Charles Hoskinson made a post that says a lot. The man behind Cardano declares that his work is autonomous. No need for him anymore, it seems. However, he does not leave the stage quietly. He talks about a risky journey, a possible death. And above all, he insists: Cardano is decentralized. It's up to you to judge whether he is taking his bow or launching a new magic trick.

Short news

On April 13, Bitcoin surpassed $86,000 before plunging below $84,000, without any macroeconomic alerts or exogenous factors. This abrupt reversal can be explained by an unprecedented imbalance in liquidations: $52 million in long positions against only $15 million in short positions, representing a gap of 346%. This anomaly reveals a structural tension related to leverage, where excessive speculative optimism makes markets particularly sensitive to internal corrections.

China does not intend to yield to the new American protectionist measures. In response to the tariff surge imposed by Donald Trump, Beijing retaliates directly by demanding the immediate removal of tariffs, fearing the effects of a major global economic shock.

As the crypto markets catch their breath after a period of high volatility, all eyes are on three giants: Bitcoin, Ethereum, and Ripple. This week is set to be decisive, with critical technical levels and macroeconomic factors that could redefine market dynamics. Between hopes for breakthroughs and risks of correction, here’s what could shake up portfolios.

XRP finds itself at a strategic turning point, facing technical resistance that could redefine its market trajectory. Since the settlement of the dispute between Ripple and the SEC, the asset has gained renewed confidence, but investors remain cautious. The crossing of this decisive threshold is being closely watched: a failure could stifle the current momentum, while a breakthrough would pave the way for new highs. Thus, it is now a time for confirmation for supporters of the bullish scenario.

The increasing trade tensions between the United States and China have significantly impacted American spot Bitcoin ETFs. These financial products recorded a net outflow of $713 million last week, marking their seventh consecutive day of withdrawals.

As markets shake and capital flees risk assets, Michael Saylor stands firm. The founder of Strategy, indifferent to macroeconomic upheavals, has just added more than 22,000 bitcoins to his treasury. Indeed, the timing raises questions: BTC's correction is intensifying, and geopolitical uncertainty is settling in. However, Saylor does not waver. For him, bitcoin is not a gamble; it is a conviction. A sharp position, contrary to the consensus, which reignites the debate on the resilience of the maximalist strategy.

April's volatility in the U.S. financial markets is worrying global investors. Since the surprise announcement of new tariffs by Donald Trump on April 2, the S&P 500 has lost 5.4%. However, it is mainly the signals from the bond market and the dollar that raise fears of a deeper movement: an exodus of assets out of the United States.

The MANTRA crypto project is facing an unprecedented storm. Its native token, OM, has lost more than 90% of its value in a few hours, erasing billions of dollars in market capitalization. A brutal drop that raises many questions within the crypto community and among investors.

A rare chart figure is forming on Ethereum, capturing the attention of crypto analysts. If confirmed, this setup could trigger a powerful upward movement, with a price target around $3,360 in the coming days.

XRP is making a strong comeback among the major contenders at the top of the crypto market. Standard Chartered expects a surge of 500% by 2028, enough to surpass Ethereum in market capitalization. Such a scenario would place Ripple at the heart of new digital balances, just behind Bitcoin. This rise is supported by the momentum of tokenization, the growing commitment of institutions, and an improving regulatory climate. The hierarchy of cryptocurrencies may be on the verge of tipping.

Solana crypto is regaining momentum. After a 47% drop since early March, SOL has just rebounded strongly, surpassing the critical threshold of 125 dollars. This technical breakout has immediately attracted the attention of investors, potentially marking a major turning point in the recent downward trend.

While economists count illusions, Bitcoiners sense the truth. False data, weakening dollar: a new monetary dogma is being born before our eyes, far from official reports.

As geopolitical tensions reshape global balances, the BRICS are accelerating the establishment of their own payment network. Led by Russia, this infrastructure aims to free itself from SWIFT and open a financial pathway outside of Western control. The announcement of its accessibility to non-member countries marks a strategic rupture. Beyond being a regional tool, BRICS Pay becomes a lever of global influence and a strong signal in favor of a multipolar monetary order.

As macroeconomic tensions intensify, gold continues to break records and reaches a new high of $3245. Driven by the fall of the dollar and rising bond yields, the precious metal confirms its role as a safe haven. An analysis of a bullish trend that seems far from over.

Larry Fink, head of the world's largest asset manager, BlackRock, believes that the American economy may have already entered into recession, mainly due to the impact of Donald Trump's tariff policies.

Dogecoin, long considered a mere crypto joke, continues to surprise. With the release of Libdogecoin v0.1.4, the developers demonstrate their desire to professionalize the project. This major update enhances security, improves performance, and equips the blockchain with advanced tools for both users and developers.

After a brutal correction of 30% that caused bitcoin to fall below $75,000, the leading cryptocurrency is once again showing signs of strength by stabilizing around $84,500. This significant rebound has been amplified by President Trump's announcement of a temporary suspension of tariffs for most countries.

XRP, the emblematic cryptocurrency of Ripple, is the subject of frontal attacks on its structure and philosophy. A blockchain expert questions its alleged decentralization and accuses the protocol of authoritarian drift. This criticism reignites a central debate in the industry: what truly constitutes a decentralized blockchain? Ripple, for its part, defends its design and claims resilience and efficiency. As pressure mounts, XRP finds itself at the heart of an ideological clash that could redefine the criteria for acceptability in the crypto universe.

Crypto in France is moving out of its phase of euphoria towards a more mature structuring. This 2025 study by Adan (Association for the Development of Digital Assets), conducted with Deloitte and Ipsos, presents a clear assessment: stabilized adoption, asserted industrial ambitions, but persistent challenges. Amid the rise of Web3, institutional openness, and regulatory barriers, the French ecosystem is carving its path towards sustainable integration. This survey sheds light on the springs of a dynamic in full redefinition, where the strategic future of cryptocurrencies in Europe is at stake.

Born from a meme, Dogecoin has established itself as a paradox of cryptocurrencies: both a joke and a serious asset. This Saturday, the price of DOGE surprised with a 6% rebound, reaching $0.166. Behind this surge, a rare technical signal on the hourly chart rekindles speculation. But amid contradictory indicators and recent news, the trajectory of the crypto dog remains enigmatic.

While the markets sneeze, the old Bitcoin veterans are back in charge. Accumulation, resistance, and conviction: a discreet but possibly explosive cocktail in this unstable monetary theater.

As the standoff between Binance and the SEC shapes the regulatory future of crypto in the United States, both parties are seeking a new 60-day judicial stay. A strong signal, indicative of a possible strategic shift within the regulator, and a likely signing of an agreement between the two parties.

On April 12, Donald Trump surprised the markets by lifting a series of tariffs on strategic technology products. This move, amidst the rivalry with China, instantly propelled bitcoin beyond $85,000. Far from a simple trade adjustment, this decision reshapes industrial balances and sends a strong message: American economic policy is now aligned with the interests of digital players and the crypto sector.

As the market regains its senses, SHIB lights the fuse. Fewer tokens, more ambition: what if the burn melts resistance at $0.00001570?

The crypto universe is moving at lightning speed, and BNB Chain seems determined not to be left behind. As blockchains fiercely compete to gain speed and efficiency, the Binance-affiliated platform is preparing a series of technical updates that could redefine industry standards. In April, the main network is set to experience a turning point, following the success of the Lorentz test network. But behind these technical adjustments lies a more ambitious strategy: to dominate the game in 2024.

American bitcoin miners are facing a new blow. The Trump administration has imposed heavy tariffs on mining equipment from Asia. As a result, costs are skyrocketing and the worst is yet to come...

The founder of Tron, Justin Sun, claims to be unaware of reports that Changpeng Zhao "CZ," the former CEO of Binance, provided evidence against him as part of his agreement with U.S. authorities.

Amid a strong daily volume, a hefty TVL, and millions of transactions, Base is pulling ahead. What if the Layer 2 battle already has its silent winner?

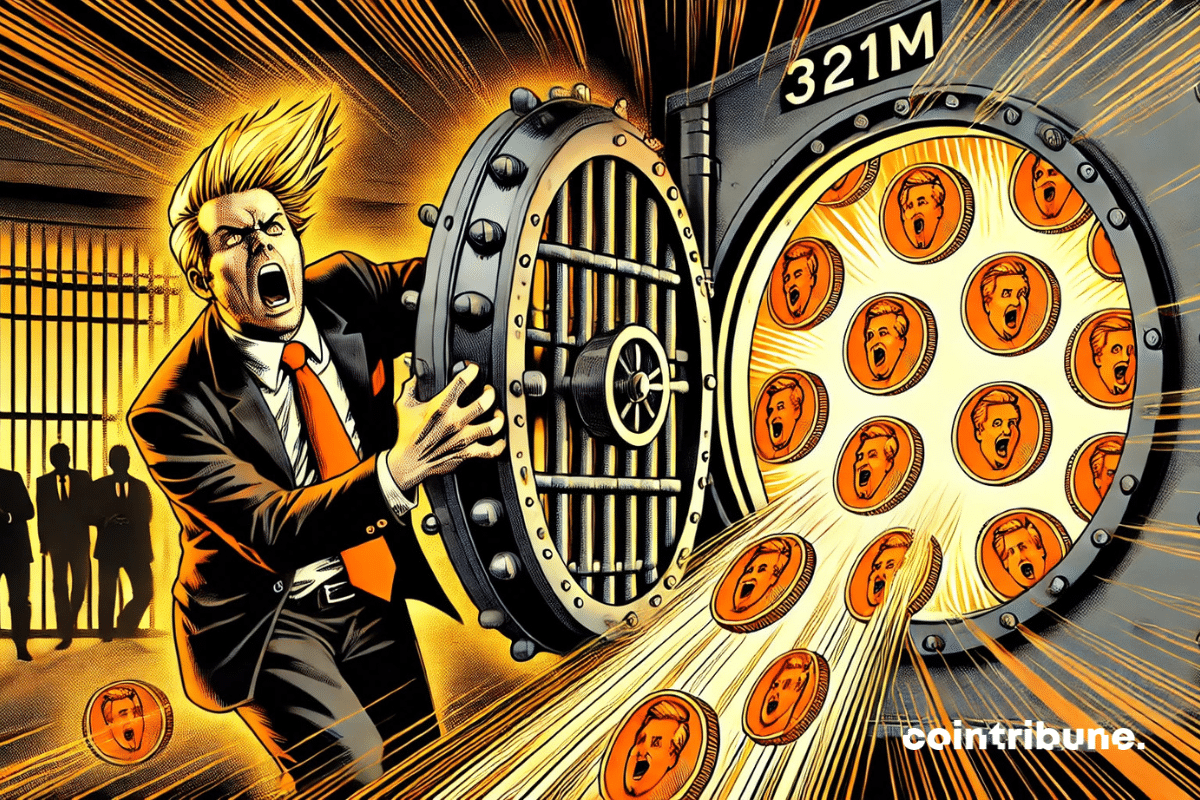

In the unpredictable arena of cryptocurrencies, unexpected twists often defy logic. The upcoming release of 321 million dollars in Trump tokens, scheduled for April 18, is proof of this. While the official memecoin of the American president has lost 89% of its value since January, this massive unlocking raises a crucial question: how can a plummeting asset still threaten the market?