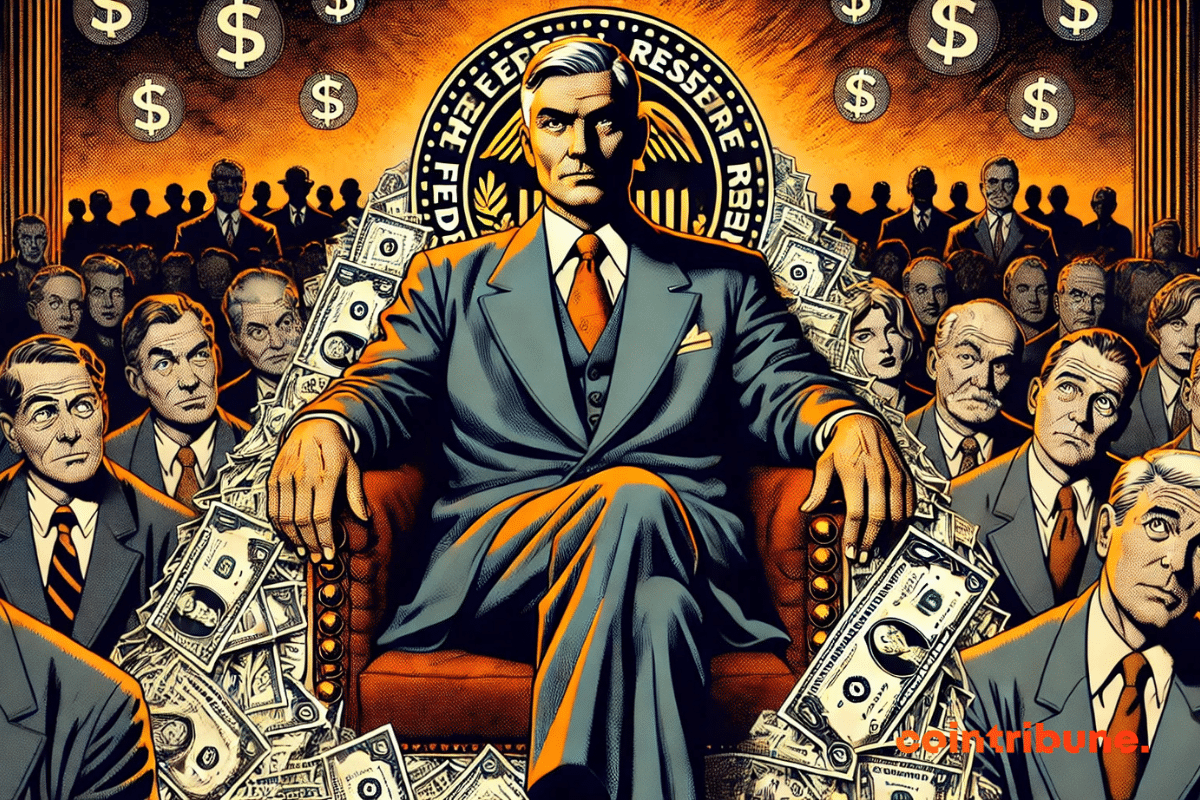

In a recent explosive statement, Donald Trump did not mince his words regarding Jerome Powell. The American president stated that the "resignation of the Fed chief couldn't come soon enough" and that he would not hesitate to fire him if he wanted to.

Jerome Powell

Donald Trump has renewed his attacks against Jerome Powell, the chairman of the Federal Reserve. He accuses him of not acting quickly enough to lower interest rates. Amid political tension, this criticism reignites the debate over the FED's independence and its growing influence on financial markets.

Cryptos are gaining legitimacy. Powell is betting on stablecoins and clear legislation, with appropriate regulations, even in the face of less optimistic economic forecasts for the United States.

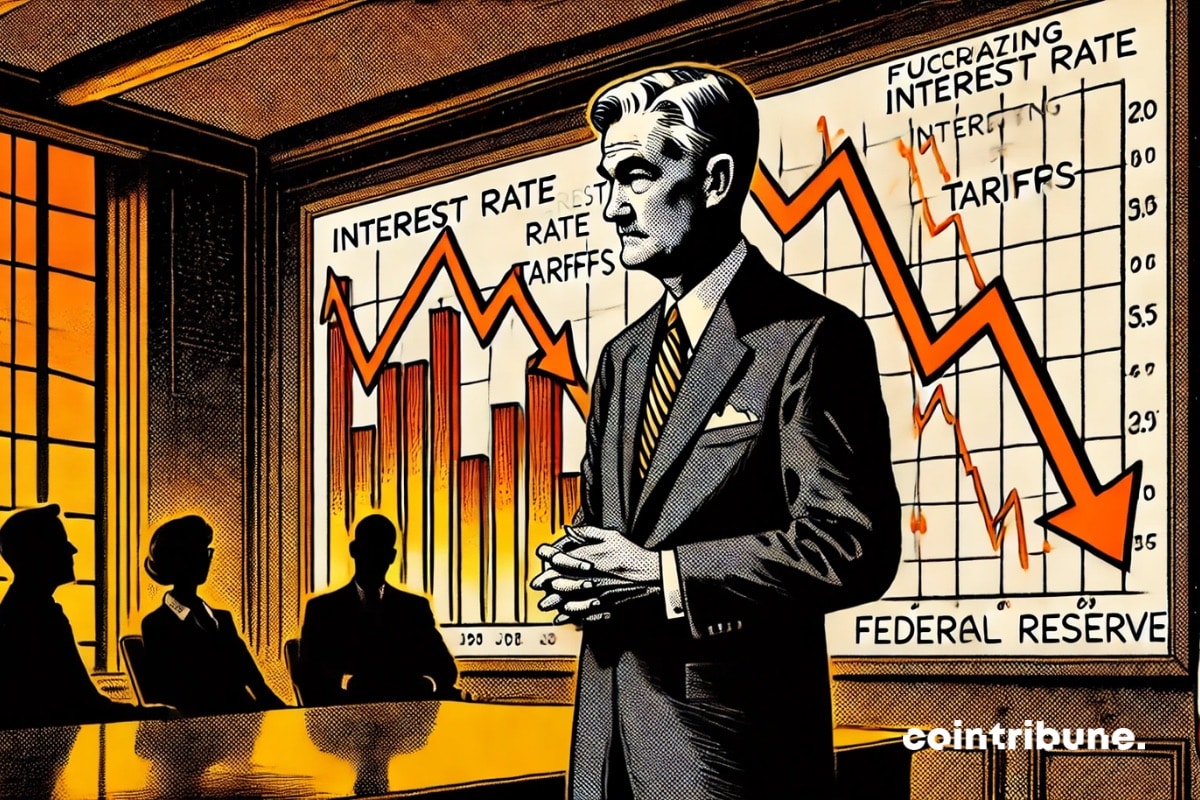

Jerome Powell's words have rarely sounded so heavy. Faced with a weakened economy and renewed trade tensions, the Fed chairman warns: new tariffs could plunge the United States into a zone of turbulence. Growth under pressure, inflation lurking, political uncertainties: the Federal Reserve must now contend with increasingly contradictory variables, risking losing control over the country's economic balance.

JPMorgan has revised its economic forecasts for 2025, raising the probability of a global recession to 60% due to the new tariffs imposed by the Trump administration. According to a report released this Thursday, titled "There will be Blood," the investment bank warns that the tariffs, which will take effect next week, risk plunging not only the United States but the entire global economy into a recession.

Donald Trump recently triggered an economic shockwave by announcing new tariffs. In response, Jerome Powell, the Chair of the Federal Reserve (FED), warned that these measures could exacerbate inflation while slowing down growth. What will be the impact on interest rates? Find out here.

Powell, the guardian of the threshold, shapes the moment. Frozen rates, blurred hopes. The economy wavers, suspended between the fire of inflation and the ice of slowdown. The markets shiver.

The foreign exchange market is abuzz. While the American Federal Reserve maintains a cautious stance on interest rates, the dollar is sinking against major currencies. In a context of economic uncertainty, between rising inflation and trade tensions exacerbated by Donald Trump, investors and analysts are closely monitoring every statement from the Fed chair, Jerome Powell. His testimony before the Senate confirmed that the monetary institution would not hasten interest rate cuts, despite market expectations. Meanwhile, the announcement of new protectionist measures by the U.S. executive fuels fears of a tightening global economic climate.

Every decision made by the American Federal Reserve shapes the global economy and influences the cost of credit, the direction of investments, and the stability of financial markets. At its first meeting of 2025, the Federal Open Market Committee (FOMC) chose to keep interest rates unchanged, despite Donald Trump's persistent calls for monetary easing. This status quo caused a contrasting shock wave: stock indices, from Nasdaq to Dow Jones, closed lower, while Bitcoin surged by 2.5%. Thus, this movement underscores once again the unique trajectory of cryptocurrencies, which seem to diverge from traditional economic logics.

The relationships between political leaders and financial institutions are going through a phase of great tension. Donald Trump, the President of the United States, has strongly criticized the Federal Reserve (Fed) and is calling for an immediate reduction in interest rates. This appeal, made during the World Economic Forum in Davos, comes at a time when the Fed, led by Jerome Powell, is maintaining a cautious approach in the face of persistent inflation and a strong labor market. Such a showdown highlights critical stakes for the American economy, raising questions about the independence of central banks on a global scale.

Between Trumpian euphoria and the cold mechanics of the Fed, bitcoin swings, a fragile king of a kingdom of uncertainties.

Between a provocative Trump and an inflexible Fed, the economy wobbles. Interest rates rise, prices soar, and nerves fray.

Amid whispers of inflation and hopes for growth, the Fed is reshaping its horizons. Powell, with caution in hand, challenges a nascent economic storm.

After the governor of the Bank of France, it is now the turn of the Fed's governor to temper his stance regarding Bitcoin.

Investors are ramping up their bets on a decrease in the U.S. Federal Reserve's benchmark interest rates in December, according to the CME FedWatch tool. The probability of a 25 basis point reduction has surged to 74.5%, compared to 66% last week.

With XRP soaring, Ethereum galloping, and the Fed squawking, the week promises to be as unpredictable as a night market. Watch out for the jolts!

Trump wants to lead the Fed, but Powell, stoic as a Swiss banker, refuses to relinquish the reins. Guaranteed economic duel!

The U.S. Federal Reserve took a decisive step this Thursday by lowering its key interest rate by 25 basis points, bringing it to a range of 4.5%-4.75%. This decision, coming the day after Donald Trump's electoral victory, immediately propelled the crypto market to new heights, with Bitcoin reaching an all-time high of $76,951.

The American economy is going through a pivotal phase, where every word spoken by the Federal Reserve Chairman, Jerome POWELL, is scrutinized with particular attention. Indeed, he has expressed cautious optimism about the possibility of reducing inflation to 2%, the Fed's target. This statement is not only crucial for traditional markets, but it could also be the catalyst for a new major rally in Bitcoin.

Bitcoin under pressure: the Fed lowers rates and the crypto market could emerge either shaken or pleased!

Bitcoin rises 543 million $ after comments from Jerome Powell, the chairman of the FED, on the possible rate cut in September.

Between euphoria and mistrust, Bitcoin attempts to reach $68,000 while Powell sharpens his monetary tools.

Jerome Powell has finally announced the interest rate cut from Jackson Hole. Bitcoin is moving forward again.

Bitcoin rises after Powell's statements on interest rates. Markets anticipate a Fed easing.

Jackson Hole raises doubt: the CAC 40 moves cautiously, investors await the Fed's verdict.

Freefall for Bitcoin and Ethereum: blame it on Japanese interest rates. Other economic events could worsen the situation.

Has the brewing war in the Levant prompted the Fed to be cautious? Is the end of the petrodollar near? What about bitcoin?

The Federal Reserve chairman has just made unexpected statements about interest rates! The crypto market will be shaken!

The Fed kept its key rate unchanged, constrained by high inflation. Little impact on Bitcoin.

The Bitcoin market is in turmoil as Jerome Powell, chairman of the Federal Reserve, prepares to deliver a highly anticipated speech. Despite the surrounding uncertainty, traders remain optimistic and see the price of BTC surpassing the symbolic $65,000 mark.