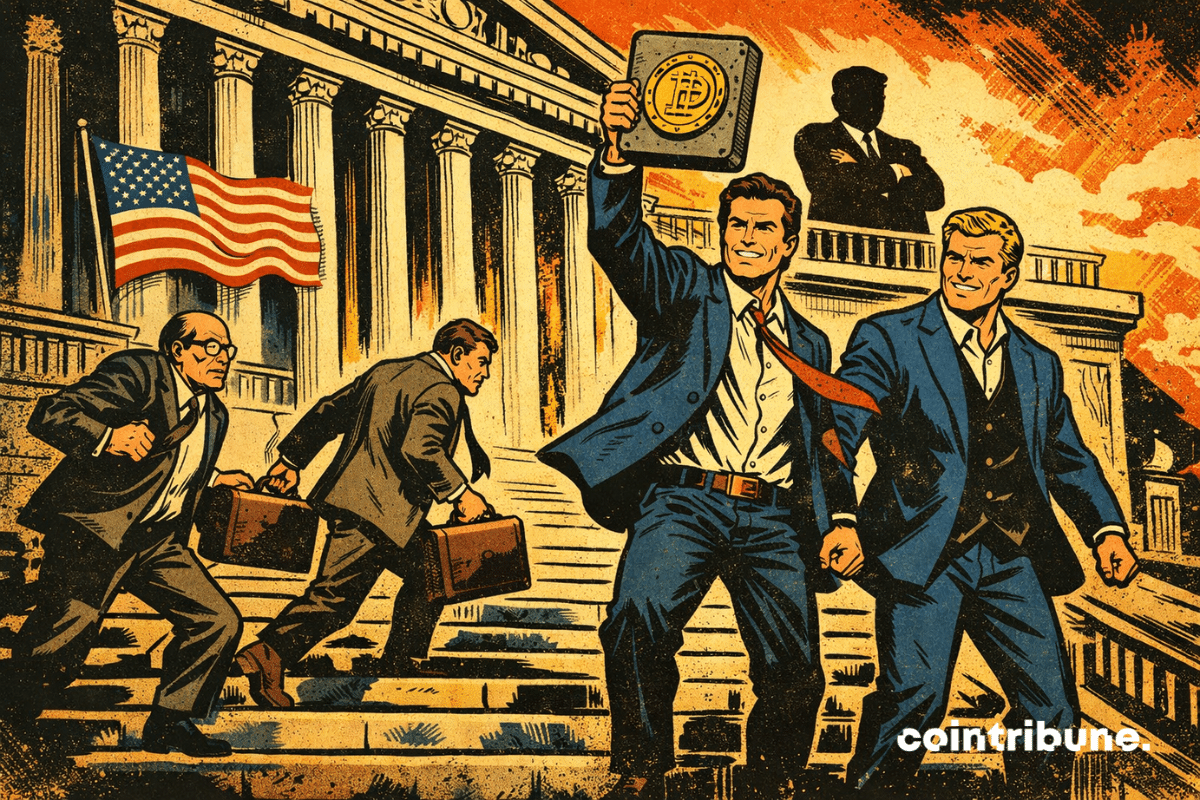

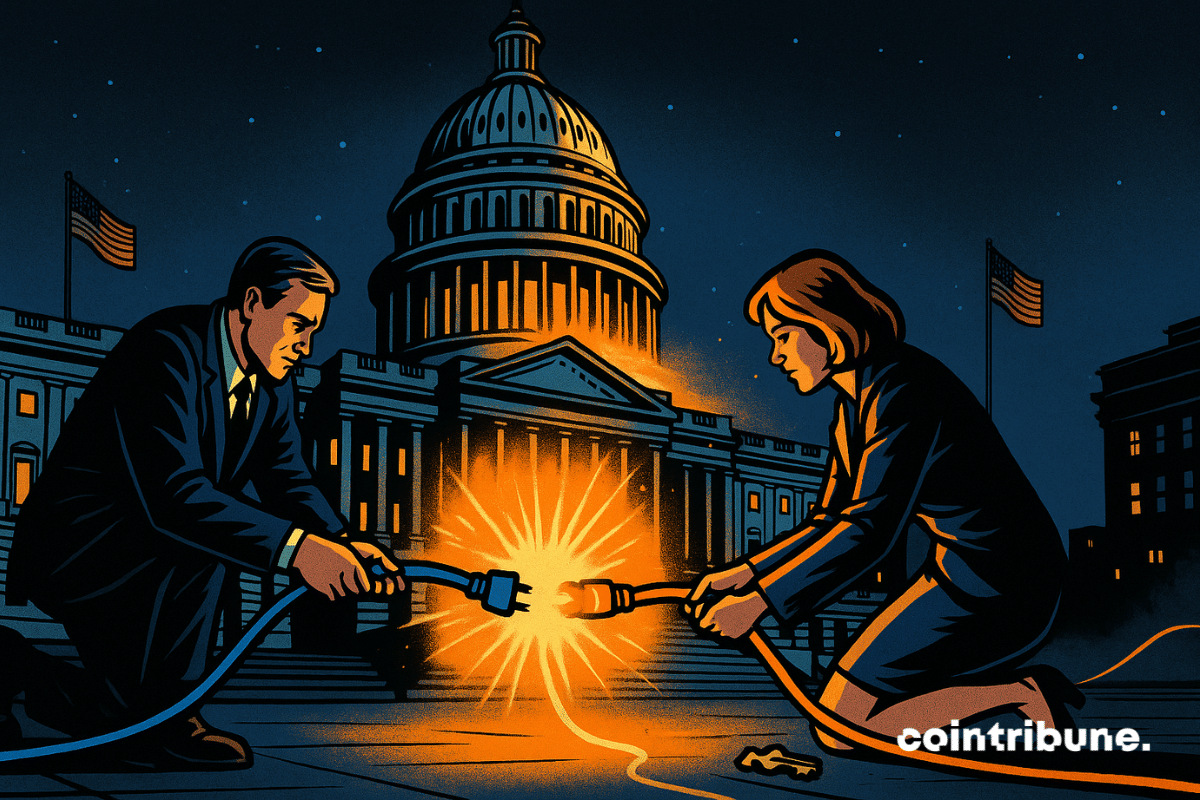

TD Cowen Warns U.S. Crypto Market Structure Bill May Be Delayed Until 2027 as Political Hurdles Grow

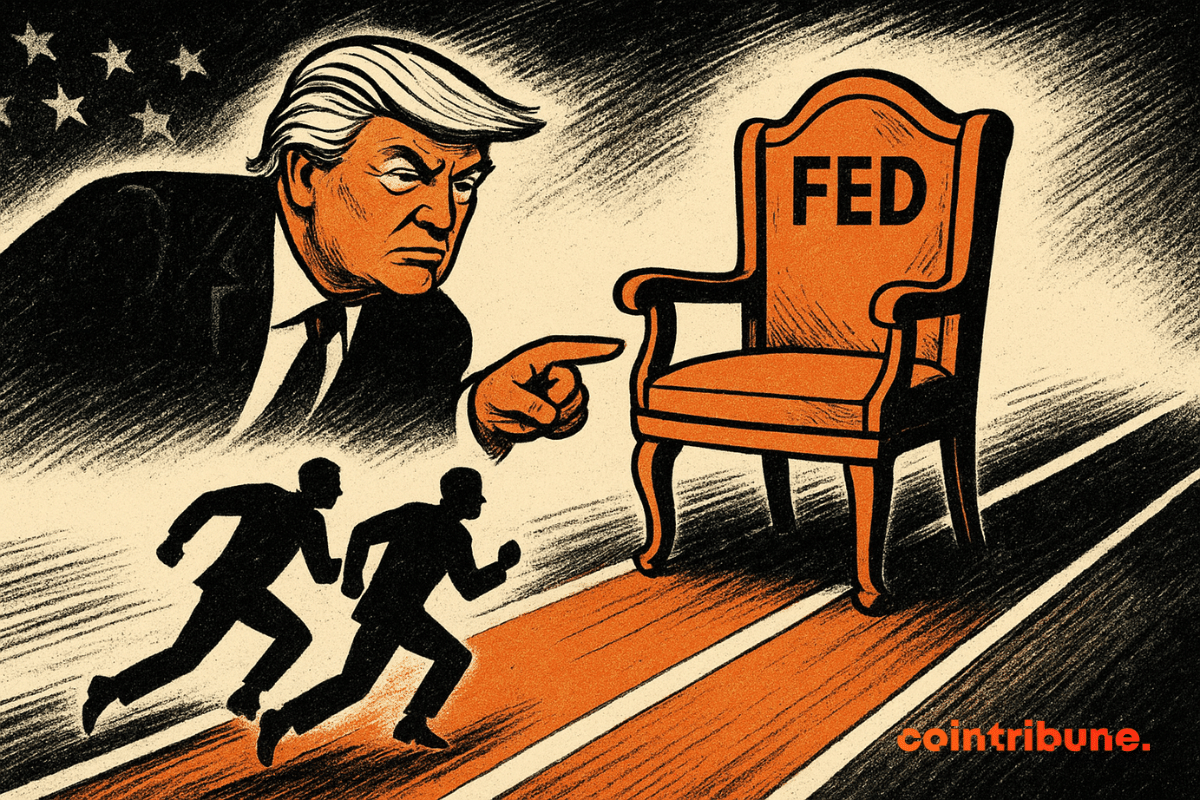

Efforts to establish clear rules for the U.S. crypto market are likely to take longer than many industry participants expect. An analysis from TD Cowen indicates that while passage remains possible in the near term, political dynamics in Washington increase the likelihood of delays. Approval may not occur until 2027, with full implementation extending to 2029.