Trump wants to lead the Fed, but Powell, stoic as a Swiss banker, refuses to relinquish the reins. Guaranteed economic duel!

Securities and Exchange Commission (SEC)

Trump and Gaetz, two Bitcoin cowboys. One invests in the White House, the other in Justice, ready to cheer up crypto America.

The Bank of France, like a warrior of old, demands order over the chaos of cryptocurrencies, calling for Esma for support.

The crypto market is holding its breath: on January 15, 2025, the SEC will file its opening brief in the case against Ripple. This crucial document could redefine the rules of the game for XRP… and far beyond. The stakes? Potentially, the future of many cryptocurrencies in the United States.

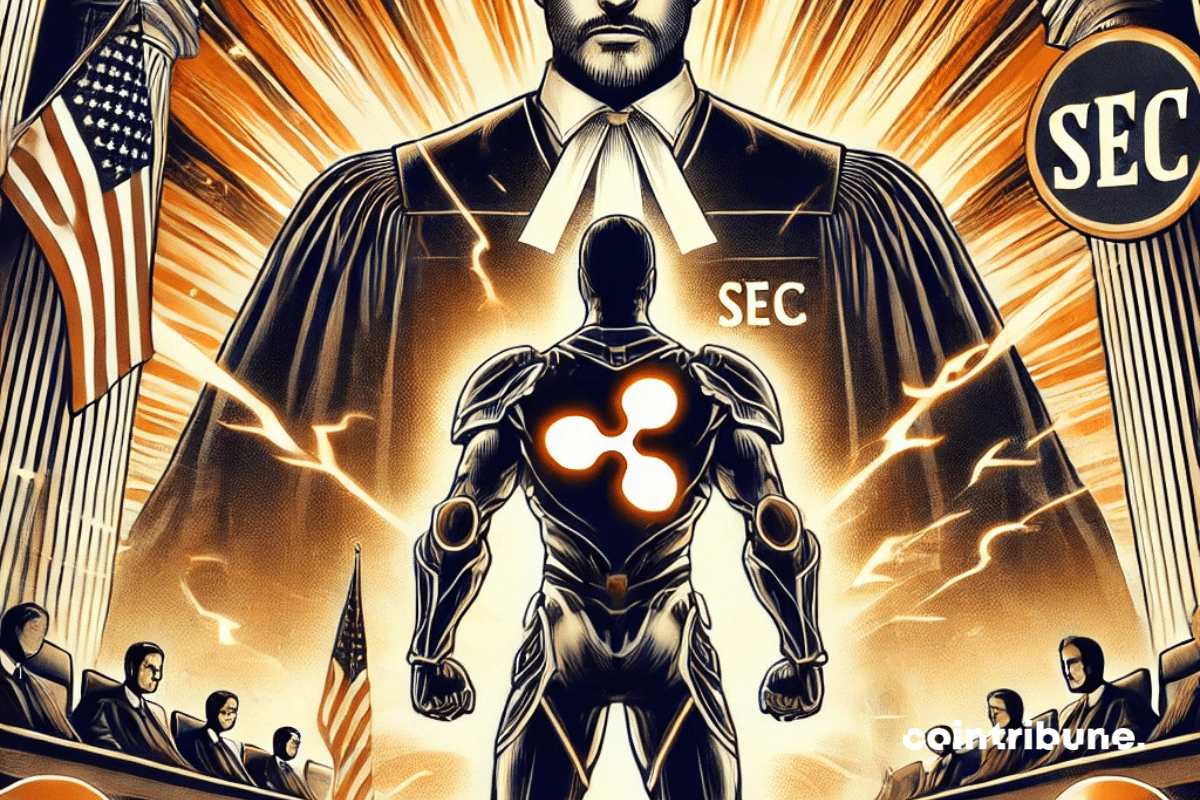

The crypto giant Ripple is intensifying its legal battle against the SEC by filing an appeal that could redefine the regulation of digital assets in the United States. This new phase of the conflict comes as the company challenges the classification of some of its XRP sales as unregistered securities.

The president of the SEC remains skeptical about the widespread adoption of crypto as a means of payment, despite their growing popularity.

The FBI recently took an unprecedented step by launching its own cryptocurrency! This innovative initiative has allowed for the dismantling of a complex network of fraudsters operating in the crypto sector.

Under the sun of the SEC, no shadow for the XRP ETF: the crypto market waits, Bitwise is brooding.

XRP has fallen by more than 15% and is now at $0.51! Several factors could drive the cryptocurrency to collapse further.

The future of cryptocurrency regulation in the United States could unfold in the coming months, and the Ripple case is at its core. Indeed, the filing of a new appeal by the Securities and Exchange Commission (SEC) on October 2, 2024, in its lawsuit against Ripple Labs reignites the debate over the legal status of cryptocurrencies. Following an initial ruling in favor of Ripple in 2023, this appeal reshuffles expectations, as the upcoming decision could redefine the rules of the game for the entire ecosystem.

Bitwise sorts the heavy artillery with an XRP ETF, but the SEC is slower than a turtle on vacation.

Gary Gensler refuses to comment on Trump's Bitcoin reserve. What is this silence hiding? Here are the possible implications.

In a decision that could shake up the crypto mining industry, the Securities and Exchange Commission (SEC) has just scored a decisive point. A federal court has upheld the agency's position that certain mining devices can be considered securities.

Another report on Ethereum ETF options: the American crypto regulator SEC sets new deadlines. The details!

Ethereum, title or not? The SEC puts a stop to Consensys, but the match is far from over.

When the SEC plays the role of the Scrooge for airdrops, McHenry and Emmer bring out the sticks to restore order.

The SEC is getting angry and making the big fish of crypto cry. Record fines to calm the cowboys!

VanEck persists with the Solana ETF despite regulatory hurdles. A risky gamble or a future success?

Ripple must pay 125 million dollars in penalties, marking the end of the trial against the crypto regulator, the SEC!

Crypto secretly influences American elections and supports Democratic candidates for 2024!

The SEC is modifying its complaint against Binance, which will have a significant impact on several crypto tokens!

Donald Trump promises to make Bitcoin a strategic crypto asset and to fire Gary Gensler if he is re-elected president!

The Ethereum ETFs approved by the SEC start trading on July 23! Providing a new cryptocurrency investment opportunity.

The SEC, accused of over-regulating, is facing seven U.S. states to protect the crypto market and innovation.

The SEC gives its green light to two Ethereum ETFs. Who are they and what are the implications for the crypto market? Answers!

The imminent approval of Ethereum spot ETFs could propel Ether ahead of bitcoin in terms of performance. This is suggested by a recent report from Kaiko, as the crypto industry eagerly awaits SEC approval for these new investment products.

A renowned analyst is predicting the imminent launch of Ethereum ETFs! This will be a key milestone for the crypto industry.

In the crypto industry, Asia and Africa surpass the United States in startups. Discover the reasons behind this trend.

The CFTC chairman challenges the SEC and asserts that the majority of cryptos are not securities, favoring innovation.

Decisive week for crypto: Ethereum ETF, U.S. CPI and legislation, key events that could transform the market!