Markets have fallen historically in recent days. Are we heading towards a new descent into hell, or will the Fed lower its rates and launch a new stock market boom?

Inflation

July sees a resurgence of inflation in France at 2.3%, caused by a significant rise in energy prices.

If we follow the latest data from bitcoin ETFs, it seems that the coming weeks will be bright for bitcoin. After a dull June, particularly following Germany's sale of 50,000 BTC, can we expect a new bull run to reach $80,000 by the fall?

On July 18, 2024, the Governing Council of the European Central Bank (ECB) decided to keep key interest rates unchanged. This decision, aimed at controlling persistent inflation, raises crucial questions about its impact on the crypto market. Indeed, crypto investors closely monitor these monetary decisions as they influence the perception of digital assets as an alternative store of value. How do high interest rates truly affect cryptocurrencies? Let's explore this complex dynamic.

Crypto in crisis: 14.4% decline in Q2 2024. Bitcoin and Ethereum have not taken off yet.

Bitcoin is for the first time integrated into the French Retirement Savings Plans (PER) through the innovative alliance between VanEck Europe and Inter Invest. This strategic partnership introduces a Bitcoin ETN into the PER, offering savers unprecedented exposure to the leading crypto.

This Thursday, all eyes are on the United States with the eagerly awaited release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, particularly for the US dollar and cryptocurrencies. While investors are on high alert, speculations are rife about the potential impact of these key figures.

The United States is facing multiple perils: debt, inflation, civil war... Yet, a terrifying threat could be imminent and lead to the fall of the United States, in a historical event comparable to 1945.

Inflation slowed in May in the United States, fueling speculation about a decrease in interest rates by the Federal Reserve in September. This development has sparked keen interest among cryptocurrency investors, who are wondering how bitcoin and altcoins will react to this decrease in inflation. Analysts offer different interpretations of this economic change.

Bitcoin shows relative stability after the release of mixed U.S. economic data. Details in this article.

Bitcoin has already massively underperformed Nvidia. While bitcoin has seen its price increase by about 300% in the past 18 months, Nvidia's stock has experienced a surge of over 800%. So, to get rich, is it better to buy Nvidia stocks or BTC?

The global stock market is eagerly awaiting central bank decisions. This necessarily impacts the crypto market.

Ukraine, Middle East, Pacific... : war is back. As conflicts multiply, what is the optimal financial strategy in times of war?

Gary Gensler's comments have reignited hope for the imminent approval of Ethereum ETFs. More details in this article!

The cryptocurrency market just experienced a spectacular surge this Wednesday as the price of Bitcoin once again surpassed the symbolic $69,000 mark. This rapid increase follows the release of lower-than-expected U.S. inflation data, reigniting investor optimism and fueling a wave of transactions.

In an unexpected turn of events, the European Central Bank has announced a 0.25% cut in its key interest rates, raising hope for a similar monetary easing from the US Federal Reserve. This decision could breathe new life into the crypto market.

The election of Donald Trump in November could well plunge America into a bloody internal chaos. He is preparing to wage total war on American institutions: from the military to the justice system! Are we headed towards an American dictatorship?

The probabilities of interest rate movements change quite regularly and are always deferred. But what about 2024?

Bitcoin's volatility continues to captivate investors worldwide, and recent economic developments in the United States could well determine its next major move. As expectations turn towards the imminent release of inflation data, an intriguing correlation between the Consumer Price Index (CPI) and Bitcoin fluctuations has been highlighted.

The inflationary spiral seems well anchored in the eurozone. The latest inflation figures published this Friday exceeded expectations, propelling the euro against the dollar, but severely penalizing European stock exchanges.

In the face of a constantly evolving global economy, investors are on high alert. Recently, Peter Schiff, a renowned economist and avid gold advocate, issued a clear warning against buying US dollars. According to him, the combination of rising Treasury bond yields and runaway inflation could precipitate a dramatic depreciation of the US currency. A perspective that deserves special attention from all economic actors.

As inflation and geopolitical tensions persist, Bitcoin is gaining popularity among American voters. Nearly half of the voters would now consider integrating cryptos into their portfolios. What is driving this renewed interest and what are its potential consequences for the financial market?

Stock market: The CAC 40 is navigating in anticipation awaiting the Fed's decisions regarding interest rates. Details!

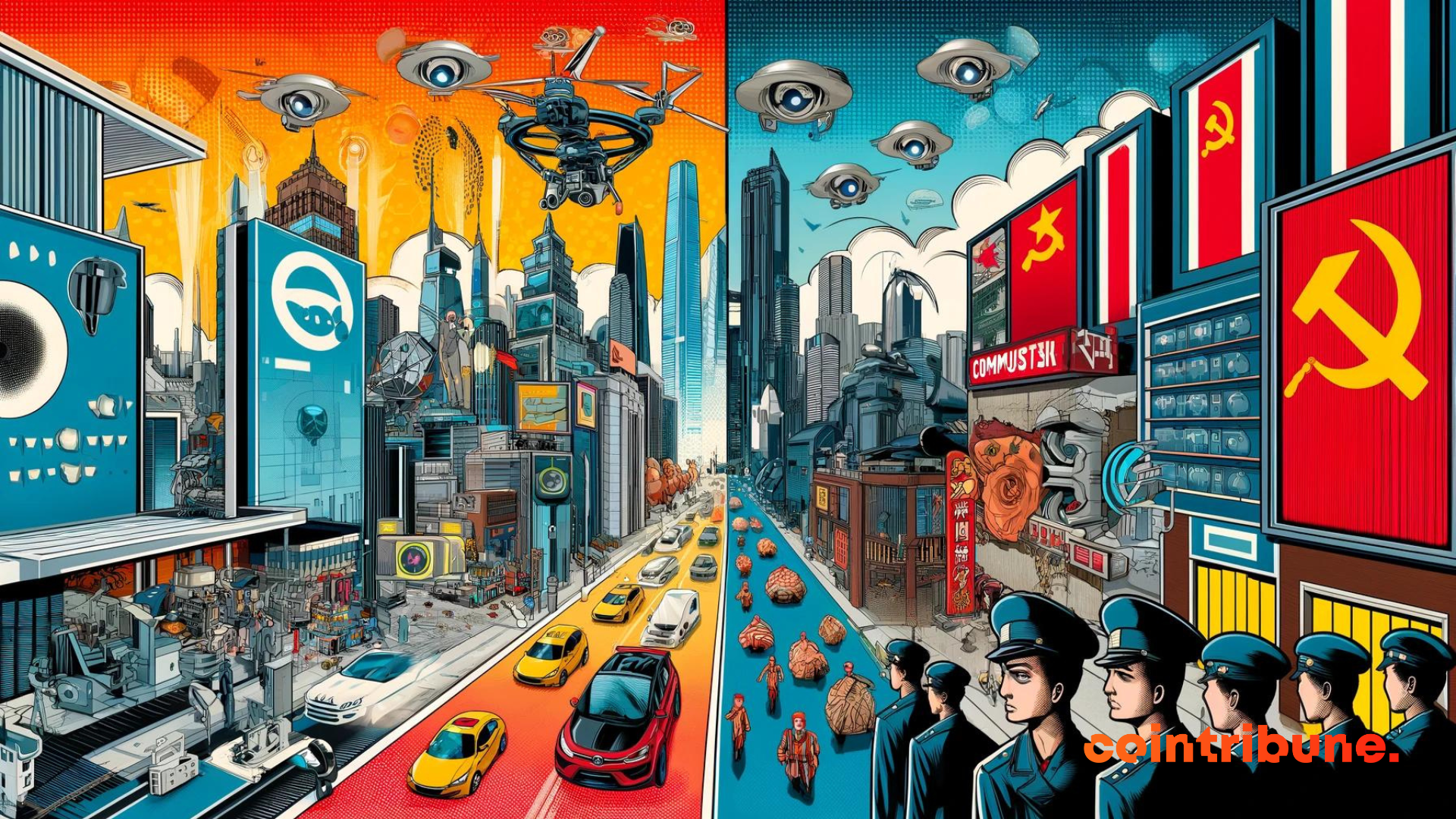

Liberal democracy seemed invincible, triumphing over the forces of fascism and communism. Two decades later, this supremacy is seriously being called into question. Information dynamics in the technological age and geopolitical alliances are threatening liberal democracy in the 21st century. Are we heading towards communism in the coming years?

The Paris stock market is expected to open sharply lower this Friday, with investors fearing that the strength of the American economy may delay the long-awaited first rate cut by the Fed. The CAC 40 could lose 0.58% at the opening according to analysts.

The key indices of Wall Street, the S&P 500 and the Nasdaq Composite, reached new highs this Wednesday, galvanized by a reassuring report on US inflation. The Cac 40, on the other hand, failed to join the general euphoria, falling just short of equaling its record.

One of the basic tenets of MMT is that the government has no budget constraint. Yet this dangerous theory has colonized the highest echelons of government.

The fiat system is a Ponzi scheme that requires impossible growth in physical flows. We are headed towards an inflation as painful as it is conducive to Bitcoin.

The 3rd largest economy in terms of GDP is on the brink of collapse with a colossal debt and a free-falling currency. If the trend continues, the problems will be terrible for the entire world...

Exposed to geopolitical, economic, and fiscal pressures throughout the month of April, Bitcoin once again proves its resilience as an asset. While one could have expected a more rapid decline in its price, the cryptocurrency closes the month of April with only a 10% decrease. Details in the following.