MicroStrategy strengthens its Bitcoin portfolio after a significant $500 million fundraising!

Microstrategy

Like Microstrategy, Semler Scientific will now place its treasury reserves in Bitcoin.

After a period of stagnation, Bitcoin shows signs of recovery, supported by Saylor's optimism.

The company Metaplanet will implement the same Bitcoin strategy adopted by Microstrategy, Michael Saylor's firm.

The SEC, master of procrastination: the decision on Ethereum ETFs, still postponed yet again!

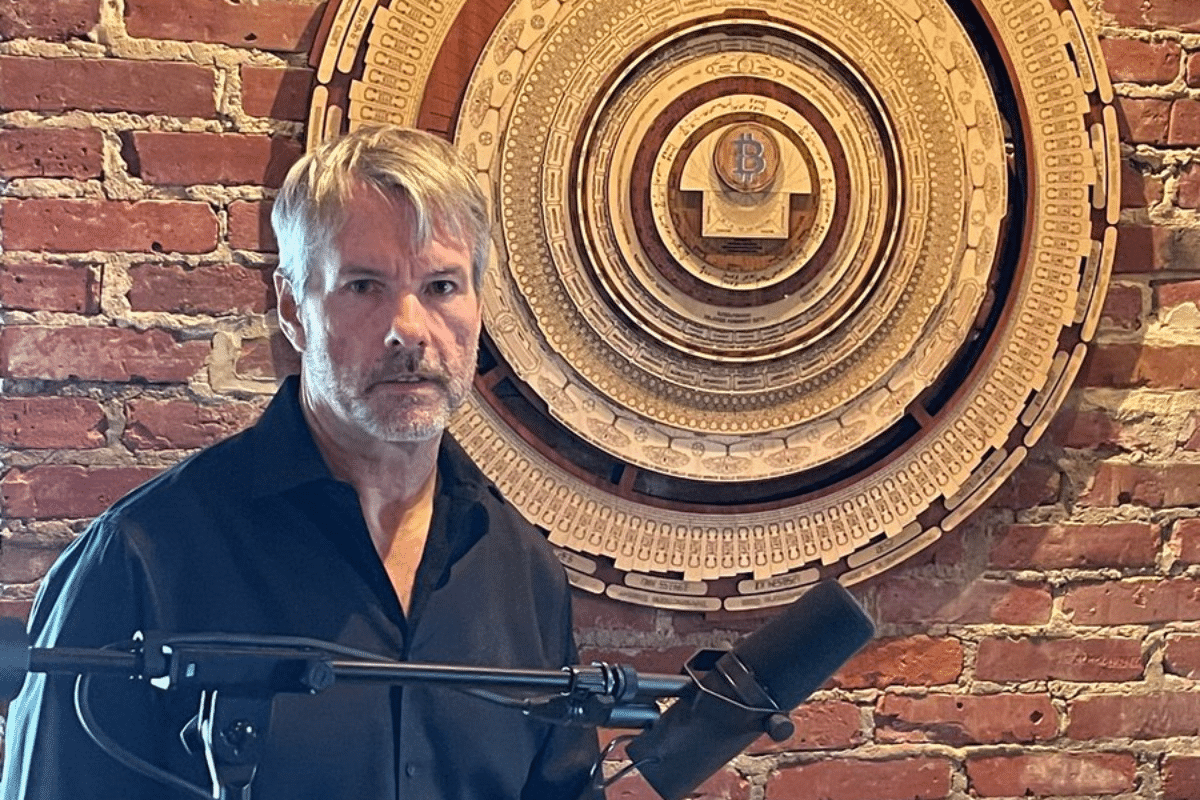

Michael Saylor, a fervent supporter of Bitcoin and founder of MicroStrategy, recently revealed the impressive number of hours he dedicated to in-depth study of the first crypto. A process that allowed him to grasp the full extent of this revolutionary digital asset.

Despite massive losses, MicroStrategy is still investing in Bitcoin. Why this bold decision? Crypto analysis.

Michael Saylor, President of MicroStrategy, believes that the current geopolitical chaos is beneficial for Bitcoin, despite the heavy losses suffered by his company. A perspective that is not unanimous on social networks.

According to latest reports, MicroStrategy's investments in bitcoin (BTC) are proving to be very profitable. Despite some suggestions, the company seems determined not to cash out these profits. On the contrary, it is doubling down on its acquisition strategy as evidenced by MicroStrategy's recent significant purchases of bitcoins. This is happening as the price of the leading cryptocurrency continues its remarkable surge.

Unperturbed in the face of headwinds, Michael Saylor tirelessly continues his quest to accumulate more bitcoins for MicroStrategy. The company has once again added 3,000 BTC to its reserves.

Bitcoin (BTC) is experiencing a remarkable resurgence. An opportunity that is always seized upon by Michael Saylor, the co-founder of MicroStrategy, to share his thoughts on what he believes will happen to the flagship cryptocurrency in the future. His projections regarding Bitcoin (BTC) are rarely pessimistic.

"Wall Street loves bitcoin. They are buying 12.5 times more bitcoins per day than the network can produce," astutely notes crypto trader Pomp on Twitter. According to him, daily acquisitions far exceed the network's production, reaching up to 12.5 times more. For Michael Saylor of MicroStrategy, Bitcoin spot ETFs have played a crucial role in popularizing cryptocurrency, thus propelling its price to new heights.

The soaring rise of BTC towards $50,000, fueled by increasing institutional adoption and profitable addresses.

MicroStrategy boldly navigates the volatility of Bitcoin amidst accounting changes. A financial odyssey full of twists and turans.

The bearish pressure imposed on bitcoin by the GBTC ETF is clearly diminishing. Is the Bull Run about to resume?

When it comes to betting big on bitcoin, Microstrategy and its visionary captain, Michael Saylor, appear to be the undisputed kings of the cryptosphere. With a recent acquisition of 14,620 BTC, amounting to an investment of $615 million, this bold move positions the company and BTC itself in the spotlight.

The first domino of the Bull Run has officially fallen. American companies can now display their bitcoins at their fair value.

As the halving approaches and the SEC prepares to rule on the Bitcoin ETF, MicroStrategy has unveiled its financial results for the third quarter of 2023, highlighting a particularly promising Bitcoin portfolio.

The first domino of the bull run has fallen. U.S. companies will soon be able to account for their Bitcoin holdings at their fair value.

One thing's for sure: as long as the price of bitcoin remains correct, Microstrategy won't part with its holdings, says broker Bernstein. Michael Saylor's company has built up a solid reputation, but nothing can match its firm belief in the most famous of cryptocurrencies.

After a week of consolidation, bitcoin (BTC) is at a decisive point. Bullish indicators suggest that the 25% rise could continue. Nevertheless, it's important for investors to be cautious, as a decline is also a possibility.

During the Bitcoin 2023 conference in Miami, Michael Saylor, Executive Chairman and Co-founder of MicroStrategy, shared his thoughts on the superiority of Bitcoin. He also took the opportunity to express his views on crypto regulation in the United States, questioning whether the uncertainty and regulatory ambiguity are deliberate.

Currently, Argentina is facing a worrying inflation crisis of over 100%. Argentines are at a loss as to what to do about the ever-increasing poverty in their country. A Reuters report released on April 14 shows that nearly 40 % of them live in poverty. In addition, they have suffered billions of dollars in economic losses due to one of the worst droughts in their history. Faced with this situation, the co-founder of MicroStrategy advises Argentines to turn to crypto.