drop in price below the symbolic level of 50,000 dollars. This worrying outlook can be explained by evolving liquidity conditions and concerning technical signals.

Getting informed

The president of the SEC remains skeptical about the widespread adoption of crypto as a means of payment, despite their growing popularity.

October 2024 is currently marked by notable declines in the crypto market. Investors, very concerned, are wondering if Uptober will ultimately take place, or if they should already consider other solutions. In any case, the analysis of this week 41 of 2024 will allow them to position themselves and make informed decisions for the end of the year.

A wave of massive ETH sales from the PlusToken affair, an old Ponzi scheme that wreaked havoc in 2019, is bringing back ghosts from the past. This situation, reminiscent of the events of 2021, is putting pressure on the price of Bitcoin and causing panic among some investors.

This Wednesday, October 9, 2024, François Villeroy de Galhau, Governor of the Bank of France, made a direct call: "It is time for everyone to make an effort." In a context where public finances are spiraling out of control, with a deficit that has widened by 100 billion euros since January, this statement leaves no room for ambiguity. Every economic actor, from citizens to businesses and local authorities, must accept sacrifices to avoid a budgetary collapse.

The world of cryptocurrencies is ruthless. While some projects emerge with brilliance, others struggle to convince or sink into obscurity. This harsh reality is what Max Keiser, an iconic figure of Bitcoin maximalism, bluntly reminds XRP holders. With a statement as sharp as it is expected, he announces that "the XRP rally will never happen," attacking Ripple's cryptocurrency once again. While the XRP community still hopes for a rebound, the latest developments in the lawsuit against the SEC continue to weigh down its price. Nevertheless, optimistic voices persist and bet on a potential technical reversal.

Bitcoin is soaring, but Wall Street is snoozing. While Americans are counting sheep, Asians are driving up BTC!

The Shiba Inu is going through a tumultuous period, far from the past euphoria of meme coins. While its price struggles to break out of a narrow range, the activity of Shibarium, its layer 2 network, is dangerously waning. The crypto sector is, by nature, dynamic and volatile, but this…

Uniswap Labs, the creator of the renowned decentralized crypto exchange protocol, unveils Unichain, its Layer 2 blockchain based on Optimism's OP Stack technology. This innovation promises faster and cheaper transactions, strengthening its position in the DeFi ecosystem.

Chinese Commerce Minister Wang Wentao recently expressed his "serious concerns" to his American counterpart Gina Raimondo, amid rising tensions that threaten the world's economic balance.

On Polymarket, it’s 12.7% that take the prize… the others remain in "dreamer" mode with their Bitcoins.

The TON blockchain, once developed by Telegram, has just crossed a key threshold: that of 100 million active users. This figure reflects rapid and massive adoption, propelled by a series of technological developments within the ecosystem. However, this rise raises questions about the mixed performance of Toncoin, the native cryptocurrency of TON.

After showing signs of recovery in September, Bitcoin starts October on a downtrend. Let’s analyze the future prospects of BTC price together. Bitcoin (BTC) Price Situation After reaching a peak at $65,000, Bitcoin plunged again below $60,000 and then reached $52,500. It is from this price level that the cryptocurrency…

As the year 2025 looms on the horizon, crypto investors are closely monitoring the forecasts from major financial institutions. The report from Standard Chartered could well redefine market expectations. Indeed, the British bank anticipates a major upheaval among the leading cryptos, with Solana (SOL) potentially surpassing Ethereum (ETH) and even Bitcoin (BTC), should Donald Trump be re-elected as President of the United States. Beyond the usual fluctuations, it is the correlation between American economic policies and the evolution of cryptocurrencies that is highlighted.

The neutral fear and greed index? An opportunity for those who prefer smart buying over depressing plunges!

The tech company MicroStrategy, known for its massive investments in Bitcoin, has just achieved an exceptional stock performance. According to a recent report, its stock recorded a staggering gain of 1,208% since 2020, far surpassing Bitcoin's rise of 445% during the same period.

France is facing an unprecedented financial deadlock, with public debt estimated at 110.6% of GDP and a deficit well beyond European criteria. Indeed, the era of half-measures seems to be over, and the Montaigne Institute, an influential Parisian think tank, is sounding the alarm with a bold report titled "Public Finances: The End of Illusions." This document proposes ambitious reforms aimed at saving nearly 150 billion euros by 2050.

More and more voices are being raised in favor of Quantitative Easing in China. An analyst from Goldman Sachs.

The escalation of trade tensions between the European Union and China regarding tariffs on electric vehicles threatens to shake the global economy. While Brussels has voted in favor of these measures, Beijing is preparing its response, casting a shadow of targeted reprisals over the European countries most supportive of this decision.

Cointribune has interviewed Anti Danilevski. He is the CEO of Kicked, an exchange operating in Russia. We talked about the western sanctions over Russia, the BRICS and what is in store for bitcoin.

With massive whale sales, Ethereum is approaching crucial support at $2,300. Will it bounce back to $6,000 or collapse to $1,600?

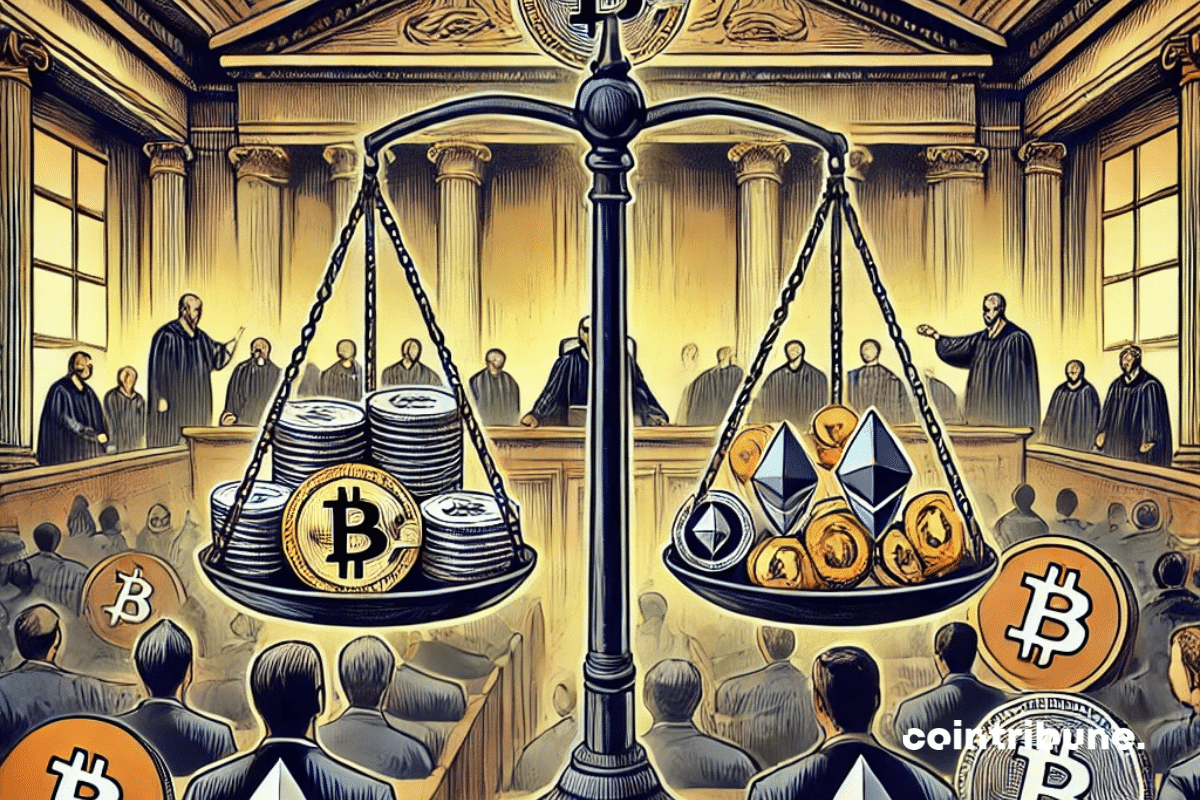

The decision of the U.S. Supreme Court has just shaken the world of crypto. By dismissing the controversial case of Battle Born Investments, which claimed ownership of 69,370 Bitcoins seized on Silk Road, the highest court in the United States has opened the door to a possible massive liquidation by…

In a volatile context, JPMorgan analysts identified in a report the key elements likely to influence the upcoming weeks for Bitcoin, Ethereum, and the entire crypto market. These observations are particularly relevant at a time when regulation, monetary policies, and technological advancements converge to reshape an ever-changing ecosystem.

The legal saga of FTX is finally coming to an end. After nearly two years of battles and attempts to recover funds, the courts have finally ordered the repayment of 16 billion dollars to the former clients of the asset exchange platform through the approval of a plan.

Bitcoin stumbles, POPCAT laughs: a supercycle of memecoins may indeed be about to hit us.

The Bitcoin market is experiencing a remarkable evolution: investors are increasingly reluctant to sell their cryptos. This trend reveals a growing confidence in the long-term potential of BTC, despite its persistent volatility.

The world's second largest economy is preparing to launch a vast program of measures aimed at stimulating its sluggish growth. After months of hesitation, Beijing finally seems ready to deploy heavy artillery to revive an economy weighed down by a real estate crisis and weak consumption.

As Chinese stocks soar, Tether declines. It's not easy to play both sides at once!

The rapid rise of artificial intelligence (AI) tokens is far from being just a passing trend in the crypto world. Fueled by the growth of machine learning technologies and the integration of AI across various sectors, these assets are capturing the attention of investors and redefining the crypto landscape. Over the past week, several AI tokens have seen their trading volumes skyrocket, reaching unprecedented levels, as revealed by a recent analysis from Phoenix Group.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic challenges. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.