Binance played the role of a catalyst for the rise of LUNC. The crypto exploded by 60% following an announcement from the exchange.

Theme Invest

Canadians would be disappointed with cryptocurrencies. According to the latest statistics, a significant number of them have regretted their investments in this digital asset. Details !

The fact that Changpeng Zhao (CZ) is facing the full force of U.S. law has not prevented him from sharing a poignant testimony about Bitcoin (BTC). The former CEO of Binance recounts how his decision, a decade ago, to invest his entire being into the flagship cryptocurrency, completely changed his life. However, he does not call on users to emulate him.

Bitcoin is on its way to the moon. Its recent performances have sparked unprecedented enthusiasm, leading to a dramatic increase in the number of addresses with a non-zero balance. Details !

Is the future of Bitcoin in the hands of small investors? Indeed, 74% of holders have less than 0.01 BTC.

Elon Musk, the billionaire with quick wit, has just thrown his feelings in the face of advertisers who have interrupted their advertising campaigns on X. Feeling subjected to a kind of blackmail, the irritated entrepreneur throws away the cloak of political correctness and let loose. “Go fuck yourselves!” he shouted at the companies trying to “blackmail X”. It was on November 29th, during a conference organized by the New York Times in New York.

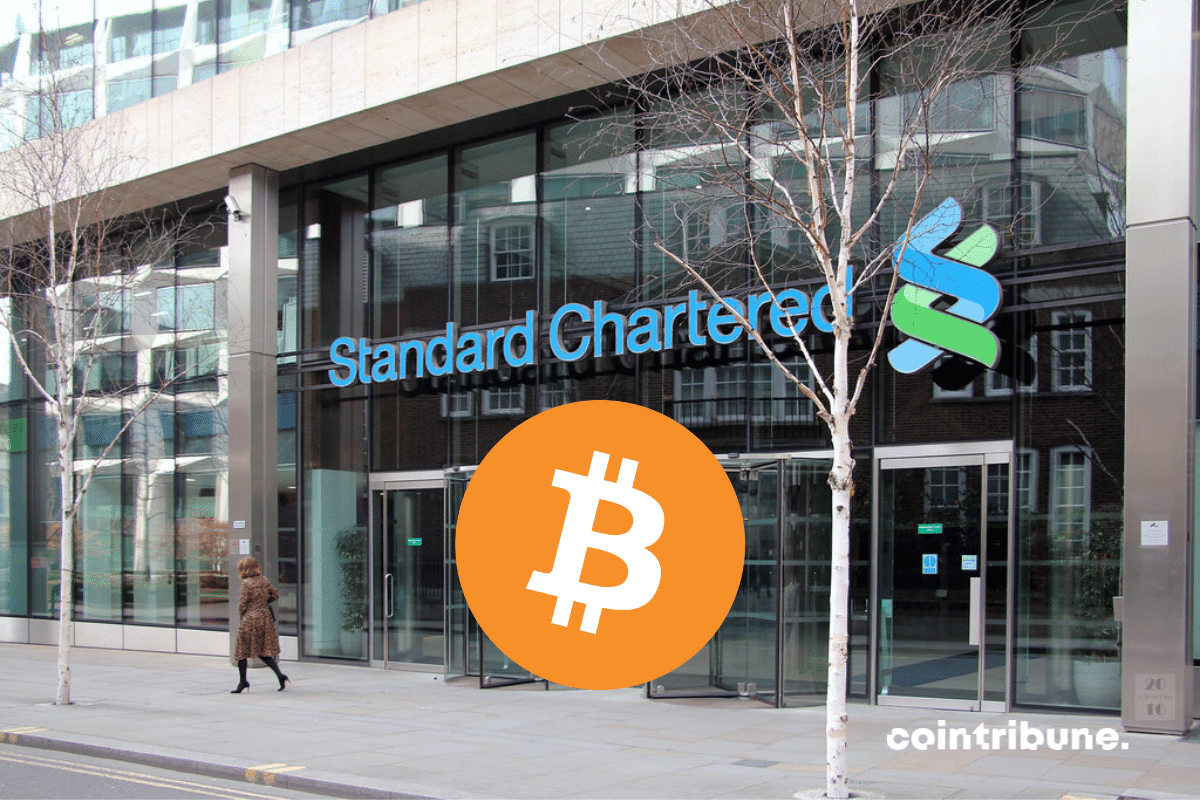

Everything is going according to plan for Standard Chartered Bank, which reiterated its April forecast that Bitcoin would reach $100,000 by the end of 2024.

"""You are translator in the blockchain field."""

Things are heating up between Venezuela and Guyana right now. The reason? Nicolás Maduro wants to reclaim Essequibo, a territory awarded to the British in 1899 following a “partial” decision by the judges of the time. Burdened by massive inflation, Venezuela needs to find other alternatives to get its economy back on track. And if that means the annexation of 2/3 of Guyana, where there are oil and other mineral resources, so be it.

A mysterious "whale" has been buying bitcoins without counting since the beginning of the month. This is an unmistakable sign.

While Chinese growth is faltering, Beijing is not hesitating to open the floodgates of fiscal and monetary stimulus in order to try to boost its battered economy. With credit easing, early distribution of local borrowing quotas, and massive issuance of government bonds, the Middle Kingdom is multiplying unprecedented expansionary measures. Objective: to regain vigorous growth by 2024.

A major transformation is shaking up Ethereum, making the global supply of crypto ETH deflationary. Decoding it!

Accused of promoting risky investments with Binance, Ronaldo finds himself the subject of a class action lawsuit. Details here!

A recent survey conducted by the Autorité des marchés financiers (AMF) reveals a growing preference among French people for cryptocurrencies compared to stocks and ETFs. Currently, 9% of French adults hold cryptocurrencies, compared to 7% in stocks and 2% in ETFs. This trend is particularly pronounced among young people, with 31% of them open to being paid in cryptocurrencies. The impact of the pandemic has played a role in this shift in investment preference. Additionally, 24% of French adults invest in various financial instruments, and over 10% are turning to real estate funds.

In recent weeks, statistics reveal a strong enthusiasm from institutional investors for Bitcoin. This week, Bitcoin whales have broken the annual record for the amount of BTC held. Yet, exactly one year ago - November 11, 2022 - they all suffered the consequences of the collapse of the FTX crypto exchange. What justifies this rapid and massive accumulation of BTC just a few weeks before the end of 2023?

The crypto community is eagerly awaiting the approval, by the Securities and Exchange Commission (SEC), of several ETFs, including potentially the first Bitcoin ETF in cash. Regarding the latter, for example, analysts have suggested that a decision should be made by January 2024. The SEC has postponed its decision.

Exactly one week ago, financial giant BlackRock filed for registration of the iShares Ethereum Trust, the proposed ethereum (ETH) cash ETF. The news caught the attention of crypto analysts as it suggested the upcoming filing of an Ethereum ETF application with the SEC. That has now been done.

Despite the cheers, the fact is that inflation continues to erode Americans' savings. Much more than what official figures suggest.

For Michael Saylor, Bitcoin doesn't need to replace fiat currency to reach several hundred trillion dollars.

Indeed, the FTX storm has wreaked havoc in the United States, Japan, and even France, but this hasn't prevented an increase in the rate of crypto adoption in France. According to a report by the Financial Markets Authority (AMF), the number of local adults investing in cryptocurrencies has relatively increased. Details!

The launch of the first spot Bitcoin ETF in the US is inching closer to reality, and one crypto project is already capitalizing on the excitement.

Ethereum crypto: on-chain and technical indicators suggest the imminent arrival of a significant bullish wave.

After months of operational struggle, Bitcoin (BTC) reigns over the ecosystem stronger than ever. In the past 24 hours, the asset's valuation increased by 3.18%, surpassing the symbolic $35,000 mark. This brought delight to enthusiasts of this crypto asset. A Canadian parliamentarian, a few days ago, encouraged the public to actively engage with this cryptocurrency that continues to surprise.

"The Bitcoin Spot ETF is a financial product that allows investors to access the Bitcoin market without directly owning the cryptocurrency. According to a study by Galaxy Research, the Bitcoin ETF could experience tremendous success in the years to come. Details below!

On Monday October 23, the Depository Trust and Clearing Corporation (DTCC) had listed BlackRock's iShares Bitcoin Trust (iBTC), to which it had added the ticker. This symbol, used to identify the asset manager's ETF, was withdrawn on Tuesday October 24. The latest news confirms the relisting of BlackRock's Bitcoin ETF.

New York investment bank Morgan Stanley suggests that bitcoin is slowly entering a bull market.

MicroStrategy, long seen as a Bitcoin stalwart, is actually eclipsed by an elusive player, Block.One. But who is this giant lurking in the shadows?

The ascent of cryptocurrency in the modern economic world is undeniable. At the heart of this revolution, XRP, whose reputation is steadily growing, has just received a significant vote of confidence from the Old Continent. The Banque de France appears ready to adopt this token for its digital euro project.

The explosive rise of Bitcoin and crypto in general is undeniable. Among the many harbingers of this new financial era, the announcement by Standard Chartered, a colossal $840 billion bank, to enter the Bitcoin arena is undoubtedly one of the most significant.

While Bitcoin reached $30,000 this Monday and seems to be gearing up for a new rally, it's not yet time to celebrate, according to highly followed crypto analyst Benjamin Cowen. In an interview with Scott Melker, the expert predicted an imminent sharp drop in Bitcoin's price ahead of the expected halving in April 2024. Find out more in this article.