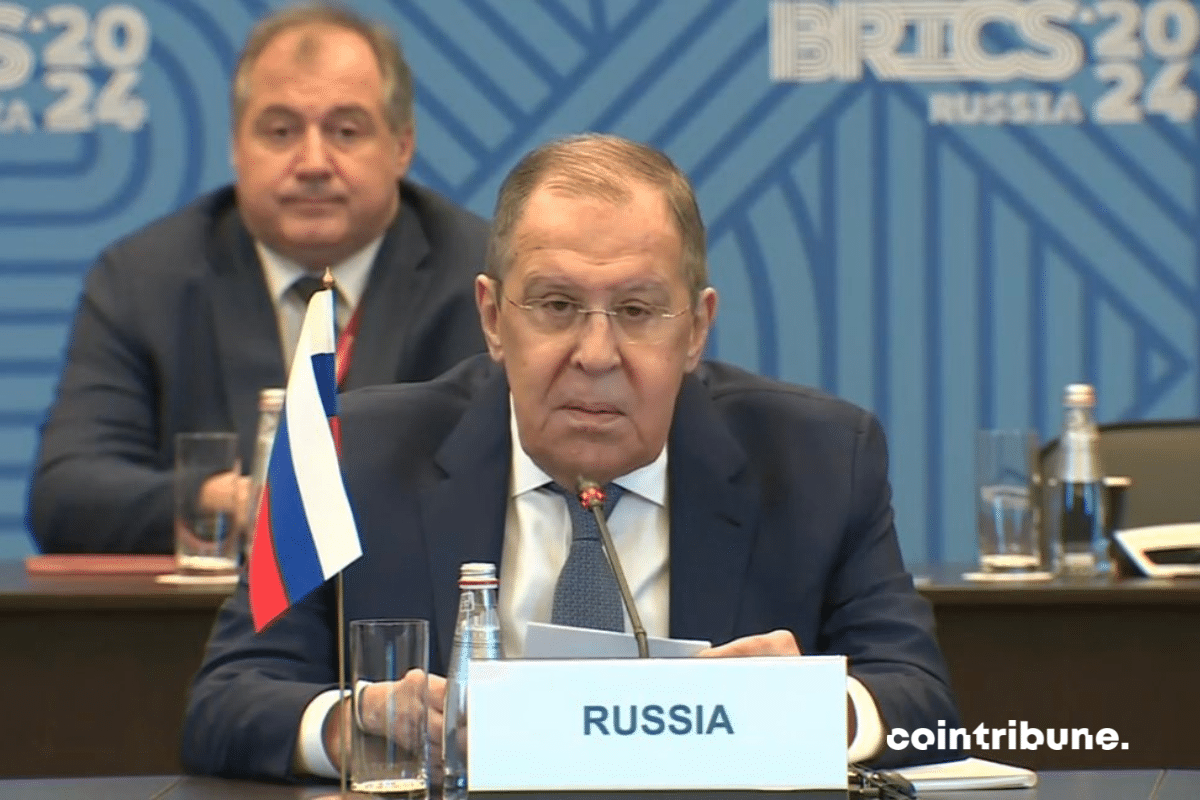

The monetary influence of BRICS is increasing day by day. The latest news reports that the Chinese currency, the yuan, has surpassed the dollar as the most used currency in Russia. This change aligns with the alliance's desire to reduce their dependence on the American currency.

Theme Payment

Telega.io announces the integration of Toncoin for Telegram advertising payments, a move aligning with the crypto ecosystem to boost Telegram ad opportunities. This update positions Telega.io as a cutting-edge web3 ad exchange, facilitating advanced crypto promotion and guiding users on how to promote web3 startups and web3 projects and how to find new crypto projects. It acts as a gateway to crypto Telegram groups, providing a crucial platform for web3 startups and emerging crypto projects to showcase and promote their ventures.

The BRICS have announced their plan to launch their own currency to break free from dependence on the dollar. While waiting for this project to materialize, the alliance is shunning the dollar through various strategies. One of the most recent ones is the massive use of gold by the BRICS to support their local currencies.

In a bold move that combines the efficiency of traditional finance with the innovation of blockchain technology, PayPal is opening new horizons in the field of cross-border money transfers. Its American users can now use the PayPal USD stablecoin (PYUSD), its dollar-backed crypto, to fund international transfers without incurring transaction fees through the Xoom service.

The BRICS plan to break away from the reliance on the US dollar will have a significant impact on the United States. An effect that, according to analysts, will affect three vital sectors of the American economy, including banking and finance, technology, and trade. This is not to mention the consequences of a debt crisis.

A central bank digital currency (CBDC) linked to the SWIFT network is expected to be launched in the coming months. This development challenges the BRICS countries, which are also working on issuing their own currency. Perhaps this is another reason to place more emphasis on this project?

The main Indian opposition party alleges that the Modi government has "paralyzed" it by freezing bank accounts. Bitcoin fixes this.

The BRICS plan to end the hegemony of the dollar in international transactions continues to provoke reactions in the United States. American Treasury Secretary Janet Yellen recently expressed her concern about the implementation of this project. Especially since, according to her, detrimental effects are being observed on the dollar.

Donald Trump, the likely next president of the United States, has softened his stance on bitcoin.

Former Zimbabwean Finance Minister Tendai Biti does not believe in the promises of financial autonomy through the BRICS' proposed exit from the dollar. In his view, this project being actively pursued by the country alliance is not positive, especially for his country considering joining the BRICS, which is completely understandable.

In an era where blockchain technology and cryptocurrencies are redefining the boundaries of global finance, the BRICS are positioning themselves as pioneers of radical change. With the announcement of an innovative payment system, these emerging powers challenging the hegemony of the US dollar are outlining the contours of a new global economic order based on inclusivity, security, and the speed of financial transactions.

On Monday, February 26, 2024, the European Union adopted a regulation that will require banks, as of 2025, to offer instant transfers at the same price as standard transfers. A small revolution in finance that should boost the use of this still marginal service.

"Will Nigeria have the courage to de-dollarize in order to join the BRICS?"

The World Economic Forum discusses CBDCs, raising concerns about state control and triggering various reactions.

In accordance with their ambition to move away from the dollar, the BRICS countries are increasing their initiatives deemed useful to achieve these goals. Essentially, this involves questioning certain institutions that promote American hegemony. Following this logic, Russia, an influential member of the BRICS, plans to present a new payment system that aims to undermine the SWIFT network.

Would the totalitarian regime in Orwell's novel 1984 have appreciated CBDCs? We asked ChatGPT.

More than two decades after the Gulf War, the Iraqi parliament wants to get rid of the dollar again. Why not embrace Bitcoin?

Russia will take over the presidency of BRICS in 2024. Dedollarization will accelerate, as well as cross-border payments involving CBDCs.

We knew that the BRICS were considering, in order to end the hegemony of the dollar, to establish a common currency with possibly a digital option in crypto. It seems that the crypto in question would be bitcoin (BTC) according to the latest news. But can the flagship crypto really be a relevant means of de-dollarization?

The giant of online payment Visa has once again made headlines. Through a strategic alliance with Transak, the platform makes crypto withdrawals via debit card accessible. 145 countries are affected by this development, which highlights Visa's commitment to promoting the sector.

"The Worldcoin ORB promises a crypto revolution through the alliance of AI and biometrics, redefining global access to the economy."

US banks are diving into the magic of Ripple's XRP, speeding up international payments for an enchanting financial future.

The possibility of a common currency for the BRICS has been making headlines for several months. The latest news is that three out of the five member countries of the organization are particularly ready for the realization of this revolutionary monetary option from a geopolitical point of view. Here's which ones.

The SPFS international payment system, the Russian equivalent of SWIFT, is now available in over twenty-five countries. What about Bitcoin?

In general, the year 2023 has been particularly dynamic for the crypto industry. Specifically, the crypto payments segment is no exception as it has achieved exceptional performance throughout that year. This is at least what a recent study by crypto firm CoinGate indicates.

The American bank JP Morgan believes that the Chinese yuan could take over the crown of hegemony in the financial markets from the dollar. In 2023, the currency of the Middle Kingdom has continued to gain importance. This situation benefits the BRICS, of which China is one of the most influential members.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

Discover the Ripple Payments guide that reinvents IT payments. Fast, secure, and transparent cross-border transactions!

After China, Russia has just finalized an agreement with Iran to trade in their local currencies instead of the US dollar. When will it be the turn of Bitcoin?

The United States finds itself at a strategic crossroads today. Despite the increasing power of China and the BRICS, the military potential of the United States is declining. As military conflicts multiply around the world, are we witnessing the end of American military superpower and the death of liberal democracy?