Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic strife. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Investissement

Amid a period of global economic volatility, Saudi Arabia has made a decision that could redefine energy and geopolitical balances. As the price of a barrel of oil reached 100 dollars, Riyadh chose to significantly increase its oil production, a maneuver aimed at lowering crude prices in international markets.

The global financial landscape continues to transform at a dizzying pace. And Bitcoin, once seen as a risky bet, has gradually established itself as an asset of choice for large institutional investors. Among them, BlackRock, the largest asset manager in the world, marks a new milestone in the adoption of Bitcoin. With new strategic acquisitions, this company has seen its Bitcoin holdings reach nearly $24 billion, thereby confirming its key role in the evolution of the crypto ecosystem.

As the global economy wavers between geopolitical uncertainties and monetary adjustments, one asset continues to attract the attention of investors: Bitcoin. Within hours, the queen of cryptocurrencies has once again crossed the symbolic threshold of $66,000, a performance that not only marks impressive resilience but also a resurgence of optimism in a market seeking direction. Behind BTC, altcoins are also making a strong comeback, with double-digit increases illustrating a general recovery in investors' appetite for risk. Should we view this as a mere rebound effect or the beginnings of a new sustainable bullish phase for the crypto market?

In the rapidly evolving financial world, decentralized finance (DeFi) emerges as an innovative and booming sector. With its promises of high returns and new forms of investment, DeFi attracts a growing number of investors. However, navigating this complex and ever-changing space can be intimidating, especially concerning optimizing gains while minimizing risks. This article aims to demystify investment strategies in DeFi, focusing on best practices to boost profits. We will explore key approaches such as thorough research, risk management, and security, essential practices for succeeding in the DeFi universe.

Decentralized finance (DeFi) has emerged as a revolutionary sector in the investment world, redefining the way financial transactions are conducted. Through blockchain technology, DeFi offers a transparent and accessible alternative to traditional financial systems. However, investing in DeFi can be complex, requiring a clear understanding of the underlying technologies and investment strategies. This article aims to demystify the investment process in decentralized finance, addressing the essential knowledge needed, the steps to get started, and strategies to optimize returns on investment in this rapidly expanding universe.

OpenAI initiates a historic new phase that redefines the future of Artificial Intelligence. Through its transformation into a for-profit entity, the company, once a pioneer in altruistic AI research, disrupts its founding model. This decision, which represents a profound break in OpenAI's history, occurs at a time when technologies related to Artificial General Intelligence (AGI) occupy a central place in scientific and political debates around the world.

After the ECB and the Fed, it's the turn of the Chinese central bank to significantly ease its monetary policy. What impact will it have on the stock market and Bitcoin?

In an increasingly polarized world, geopolitical alliances play a crucial role in redefining power balances. North Korea, traditionally isolated on the international stage, seems to be intensifying its efforts to align with economic blocs like the BRICS, amid growing ties with Russia. This strategy could have major implications, not only for Pyongyang's diplomacy but also for global geopolitics. The notable absence of North Korea at the United Nations General Assembly in favor of a BRICS event in St. Petersburg is a warning sign.

Another report on Ethereum ETF options: the American crypto regulator SEC sets new deadlines. The details!

Bitcoin is regaining altitude, and four factors make it very optimistic for the end of the year and next year.

Amid revolutionary announcements, technological advancements, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a realm of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The world of traditional finance has never been so close to the blockchain ecosystem. While the boundaries between the two realms seemed rigid just a few years ago, major institutional players are now taking the plunge with increasing determination. In 2024, Solana, one of the leading blockchain networks, is emerging as the new darling of global finance, attracting the attention of giants like Citibank and Franklin Templeton. These players, who have been cautious regarding the crypto universe for a long time, no longer hide their interest in the opportunities offered by Solana.

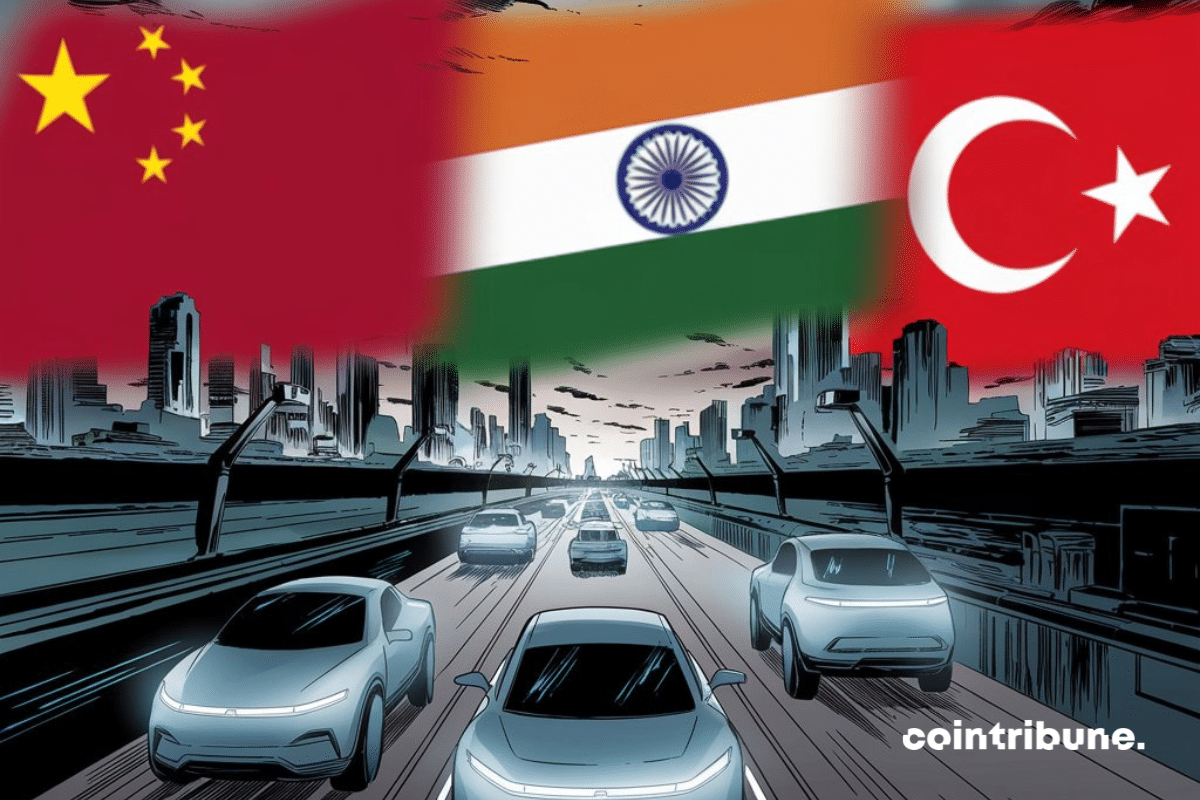

In an increasingly tense global economic context, China has just issued a significant strategic advisory for its electric automotive manufacturers. As the undisputed leader in electric vehicle production, China has made a major strategic decision. Beijing has advised its manufacturers to abandon any intention of investing in India and Turkey, two promising and rapidly growing markets.

BlackRock has published a laudatory report on bitcoin. The giant fund entertains the idea that it could become the international reserve currency.

Bitcoin, often compared to digital gold, is currently at a crossroads. As global financial markets scrutinize the decisions of the U.S. Federal Reserve, a potential interest rate cut could propel the first cryptocurrency to new heights. In a context of controlled volatility, and after months of stagnation, optimism is reborn: some experts, like Charles Edwards from Capriole Investments, already see Bitcoin reaching $64,000 in the near future.

In the crypto universe, where each tweet, prediction, or technical analysis can sway the markets, a new forecast is shaking the XRP community. This time, it is not just a publicity stunt or a hype effect, but a quantified hypothesis that could change the game: XRP at 100 dollars. This estimate, proposed by a recognized researcher, is based on the idea that the crypto captures 10% of the daily transaction volume of SWIFT, the giant of interbank payments. A spectacular scenario that raises as much hope as skepticism.

Behind the daily fluctuations of BTC prices, a trend is emerging: investors, whether retail or institutional whales, are withdrawing their Bitcoins from exchanges at a rate not seen in eight years. While attention is focused on the upcoming decision of the U.S. Federal Reserve regarding interest rates, this movement, far from being trivial, reflects a profound change in market dynamics, fueled by strategic anticipations and a rekindled bullish sentiment.

The real estate market in the Île-de-France is teetering, and the figures keep coming, relentless. This sector, once a solid pillar of the regional economy, now finds itself caught in an unprecedented downward spiral, where transactions are collapsing and prices continue their dizzying fall. The walls of the capital and its surroundings, once synonymous with stability, are cracking under the combined effects of soaring interest rates, economic uncertainty, and buyer reluctance. In this tense climate, where the cards are being reshuffled, buyers are regaining control while sellers are struggling to adapt.

The French economic landscape has just crossed a symbolic threshold: inflation has finally fallen below the 2% mark, the first time in three years. As economists and markets scrutinize every variation of the indicators, this return to a historically low rate marks a turning point after a period characterized by incessant price increases, particularly in energy. In this post, we will analyze in detail the figures that confirm this trend, relying on the latest data provided by Insee. We will then examine the specific factors that have contributed to this slowdown in inflation, and the implications of this development for consumers, businesses, and economic policies.

Are we on the brink of a return to the Gold Standard? This is what Saudi Arabia's secret purchases suggest. When will Bitcoin arrive?...

Russia is facing a growing threat of stagflation, as its economy slows under the weight of massive military expenditures and rampant inflation. With an inflation rate of 9% in August 2024 and an economy marked by significant military spending since the invasion of Ukraine, experts are concerned about the long-term repercussions.

Within the span of three days, the Bitcoin market was shaken by a massive sell-off estimated at $1.71 billion orchestrated by miners. This series of unexpected sales quickly worried investors, especially as the crypto was already struggling to regain its momentum after several weeks of correction.

After the recent cryptocurrency market downturn, Sui has shown an impressive rebound of over 140%. Let’s examine the possible scenarios for the evolution of the SUI price. Sui Situation After being listed on various exchanges, the Sui cryptocurrency unfortunately failed to appreciate. Indeed, it quickly fell…

After initiating a rebound following the recovery of the cryptocurrency market, Solana has finally returned to its support for the sixth consecutive time. Let’s examine the upcoming prospects for the SOL price. Solana (SOL) Situation After plunging towards $110 following the overall decline of financial markets, Solana quickly repositioned itself…

The companies in the S&P 500 are competing to maintain their growth in a volatile economic environment. However, one company stands out in this rivalry: MicroStrategy. Led by Michael SAYLOR, this company has adopted a bold strategy through massive acquisitions of Bitcoin. This initiative allows it to surpass all its competitors and propels its stock to record levels.

The Republican candidate for the American presidency threatens the BRICS with heavy economic sanctions if they turn away from the dollar. Bitcoin as an alternative solution...

Amid revolutionary announcements, technological advancements, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic struggles. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The Republican candidate for the presidency of the United States, Donald Trump, wants to lift all sanctions against Russia. Is it not too late to save the dollar?

Financial markets are once again under pressure, and Bitcoin is not escaping the storm. The most famous cryptocurrency, often regarded as a barometer of global risk sentiment, has just hit its lowest level in a month, shaken by mixed U.S. economic figures. As economic uncertainty prevails, and decisions from the Federal Reserve are closely scrutinized, a sense of distrust is settling in among investors.