Russia is moving to impose tougher penalties on illegal cryptocurrency mining after officials reported low compliance with new registration rules. A draft bill from the Justice Ministry proposes fines, forced labor, and prison terms for miners operating outside the law. Officials say the measures are intended to bring a rapidly expanding sector under state oversight and into the tax system.

Theme Mining

Cryptocurrency mining in Russia is helping support the ruble, with officials noting its growing role in the economy and financial flows.

Reports of a renewed crackdown on Bitcoin mining in China’s Xinjiang region triggered concern across crypto markets this week. Early claims warned of severe hashrate losses and widespread shutdowns. Mining data reviewed after the initial reaction suggests, however, that the impact was brief and far smaller than first reported.

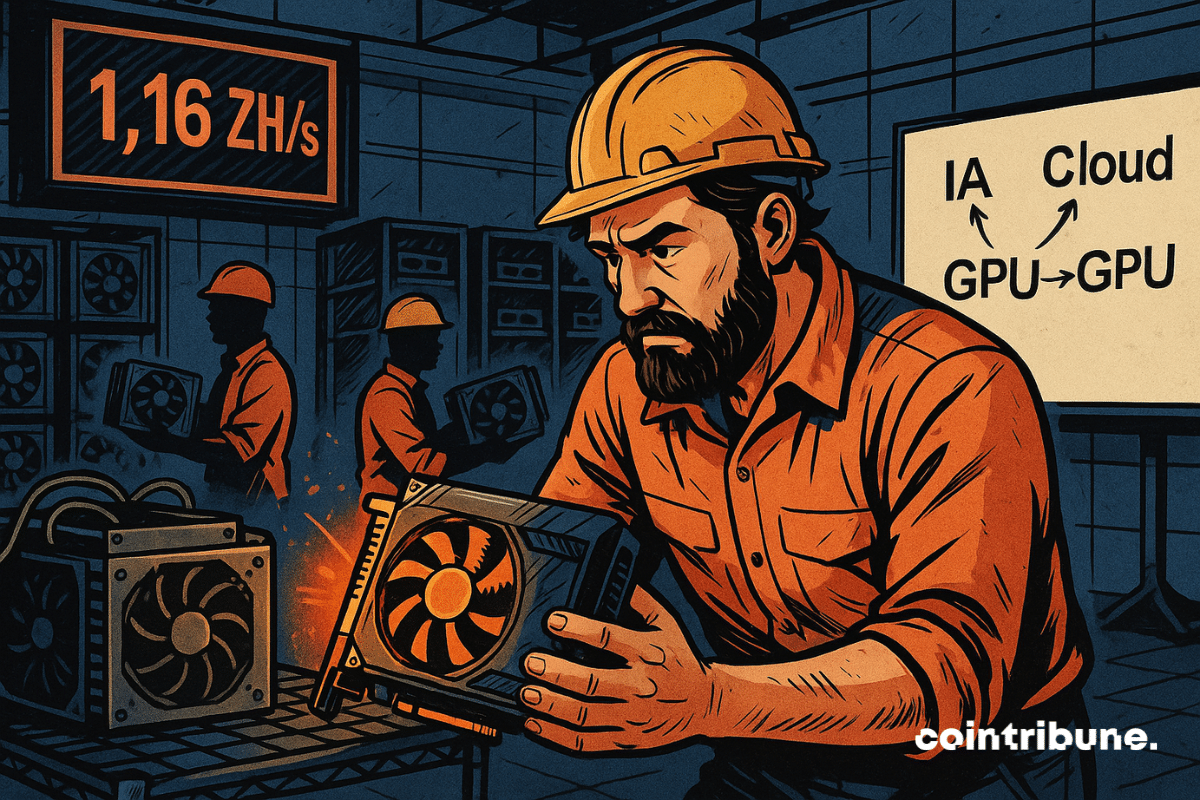

Bitcoin tumbles, miners migrate to AI. Microsoft pays, stocks rise… But their profits? Still striking. The future is now written between cloud and a gamble.

Banned but coveted, China plays it cool and reconnects its bitcoin machines. Silence in Beijing, but business is booming in provinces where electricity costs nothing.

A solo Bitcoin miner defied the odds to secure a rare block, earning 3.146 BTC worth around $266,000.

Bitcoin miners are taking on record levels of debt to finance new equipment and expand operations into artificial intelligence (AI) and high-performance computing (HPC). As competition for hashrate intensifies and post-halving profits shrink, miners are increasingly turning to debt markets to maintain an edge in both Bitcoin production and data infrastructure growth.

American Bitcoin Corp. (ABTC)—co-founded by Eric Trump—has released its October 2025 investor presentation, marking a major milestone in its evolution from a pure Bitcoin miner to a full-scale digital-asset ecosystem. The strategy focuses on building a U.S.-based Bitcoin powerhouse to reinforce America’s leadership in the global Bitcoin market.

Bitcoin miners are getting a brief reprieve after months of mounting pressure. At block height 919,296, the Bitcoin network recorded its first difficulty drop since June—a 2.73% decrease to 146.72 trillion. The adjustment offers temporary relief after a prolonged period of rising computational demand that pushed many miners to the brink.

New project: a crypto bank could be launched in Russia. We deliver all the details in this article.

A solo Bitcoin mining success earned an independent miner $365,000 from block number 910,440.

Google took a 14% stake in the bitcoin mining company, TeraWulf. This operation follows an increase in its financial commitment in a colocation agreement with Fluidstack. Thanks to this move, the tech giant becomes the main shareholder of TeraWulf and thus strengthens the credibility of its model between crypto and high-performance hosting.

When the Assembly knits bitcoin to recycle excess electricity, power plants smile, miners get busy... and digital gold suddenly becomes more French than a baguette under the arm.

While Moscow electrifies its farms and Beijing mines quietly, Washington subtly pulls the strings: but who is really pulling the strings of bitcoin in this strange energy game?

While Bitcoin mining now seems to be reserved for industrial giants equipped with powerful ASICs, an improbable feat challenges this logic. A solo miner, armed with only 2.3 PH/s, mined a block on his own via Solo CK, earning about $350,000. This almost impossible statistical achievement recalls the more open beginnings of the network. In an increasingly centralized ecosystem, this isolated victory revives the fundamental question: is the Bitcoin network still accessible to independents?

It had been a long time since Bitcoin miners had been caught off guard by such a mining difficulty adjustment.

"While Bitcoin is catching its breath after a mining sprint, some miners are playing the capitalist ants. Not fools: produce, hold, and wait for it to soar. A strategy... not so cryptic."

An unknown geek, armed with rented hash, snags $330,000 in bitcoin. Technical coincidence, bluffing move, or a silent revolution under the bits of solo mining?

The Bitcoin DeFi ecosystem shows contradictory signals. The Rootstock platform records a spectacular increase in its network security in the first quarter of 2025, even as the total value of investments and user activity significantly decline.

A tiny device challenging the monsters of Bitcoin mining, a chance worthy of a miracle, and there is a solitary miner pocketing $260,000 under the astonished gaze of the industry.

Nuclear energy and cryptocurrencies: an unlikely marriage? Marine Le Pen, a significant figure in the French political landscape, has shaken things up by linking these two worlds. During a visit to the Flamanville EPR, she outlined a vision where surplus nuclear electricity would power Bitcoin mining.

Bitcoin has just experienced an unexpected hiccup: its mining difficulty has decreased for the first time in four months. A fragile breath in an ecosystem accustomed to constant escalation. However, behind this seemingly technical number lies a much more tumultuous story. Amid site closures, rapid updates, and survival strategies, the mining sector is navigating a silent storm. What if this decline were a symptom of a deeper transformation?

After Texas, Russia is also turning to the Bitcoin industry to balance its electrical grid and reduce costs. When will France wake up? And Germany?

At $105,000 per Bitcoin, miners are singing in the rain of exahashes. Fierce competition, stellar margins: it’s a dance of numbers and electricity.

How to know how much you can earn from BTC mining? Discover the answer in this comprehensive guide to bitcoin mining. Before knowing how much bitcoin mining can yield, one must first understand how this activity works.

Are you interested in mining Bitcoin (BTC) and hesitating to start with a processor (CPU)? Know that it is entirely possible to mine Bitcoin using the processing power of your computer. In fact, it is an easy way to get started in cryptocurrency mining, as you do not need expensive hardware or special knowledge. In this article, we will guide you through your first steps in CPU mining.

Have you ever heard of FPGA? It is a type of hardware used for mining cryptocurrency, whose popularity continues to grow. This article covers all the necessary steps to mine Bitcoin (BTC) with this device. But before diving into the heart of the matter, let’s start by defining the concept and what the advantages and disadvantages of this practice are.

The Stratum mining protocol is an essential component of the Bitcoin (BTC) network. It allows mining software to connect efficiently and securely to the blockchain, optimizing the mining process. Developed in 2012, Stratum has since become the most popular protocol used for mining bitcoins. In this post, we will explore the definition of this technology and the reasons why it is so important for Satoshi Nakamoto's network.

Bitcoin is a popular cryptocurrency that facilitates secure and decentralized exchanges. Each transfer of bitcoins from one user to another is a mathematically verified operation to ensure the reliability of exchanges. Let's see how these calculations take place in the network and how they contribute to the bitcoin mining process.

Bitcoin mining is the process by which new units of bitcoins (BTC) are created. It is an effective method if you want to acquire Bitcoin. But before you dive into this activity, you may be wondering how long it takes to generate BTC. In this article, we will explore this question in depth. You will discover, among other things, how difficulty, hash rate, and other parameters influence this metric.