Rumor has it that the SEC is about to approve Ishares' Bitcoin ETF. Verdict tomorrow.

Theme Invest

The US government currently holds 200,000 Bitcoin (BTC). Yet it seems in no hurry to sell this colossal treasure.

Glassnode, the cryptocurrency analysis company, has suggested a decrease in liquidity in the altcoin market. This situation is said to be linked to a waning appetite for cryptocurrencies. The company specifically points out a market weakness based on the fundamental parameters of altcoins, which are at critically low levels.

Fervent Bitcoin (BTC) advocate, Arthur Hayes, has predicted that the asset will see its price skyrocket to reach a valuation of one million dollars. This could happen if the company BlackRock obtains the Bitcoin ETF they have filed for. However, this perspective, although initially interesting for the crypto industry, does not reassure the investor.

One Step Forward, Two Steps Back: SEC Approves Bitcoin/Ethereum Futures ETFs, but Remains Cautious on Bitcoin Spot ETFs. Crypto Community, Financial Institutions, and U.S. Officials Grow Impatient. When Will Gary Gensler's Team Decide on Bitcoin Spot ETFs? A Former BlackRock Executive Shares Insights.

At the heart of a monetary revolution, Bitcoin challenges conventions and shakes the foundations of finance. Financial turmoil has always been the stage for engaging debates, conflicts of interest, and strong opinions. In this world where fiat currencies reign supreme, a recent statement by tech magnate Elon Musk has stirred the pot: according to him, fiat currency is the biggest scam of our time. But to understand this bold declaration, one must first delve into the complex world of Bitcoin.

ProShares, the global leader in crypto-linked ETFs, announces the launch on Monday, October 2, of the ProShares Ether Strategy ETF (EETH), the first ETF to target the performance of the cryptocurrency ether. At the same time, ProShares is also launching two ETFs that each look to provide performance that corresponds to a blended return of bitcoin and ether.

From the surprising cyberattack faced by Huobi, to the mounting pressure on the SEC regarding the approval of the Bitcoin ETF, and the bold initiative by NASA to use blockchain to authenticate its moon landings – the week has been full of twists and turns. And that's just a glimpse. Let's dive into these stories and more to start this new week with a clear view of the crypto horizon!

VanEck anticipates that its request for the deployment of an Ethereum ETF futures will receive approval from the SEC in the near future. This prediction is accompanied by an extensive charm offensive aimed at the crypto community. Recently, VanEck has made a commitment to donate a portion of its profits derived from its ETH ETFs to Ethereum. Details!

From Bitcoin's meteoric rise, now surpassing Visa in transaction volume, to Binance's bold prediction about the demise of stablecoins in Europe, the news has been as varied as it has been impactful. Citigroup has also made a splashy entry into the crypto world, while the Ethereum ecosystem faces turbulence with the rejection of its Shanghai upgrade. And the FTX case, nearing its resolution, marks a pivotal moment for millions of investors. Dive with us into this weekly roundup to stay informed about the significant events of the past week.

The dynamics of the crypto market are often influenced by major transactions. Recently, an investor who participated in Ethereum's 2014 ICO caused quite a stir by transferring a colossal amount of ETH to Kraken. Should we be concerned?

Bitcoin is poised to deliver a performance that could leave the audience in awe. In these times of economic turbulence, the star of Bitcoin shines with a newfound brilliance, promising a golden dawn that would surprise even the most optimistic among us. Behind the scenes of this grand stage are significant movements, signaling an unexpected and historic surge.

The world of crypto is catching its breath: Bitcoin (BTC) has surged to $27,400, marking a 10% increase over the past week. Additionally, the open interest on BTC also saw a 10% rise in just 3 hours yesterday. However, this situation is evoking familiar sentiments among investors, reminiscent of the temporary surge on August 29th, following Grayscale's victory over the SEC. Are we witnessing a similar scenario?

In a world where bitcoin fever continues to gain momentum, a new chapter looks set to open, promising far-reaching upheavals in the global financial landscape. A veritable tidal wave seems to be in the making, orchestrated by asset management titans who control colossal fortunes. These giants, armed with their trillions, are ready to invest massively in bitcoin. Such an incursion could well redefine the financial paradigms we know today. But what if a significant fraction of this financial windfall were to make its way into the crypto market?

While the United States, through the SEC and CFTC, grapples with regulatory challenges in the cryptocurrency market, Germany is forging ahead. Currently, numerous German banks have already stepped into the exciting world of cryptocurrencies, and some local financial institutions believe it's time to embark on this adventure. This includes the Stuttgart Stock Exchange, which plans to launch crypto staking next year.

Renowned for being tamper-proof and completely transparent, Bitcoin is often touted as a perfect 'trustless' network. But can we truly say that we trust no one but ourselves when we use Bitcoin? This is the question posed by Pierre Schweitzer during the Surfin Bitcoin 2023 event in Biarritz.

What is the cumulative inflation since 2010? What is the extent of purchasing power loss?

All eyes are on bitcoin (BTC). Prices are not showing positive signs, and investors are becoming increasingly concerned. But while some are desperately hoping for a rise, their wish is unlikely to come true. According to Jamie Coutts, the downtrend has not said its last word.

Cardano suffered a decline of around -37% this summer 2023. Let's take a look at the prospects for the ADA price.

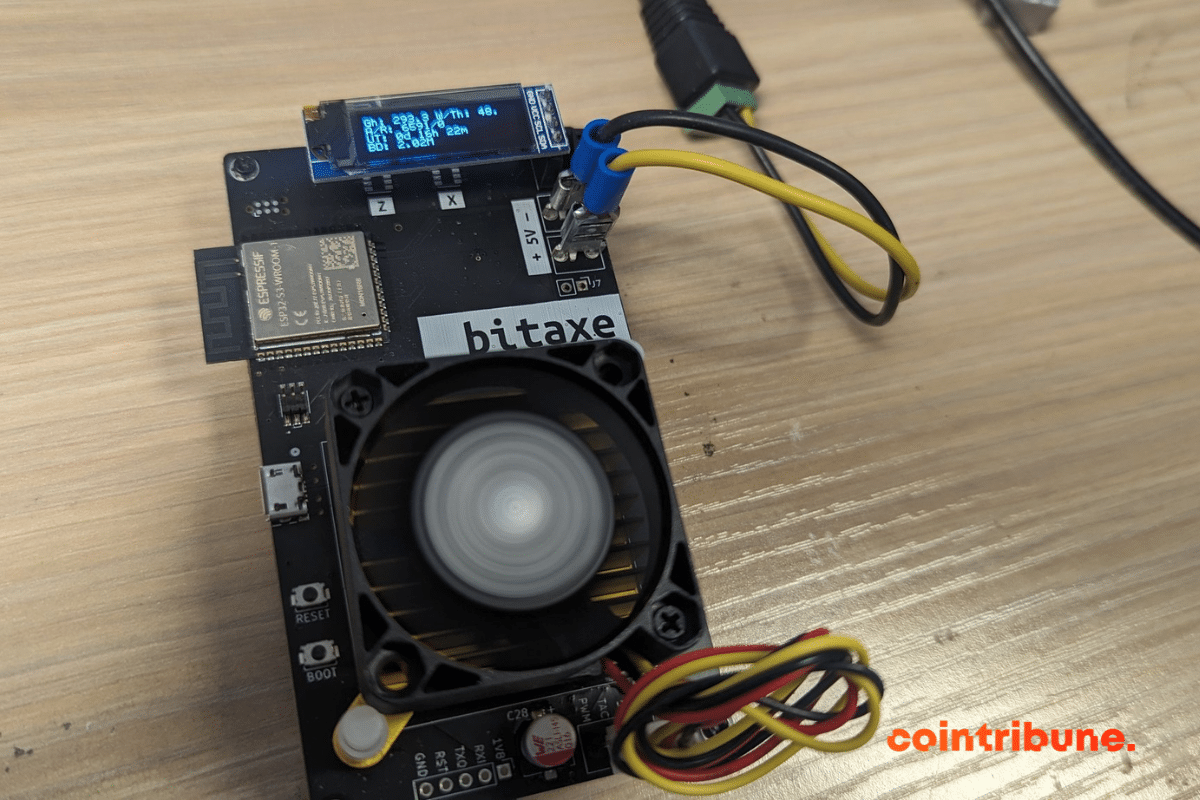

Is the decentralization of the Bitcoin network about to improve thanks to minimalist miners such as Nerdminer and Bitaxe?

In the vast crypto universe, every week brings its share of revelations and surprises. As enthusiasts and investors alike scrutinize the evolution of Bitcoin, the crypto giant has a week full of developments in store for us. Without further ado, let's dive into the fascinating world of Bitcoin, exploring the five major alerts that are on everyone's lips.

Renowned investor Warren Buffett doesn't like cryptocurrencies, bitcoin (BTC) included. And he's not hiding it. On several occasions, the billionaire has explained why, in his opinion, this asset is not worth investing your money in. Yet there is evidence that the businessman has missed an opportunity to increase his fortune.

The first domino of the bull run has fallen. U.S. companies will soon be able to account for their Bitcoin holdings at their fair value.

As we enter the final months of the year on the financial markets, there may be a seasonal trend known as the end-of-year rally. This trend intensifies before the Christmas holidays. Let's take a look at bitcoin's behavior in the run-up to Christmas, and the factors that can influence its price.

Bloomberg analysts increase their estimates of the chances of approval of a Bitcoin Spot ETF in the US. This change is the result of Grayscale's recent victory against the SEC in the Court of Appeals. An analysis which, if it proves correct, should boost the crypto sector considerably.

After suffering a drop of almost -10%, Ethereum came back to perform at over 5% at the start of the week. Let's take a look at the prospects for ETH.

In 2021, cryptocurrencies as a whole exploded the market counters in terms of valuation. Since then, the performance of the crypto industry has not reached a similar level. However, several experts are anticipating an end to this period of drought.

On September 18, 2023, The Lost Wallet will launch a free online game available at https://www.thelostwallet.com/ : an arcade game with a CryptoPunk worth $120,000 and a selection of NFTs as prizes. To win these rewards, the rule is simple: be the player with the fastest time in this arcade game. The course can be completed in less than 5 minutes.

The Bitcoin (BTC) price rebounded by over 1%, reaching a peak of $26,438. This rise is the result of several factors, including improved investor sentiment. The latter are beginning to ease liquidations on long positions.

While the Binance platform is facing numerous difficulties, the BNB price has not remained unaffected. Let's take a look at the prospects ahead for the leading exchange cryptocurrency.