X, formerly Twitter, soon to be a bank, wallet, and exchange? Musk is betting big with X Money, the "crazy ambition" to dethrone banks… stay tuned!

Theme Payment

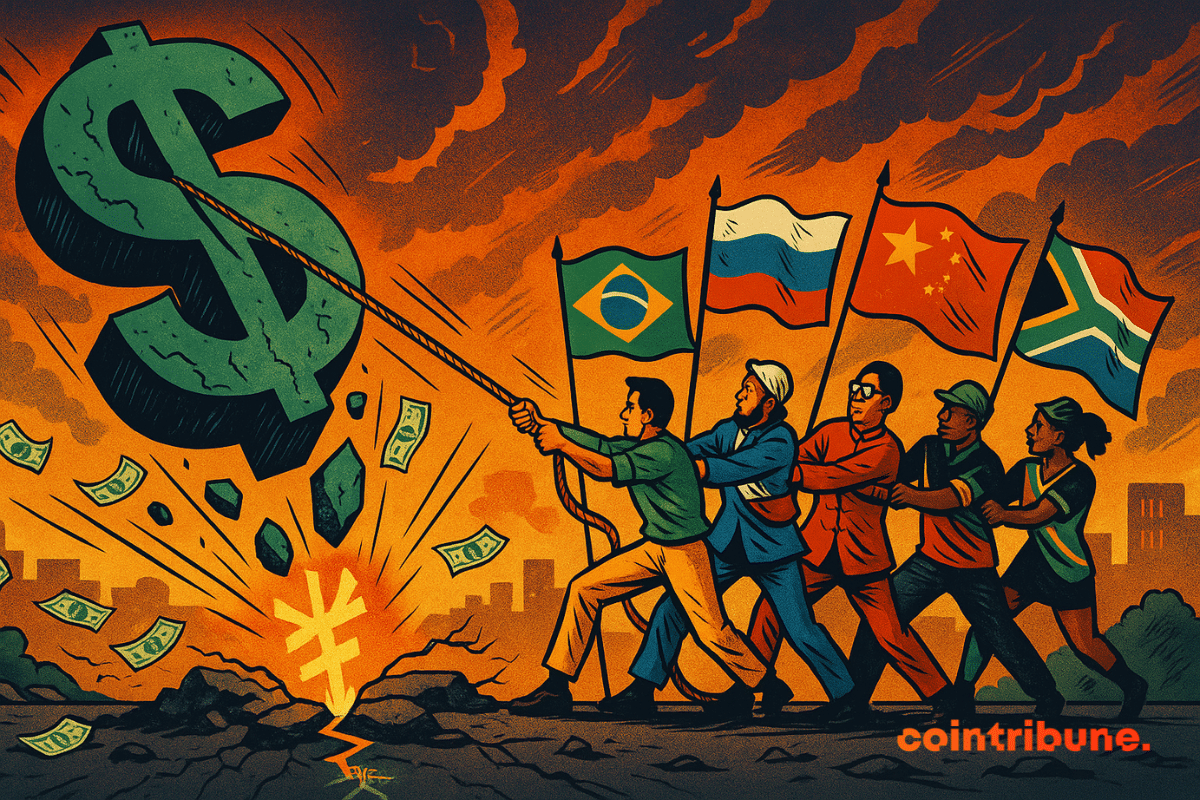

As geopolitical rivalries flare up, dedollarization reemerges as a lever of monetary sovereignty. For a long time, the BRICS have been at the forefront of this ambition, seemingly seeking to challenge the economic order dominated by Washington. However, a strategic repositioning by Brazil, an influential member of the bloc, disrupts this trajectory. By dismissing the idea of a common currency, the country reshuffles the cards of an already fragile project, revealing the limits of monetary coordination in the face of the reality of economic power dynamics.

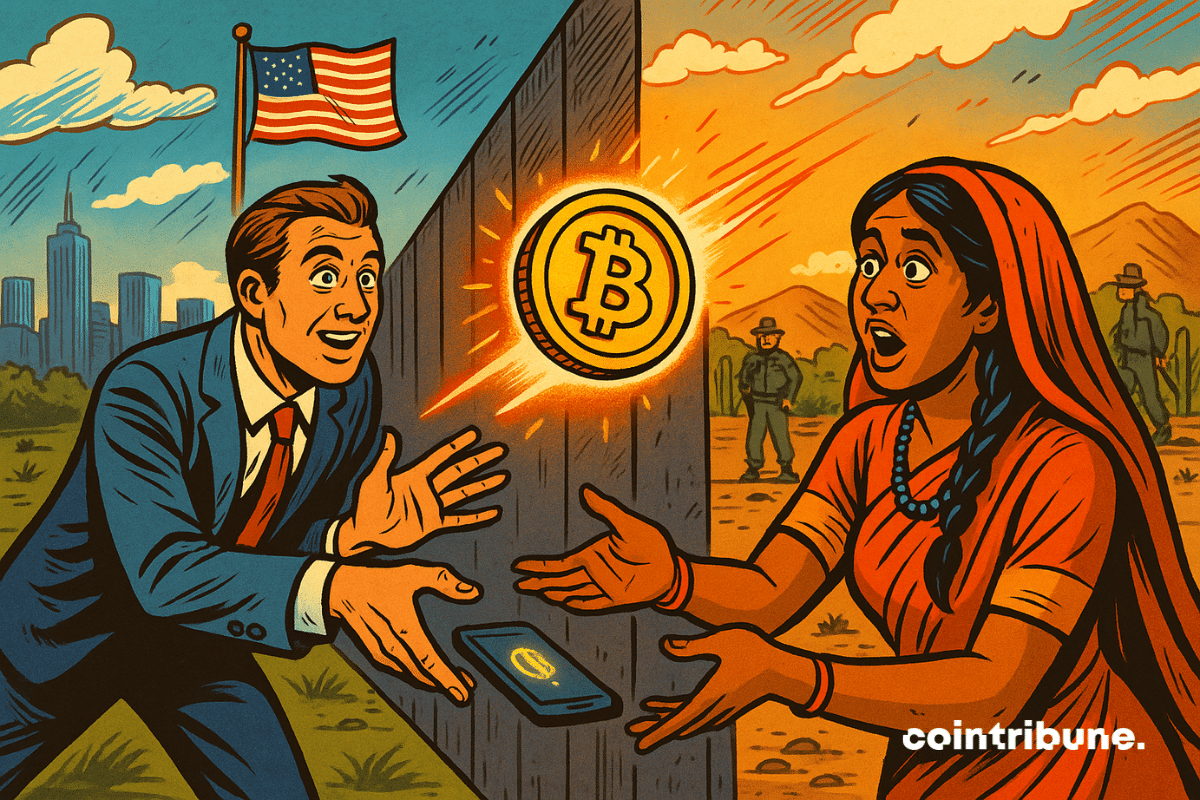

While the major emerging powers are making calls to reduce their dependence on the US dollar, a key player has just slammed the door on any desire for a break: India. In a tense international context, where Western sanctions are pushing some countries to explore alternatives to the dollar-dominated monetary system, New Delhi chooses to play the stability card. By stating that it has "absolutely no interest" in engaging in a de-dollarization dynamic, India sends a strong signal to its partners within the BRICS and the Global South.

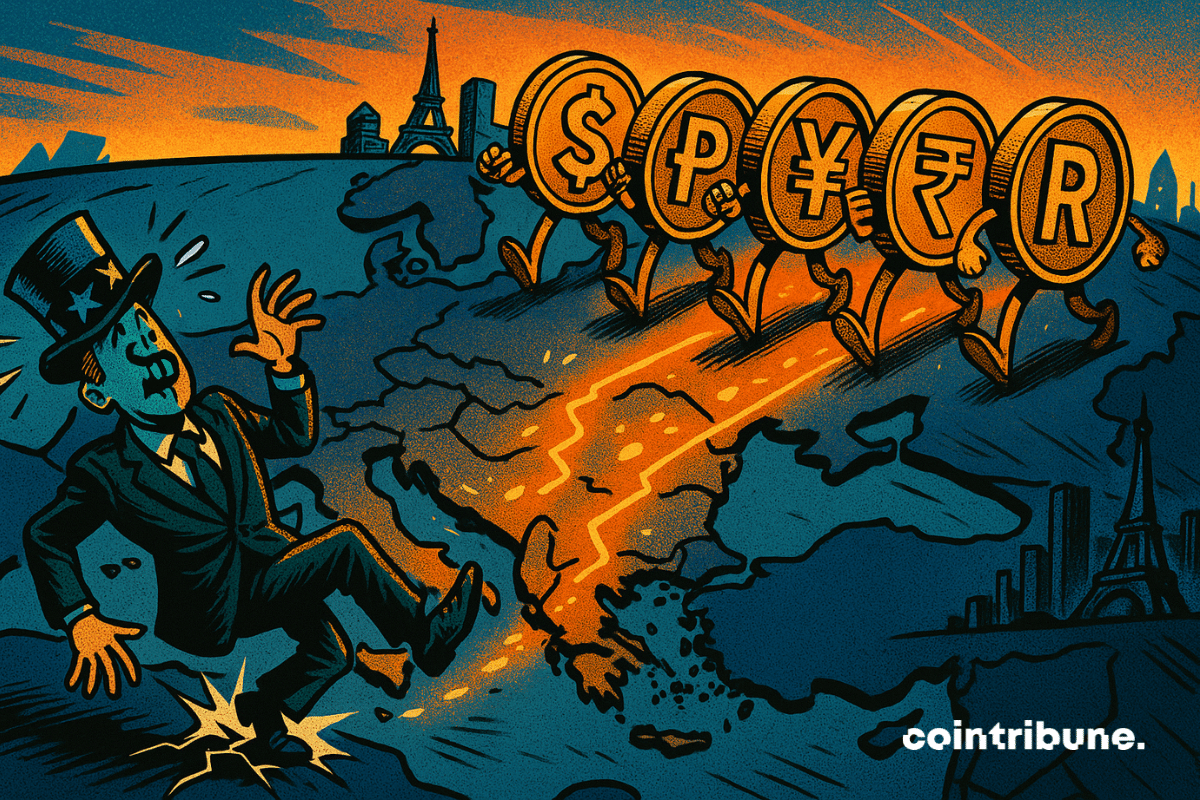

Unbeknownst to the general public, a monetary shift is taking place in Europe. The US dollar is losing ground there. Since the beginning of the year, foreign companies and funds are demanding payments in local currencies, revealing a strategic fracture at the heart of continental finance. This movement, far from being anecdotal, aligns with the ambitions of the BRICS, who are determined to erode the hegemony of the greenback. Discreetly, it is the very architecture of international trade that is wavering, driven by an emerging alliance in search of economic sovereignty.

The BIS reveals that $600 billion in crypto circulated in 2024, primarily for speculation, not for real use. Details here!

The global monetary architecture is shaking on its foundations. By reducing the share of the dollar in their exchanges to 33%, the BRICS are signaling a historic break. Their trade now largely relies on their own currencies. Behind this shift lies a deliberate strategy to fragment a system dominated by the greenback. This is no longer an intention; it is a movement underway. And it is reshaping the balances of a financial order that has until now been under the influence of Washington.

Tether merges crypto and AI to create a P2P platform without APIs. Discover all the details in this article!

The dollar has slowed down, but global markets are holding their breath. After three weeks of rising, the greenback is losing ground, driven by a more robust employment report than expected. However, tensions persist: a resilient growth, stagnant rates, and ongoing tariff uncertainties. Cryptos are not exempt from this monetary ballet. For crypto traders, every fluctuation of the dollar redraws the risk map, shifts the boundary of volatility, and reshapes liquidity expectations.

Crypto: Mastercard and its partners are reinventing the digital economy with the integration of stablecoins into payments. The details!

Bunq, the well-known European neobank for digital nomads, is expanding its offering: it's time for cryptocurrencies! The app now allows users to manage savings and crypto in one basket, thanks to Kraken.

As international monetary tensions intensify, China is ramping up its offensive against the dominance of the dollar. Beijing is formalizing the launch of a strategic plan to impose its own international payment system. This initiative marks a major turning point in the redefinition of global financial flows, reinforcing China's ambition for a multipolar economic order. By directly targeting traditional networks dominated by the West, this maneuver is now capturing the attention of markets, governments, and major financial institutions.

A viral video on TikTok claims that a law banning cash has been adopted in France. In just a few days, this clip has reignited fears about the end of cash and a fully digitized society. However, this claim is false, as no legal text confirms such a ban. Behind this misleading narrative, a very real topic deserves attention: the digital euro project put forward by the ECB, which aims to complement cash rather than eliminate it.

Russia, an influential member of the BRICS bloc, has just crossed a historic monetary milestone: in February, more than half of its imports were settled in rubles. This strategic advancement, confirmed by the Central Bank, is part of a clear break with the dollar-dominated system. As tensions with the West escalate, Moscow is redirecting its trade towards partners deemed "friendly," thus redefining global financial balances and accelerating its trajectory towards strengthened economic autonomy.

As the bank failures of 2023 continue to shake the markets, economist Peter Schiff is fueling fears of a total collapse of the American financial system. Known for his attachment to gold, he warns that a recession of historic proportions is underway and that all banks are destined to fall. Thus, this radical diagnosis, issued in an already tense context, reignites the debate over the strength of financial institutions and the viability of economic policies pursued since the 2008 crisis.

As geopolitical tensions reshape global balances, the BRICS are accelerating the establishment of their own payment network. Led by Russia, this infrastructure aims to free itself from SWIFT and open a financial pathway outside of Western control. The announcement of its accessibility to non-member countries marks a strategic rupture. Beyond being a regional tool, BRICS Pay becomes a lever of global influence and a strong signal in favor of a multipolar monetary order.

Amid mixnets, shielded balances, and disposable addresses, Vitalik wants to re-dress Ethereum. No revolution, but a digital guerrilla against mass surveillance. Discretion required, resistance activated.

As the BRICS intensify their dedollarization strategy, Beijing and Moscow are taking an unprecedented step: using bitcoin to settle certain trade transactions. This initiative, revealed by VanEck, marks a symbolic turning point in the internationalization of cryptocurrencies. It reflects a clear intention to break free from financial circuits dominated by the West, aiming to give bitcoin a new geopolitical role. This shift could herald a new monetary order in which cryptocurrencies redefine the levers of economic sovereignty.

"Kraken and Mastercard are teaming up to launch a crypto debit card in Europe and the UK. This announcement illustrates the willingness of industry giants to make cryptocurrencies a tangible payment tool, beyond speculation. In a market under regulatory pressure, this initiative embodies a new phase: that of usage and the real integration of cryptocurrencies into everyday life. It is a strong signal at a time when the industry is seeking tangible and compliant use cases."

Cryptocurrency is no longer a marginal experience. It is now embedded in the daily lives of millions of Americans, reshaping the contours of their financial autonomy. A recent study by the National Cryptocurrency Association reveals that 55 million adults hold digital assets. Among them, 76% believe that this technology has improved their quality of life. Far from clichés about speculation, these figures unveil a more nuanced reality: massive, pragmatic adoption, and a source of concrete hopes.

In a geopolitical context undergoing a major reshuffle, two significant initiatives are shaking the hegemony of the dollar. Brazil and China are making a strategic shift by favoring their national currencies for bilateral exchanges. For their part, Russia and Iran are announcing the launch of a new common currency to circumvent Western sanctions. These distinct yet converging movements illustrate a shared desire among influential BRICS members: to build a financial system that is less dependent on the greenback and to assert monetary sovereignty in the face of external pressures.

In a single session, the euro surged 2.15% against the dollar, reaching $1.109, its largest increase since 2015. This abrupt jump exceeds the mechanics of exchange rates. It signals a sudden loss of confidence in the American currency. Through this shift, markets appear to be reassessing the balance of power among major currencies, in a context where macroeconomic signals and central bank choices are redefining monetary fault lines.

In a single session, the euro surged 2.15% against the dollar, reaching $1.109, its largest increase since 2015. This sharp rebound goes beyond the mechanics of exchange rates. It signals a sudden loss of confidence in the American currency. Through this shift, markets seem to be reevaluating the balance of power between major currencies, in a context where macroeconomic signals and the choices of central banks are reshaping the lines of monetary fracture.

At the start of this year, amid high geopolitical tension, dedollarization emerges as a strong signal of a global monetary shift. Once relegated to the background of economic debate, this dynamic is intensifying as confidence in the stability of the United States erodes. The dollar's share in global reserves is slowly but surely declining, a trend closely watched by markets and feared by strategists. Behind this retreat, the international monetary order may be entering a phase of reorganization.

In the shadow of tyrannies, outstretched hands receive satoshis. The HRF sows crypto light in the invisible pockets of silent resistances, where fiat no longer prevails.

The dominance of the US dollar in international trade and global reserves has never been so challenged. Indeed, Deutsche Bank is sounding the alarm on a growing phenomenon: dedollarization among the allies of the United States. In the face of geopolitical tensions and financial sanctions, several nations are seeking to reduce their dependence on the greenback. If this trend accelerates, the impact could be considerable, drastically altering the global monetary balance and redefining the power dynamics within the international financial system.

And if independence no longer came through weapons, but through blocks of code? The BRICS dream of sovereignty in cryptocurrencies, with Siluanov as a digital scout.

Central bank digital currencies would eliminate all privacy, but few seem to care. Fortunately, there will always be Bitcoin.

Crypto payments are booming, but a danger persists. Bitget Wallet reveals all in its report! Details in this article.

The European Union is undergoing a discreet yet persistent revolution. A recent report from Oobit, a platform specialized in crypto payments, reveals that 70% of crypto transactions on its network are absorbed by retail, food, and beverages. This figure shatters the clichés about the marginal use of cryptocurrencies. But how can we explain this silent infiltration into the daily lives of Europeans? Between regulatory adoption and economic pragmatism, the landscape is reshaping.

In his recent intervention, Subrahmanyam Jaishankar sought to dispel any ambiguity about India's position regarding the dollar: "there is no policy on our part aimed at replacing the dollar. At the end of the day, the dollar as a reserve currency is a source of international economic stability."