The Bitcoin bull cycle is still ongoing and the crypto queen is expected to experience a sustainable explosion in 2025!

Short news

Hedge funds, these major players in traditional finance, are now turning their gaze to a market once deemed too volatile: cryptocurrencies. According to a recent report by the Alternative Investment Management Association and PwC, nearly 47% of hedge funds that usually trade on traditional markets now hold digital assets. This…

The identity of Satoshi Nakamoto continues to fascinate the entire world. This mysterious creator of Bitcoin, who initiated a true revolution in the field of crypto, remains unknown. Despite years of speculation, no one has ever managed to unravel the mystery. Currently, the HBO documentary Money Electric: The Bitcoin Mystery has reignited the debates and claims that Peter Todd, a well-known Canadian developer in the community, is the man behind Satoshi Nakamoto. This statement has quickly ignited discussions and provoked strong reactions, notably from Adam Back, who strongly opposes this theory.

Worldcoin is heating up the blockchains, with its series tokens and millions of transactions: crypto is going crazy!

The crypto market experienced a meteoric rise in September, far surpassing traditional assets! Here are the factors behind this increase.

To court the crypto electorate, Harris receives a nice "gift" from Ripple: one million in XRP. An unselfish donation?

As inflation runs rampant, USDT trots in as a savior! Tether, proud of its stablecoin, is preparing a tribute film.

The Bitcoin network has recently reached a historic milestone by achieving a new record! This impressive milestone was achieved on October 10, 2024, despite ongoing challenges in the market.

Millennials? Always fully invested in crypto, treating themselves to a little ETF to cushion the digital shocks!

Participate in Genezys' Read to Earn quest on Cointribune, and earn crypto rewards while learning!

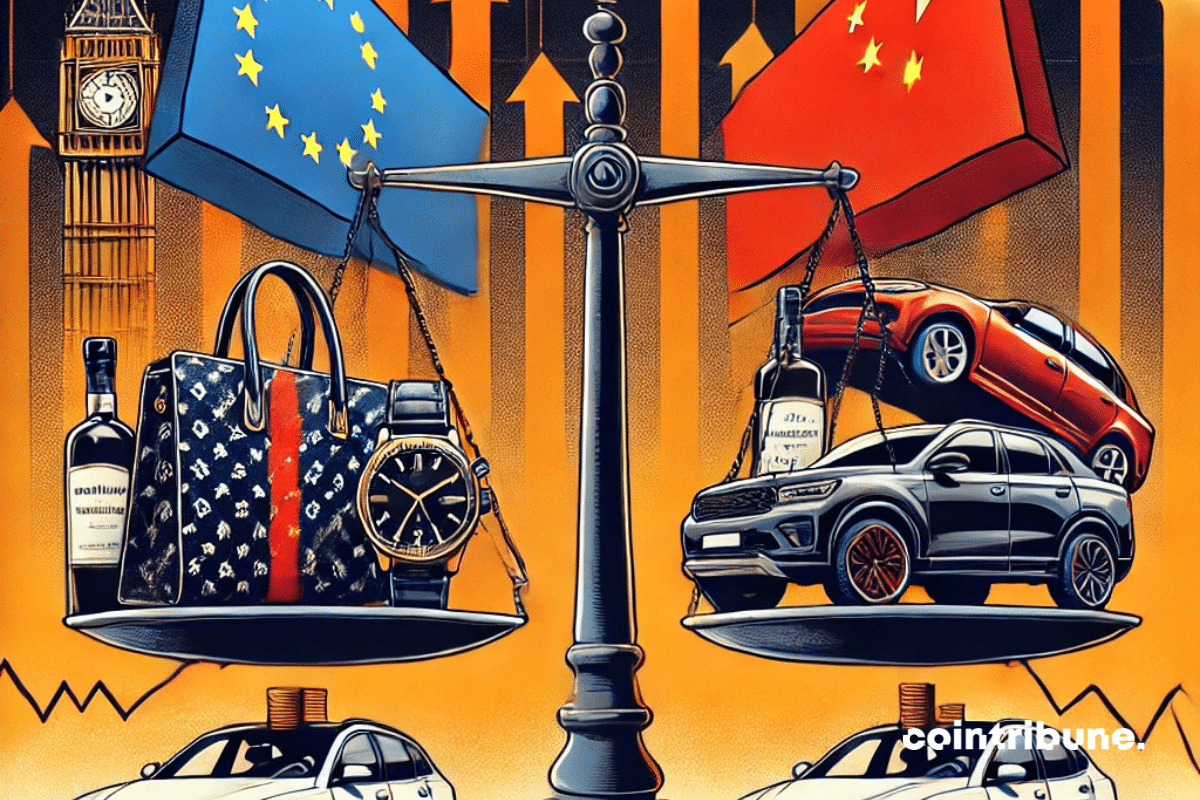

The trade war unfolding between the European Union and China is taking an unexpected turn. As the first sanctions hit strategic sectors such as electric vehicles and spirits, a new player enters the turmoil: European luxury. This economic stronghold, which symbolizes both creativity and prosperity in Europe, now finds itself at the center of speculations about potential Chinese retaliation. But behind this apparent storm, a more subtle equilibrium is taking shape. Experts, aware of the colossal economic stakes for China itself, are questioning: Will Beijing really take the risk of stifling one of the engines of its domestic consumption? In this article, we will first analyze the immediate consequences of this crisis on the financial markets of European luxury. Then, we will delve into the long-term perspectives and scenarios that could shape the relations between these two economic giants.

Here is a budget! Barnier sizes, cuts, siphons... and the French grumble louder than ever.

The interaction between sports fans and their favorite athletes is undergoing a revolution thanks to captivating challenges and unique crypto rewards. Discover how each interaction transforms into a rewarding and engaging experience, offering exclusive opportunities and exceptional rewards.

Despite monthly revenues of 300 million, the AI company OpenAI faces massive losses until 2029. Here are the reasons!

Inflation, often seen as one of the important economic indicators, shapes the trajectory of global financial markets. This time, the new data on inflation in the United States reveals a potentially crucial change for the crypto sector, and in particular for Bitcoin.

The Bitcoin network is currently facing a quiet but serious threat. Approximately 13% of the nodes that maintain and secure the blockchain are vulnerable to a critical flaw that could cause them to fail. This vulnerability, identified in May 2023, still persists on several nodes that have not yet been updated with the latest version of the Bitcoin Core software. While Bitcoin's security is often touted for its robustness, this issue reveals systemic flaws related to the management of essential software for the proper functioning of the network.

Inflation down in the United States? Yes, but be careful: between hurricanes, strikes, and unemployment, the economy has not said its last word!

The Mt. Gox exchange platform, a victim of a historic hack in 2014, has just announced a one-year extension of the deadline for reimbursing its creditors. This surprise announcement shakes the market: on one hand, it alleviates fears of a massive Bitcoin sell-off, while on the other, it rekindles anxiety among the victims. Will the creditors ever see their money again?

drop in price below the symbolic level of 50,000 dollars. This worrying outlook can be explained by evolving liquidity conditions and concerning technical signals.

Heated debate at the FED! Inflation and interest rate cuts divide financial experts who can no longer understand each other.

The president of the SEC remains skeptical about the widespread adoption of crypto as a means of payment, despite their growing popularity.

October 2024 is currently marked by notable declines in the crypto market. Investors, very concerned, are wondering if Uptober will ultimately take place, or if they should already consider other solutions. In any case, the analysis of this week 41 of 2024 will allow them to position themselves and make informed decisions for the end of the year.

A wave of massive ETH sales from the PlusToken affair, an old Ponzi scheme that wreaked havoc in 2019, is bringing back ghosts from the past. This situation, reminiscent of the events of 2021, is putting pressure on the price of Bitcoin and causing panic among some investors.

According to a recent report from the United Nations Office on Drugs and Crime (UNODC), the messaging application Telegram has become a preferred tool for illicit activities related to cryptocurrencies. This report highlights how powerful criminal syndicates in Southeast Asia are using Telegram to conduct large-scale operations, including money laundering and crypto fraud.

The FBI recently took an unprecedented step by launching its own cryptocurrency! This innovative initiative has allowed for the dismantling of a complex network of fraudsters operating in the crypto sector.

This Wednesday, October 9, 2024, François Villeroy de Galhau, Governor of the Bank of France, made a direct call: "It is time for everyone to make an effort." In a context where public finances are spiraling out of control, with a deficit that has widened by 100 billion euros since January, this statement leaves no room for ambiguity. Every economic actor, from citizens to businesses and local authorities, must accept sacrifices to avoid a budgetary collapse.

The world of cryptocurrencies is ruthless. While some projects emerge with brilliance, others struggle to convince or sink into obscurity. This harsh reality is what Max Keiser, an iconic figure of Bitcoin maximalism, bluntly reminds XRP holders. With a statement as sharp as it is expected, he announces that "the XRP rally will never happen," attacking Ripple's cryptocurrency once again. While the XRP community still hopes for a rebound, the latest developments in the lawsuit against the SEC continue to weigh down its price. Nevertheless, optimistic voices persist and bet on a potential technical reversal.

Bitcoin is soaring, but Wall Street is snoozing. While Americans are counting sheep, Asians are driving up BTC!

The Shiba Inu is going through a tumultuous period, far from the past euphoria of meme coins. While its price struggles to break out of a narrow range, the activity of Shibarium, its layer 2 network, is dangerously waning. The crypto sector is, by nature, dynamic and volatile, but this…

Uniswap Labs, the creator of the renowned decentralized crypto exchange protocol, unveils Unichain, its Layer 2 blockchain based on Optimism's OP Stack technology. This innovation promises faster and cheaper transactions, strengthening its position in the DeFi ecosystem.