In an exceptional bull market context, Bitcoin has just established a new all-time high. The world’s leading cryptocurrency has seen its market capitalization surpass the $1.6 trillion mark, driven by a price that now exceeds $81,000.

Short news

Ethereum, fleeting king of gains? A whale relinquishes its fortune, sowing doubt in the crypto court. What a tide!

In a context where Bitcoin reaches historic highs beyond 81,000 dollars, MicroStrategy sees its investment strategy paying off with a return on investment now exceeding 100%.

The world of traditional finance is shaking as the crypto world reaches new milestones. Ethereum, the second-largest cryptocurrency by market capitalization, has surpassed a financial giant, Bank of America. This symbolic milestone, reached with an ETH price peaking at $3,200 on November 10, reflects the shift of values towards cryptocurrencies as Bitcoin also hits historical highs of over $80,000. Thus, this breakthrough of Ethereum reflects a transformation in the appeal of decentralized assets and in the very structure of the global financial market.

Surpriiiise: Bitcoin could soar to $300,000! Experts are rejoicing, bears are crying, and Wall Street is finally applauding.

Solana crypto (SOL) has just crossed a historic milestone by reaching $214, its highest level since December 2021. This spectacular performance marks a rebound of 2,500% since its post-FTX all-time low.

"Big crisis, big doubts!" Musk already sees America in ruins... unless a bit of Bitcoin comes to solve everything!

Bitcoin continues its meteoric rise in 2024, reaching a new historic high of $80,116 this Sunday, November 10. This exceptional performance comes against a backdrop marked by the recent reelection of Donald Trump and a massive influx of institutional investments through Bitcoin ETFs.

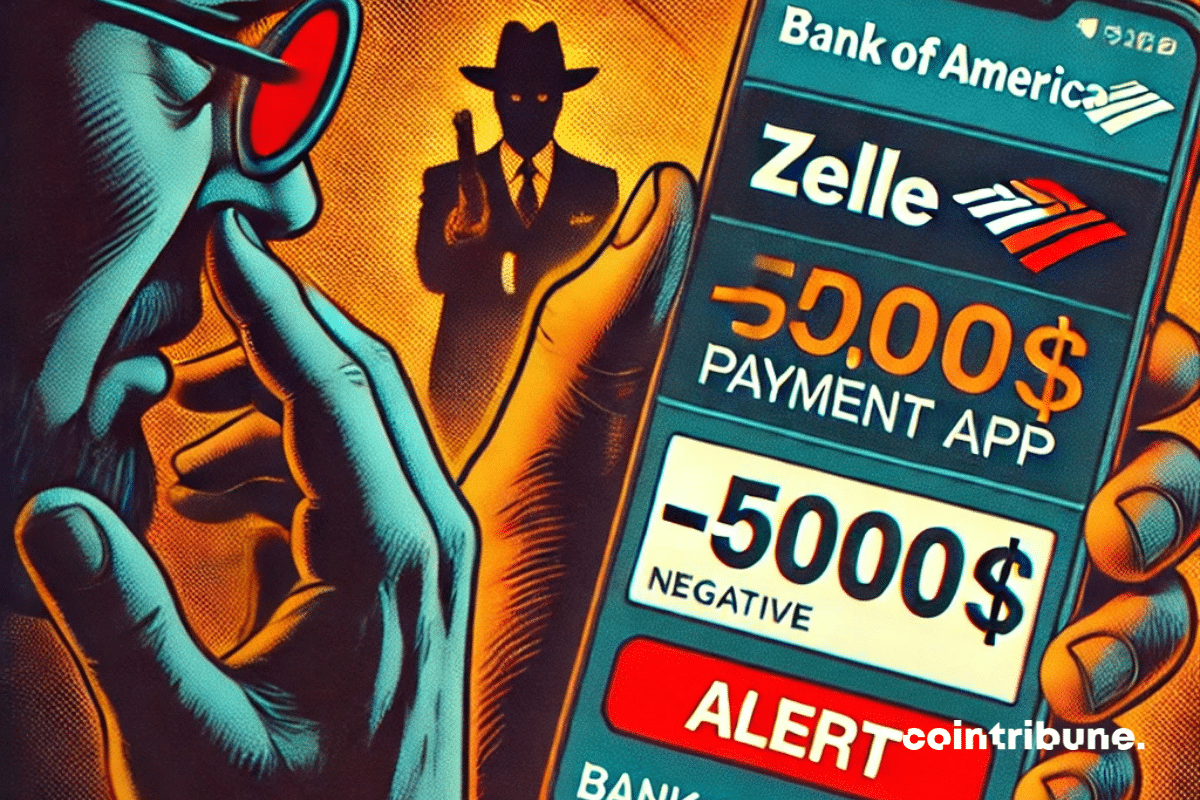

Bank of America, one of the largest American banking institutions, finds itself in the spotlight in a potentially explosive case. Indeed, an $800 million loss looms for the bank, under the threat of a federal investigation related to accusations of non-reimbursement of customers who fell victim to fraud via the Zelle payment network. This case raises further questions about consumer protection practices in the American financial sector, as pressure intensifies on banks to ensure secure transactions and reimbursements in cases of fraud.

Solana climbs, climbs, and soon touches the grail of 100 billion. Trump applauds, the crypto world holds its breath!

Bitcoin continues its wild ride, reaching a new all-time high of $79,141, as market experts urge investors to keep their cool in this highly bullish context.

The return of Donald Trump to the presidency could transform the future of cryptocurrencies in the United States, as this reelection generates both hope and apprehension. Some players in the sector see it as an opportunity for more favorable regulation, while others question the true intentions of the future administration. Indeed, while the United States holds a prominent position in the development of crypto, Trump's policy on this sector could redefine standards and influence the price of assets, particularly Bitcoin.

Excitement in the crypto zoo: Bitcoin pulls back, altcoins tease an ascent. Breathless suspense, verdict soon, it promises!

Bitcoin is reaching new heights, now flirting with the $77,000 mark, a feat largely driven by the announcement of Donald Trump's victory in the U.S. presidential elections. In a context of high volatility, where institutional players and analysts sharpen their projections, the famous stock-to-flow model by analyst PlanB now forecasts a potential surge in Bitcoin's price up to $500,000 by the next four-year cycle. This renewed institutional interest, supported by favorable political initiatives, promises to disrupt the crypto market.

Nvidia in the Dow? It's tickling Wall Street! Yet, not so big after all in the kingdom of portfolios...

Crypto euphoria is once again gripping the markets as major exchange platforms experience a significant increase in traffic in October 2024, driven by investor optimism and U.S. political prospects.

As Bitcoin continues to captivate investors worldwide by flirting with new historical highs, an unexpected voice rises to temper the euphoria surrounding the queen of crypto: that of Ki Young Ju, CEO of CryptoQuant, a benchmark in the industry. In a context where markets are buoyed by the prospect of Fed rate cuts and the repercussions of the recent U.S. presidential elections, Ki Young Ju makes a strange and far from optimistic prediction. According to him, Bitcoin could experience a drop of nearly 24% by the end of 2024, with a level around $58,974. This prediction, although out of step with the current enthusiasm, is based on a meticulous analysis of past trends and market data.

The co-founder of Ethereum is shaking up the codes of decentralized finance by proposing a new concept called "Infofinance," aimed at transforming prediction markets into true sources of reliable information. This innovation could redefine the way we generate and value information in the crypto ecosystem.

The stunning victory of Donald Trump in the American presidential election triggered an unprecedented financial tsunami on Wall Street. In a single historic day, the ten wealthiest people on the planet saw their net worth jump by $63.5 billion, marking the largest increase ever recorded by the Bloomberg Billionaires Index since its inception in 2012.

Bitcoin is establishing itself as a strong player in the market! BlackRock, abandoning gold, is swimming in crypto green. A true idol reversal!

French and Singaporean banking giants take a decisive step in the race for post-quantum security. The Bank of France (BDF) and the Monetary Authority of Singapore (MAS) have just achieved a world first: successfully testing a banking communication system resistant to future quantum attacks.

As the price of Bitcoin reaches historic highs, having nearly touched 77,000 dollars yesterday, Friday, November 8, 2024, investors are faced with a critical question: is this rapid rise supported by real value, or is the market already hitting its limits? In a price discovery phase where traditional benchmarks seem to dissolve, analyses on on-chain metrics allow for a better understanding of the underlying potential of the most emblematic cryptocurrency. Five key indicators show that, despite this peak, Bitcoin remains fundamentally undervalued.

Trump at the helm and here comes Bitcoin sparking: BlackRock scoops up billions, everything is rolling for the ETF!

CZ is considering selling its stake in Binance, sparking speculation about a possible liquidation of the crypto platform.

Eclipse launches its mainnet, combining Ethereum and Solana for fast and cost-effective crypto transactions!

The French industrial giant Schneider Electric is facing a new cyberattack, the third in two years. The hacker group "Hellcat" threatens to disclose 40 GB of sensitive data, initially demanding an unusual ransom of 125,000 dollars in baguettes before backtracking to demand payment in Monero cryptocurrency.

Donald Trump's election to a second term as President of the United States could redefine the balance of power between Europe and its traditional ally across the Atlantic. In the face of this political upheaval, European leaders are confronted with critical questions about the future of their security, their strategic autonomy, and their economic partnership with the United States. As Europe is already weakened by internal tensions, Trump's return rekindles fears of an American disengagement in defense matters, as well as the threat of a trade war.

Trump at the helm and here comes Bitcoin sparking: BlackRock scoops up the billions, everything is going smoothly for the ETF!

Wecan Group, a Geneva-based fintech, transforms KYC compliance in Europe through a decentralized blockchain solution. Sought after by institutions in financial centers in Luxembourg, this innovation redefines traditional practices, enhancing security and efficiency.

The storm may be brewing for Bitcoin. This time, it is not the result of the usual market fluctuations, but of an analysis anticipating a drop that could shake investor confidence. As Bitcoin flirts with a new historical peak around $75,000, respected analyst Benjamin Cowen warns of a possible substantial drop in price. According to him, a reversal could take shape in early December, coinciding with the release of the U.S. employment report.