While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

Getting informed

Bet on the victory of a candidate or a token from your crypto wallet? Trust Wallet believes in it strongly... If you don't win, at least you will have guessed the news.

Once reserved for human hackers, crypto scheming has found its master: AI, which digs the hole... directly into decentralized wallets, without asking for permission!

ZK Secret Santa uses zero-knowledge proofs to let users interact anonymously on Ethereum, keeping actions and identities private while ensuring fairness.

European regulators are increasing pressure on cybercrime networks as they target services that conceal the movement of digital funds. A coordinated action supported by Europol has taken down Cryptomixer, a long-running platform used to mask crypto transactions on the clear web and the dark web. Authorities report that the site handled more than a billion euros over the past decade and became a prominent method for laundering illicit proceeds.

BlackRock argues that tokenization is becoming a defining trend in global finance, with real-world asset adoption surging and the industry entering a new phase of digital transformation.

Shiba Inu’s Shibarium network is set for a major evolution with Zama’s 2026 privacy upgrade. Fully homomorphic encryption could bring private transactions, confidential smart contracts and stronger security after the 2025 exploit.

Gold breaks records, global liquidity explodes, but bitcoin lags behind. This divergence raises questions: why does the flagship crypto asset, supposed to protect against monetary dilution, not react? A Bitwise report reveals an unprecedented valuation gap between BTC and money supply growth. Market error or major opportunity? The lines could move, and faster than we think.

Despite a cautious atmosphere in the crypto market, one asset captures the attention of institutional investors: XRP. Long weighed down by its regulatory troubles, the altcoin has triggered a spectacular resurgence of interest since the launch of several spot ETFs in the United States. Capital inflows continue at an unprecedented pace, revealing a possible turning point in the token's trajectory. Should this be seen as the signal of a new bullish cycle, driven both by traditional finance and encouraging technical signals?

Ethereum just experienced a historic purge: 6.4 billion dollars in leverage evaporated, causing its price to drop. Yet, whales are taking advantage to massively accumulate. Why this paradox? A crisis or an opportunity? Analysis of a decisive turning point for crypto.

The second largest American bank officially opens its doors to Bitcoin. Bank of America now recommends its wealthy clients allocate between 1% and 4% of their wealth in crypto. A strategic shift marking a decisive step in institutional adoption.

2026 will mark a historic turning point: real world assets (RWAs) tokenized are establishing themselves as the new standard for global payments. Programmable stablecoins, digitalized government bonds, and massive adoption by banks — this financial revolution is already redefining liquidity and transactions. Ready to understand how these assets are transforming the economy?

Could bitcoin's four-year cycle be living its last moments? This is the unexpected hypothesis put forward by Grayscale in a report published on Monday. According to the asset manager, the crypto king could break free from its historical mechanics as early as 2026, reaching new heights well before the usual deadline. This major challenge to a pillar of crypto analysis sparks as much hope as questions in a rapidly changing market.

BitMine buys $70M of Ethereum in 3 days. Supercycle coming? Discover all the details of this massive operation.

An arithmetic bug, billions of tokens, a hurried hacker… and Yearn retrieving $2.4M in commando mode. In the crypto jungle, treasure hunts are intensifying.

Goldman Sachs has agreed to acquire Innovator Capital for $2B, bringing new ETF and crypto-linked products, with the deal set to close in 2026.

Kalshi is pushing prediction markets further into the crypto space as global demand accelerates. Rising interest in event-based trading has prompted the platform to tokenize event contracts on Solana, giving users more in sensitive markets. Analysts say this shift could position Kalshi to challenge competitors and keep pace with the industry’s rapid growth.

Changpeng Zhao and his investment company YZi Labs come out swinging against the management of CEA Industries, accused of letting the BNC stock price collapse by more than 90%. This offensive marks a turning point for the future of this treasury company dedicated to BNB. Will shareholders follow CZ in this battle to regain control?

Vanguard, asset management giant, has just shaken up the market by opening its doors to crypto ETFs for its 50 million clients. A decision that could cause Bitcoin to explode and redefine institutional investment. Why this turnaround, and what will be the consequences?

After a month of massive disengagement, crypto investment products record a spectacular comeback. In a single week, crypto ETPs attract 1.07 billion dollars, breaking a series of four consecutive weeks of outflows totaling 5.5 billion $. This renewed interest marks an unexpected turning point in a highly uncertain monetary context, where markets scrutinize Fed signals.

Bitcoin is collapsing, miners are coughing, and some flee to AI: when digital gold turns into an electric burden under maximum stress!

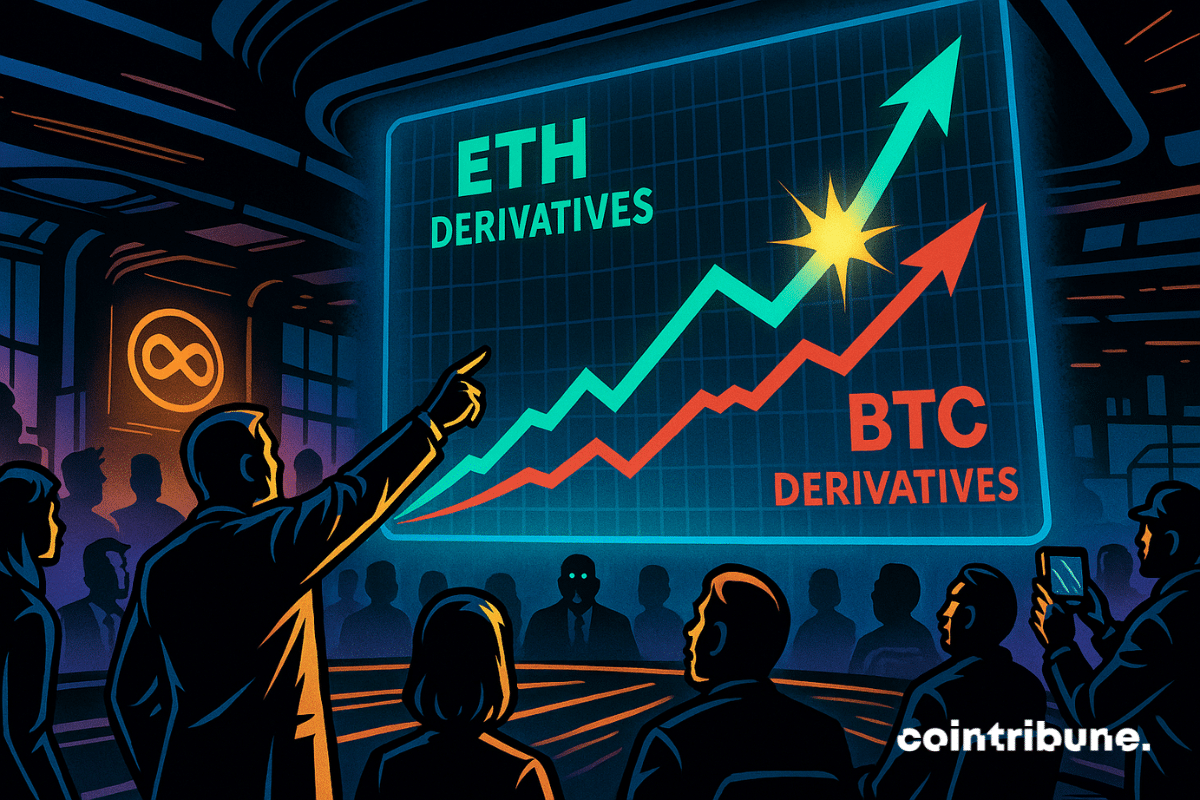

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

The news may seem trivial at first glance, but it marks a strategic turning point for Sony. After conquering trade shows worldwide with PlayStation, the group now wants to leave its mark on a rapidly evolving sector: crypto payments. Behind the scenes, Sony Bank is accelerating, preparing a regulatory offensive, and laying the foundations for a future stablecoin, an initiative that could transform the way millions of players consume their digital content.

Bitcoin has just crossed a critical threshold by falling below $84,000, plunging investors into uncertainty. This week promises to be decisive for the 2025 year-end closing: rebound or collapse? Analysis of key levels, macroeconomic risks, and opportunities to seize before year-end.

Strategy launches a giant dollar reserve to support its Bitcoin bet. Discover all the details in this article.

David Sacks, a key figure in crypto and Trump advisor, calls the New York Times accusations a pure "nothing burger." Between threats of lawsuits, sharp denials and political stakes, this clash reveals much more than a simple media dispute.

A hacker, a forgotten division, and nine million vanished... The arithmetic falters, the vaults empty, and Yearn's coders mourn their yETH. Crypto drama or bad comedy?

The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

China has just made a big move: the central bank is further tightening its crackdown on crypto and stablecoins, calling them a major threat. Why this radical decision? What impacts for the global market and investors?

Billy Markus, creator of Dogecoin, has just torn apart the manipulation accusations that bloom after every crypto crash. His sarcastic message on X is timely: the market just lost 200 billion dollars in 24 hours. Who to blame this time?