Ethereum stumbles. The crypto-sphere holds its breath: the established order wavers, and the throne of altcoins threatens to change hands.

Solana (SOL)

The crypto market is buzzing, traders are accumulating, stablecoins are soaring. A prelude to a bullish party or the swan song before an unexpected crash? The riddle persists.

The craze for memecoins on the Pump.fun platform is drastically fading. The survival rate of tokens has fallen below 1% for four consecutive weeks, reflecting a growing disinterest from investors in this type of speculative asset.

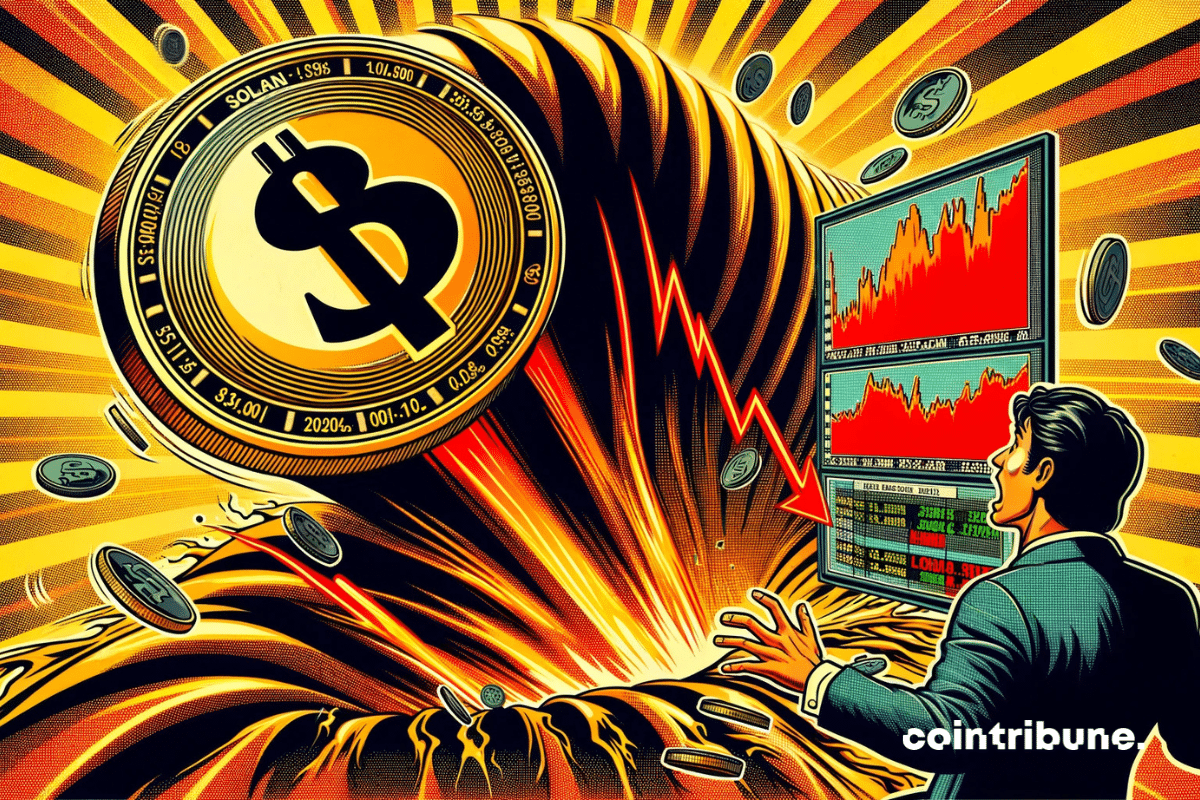

The rapid rise of the Solana network at the beginning of the year seemed to herald a new era for its ecosystem. Fueled by an unprecedented speculative frenzy around memecoins, the blockchain recorded record revenues, reaching $55.3 million per week. However, the party was short-lived. Within weeks, the excitement evaporated, leading to a brutal collapse. Today, Solana's weekly revenues have fallen back to $4 million, a staggering drop of 93%. This sudden turnaround raises a central question: Can Solana survive the end of this euphoria and find a sustainable growth model? On one hand, the frenzied speculation around meme coins has revealed an undeniable pull of the network, but on the other hand, its dependence on these ultra-volatile tokens undermines the entire economy.

The crypto market is going through a phase of uncertainty, where every technical indicator is scrutinized closely. Solana, long considered one of the most promising projects in the sector, finds itself at a decisive crossroads today. As its price records a notable drop, a feared signal from analysts threatens to increase the pressure: the death cross. This technical event, often interpreted as a bearish indicator, could well influence investor behavior and trigger a new cycle of volatility. But is this signal really heralding a prolonged downtrend, or could it precede an unexpected rebound?

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a realm of limitless innovations and a battlefield of regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The history of cryptocurrencies is marked by episodes where volatility defies the logic of markets. Solana (SOL), one of the most promising blockchain ecosystems, is currently experiencing an intense phase of fluctuations. While its price has seen a significant drop in recent days, its trading volume has witnessed a spectacular surge. Over 5.18 billion dollars have flowed through the platforms, a movement that is as intriguing as it is concerning. This resurgence of activity reveals a complex dynamic where financial losses and hopes for a rebound intertwine.

On the crypto scene, Trump plays the alchemists: he transforms tokens into gold… but the magic primarily works for those around him.

The volatility of cryptocurrencies spares no one, and Solana (SOL) is no exception. After reaching a low of $125 on February 28, the native token of the Solana blockchain saw a rebound of 17%, hinting at a possible return towards $180. However, this recovery is far from guaranteed. Still down 50% from its all-time high of $295, SOL is facing several obstacles that could hinder its ascent. Between the slowdown in its on-chain activity, the lack of demand in the derivatives markets, and the concentration of transaction fees in the hands of a handful of users, the Solana ecosystem is wavering. What are the signals that could trigger a bullish rally?

The NFT eldorado has turned into a frozen desert: 13.7 billion in volumes vanished, a crash worthy of the most beautiful digital illusions. Who will still bet on these mirages?

The crypto ecosystem is going through an expansion cycle where competition among blockchains is intensifying, especially in the decentralized exchanges (DEX) market. Indeed, long dominated by Ethereum, this sector is seeing the emergence of a significant competitor: Solana, whose trading volumes briefly surpassed those of Ethereum in February. This unexpected performance occurred despite an unprecedented crisis in the memecoin segment, these speculative cryptos that have long been a key economic driver of the network. Solana is holding on to its place among the DEX leaders, but the recent collapse of memecoins raises a major question: can the network maintain its position without this asset?

Anatoly Yakovenko, co-founder of Solana, expressed his skepticism about the idea of a strategic reserve of cryptocurrencies in the United States, fearing for the decentralization of the sector. However, he remains open to objective criteria if such a reserve were to come into existence.

The Trump administration has just taken a new step in the regulation and integration of cryptocurrencies in the United States. President Donald Trump signed a presidential decree late last night that establishes a Strategic Bitcoin Reserve and a Digital Asset Stockpile, an initiative that transforms the American approach to cryptocurrencies.

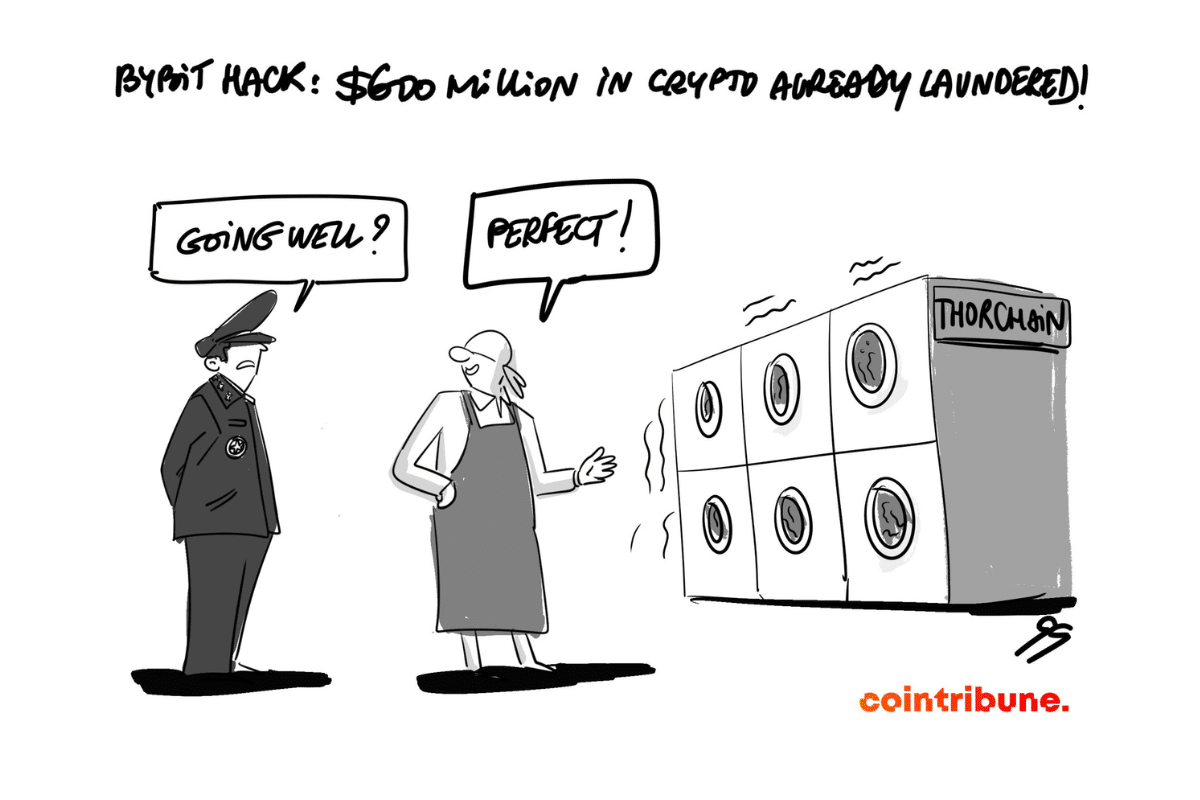

In a context of increasing uncertainty in the crypto market, Solana experienced a capital hemorrhage in February 2025. Investors, burnt by scandals related to memecoins and the recent record hack of Bybit, are massively turning to digital assets deemed safer.

On March 6, 2025, Solana validators will vote on two major proposals aimed at modifying the network's economy and the reward system for stakers. These proposals, known as Solana Improvement Documents (SIMDs), are generating intense debate within the crypto community, particularly due to their impact on validator revenues, which are set to decrease dramatically.

Donald Trump sparked an uproar by announcing that the strategic reserve of bitcoins would also include other cryptocurrencies.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

With a snap of the presidential fingers, XRP enters history. The SEC falters, Garlinghouse exults: a new era blows over crypto.

The past few weeks have been tough for crypto investors. Indeed, they have been marked by a prolonged market downturn and a growing sense of distrust. Bitcoin, the engine of the sector, has nonetheless recorded a spectacular rebound. Thus, it surpassed $84,000 after having dropped to as low as $78,248. This turnaround raises an essential question: is this a true signal of recovery or just a brief surge before a new phase of turbulence? In the shadow of this rise, major altcoins like Ethereum (ETH), Solana (SOL), and XRP have experienced mixed performances. Some may take this opportunity to regain ground, while others remain under pressure.

"Binance, accused of pulling the strings of the grand crypto ball, defends itself. Meanwhile, Solana wavers, and investors search for a culprit. A twist of fate or mere panic?"

Solana is bonding like a cat escaping the downpour, but the storm of March 1st is approaching, ready to clip its wings.

MetaMask sets sail, goodbye gas fees, hello Bitcoin and Solana. A revolution is blowing through crypto, shaking up certainties and driving competitors wild.

The crypto market is undergoing a new phase of turbulence. Solana (SOL) has fallen by 41% in just a few weeks. This decline is not just a simple market correction: it highlights structural vulnerabilities and a high dependence on certain speculative trends.

Amidst sordid scandals, Pump.fun devalues by 80% in February. The excitement of memecoins fades under the weight of disappointment, while confidence collapses inexorably.

Altcoin ETFs are arriving, but the initial frenzy seems to dissipate quickly. Savvy investors prefer direct acquisition on platforms, far from these newly reinvented promises.

The week starts in the red—it's a bloodbath for crypto. Ethereum, Solana, and the market are plunging. Even Bitcoin isn't spared.

Cryptos are experiencing a new episode of brutal volatility, shaking a market already weakened by macroeconomic uncertainties. Solana is collapsing by 14%, XRP and Dogecoin are down more than 8%, while Bitcoin has dipped below $91,000. This movement, amplified by massive liquidations, raises questions about the resilience of these assets in the face of global economic pressures. Thus, the question now is whether this drop indicates a simple correction or the beginnings of a trend reversal.

After months of excitement, the frenzy surrounding the launch of tokens on Solana is slowing down significantly. Pump.fun, the leading platform for launching memecoins, is experiencing a marked decline in its activity and revenue. Amid growing mistrust and market fatigue, the enthusiasm for these ultra-speculative tokens seems to be fading.

The Solana ecosystem is currently going through a period of turbulence due to the increase in scams related to memecoins. The drop in capital flows and the 40% decrease in active users reflect a loss of confidence among investors. However, this crisis could cleanse the market and strengthen the network's credibility.

Bitcoin sways under a threatening sky, and nearly 300 million dollars vanish in the storm. Traders, like tightrope walkers, are scrutinizing the bar at 96,000 dollars.