After rejecting the $2.1K mark, the Ethereum price twice unsuccessfully tested the psychological $2,000 threshold.

Theme Invest

According to analysts, the ongoing sell-off in the US dollar has always pulled bitcoin down. But bitcoin's correlation with DYX won't last forever, argues Acheson, former head of research at CoinDesk and Genesis.

Asset manager BlackRock recently filed a Bitcoin ETF application with the SEC. The procedure has had such a positive impact that many analysts see the bitcoin (BTC) market exploding. In the meantime, the procedure initiated by BlackRock seems to have a more important, short-term objective.

Yesterday's release of the US inflation rate suggests an imminent rise for the queen of cryptos. Bitcoin (BTC) seems headed inevitably for $50,000.

Recent news seems favorable for cryptos. Indeed, a former SEC official's opinion that the Bitcoin ETF should be approved is seen as positive for the crypto market. Is the next Bitcoin (BTC) bull-run imminent?

Solana (SOL) is currently not at its best in the crypto market. However, some analysts believe this is just temporary.

With the US CPI due for release on July 12, Bitcoin (BTC) and Ether (ETH) are stabilizing, raising investor expectations. The previous month, these two cryptocurrencies soared in response to this economic indicator. Could this trend be repeated this month?

Central banks continue to accumulate gold. Geopolitics and inflation redefine the rules of the game.

BTC continues to hold in the $30,000 to $31,000 range. Large investors seem to remain optimistic and continue to accumulate. The long-term price trend for bitcoin (BTC) remains bullish, although a new DIP cannot be ruled out. Short-term selling could be attractive.

Tether, the USDT stablecoin issuer, has taken the decision to freeze $2.5 million in USDT due to its connection to an alleged hack of the Multichain interchain router protocol. Tether thus aims to protect the funds involved and prevent any potential misappropriation or unauthorized access.

With the many fluctuations and workings of the cryptocurrency market, investors need to identify and opt for an effective strategy to give themselves every chance of making a profit. From staking to one-offs to Dollar Cost Averaging or DCA, there are many options available to traders. For some analysts, more than a strategy, DCA is the best ally for bitcoin (BTC) hodlers. According to them, it's a method that enables bitcoin holders to secure profits on the cryptocurrency market.

Over the past week, Litecoin has risen by more than 30%. The LTC price tested $116, marking a new annual ATH.

It's not the first time that financial giants have made optimistic statements about bitcoin. But this time, the CEO of the world's largest asset management company openly declared his preference for bitcoin “over investing in gold, […] bitcoin is an international asset”. In the wake of this statement, bitcoin is on the verge of a bull market. As stock market indices consolidate, bitcoin is on its highest levels of the year. But is bitcoin “digital gold”? And what are the aims of this financial giant?

According to various data, the first half of 2023 is marked by a significant rise in crypto market capitalization. Just the thing to spark renewed investor interest after a year marked by scandals!

In 2017, Larry Fink, CEO of asset management company BlackRock was scathing about bitcoin. In particular, he criticized the crypto queen as a mafia asset, useful for laundering money. Now, his views on bitcoin's usefulness have changed dramatically.

As a crypto with great potential, ADA is one of those digital assets that perform remarkably well even in the midst of a bear market. Its resilience in a tumultuous market is impressing many investors. Particularly concerned about the future of altcoin, analyst Dan Gambardello predicts an imminent uptrend for this cryptocurrency. He recently shared his thoughts on the future of the digital asset with Twitter users.

Bitcoin is still sitting on $30,000, but the bullish pressure is palpable. Here are the top 5 (crescendo) bullish factors.

Bitcoin has experienced explosive price phases in recent weeks. According to several analysts, the asset's price should continue to rise despite the market's circumstances. Economist Alex Krüger is among those who believe in this prospect.

Ether (ETH) could get off to an explosive bullish start this month, in a context that seems favorable to a bullish recovery. If confirmed, this crypto could reach $2500.

According to this crypto analyst, bitcoin (BTC) could see an explosion in value in July. He points to a pattern reminiscent of the asset's price structure in 2020. Departing from the traditional four-year cycle theory, this analyst sees things from a different angle. But only time will tell if this month will be as fruitful as November 2020 for BTC.

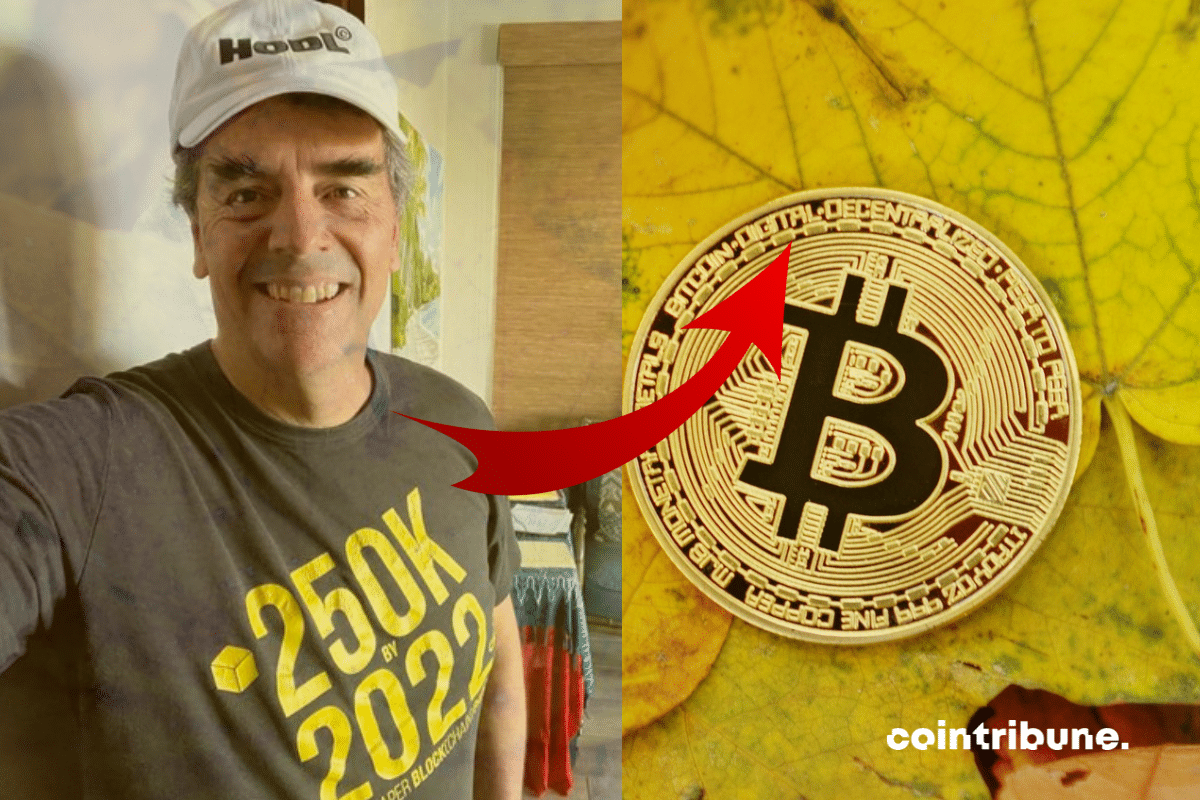

As the BTC halving approaches, bull run predictions are back in full swing. Tim Draper predicted a $250,000 bitcoin by 2022. But not everything went according to plan for the queen of cryptocurrencies. The crypto-enthusiast billionaire has rectified his earlier prediction.

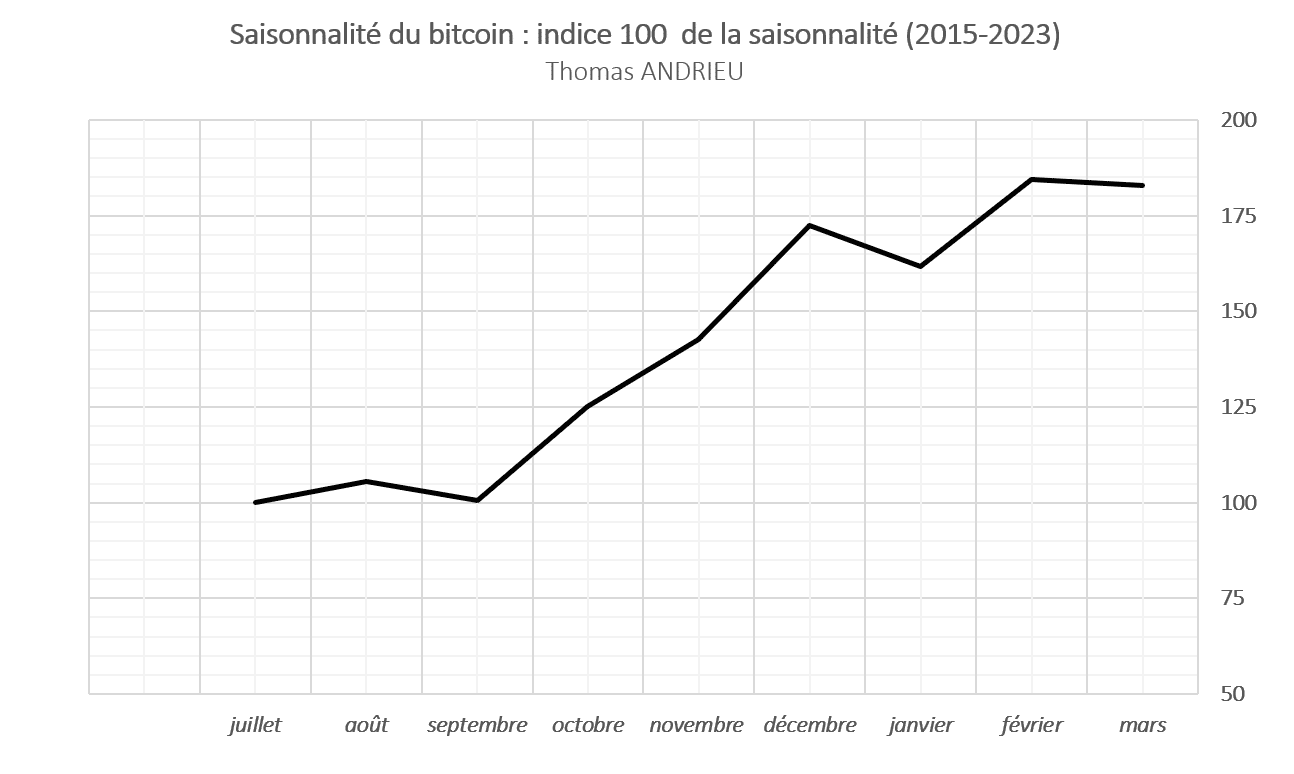

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?

After a week of consolidation, bitcoin (BTC) is at a decisive point. Bullish indicators suggest that the 25% rise could continue. Nevertheless, it's important for investors to be cautious, as a decline is also a possibility.

According to analyst Rekt Capital, three altcoins could soon be on a bullish trend. The well-known trader believes that litecoin (LTC), ATOM and SAND are all showing warning signs of an imminent rise. He shared his thoughts with his followers on Twitter.

Ether (ETH) stabilizes around $1850, potentially offering a buying opportunity. The uptrend could indeed continue in a context favorable to cryptos.

It's quite a paradox! The man who shook the Kremlin does not come from the opposition camp, nor from outside. Yevgeny Prigozhin is a very close friend and Vladimir Putin's "former Swiss Army knife". He dared to challenge the powers that be with a short-lived rebellion backed by some 5,000 men. A situation quickly resolved by Putin, and one that has been emulated by Russian crypto-enthusiasts.

Last week, bitcoin underwent a 19% rise. The price of the leading cryptocurrency rose from around $26,000 to $31,500, setting a new annual ATH.

In the financial markets, gold and bitcoin are two distinct but highly valued asset classes. Gold benefits from long-standing trust, while bitcoin has managed to establish itself as an essential asset despite the fluctuations it undergoes. According to some experts, both assets have advantages that can be asserted for a long time to come.

Cardano (ADA) is facing regulatory crackdown in the United States, but it doesn't hinder its growing adoption and exceptional growth. According to data from "Morning Consult," ADA adoption has seen a remarkable increase in the past 18 months, with nearly 10 million people (approximately 7% of Americans) currently holding this cryptocurrency.

Bitcoin (BTC) recently broke through the psychological $30,000 barrier, which seems like a good time to buy. Here are some interesting buying areas.