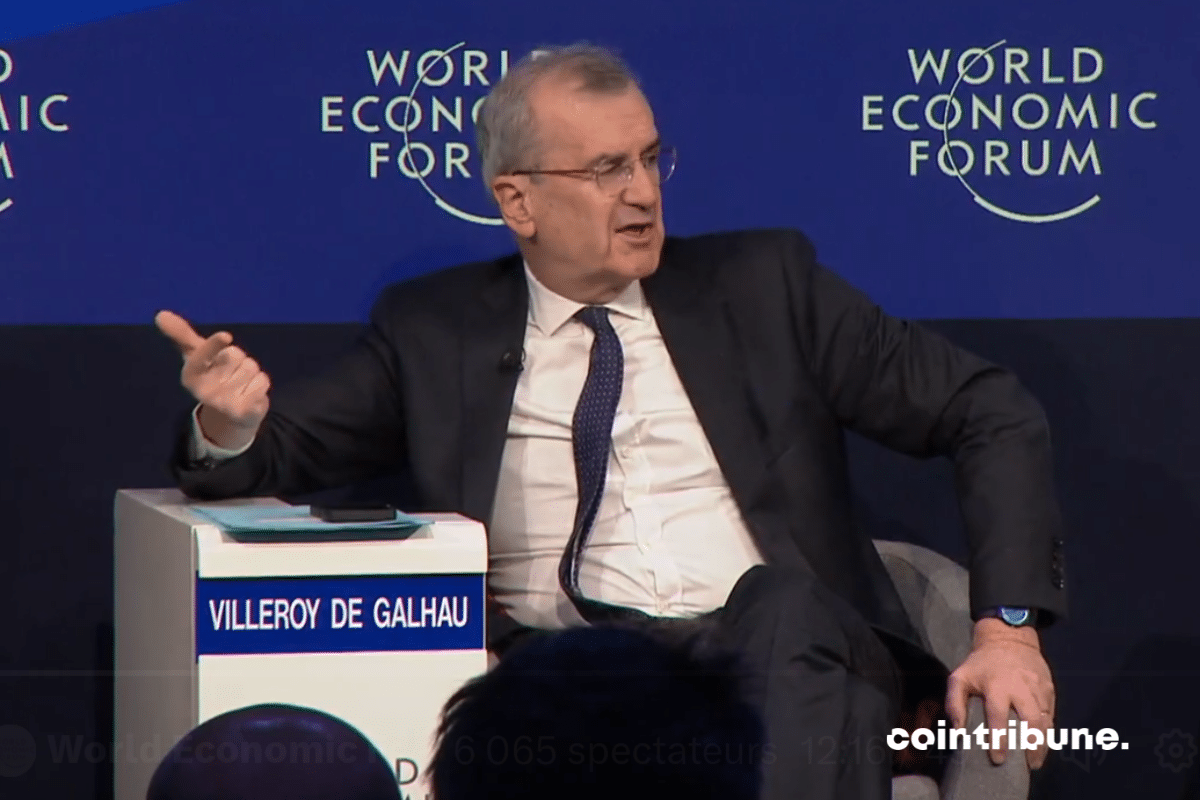

The French governor of the ECB has let the cat out of the bag during a panel organized by the World Economic Forum. Interest rates will decrease in 2024. What impact will it have on Bitcoin?

Theme Invest

Solana has marked a new yearly high before entering a correction phase. Let's examine the upcoming outlook for SOL's price.

VanEck decides to close and liquidate its Bitcoin Strategy ETF due to underperformance and lack of investor interest. Details here!

Every day, a number of crypto projects flood the market. Some manage to rise and make a place for themselves in this ever-changing ecosystem. But the truth is that most never break through and end up disappearing as quickly as they emerged. This is at least what a recent study by CoinGecko shows. It indicates that in recent years, cryptocurrencies have experienced explosive growth, leading to the flooding of the market with thousands of new crypto projects. The problem is that a large portion does not survive the dynamics of the sector. How can this be explained? That is what we will see together in this article.

The trading volumes on Bitcoin ETFs launched by BlackRock, Fidelity, Ark Invest, and others are phenomenal.

The Binance Coin has regained its former resistance around $337. Let’s explore the upcoming outlook for BNB. Situation of Binance Coin (BNB) The BNB price ended the year 2023 on a positive note, recording an impressive increase of over 40%. This movement confirms the bullish scenario…

Coinbase is at the center of Bitcoin ETFs. In addition to generating desire, the dominance of the crypto exchange presents certain risks.

Bitcoin has experienced a decrease of over 15% after reaching a new high. Let's together examine the future prospects for the BTC price.

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

Week after week, the world of cryptocurrencies continues to captivate and redefine the boundaries of digital finance and blockchain technology. This week was no exception, bringing a host of major developments, innovations, and surprises. In our weekly recap, we delve into the most significant and influential stories that have shaped the crypto ecosystem. From the historic approval of Bitcoin Spot ETFs by the SEC, to Standard Chartered's bold prediction on the price of Bitcoin, to the resilience of Binance Pay in the face of regulatory challenges, the outlook for Ethereum and XRP ETFs, and the explosion of development activity on Solana, we will review the highlights from the past week.

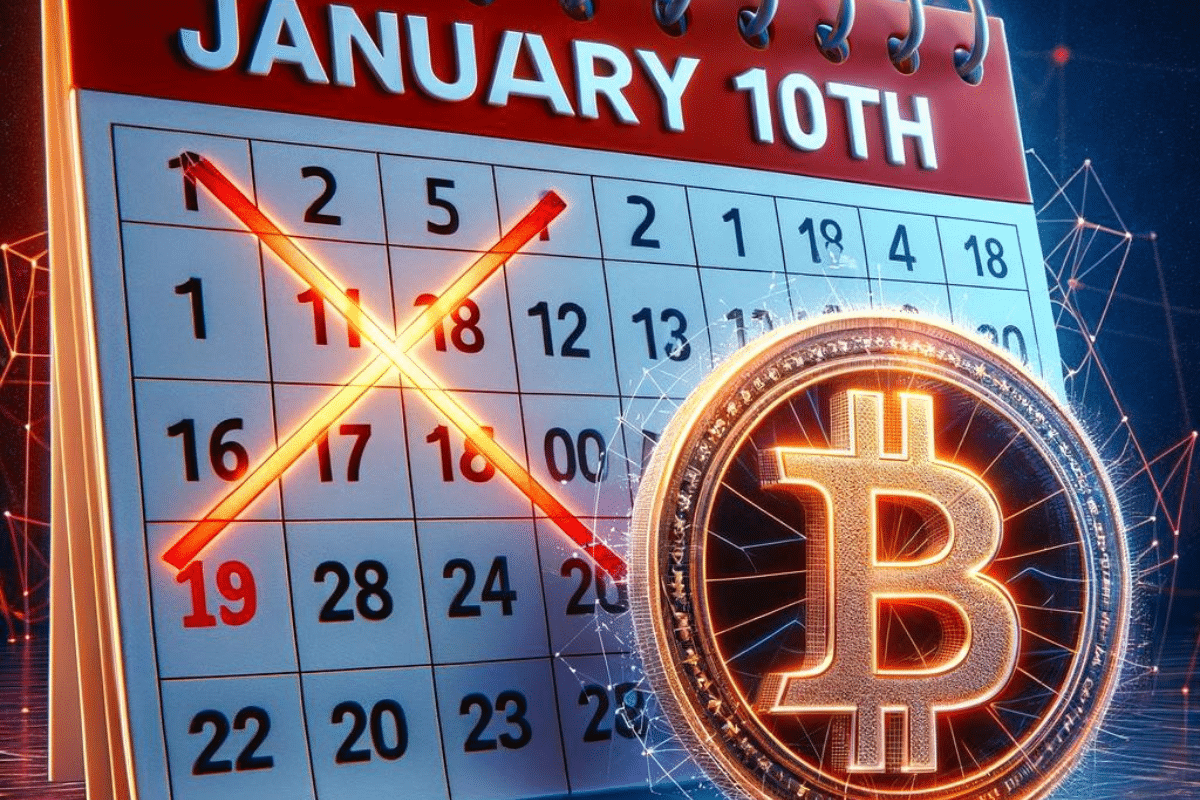

"The 2024 season of the economic calendar has just begun. What are the events that will shake up the crypto market this year?"

Here is everything you need to know about Bitcoin ETFs launching this Thursday, January 11th.

The deployment of Bitcoin ETFs by BlackRock, Fidelity, and Ark Invest was predicted to herald a new era, but the decline persists.

We will look together at how an ETF listing can impact investors' choices and its performance.

The BRICS do not skimp on the implementation of their strategy to escape the economic domination of the US dollar. The alliance's monetary projects are attracting attention, especially the massive funds they are injecting to acquire significant amounts of gold.

Currently, attention is focused on the possible approval by the SEC of a Bitcoin Spot ETF. If this possibility materializes, the emergence of an Ethereum Spot ETF should mobilize the interest of the crypto community. A perspective that would only be beneficial for the ecosystem around the market's second largest crypto.

After legalizing bitcoin, Prospera grants it another very important status.

"Cathie Wood, leader of ARK Invest, predicts a surge in Bitcoin to $1.5 million, supported by the blessing of Bitcoin ETFs."

The Bitcoin ETF has broken all records, but absurd facts have come to spoil the party, preventing Bitcoin from appreciating for now.

The power dynamics within the SEC are emerging. And after the Bitcoin ETF, eyes are already turning towards a possible Ethereum ETF.

It’s done, the worm is in the fruit. All American and Navarre investment funds will be able to easily invest in bitcoin.

Approval of BTC Spot ETFs: Nayib Bukele, former president of El Salvador, highlights that he has outpaced BlackRock in Bitcoin adoption.

The price of Ethereum has crossed the upper limit of its range, propelling it towards a new high. Let’s examine the future prospects for ETH together. Ethereum (ETH) Situation The price of Ethereum was stuck in a range for more than a month. This period of…

What do BlackRock, Invesco Galaxy, WisdomTree, and Fidelity have in common? Obviously, at first glance, they are all companies in the finance sector, each with its own specificities. But those who have been following the trends in the crypto industry in recent months know that each of these companies has, in one way or another, engaged in this industry. Good news for the latter, which sees its financial influence expanding, confirming somewhat its relevance in terms of investment. However, what seems to be a sustained adoption of crypto by institutions in the finance ecosystem does not hide significant systemic risks. It is these risks that we will be interested in in this article.

"Bitcoin ETF approvals are imminent (and this time, it's serious). Eric Balchunas shares this excellent news on his X account."

The SEC's Twitter account has been hacked on the eve of its announcements regarding the Bitcoin ETF. A collection of hilarious reactions.

After registering a decrease of -10% last week, Bitcoin has regained its strength, reaching $47,000. Let's examine together the future outlook for the BTC price.

Jay Clayton, the former chairman of the SEC, expresses his belief in the imminent approval of Bitcoin ETFs. Details in this article.

Throughout 2023, Ripple, the crypto company behind XRP, maintained a growth rate among the most notable in the crypto ecosystem. The question now is whether in 2024, Ripple could continue to make headlines in terms of performance and adoption. This remains possible under certain conditions.

Standard Chartered Bank expects Bitcoin to reach $100,000 this year and $200,000 next year.