While the West defends the supremacy of the dollar and the euro, Moscow and Beijing accelerate their divorce from these currencies. Vladimir Putin confirmed that Russo-Chinese trade is now conducted almost exclusively in rubles and yuan. This shift, supported by a spectacular rise in bilateral trade and a deliberate strategy, could mark a decisive step towards a multipolar financial order.

Theme Payment

Paybis announced a major enhancement to its platform, making it easier for users worldwide to buy USDT through a broader and faster range of payment methods. With these updates, Paybis offers users an easier way to access and use stablecoins worldwide.

The idea of paying for vacations in crypto, once marginal, is becoming established in the European landscape. A recent survey conducted by Bitget, an exchange platform and major Web3 player, highlights a strong trend: crypto is attracting more and more travelers despite technical and regulatory obstacles. And the numbers speak for themselves.

Digital assets have transcended the corridors of financing, entering the realm of space exploration. In a recent update, Jeff Bezos’s Blue Origin has joined forces with American firm Shift4 Payments to offer crypto payment services for expeditions to outer space.

While it was already being buried, cash is experiencing a revival! Between techno mistrust and tactile nostalgia, Europe is torn between digital euro and tangible banknotes...

PayPal is doubling down on crypto. The payments giant just revealed a new checkout feature that lets U.S. merchants accept payments in over 100 cryptocurrencies, including Bitcoin, Ethereum, Solana, and major stablecoins like USDT and USDC.

Pay the national debt with a simple click on Venmo and PayPal: an absurd idea? Not for the U.S. Treasury, which is now allowing citizens to voluntarily contribute to the $36.7 trillion federal debt via PayPal and Venmo. Integrated into the Pay.gov platform, this unexpected measure combines consumer technology and macroeconomic management in a gesture that is symbolically significant but heavy with meaning.

While Bayrou struggles with the budget, Occitanie is mining convictions: France's local regions are flirting with crypto, and it could very well earn them more than a Livret A.

Crypto: Western Union aims for a borderless future with a global stablecoin wallet. Discover all the details in this article.

A star shines brighter than the others in the saturated arena of neobanks: Revolut. In London, ambitions are no longer hidden. With a funding round of one billion dollars in preparation, the company aims for a colossal valuation of 65 billion dollars. And at the heart of this ascent? One word: crypto. Because it's not just a diversification, it's a strategy. A conviction. A compass.

The debate on leaving the euro is resurfacing regularly in France. With new presidential elections set for 2027, a victory for the National Rally could lead to an exit from the euro. The French could very well come out of it ruined!

Crypto cards are now competing with traditional banks for everyday purchases in Europe. With nearly half of transactions under 12 dollars, these new payment tools are transforming consumer habits. A silent revolution that is redefining the future of European payments.

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

Russia no longer tests. It imposes. By decreeing the mandatory integration of the digital ruble into the national banking and commercial system, Moscow leaves no room for doubt. The transition to a controlled, programmable, and centralized currency is underway. Gone are the ambiguities of experimentation, making way for the architecture of an unprecedented monetary system where each transaction could, tomorrow, be traced, regulated... or even blocked. This choice is not merely technological: it is political, strategic, almost ideological. For behind the apparent modernization of payments lies a much larger game.

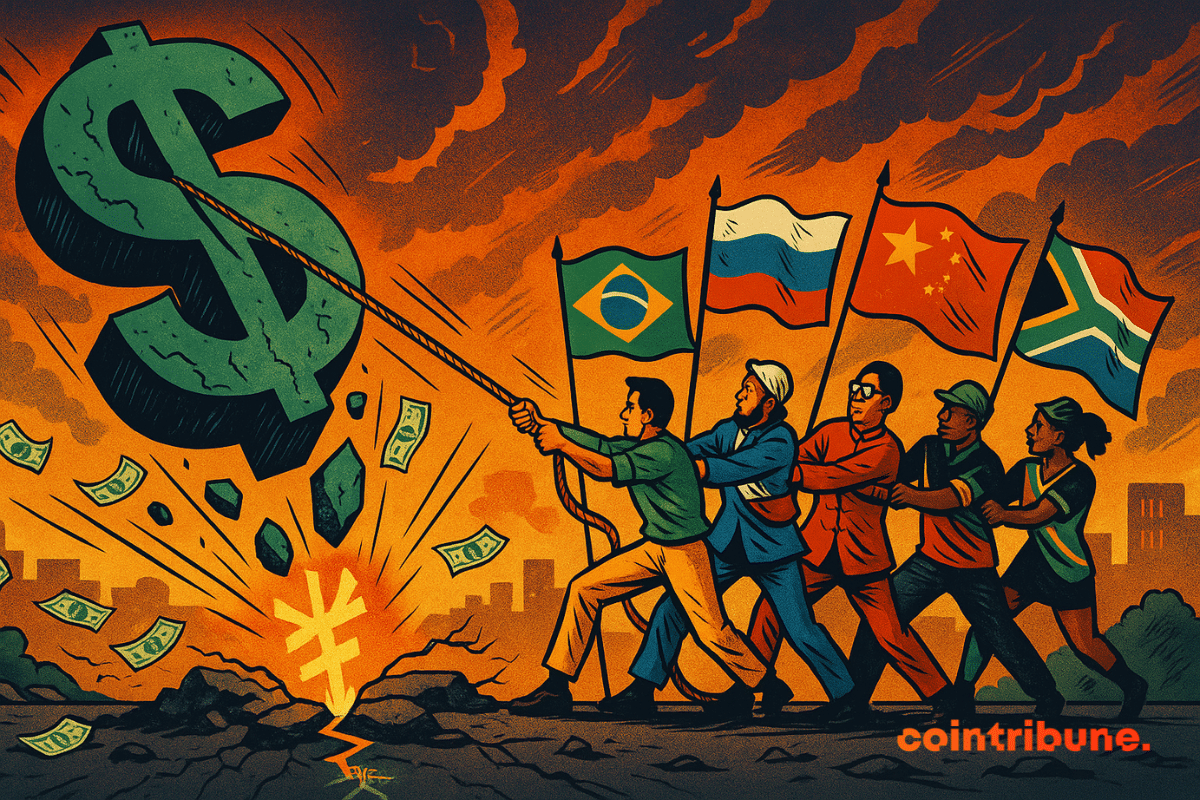

Can the dollar lose its global supremacy? What was once speculation is now taking a concrete diplomatic turn. As the BRICS summit approaches in Rio, major emerging economies are placing local currency transactions at the heart of their strategy. This shift occurs within a context of growing geopolitical tensions and demands from the Global South for a more balanced financial system. Behind this dynamic lies a possible redefinition of the rules of global trade.

Elon Musk is continuing his transformation of X into a multifunctional super app, inspired by Asian models. This week, Linda Yaccarino, CEO of the platform, announced the upcoming arrival of integrated trading and investment services. Such a major strategic evolution could redefine everyday financial usage, while bringing X closer to Musk's long-held ambition: to become a total ecosystem, combining social networking, payment, and financial services, at the heart of a rapidly evolving digital landscape.

A discreet yet massive shift is redefining the global monetary balances. Indeed, over 90 countries, led by the BRICS, are abandoning the dollar in their international exchanges. In its place, the yuan, the ruble, or the rupee are gradually taking over. This strategic realignment, far from being a mere technical adjustment, challenges the financial order built around the United States since the post-war period. A stated desire for economic sovereignty and a direct challenge to American hegemony over global flows are at the root of this movement.

At a time when financial distrust spreads in a click, a TikTok video posted at the end of May has reignited fears of increased state control. It claims that starting from October 2025, any transfer of more than 800 euros between individuals would be blocked for 24 hours for tax verification. Within a few days, the rumor has caused unrest among thousands of French citizens. What does the regulation actually say? And why is this viral announcement completely unfounded?

American retail giants Amazon and Walmart are currently exploring the issuance of their own dollar-backed stablecoins. This initiative, still in the exploratory phase, could ultimately disrupt the online payment landscape and further reinforce the hegemony of the US dollar.

As the BRICS summit in Rio approaches, Ron Paul sounds the alarm: a monetary shift is underway. The parliamentarian mentions a "Rio Reset," a coordinated offensive by emerging economies to marginalize the dollar in global trade. Behind this statement lies a broader dynamic: the emergence of a multipolar financial order. As monetary tensions intensify, the initiative backed by the BRICS could accelerate a paradigm shift with global consequences.

Digital payments are entering a new era. Apple, Google Cloud, Airbnb, and X (formerly Twitter) are quietly discussing with crypto companies to integrate stablecoins into their services. This strategic shift marks a clear turning point: blockchain is moving from the realm of experimentation to becoming a coveted infrastructure tool for tech giants.

Uber's announcement to accept bitcoin and other cryptocurrencies as payment methods marks a strategic turning point. More than just a simple technological addition, it is a strong signal. The mobility giant aims to root itself in the emerging digital economy. At a time when cryptocurrencies are gaining traction in daily usage, Uber does not want to just ride the wave, but to help shape it. This choice raises a fundamental question: what role will technological giants play in the evolution of global payment systems?

What if your Visa card became your ultra-secure crypto wallet? Discover Tangem Pay, the revolution that combines self-custody, bankless payments, and Web3 technology. An innovation that could transform your spending... into financial freedom.

As global trade lines shift under geopolitical pressure, Moscow is considering swapping traditional currencies for cryptocurrencies for its agricultural exports. This is not a marginal experiment but a massive project: the settlement of 49.5 million tons of grain could be done in crypto. An initiative that, if realized, would redefine the rules of trade for sanctioned states and impose blockchain as an alternative to dominant financial systems.

Morgan Stanley shakes the markets. Indeed, the investment bank forecasts a 9% drop in the US dollar within a year, bringing the currency down to its lowest levels since the pandemic. A shocking projection, published on May 31, which challenges the greenback's dominant status in the global monetary order and fuels fears of a lasting shift in international financial balances.

"Ledger sorts its Visa crypto card in the USA with Bitcoin cashback. Discover all the details in this article."

Slowly but surely, the power is preparing minds for the end of cash. Fortunately, there will always be bitcoin.

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

X, formerly Twitter, soon to be a bank, wallet, and exchange? Musk is betting big with X Money, the "crazy ambition" to dethrone banks… stay tuned!

As geopolitical rivalries flare up, dedollarization reemerges as a lever of monetary sovereignty. For a long time, the BRICS have been at the forefront of this ambition, seemingly seeking to challenge the economic order dominated by Washington. However, a strategic repositioning by Brazil, an influential member of the bloc, disrupts this trajectory. By dismissing the idea of a common currency, the country reshuffles the cards of an already fragile project, revealing the limits of monetary coordination in the face of the reality of economic power dynamics.