The American exchange Kraken transformed its European presence in 2025. MiCA license obtained from the Central Bank of Ireland, deployment in the 30 EEA countries, launch of the Krak Card with Mastercard, tokenized stocks xStocks, Circle partnership for stablecoins: a review of a year positioning Kraken as a major player in the European market.

Kraken

The American exchange Kraken launches "Bundles", thematic baskets of cryptocurrencies allowing you to instantly diversify your portfolio. Automatic rebalancing, recurring purchases, zero trading fees: a turnkey solution for investors of all levels.

The Kraken exchange platform officially launches xStocks for European investors, allowing the purchase of tokenized versions of American stocks and ETFs such as Apple, Tesla, or NVIDIA. A revolution in access to US markets, but with nuances to understand.

The exchange Kraken officially launched the Krak Card on November 25, 2025, a Mastercard debit card allowing spending of more than 400 cryptocurrencies and fiat currencies. Available for residents of the European Union and the United Kingdom, this card is part of Kraken's strategy to position itself as an alternative to traditional banks.

One week after the launch of the new version of Read2Earn, Cointribune steps up the pace. This time, the program is enriched with a special quest in partnership with the crypto exchange Kraken, one of the most recognized players in the sector. Objective: to help you better understand how to invest in crypto with complete peace of mind, while giving you access to an exclusive contest with rewards at stake.

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

The crypto market continues to grow, attracting an ever-increasing number of curious or eager users to invest. Yet, faced with the complexity of technologies like blockchain, access to clear and reliable information remains a real challenge. In this technical environment, Kraken establishes itself as a strategic partner for both individuals and businesses. The platform is not limited to buying or selling digital assets. It offers you a true educational accompaniment. Thanks to a rich and structured resource center, as well as a responsive and available customer support at all hours, Kraken places education and assistance at the heart of the user experience.

Investing in digital assets now appeals to a much broader audience than just tech enthusiasts. Even cautious investors are turning their attention to this emerging asset class, seen as a serious alternative in the face of growing instability in traditional financial markets. Cryptocurrencies bring a new form of diversification built on innovation, decentralization, and growth potential. In this fast-evolving environment, Kraken stands out as a reliable bridge between traditional finance and the crypto world. This article explores why Kraken is a relevant tool to diversify your portfolio within a secure, educational, and structured framework.

Security remains one of the main concerns for investors in the field of cryptocurrencies. Recent scandals, large-scale hacks, and losses due to poor management of private keys have increased mistrust towards certain platforms. In this context, transparency and the robustness of the infrastructure become decisive criteria. Kraken stands out as a reference in the protection of digital assets, thanks to a rigorous approach and proven security measures. This article highlights the concrete mechanisms put in place by Kraken to guarantee the security of funds, while providing users with tangible and verifiable proof.

The crypto market is no longer limited to speculative trading alone. A new approach is attracting investors: staking, which allows obtaining regular returns without giving up assets. This method appeals to both long-term holders and savers seeking additional income. Kraken offers a simple, accessible, and secure solution with rates reaching up to 17% APY depending on the selected asset. The platform combines performance, reliability, and transparency to provide a staking experience suited for all profiles. Let's explore together the advantages of this strategy and the guarantees offered by Kraken in its regulated environment.

Crypto trading at a professional level relies on execution speed, precision of tools, and rigorous risk management. Many active traders, tired of the limitations imposed by generalist platforms, choose Kraken Pro to enhance their efficiency. This solution is intended for those seeking competitive fees, margin access, derivatives products, and high-level technical infrastructure. Kraken Pro combines performance, security, and adaptability to meet the demands of experienced investors. In this article, we analyze in depth the strengths of this platform and the reasons that encourage traders to adopt it in the face of sometimes disappointing competition.

In the crypto world, trust is an essential pillar. As scandals multiply, more and more users turn to platforms capable of guaranteeing the security of their funds and the transparency of their operations. Kraken stands out as one of the industry's references, alongside Binance, Coinhouse, or Bitpanda, while focusing on a rigorous and sustainable approach. This guide highlights Kraken's main strengths: a solid regulatory framework, proven security, a wide range of services, and recognized performance. The goal is to help each user invest in crypto-assets with peace of mind.

The world of cryptos is generating increasing interest among the general public, driven by the evolution of bitcoin and digital assets. However, for a new investor, making a first purchase can cause hesitation and confusion. Kraken offers a clear alternative to this complexity. Thanks to a streamlined interface, a quick registration process, and purchase options accessible from 10 euros, the platform paves the way for a calm first experience. Security, education, and simplicity are at the heart of its approach. This article guides beginners step by step who wish to acquire their first cryptos without obstacles or unnecessary jargon.

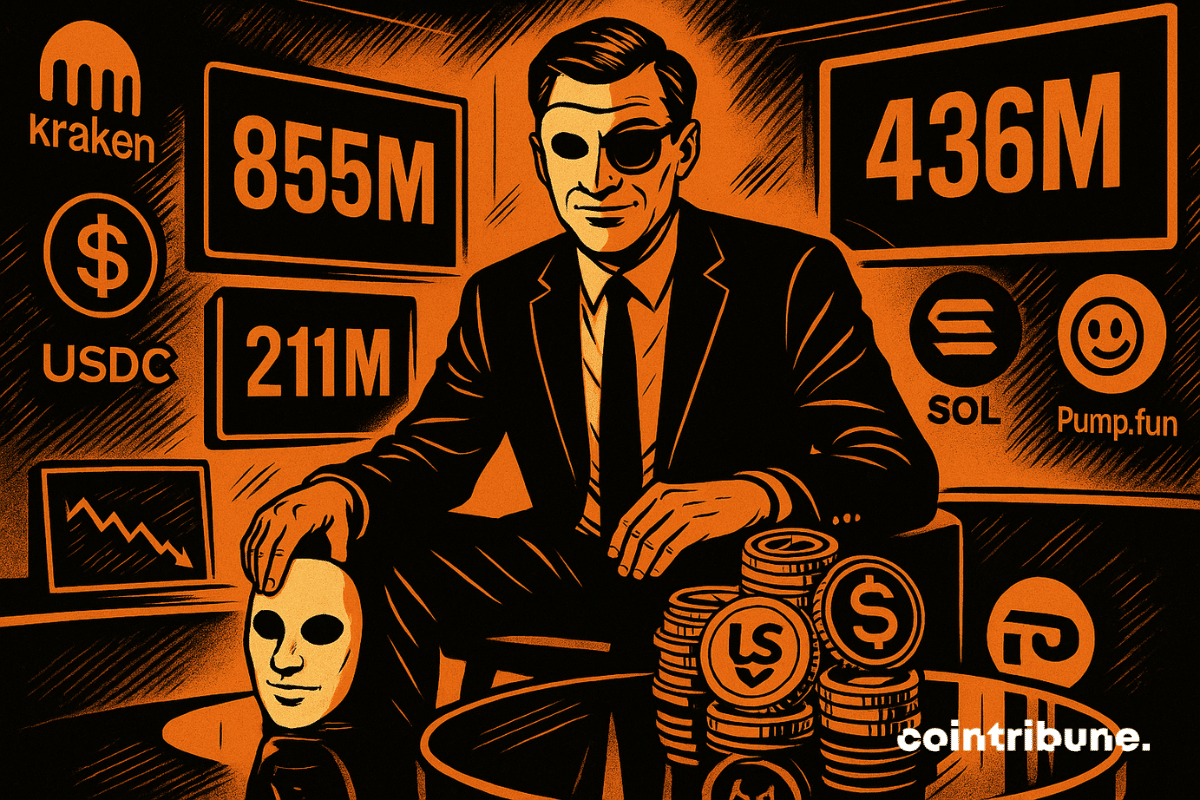

An explosive case shakes the crypto world: Pump.fun accused of siphoning $436M. The founder denies, but doubts remain.

Massive cash-out: Pump.fun withdraws $436M in crypto and triggers a shockwave on Solana. All the details in this article.

A major Cloudflare outage on Tuesday caused widespread disruptions across crypto platforms and several major websites. Service interruptions spread quickly as users struggled to load exchange portals, block explorers, and analytics tools. Early reports from affected firms indicated that Cloudflare error messages were appearing across front-end interfaces.

XStocks has reached $10 billion in just four months, drawing over 45,000 token holders and highlighting the rapid rise of tokenized stocks.

The cryptocurrency ecosystem has just experienced a major turning point with the announcement of a strategic partnership between Kraken, one of the most respected exchange platforms in the world, and Circle, the undisputed leader in stablecoins. This alliance, formalized in September 2024, promises to transform the user experience for the USDC (USD Coin) and EURC (Euro Coin) stablecoins on the Kraken ecosystem.

Mastercard is in late-stage negotiations to acquire stablecoin infrastructure provider Zerohash for an estimated $1.5 to $2 billion, according to a Fortune report citing five people familiar with the matter. The deal would position Mastercard among a growing number of global financial firms investing heavily in blockchain-based payment technology.

Kraken has just reached a major new milestone by launching Kraken Perps (Kraken perpetual contracts), available since September 11, 2025, in select regions for eligible clients worldwide. This initiative marks a significant democratization of crypto derivatives trading, previously reserved for experienced traders.

Dutch neobank bunq is rolling out flexible cryptocurrency staking across the European Union through a partnership with Kraken. The offering covers 20 digital assets with yields up to 10% annually, without mandatory lock-up periods. A first for a European challenger bank.

The American exchange platform Kraken has just introduced a new feature called "Bundles", allowing users to purchase a diversified basket of cryptocurrencies grouped by theme in a single transaction. Officially launched in September 2025, this service targets both beginner and experienced investors who want to gain exposure to multiple digital assets without having to manually compose a portfolio.

As the cryptocurrency ecosystem reaches unprecedented maturity in 2025, Kraken has emerged as one of the leaders in global crypto trading. Kaiko has ranked Kraken as the #1 global crypto exchange for Q3 2025 their first-ever top finish, achieving a steady rise from #3 in Q1 2025 and #2 in Q2. This remarkable achievement reflects the platform's relentless focus on client-first innovation and institutional-grade infrastructure that has redefined cryptocurrency trading standards.

Kraken recently completed a major acquisition of Breakout, making it the first major crypto exchange to enter proprietary trading. This strategic move represents a significant shift in how crypto traders can access capital, offering funded accounts with substantial leverage without risking personal funds once the evaluation phase has been successfully completed.

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

Kraken unfolds its roadmap and makes its own tour of France. Heading to marketplaces, village halls and provincial media libraries. The idea is simple, almost obvious: go where the French live, to talk crypto without filter or jargon, face to face. No cold keynote or impersonal livestream: a physical presence, concrete demonstrations, Q&A at eye level.

The next bullish cycle ("bull run") is already attracting new investors. Market indicators (Bitcoin at $120,000, Ethereum at $3,800, rising volumes, new ATHs on several altcoins, return of liquidity) show that the impulse phase has started: it is time to position oneself wisely.

While Bayrou struggles with the budget, Occitanie is mining convictions: France's local regions are flirting with crypto, and it could very well earn them more than a Livret A.

Pump.fun raises 500 million in a flash, while denying liking presales. Behind the bots, rug pulls are piling up. But who is really pulling the strings of the great crypto circus?