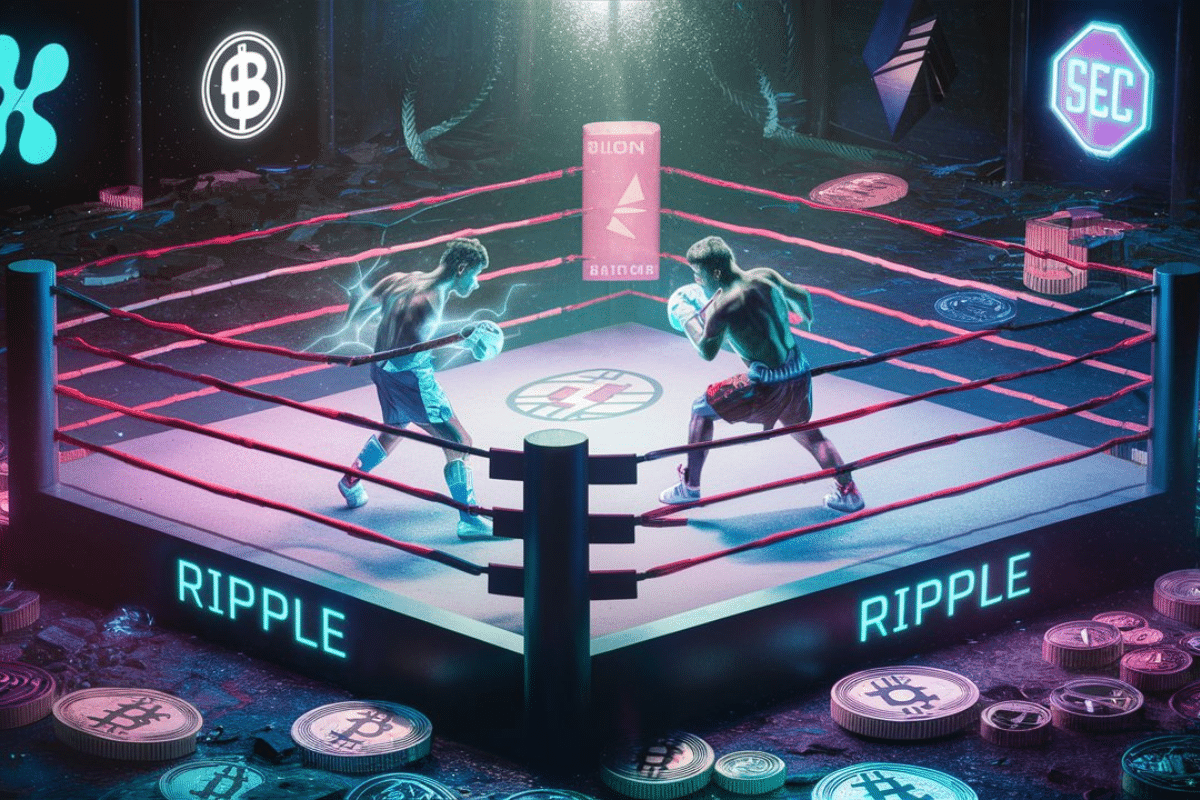

Ripple must pay 125 million dollars in penalties, marking the end of the trial against the crypto regulator, the SEC!

Theme Regulation

The regulation of cryptocurrencies in France has taken a significant new step. Indeed, the French regulator, the Financial Markets Authority (AMF), has begun accepting applications from service providers on crypto assets. This initiative precedes the implementation of the European Union (EU) rules on crypto asset markets (MiCA).

India is set to take a decisive step in crypto regulation. Indeed, the government plans to publish a discussion document by September detailing its position on digital assets. This initiative marks an important step towards establishing a regulatory framework in a country where uncertainty has long reigned.

The Duma is relying on bitcoin to bypass Western financial sanctions.

Russia is using cryptocurrencies to bypass Western sanctions, sparking concerns in the United States.

In the crypto industry, Asia and Africa surpass the United States in startups. Discover the reasons behind this trend.

The Bank of Italy announces the imminent publication of its crypto guidelines, marking a crucial step in the implementation of the European Union's MiCA regulation. Governor Fabio Panetta promises a forthcoming clarification of the regulatory framework.

Cryptocurrency in France is facing new tax challenges after the recent legislative elections! Should we pay more?

Cardano anticipates MiCA compliance with these sustainability indicators! Guiding the future of eco-friendly crypto.

The Markets in Crypto-Assets Regulation (MiCA) in the European Union introduces new disclosure requirements on environmental sustainability. However, many crypto entities appear to be misunderstanding the set deadlines, which could lead to significant regulatory consequences.

The crypto universe is in turmoil. The recent decision by the SEC to drop its investigation into Ethereum (ETH) has brought a wave of optimism in the market. Investors see this news as a promising sign for the future of ETH and altcoins. So, what are the implications of this decision for the price of ETH and other cryptocurrencies? Let’s explore this captivating question together.

Discover how Fortune 500 companies are adopting blockchain and why the United States risks falling behind?

EthCC (Ethereum Community Conference), the largest annual European Ethereum conference created for the community, by the community, will return for EthCC[7] from 8-11 July 2024 in Brussels, Belgium, and bring together the top minds in Ethereum to share their vision for the future of the ecosystem.

The European elections are approaching and attracting the attention not only of Union citizens but also of cryptocurrency investors worldwide. According to Jag Kooner, Head of Derivatives at Bitfinex, these elections could well determine the future direction of cryptocurrency regulations. While some anticipate stricter measures, others hope for favorable regulations like those envisaged by the MiCA framework. Whatever the outcomes, they will have a significant impact on the crypto market. Let's take a closer look.

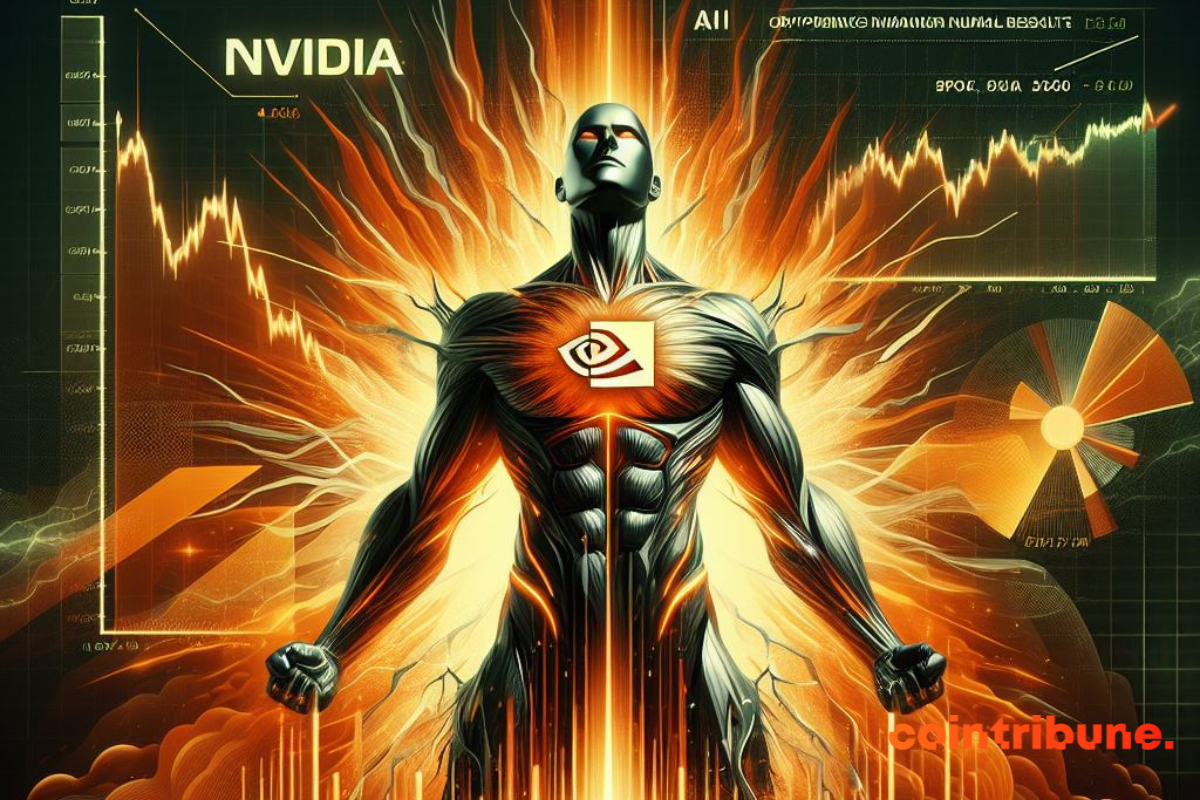

Nvidia, the giant of graphic processors, announced record quarterly results and a stock split, propelling its stock to historic highs. This news had a significant impact on AI-related cryptos.

Donald Trump accepts Bitcoin, XRP, and SHIB for his presidential campaign. Discover what this decision implies for the crypto market.

The major US banks are opposed to stricter capital requirements, fearing a negative impact on the economy.

Decentralized Finance (DeFi), threatened by the Biden administration, could become illegal. This affects investors' trust and financial autonomy.

The member states of the European Union are preparing to implement MiCA. This historic law requires national regulators to authorize and supervise service providers. MiCA is an EU-level regulation. However, countries may implement different technical standards, which requires special attention.

Discover how the end of the Ripple-SEC trial could impact the value of the XRP crypto. Experts predict significant gains.

Binance spends 2 million dollars to re-enter the crypto market in India. How does this redefine the global crypto landscape?

The US Deputy Treasury Secretary Wally Adeyemo unveils a strategy to counter Russia's use of cryptocurrencies.

The SEC denounces the practices of the crypto industry. Discover the shocking revelations of one of its members, Gurbir Grewal.

Binance makes history in the crypto industry by appointing its first board of directors. Details in this article.

The SEC is tightening its stance in the crypto world. The US regulator demands $2 billion from the crypto company Ripple.

The decision of the Federal Reserve regarding the interest rate cut was particularly anticipated. The Fed defies the predictions of some analysts by keeping them at their current level. A prudent choice that could change as the inflation of the US economy slows to 2%.

The precarious financial situation of the AMF highlighted by a scathing report from the Cour des Comptes.

The conflict between Binance, the global leader in cryptocurrency exchanges, and the Nigerian authorities has taken a new turn. A Nigerian court has ordered the platform to provide comprehensive data on all its Nigerian users, marking a new chapter in this ongoing confrontation that has been ongoing for several months.

The FED meeting could shake up the Bitcoin market. A crucial decision on interest rates will shape the future of the crypto sector.

A report reveals the plans of the SEC and the EU to regulate the crypto sector in 2024. More details in this article!