Wallets are designed in such a way that a simple dozen words can be used to reconstruct thousands of addresses. But how?

Learn

When a blockchain’s fans discover a new application of it, they usually rejoice: the usage (and hence the value) of their assets is likely to increase. Well, usually. For the past few weeks, Bitcoin maximalists have been fixated on a new standard that emerged on their very own blockchain: BRC-20. And they hate it.

Investments in cryptocurrencies such as bitcoin have exploded in recent years. To provide a better framework for them, or to some extent to profit from their rise, some European countries have defined tax rules that their citizens holding cryptoassets must comply with. In this article, we take a look at the differences between these countries' tax regimes.

Experiencing the loss of your Bitcoin account is one of the most frightening nightmares for a cryptocurrency investor. However, in the face of this perplexing situation, there are effective strategies you can deploy to fully recover your data and protect your assets. Whether it's a connectivity issue, the loss of your private keys or passwords, or even if you have been the target of phishing or hacking attacks, don’t panic. Follow the Bitcoin security tips that we will detail in this guide. They will provide you with pragmatic solutions to safely regain access to your valuable bitcoins.

With the rapid evolution of the crypto industry, the security of digital assets has become a major concern for holders of Bitcoin and other crypto assets. Soft Wallets have become essential tools for storing and managing your digital currency. However, with the number of options available in the crypto market, selecting a Soft Wallet is not that simple. Discover our complete guide to digital wallets for cryptocurrencies.

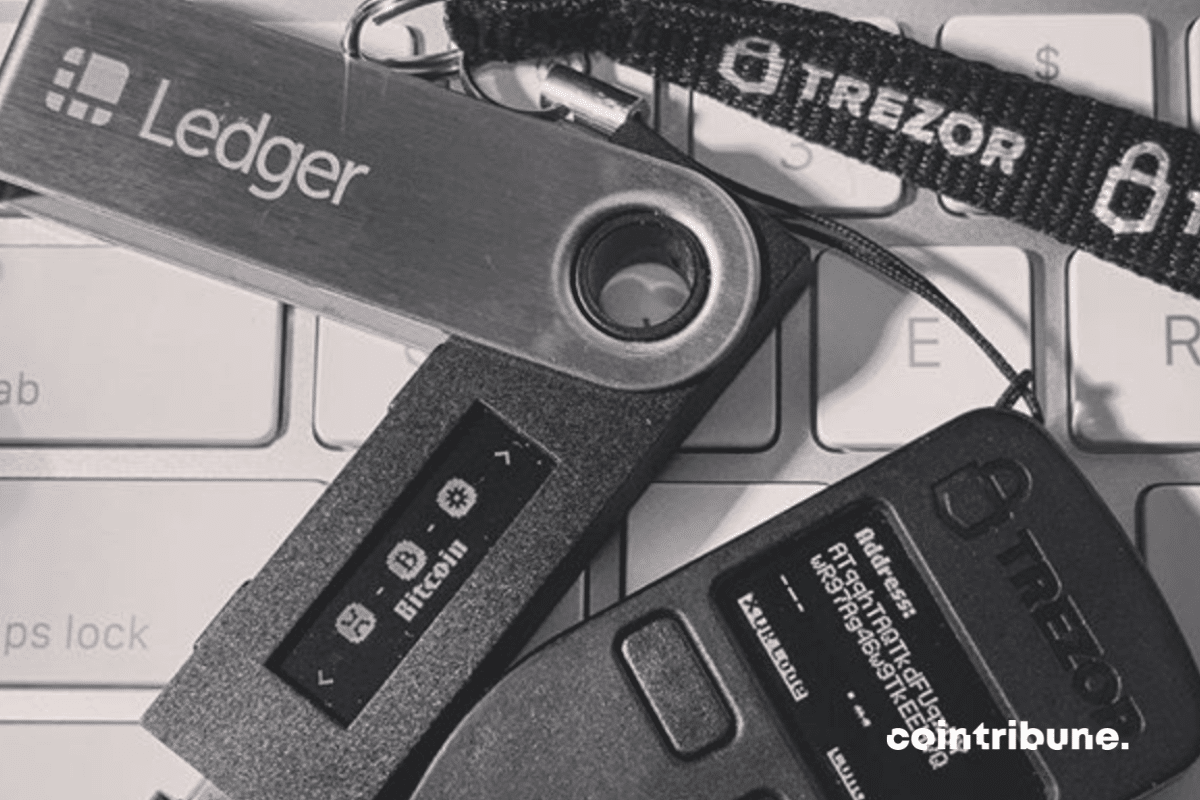

The security of digital assets is a major concern for investors. That’s why many Bitcoin holders choose to use a hardware wallet, or hard wallet, to store their cryptos with peace of mind. Discover our review of the most popular and effective hard wallets for securing your bitcoins, ethers, and other cryptocurrencies, along with their features, advantages, and disadvantages.

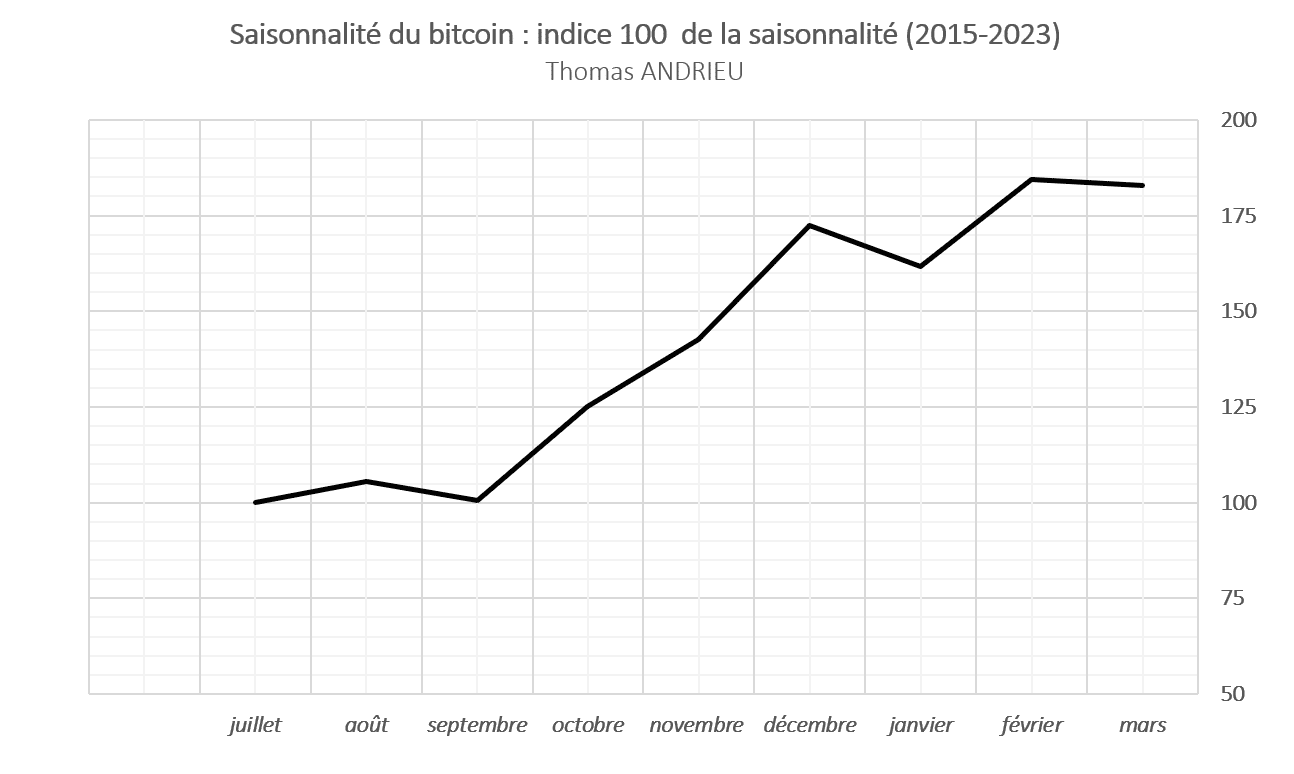

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?

The Bitcoin ecosystem is a real anthill of innovation, constantly pushing back the boundaries of what's feasible. While some are inclined to portray Bitcoin as an outdated protocol, relegated to the shadow of Ethereum, the reality is quite different. Ambitious initiatives such as Fedimint, Magma and Miniscript are at the forefront. These technologies have the potential to catalyze large-scale institutional adoption of Bitcoin, redefining the contours of finance in the 21st century. At last, you'll have the arguments to answer the shitcoiners.

Performance in the first half of 2023 has been largely supported by liquidity. Furthermore, the good news in June was the agreement reached on the debt ceiling limit. It has been increased until 2025, which subsequently reassured a number of financial market operators. It's not the agreement itself on the ceiling limit that's worth keeping an eye on, but rather the impacts of a liquidity squeeze on Bitcoin and the crypto market for the second half of the year.

We know that Bitcoin (BTC) reacts in the long term to profitability levels. That is to say, if the production cost is too high compared to the price of Bitcoin, it would not be sustainable. Therefore, studying the supply is crucial as it explains the behavior and, hopefully, the future of the cryptocurrency market.

Volatility is a peculiar topic in the world of finance, and even more so in the world of cryptocurrencies. Indeed, volatility can be analyzed from two perspectives. On one hand, it allows us to measure the likely variations of an asset and, in some cases, anticipate its movements. On the other hand, the overall volatility of assets reveals which ones truly benefit from periods of tension. In this article, we will focus on a historical volatility approach.

Hyperbitcoinization is a concept that has been theorized by some of Bitcoin's most ardent supporters. It refers to a hypothetical state where Bitcoin would be universally accepted as currency. Is this truly credible, and what would be the consequences for the global economy?

Never before have so many bitcoins stayed with the same owners for such a long time. Everyone is eagerly awaiting the halving.

As Ledger faces public backlash, let's take this opportunity to remind ourselves what a seed is, the concept of cold/hot wallets, and how BTC transactions work.

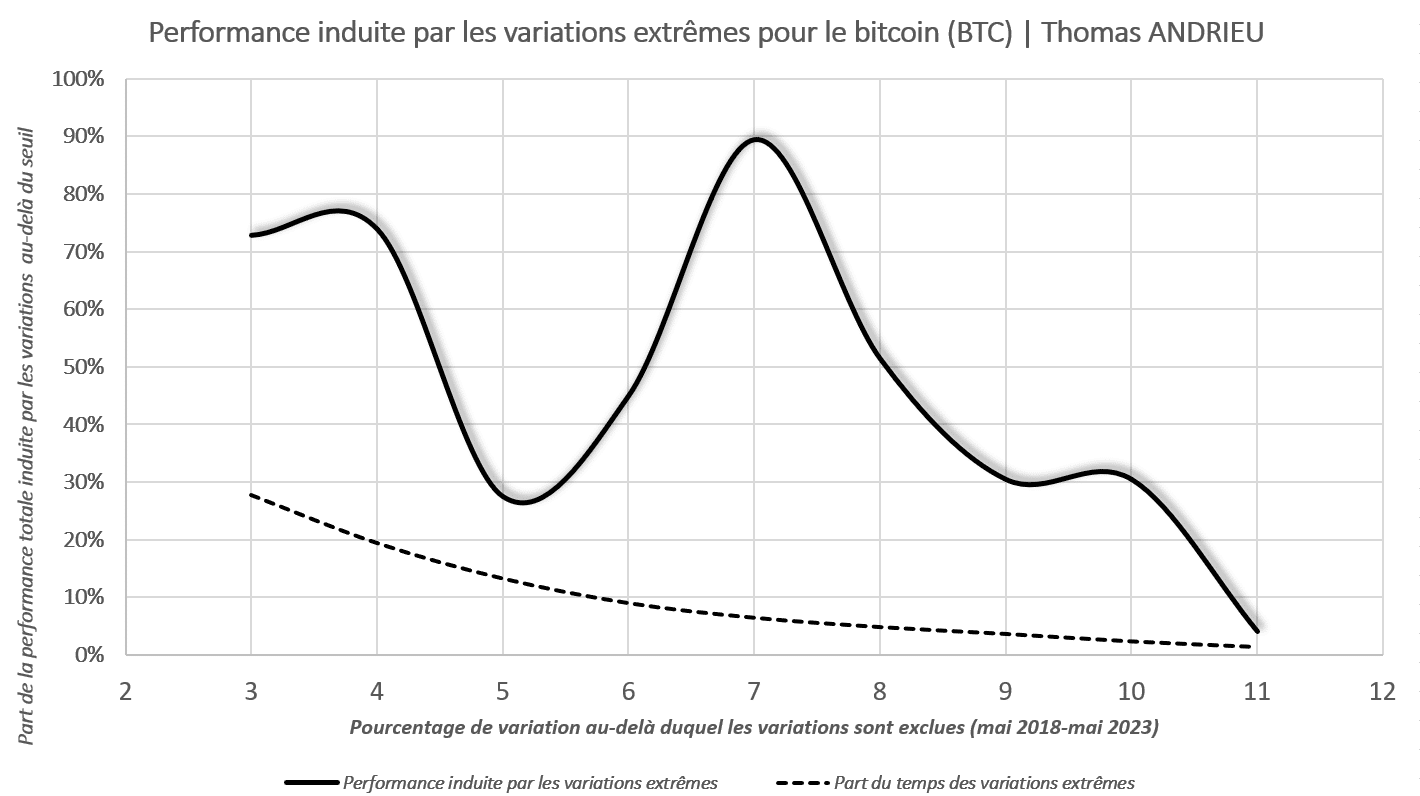

Our study focuses on the role of rare variations in Bitcoin's (BTC) performance. This exclusive study reveals some astonishing findings. In particular, it appears that 7% of the time explains up to 90% of Bitcoin's (BTC) performance. This clearly deviates from what one would expect and aligns with the conclusions of our previous article. Our study aims to identify the “rare” variations that explain Bitcoin's (BTC) performance.

In January 2023, our statistical analysis of Bitcoin (BTC) opened up the possibility of a strong bullish recovery in its price.

What is a seed? Is it possible for someone to guess it? What are the chances of that happening? What is the seed used for?

The hashrate of Bitcoin broke its record on Tuesday, May 2. How can we explain such a sudden increase?

In the world of cryptocurrencies, the Cypherpunk movement is often mentioned when discussing the origins of Bitcoin (BTC). But why? What role did it play in the creation of the pioneer of cryptocurrencies? And, most importantly, what does it entail exactly? Let's explore some answers together.

Bitcoin has always had a bad reputation due to its environmental impact. Bitcoin mining, which requires an astronomical amount of energy, is regularly criticized. It is even said that the entire Bitcoin network consumes as much energy as a whole country like Argentina. In other words, cryptocurrencies are perceived as wicked destroyers of the planet. But is this really the case?

In less than a year, the next Bitcoin Halving will take place. If history repeats itself, we may be on the verge of a new all-time high (ATH).