Trying to appropriate bitcoin to serve their shaky theories, Austrian economists are a major hindrance to its adoption by the masses.

Inflation

Have some people ever advised you to buy gold to protect yourself from inflation? You'd better read this article.

The much-anticipated Bitcoin "Halving", scheduled for the weekend of April 19, 2024, raises many questions among analysts. Will this halving of the new BTC issuance have a significant impact on its inflation rate and its status as a safe haven compared to gold?

Is the temporary negative reaction of Bitcoin to the Iranian bombing of Israel a sign that it is not a safe haven asset?

The Iran-Israel tension influences the markets: gold rises, oil fluctuates. What are the repercussions on the stock market and the oil sector?

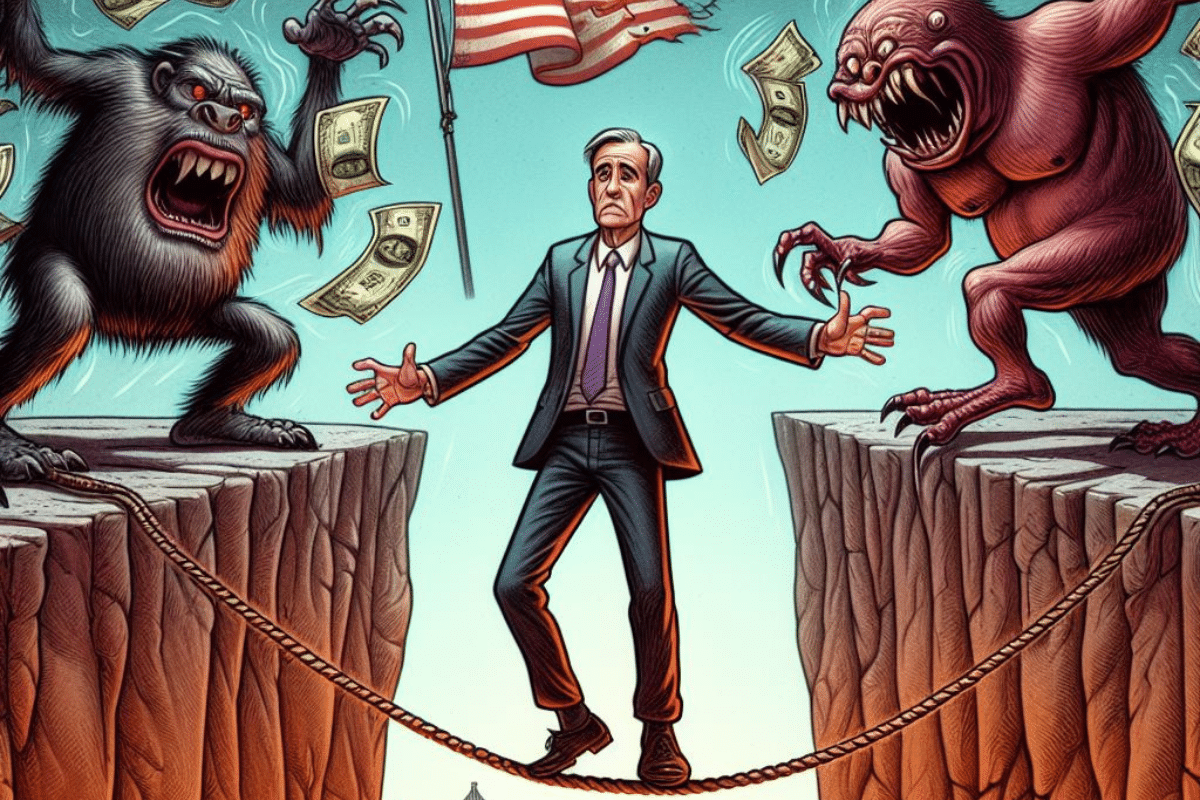

The ECB versus the Fed: global finances are at stake. Understand the risks and challenges of the current situation.

The famous bitcoiner and entrepreneur Balaji Srinivasan has just published a diatribe against the United States. According to him, the federal government is on the verge of bankruptcy and being swallowed by trillions of dollars in debt. Faced with such a crisis, the Fed would activate the largest money-printing policy in American history to divert money from taxpayers.

At the San Francisco conference, Jerome Powell confirmed that interest rates would remain unchanged until the inflation situation improves. This announcement is weighing on the crypto market, with Bitcoin falling by 1.35% in one hour.

Recent data published by the National Institute of Statistics and Economic Studies (Insee) are rather positive regarding inflation. It substantially decreased in March. Here is what needs to be remembered from this trend in the economy that is particularly followed by French financiers.

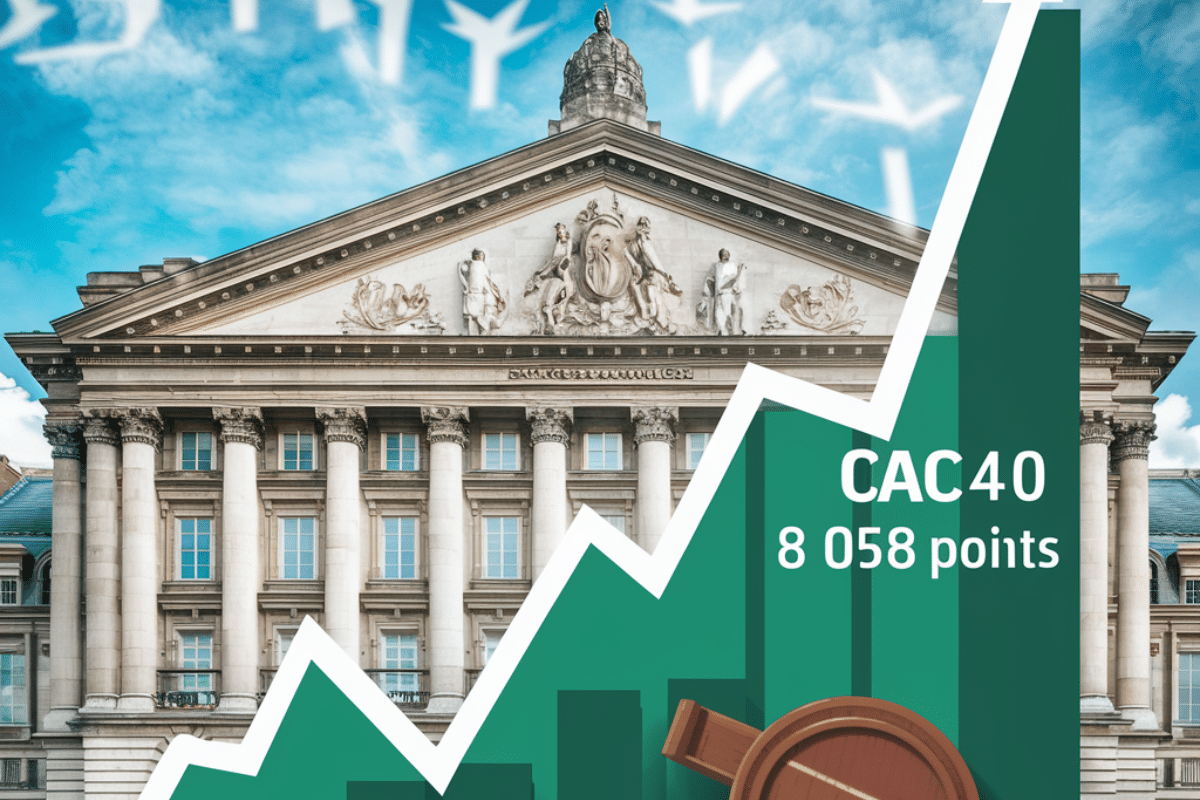

This Tuesday morning, the CAC40 reached a new historical peak at 8,058 points right at the opening. Despite a slight moderation towards the end of the morning, the flagship index of the Paris stock exchange remains in positive territory.

Is Bitcoin really intended to replace fiat currency? Is it really possible, or even desirable? What is its true primary utility?

Discover how stimulus plans and inflation could boost crypto currencies in 2024, according to Raoul Pal.

According to Peter Schiff, a monetary tightening aimed at bringing inflation to 2% would cause the collapse of the US financial system. The Fed finds itself facing a dilemma between price control and support for growth.

Bitcoin is experiencing a 2% drop after the release of an inflation figure. What are the consequences for the crypto market?

The interview of Vladimir Putin by American journalist Carlson Tucker was colorful. Especially the conversation about the dollar.

If the Fed decided to lower its interest rates, we could very well witness a soaring of the markets. Money would flow abundantly, and certain financial assets like bitcoin (BTC) could reach unprecedented heights.

S&P 500 toward 5,000, Bitcoin in precarious balance: the great show of the American financial market.

A very reliable financial indicator, the yield curve has recently inverted. And yet, Wall Street has always considered this indicator as a precursor to an impending recession. Will we therefore experience a catastrophic economic year in 2024, which could also affect the stock markets and bitcoin (BTC)?

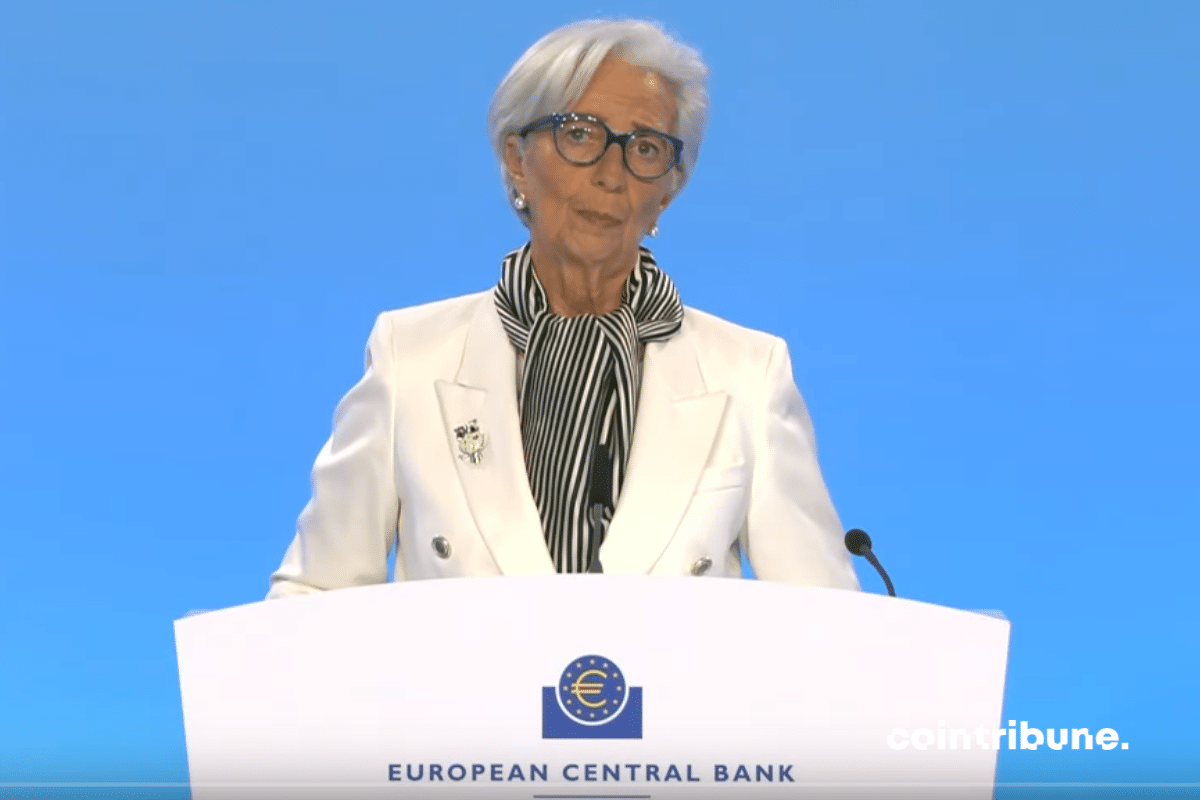

Christine Lagarde has tempered expectations of a rate cut this summer. Bitcoin will have to wait.

After nearly 10 years of rejection, 11 Bitcoin ETFs have been approved and started trading this week, marking a turning point in the history of Bitcoin. With the halving scheduled to take place within a few months, all the conditions are in place for a massive bull run and widespread adoption.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

The United States finds itself at a strategic crossroads today. Despite the increasing power of China and the BRICS, the military potential of the United States is declining. As military conflicts multiply around the world, are we witnessing the end of American military superpower and the death of liberal democracy?

Despite the cheers, the fact is that inflation continues to erode Americans' savings. Much more than what official figures suggest.

What is the cumulative inflation since 2010? What is the extent of purchasing power loss?

There's a growing chorus insinuating that the American hegemon is threatened by the BRICS. But what's really going on?

The leading cryptocurrency is back in the zone around $30k, while maintaining relatively low volatility. US inflation figures on Thursday could bring more movement on bitcoin (BTC). Is the current uptrend likely to continue?

In South Korea, gold bars can now be purchased as easily as energy drinks. Since September 2022, gold vending machines have been installed in shopping malls by GS Retail. They are accessible on a self-service basis and are very popular with the public! Interestingly, most shoppers are in their twenties and thirties. This brings the debate about access to physical precious metals back onto the table.

Bitcoin is a technological earthquake that is reshaping finance, energy, politics and morality with the aim of regenerating humanity.

Inflation has been galloping for almost two years, mainly due to the profligacy of central banks. Since then, central banks have turned around and become a little more vigilant. Nevertheless, they face a colossal dilemma: the peril of debt or the peril of inflation. It's reasonable to assume that central banks will react this time, as they have every other time: by rearming their monetary bazooka. If so, it could well be the return of happy days for bitcoiners. Let's talk bull run.

Recent news seems favorable for cryptos. Indeed, a former SEC official's opinion that the Bitcoin ETF should be approved is seen as positive for the crypto market. Is the next Bitcoin (BTC) bull-run imminent?