The rate cut is postponed due to the return of inflation across the Atlantic. What impact will this have on Bitcoin?

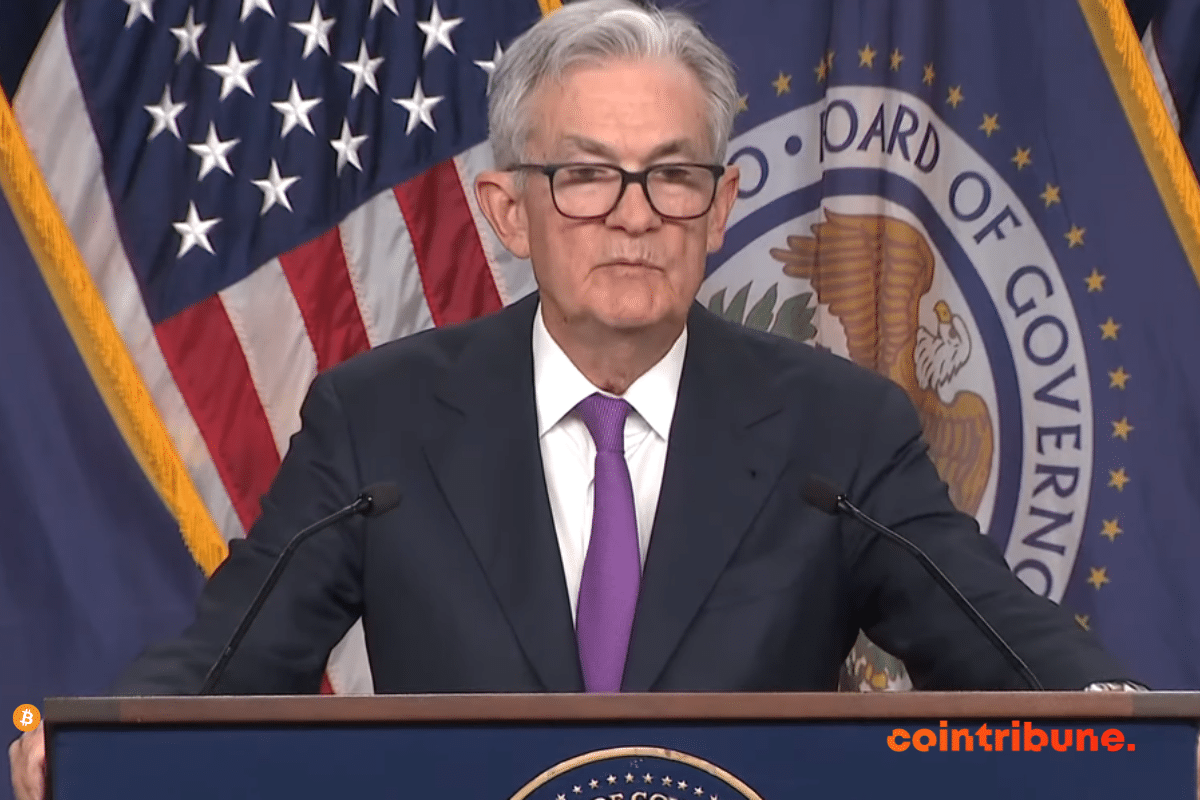

Jerome Powell

Between Jerome Powell and the markets, bitcoin feels like it's in therapy: a complicated love story in the digital age.

The Fed surprises with rate cuts in view, while volatility reigns in the crypto markets.

If the Fed decided to lower its interest rates, we could very well witness a soaring of the markets. Money would flow abundantly, and certain financial assets like bitcoin (BTC) could reach unprecedented heights.

Under the governance of Jerome Powell, the monetary policy of the USA seems destined for a stable future, which influences global finance.

Between the speeches of the Fed and the release of corporate earnings in the stock market, the week of February 5th to 11th, 2024 promises to be rich in news.

The S&P 500 lost $500 billion in just 5 minutes, after Powell declared that a rate cut by the Fed is unlikely.

A very reliable financial indicator, the yield curve has recently inverted. And yet, Wall Street has always considered this indicator as a precursor to an impending recession. Will we therefore experience a catastrophic economic year in 2024, which could also affect the stock markets and bitcoin (BTC)?

It seems that everything is coming together for Bitcoin to have an explosive year in 2024. This week has been more significant than most others in terms of the state of the markets. Two major events happened simultaneously with the release of the latest inflation data and the December meeting of the Federal Reserve, which announced plans for a rate cut.

The Fed has maintained its benchmark interest rate unchanged at 5.50% after eleven increases since March 2022.

Unlike other cryptos, stablecoins inspire relatively more confidence among users. This is due to the stability of their value, which correlates with that of a fiat currency. However, their monetary status had never been officially recognized. At least, until Jerome Powell, Chairman of the US Federal Reserve (Fed), did so. Is this a turning point?

Banks are falling like flies as the Fed finishes raising rates. Hard to imagine a more favorable situation for Bitcoin.

Five months ago, Bitcoin was trading below $16,000. Enthusiasts were feeling down at that time, but they were not giving up. Now they're seeing their bravery pay off: the cryptocurrency is selling for over $28,000 a coin. That's enough to make the people who have been waiting for the bull run cheer for a long time. But not for Nicholas Merten, a notorious analyst in the cryptosphere.