eToro's IPO launches on Nasdaq at $52 per share, exceeding expectations. The company raises $310 million, valuing it at $4.2 billion, and positions itself to compete with platforms like Robinhood.

Theme Invest

It's a paradox that would make even the most seasoned economists raise their eyebrows: while the dollar wavers, the Asian economy is rising up with an almost insolent confidence. At a time when the American Federal Reserve is hesitating on interest rates, and trade tensions seem to be easing without really dissipating, Asia is benefiting from an unexpected boost. This shows that even in the global monetary fog, some find their way.

Ethereum shows a rebound of more than 50% in less than two weeks. Find our complete analysis and the current technical perspectives for ETH.

American inflation defied all doomsday predictions in April, falling to 2.3% despite the implementation of massive tariffs by the Trump administration. This unexpected decline raises a troubling question: what if analysts had exaggerated the impact of protectionist measures? Are fears of an inflationary spiral overstated?

Bitcoin accelerates and moves back above $100,000: find our complete analysis and the current technical outlook for BTC.

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.

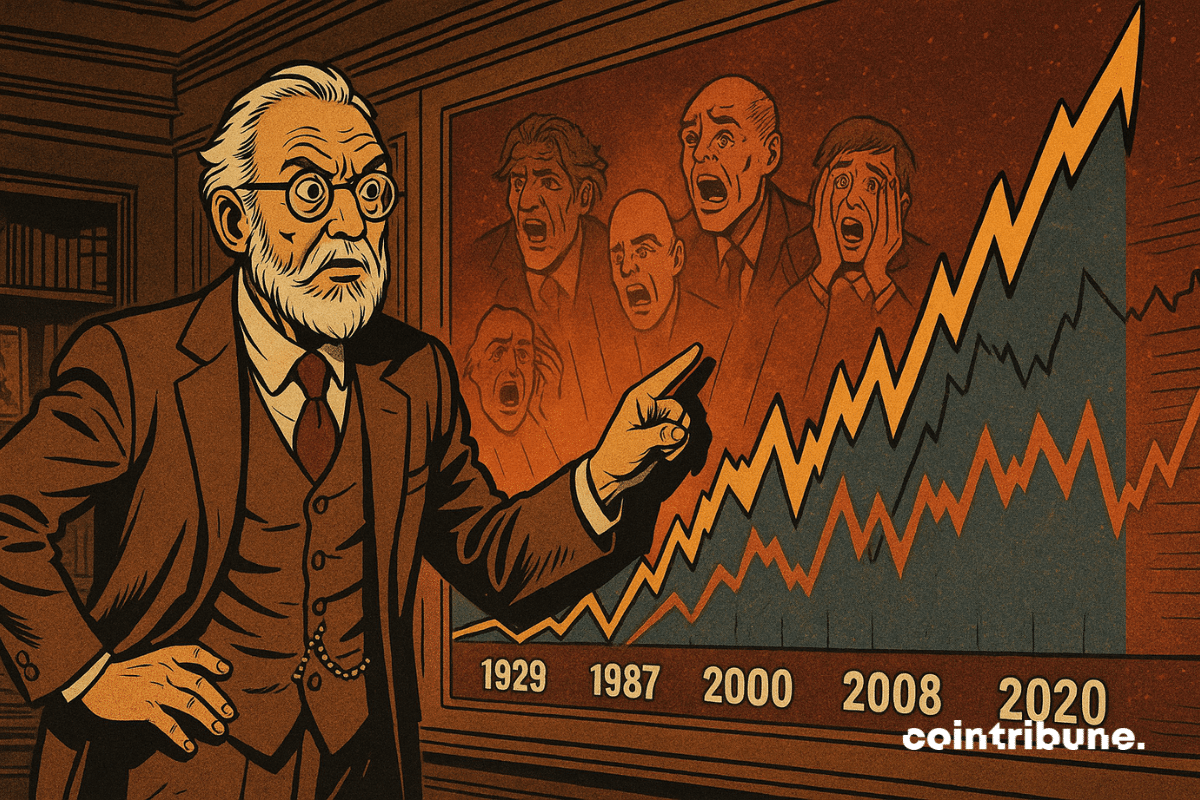

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

Refounding or not, the Ethereum Foundation continues to support the ecosystem: millions distributed, subsidized crypto-tech, Vitalik in quantum mode, and pampered developers. Who said austerity?

The realization of gains from large cryptocurrency wallets occurs at a time of growing dominance of BTC, increasing interest from institutional capital, and a price pattern similar to what preceded the rally in early November when Donald Trump won the presidential election in the United States. Despite the strengthening of BTC's narrative as a store of value, Trump himself tests the resilience of bitcoin, as the Republican insists on his tariff war while pressuring the Federal Reserve (Fed).

After its correction, SUI displays very encouraging technical signals. Find our complete analysis and the current technical outlook.

Crypto: despite 59% losses, Shiba Inu retains 78% of loyal holders. In this article, discover why.

XRP consolidates after a significant increase. Find our complete analysis and current technical outlook.

Bitcoin takes a pause after a bullish surge: find our comprehensive analysis and the current technical outlook for BTC.

In an article published this morning on Cointribune, we reported information that BNP Paribas had partnered with Pi Network to facilitate SEPA transfers in cryptocurrency. After thorough checks, this information turned out to be false.

Market: after a loss of 2.4%, gold rebounds ahead of the FED meeting. A strategy to follow for investors? Analysis.

Powell slows down, Trump strikes, the markets are in a frenzy. Between surtaxes and threats of dismissal, monetary independence is riding a rodeo amid the discreet applause of 6-dollar eggs.

Real estate remains an essential investment sector, but it presents high entry barriers. Purchasing properties requires significant capital and complex procedures. Today, decentralized finance (DeFi) and blockchain are disrupting this model by offering more accessible solutions. RealT applies these innovations to real estate investment by enabling the purchase of property shares in the form of tokens. This model facilitates access to ownership and enhances the liquidity of real estate assets. Thanks to DeFi, investors can use their tokens to generate additional returns. RealT thus positions itself as a bridge between traditional real estate and decentralized finance, creating new opportunities for investors.

Real estate investment attracts many investors due to its stability and appreciation potential. However, access to this market remains restrictive due to high costs and complex administrative procedures. The tokenization of real estate simplifies these barriers by making the purchase and management of properties more accessible. RealT allows investors to acquire fractions of properties through blockchain technology. This approach offers increased liquidity and passive income in stablecoins. This article explores how RealT works, the steps to purchase real estate tokens, as well as the profitability and successful investment case studies.

Real estate investment remains a preferred option for securing capital. However, financial and administrative constraints make this market difficult to access. Purchasing real estate requires substantial capital and lengthy processes, hindering many investors. Blockchain is revolutionizing this sector by enabling the tokenization of real estate assets. This innovation facilitates the acquisition and management of properties by eliminating intermediaries. RealT leverages this technology to make real estate investment more flexible and accessible. Its solution combines transparency, liquidity, and automation of rental income. This article analyzes the limitations of the traditional real estate market, the role of blockchain, and the advantages of RealT as a modern alternative.

Real estate investment attracts many savers. However, financial and administrative barriers make access difficult. Buying a property requires significant capital, rigorous management, and market knowledge. Fractional investment offers an alternative and allows one to acquire shares of a property with reduced capital. It is a model that simplifies management and offers greater accessibility. RealT stands out in this field. This platform uses blockchain technology to make real estate investment more transparent and flexible. Its model allows purchasing fractions of properties starting from a few dozen dollars while generating regular rental income. Let’s review this form of investment through this article.

Cryptos have revolutionized investing, but their high volatility worries many investors. Diversification becomes a necessity to limit risks associated with market fluctuations. Real estate offers a stable alternative, but access remains complex for crypto users. RealT simplifies this approach by integrating tokenization and decentralized finance. The platform allows for easy investment in real estate and receiving income in stablecoins. This solution increasingly attracts investors looking to secure part of their capital. This article analyzes the reasons behind RealT's success and its benefits for the crypto community.

Cryptocurrencies have revolutionized investment by offering new strategies to investors. This dynamic market allows access to high returns, but it also exposes investors to significant volatility. To secure their capital, many investors are seeking stable solutions. Real estate represents a reliable refuge, with a slowly progressing value and regular rental income. However, purchasing a property with cryptocurrencies remains complex due to legal and financial constraints. RealT simplifies this transition by tokenizing real estate to enable direct access via blockchain. This article explains how RealT facilitates real estate purchases, enhances diversification, and automates crypto payments.

Real estate investment attracts many investors, but it comes with significant constraints. The required capital is often high, the administrative procedures are complex, and reselling a property takes time. Blockchain is transforming this market by facilitating access to real estate through tokenization. RealT offers an innovative solution that allows individuals to acquire shares in real estate properties in the form of tokens. This approach simplifies investment, provides more liquidity, and ensures passive income in stablecoins. This article details how RealT works, real estate tokenization, its advantages over traditional purchasing, and the security guarantees offered to investors.

What if the markets were following a tempo that escapes economic logic? While the U.S. GDP is declining, the S&P 500 is rebounding after a sharp drop of nearly 20%. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists are wondering: does this sudden correction fit into a global tradition? To understand it, they delve back into a century of stock market crash history.

The crypto market for RWA (Real World Assets) would be a largely overvalued illusion according to Chris Yin, CEO of Plume. He questions the official figures and asserts that the current enthusiasm is based on false data, far from reflecting the reality on the ground or the actual interest of institutions.

Europe, once hesitant about Bitcoin, wants its MicroStrategy: TBG plans for 260,000 BTC by 2033. A strong plan that tickles the ECB and shakes the markets.

The CAC 40 is taking a significant hit. In just a few sessions, the Paris index has dropped over 6.5%, driven by a dramatic return of trade tensions. The announcement by Donald Trump of new tariffs on Chinese and European imports triggered a wave of massive sell-offs. Thus, on April 3, the Paris Stock Exchange fell by 2.25%, indicating a climate of widespread nervousness that revives the specter of a global economic war.

Solana shows a promising technical rebound. Find our complete analysis and the current technical outlook for SOL.

Ethereum remains in a waiting phase, between consolidation and potential recovery. Find our complete analysis and the current technical outlook for ETH.

Bitcoin is beginning a promising recovery: find our comprehensive analysis and the current technical outlook for BTC.