Despite American sanctions, Russia distorts calculations and shows even stronger economic health by 2024. Against all odds, the co-founder of the BRICS reveals in April an annual increase of 100% in its oil and gas revenues. From $7 billion last year, its revenue from oil and gas jumps to $14 billion in April 2024. The Russian case now stands as an excellent precedent for the BRICS in their march against the dollar.

Getting informed

Bitcoin experienced a sharp drop Wednesday morning, reaching its lowest level since late February at $56,556. Analysts are citing several key factors behind this decline, casting doubt on a quick market recovery.

Real-World Asset (RWA) tokenization protocols are experiencing explosive growth, with crypto TVL reaching $8 billion!

The first Bitcoin and Ethereum spot ETFs in Hong Kong made a mixed debut on April 30. Despite modest volumes, experts see long-term potential for this promising new market.

Bitcoin is once again playing with the nerves of its followers and detractors, flirting dangerously with the symbolic $60,000 mark. This recent fluctuation represents more than just an isolated financial dance. Indeed, it sets off a series of chain reactions in the crypto market, painting performance charts a bright red.

Cronos has gone from $0.050 to $0.18 since October 2023. Let's analyze together the future prospects for the CRO price.

The member states of the European Union are preparing to implement MiCA. This historic law requires national regulators to authorize and supervise service providers. MiCA is an EU-level regulation. However, countries may implement different technical standards, which requires special attention.

The former Bitcoin evangelist, Roger Ver, is facing serious allegations of tax fraud amounting to $50 million!

The Securities and Exchange Commission (SEC) filed a motion with the court on Monday to oppose Ripple's request to dismiss the declaration of Adrea Fox, a summary witness for the SEC. According to the SEC, Ripple falsely claims that this declaration constitutes undisclosed expert testimony.

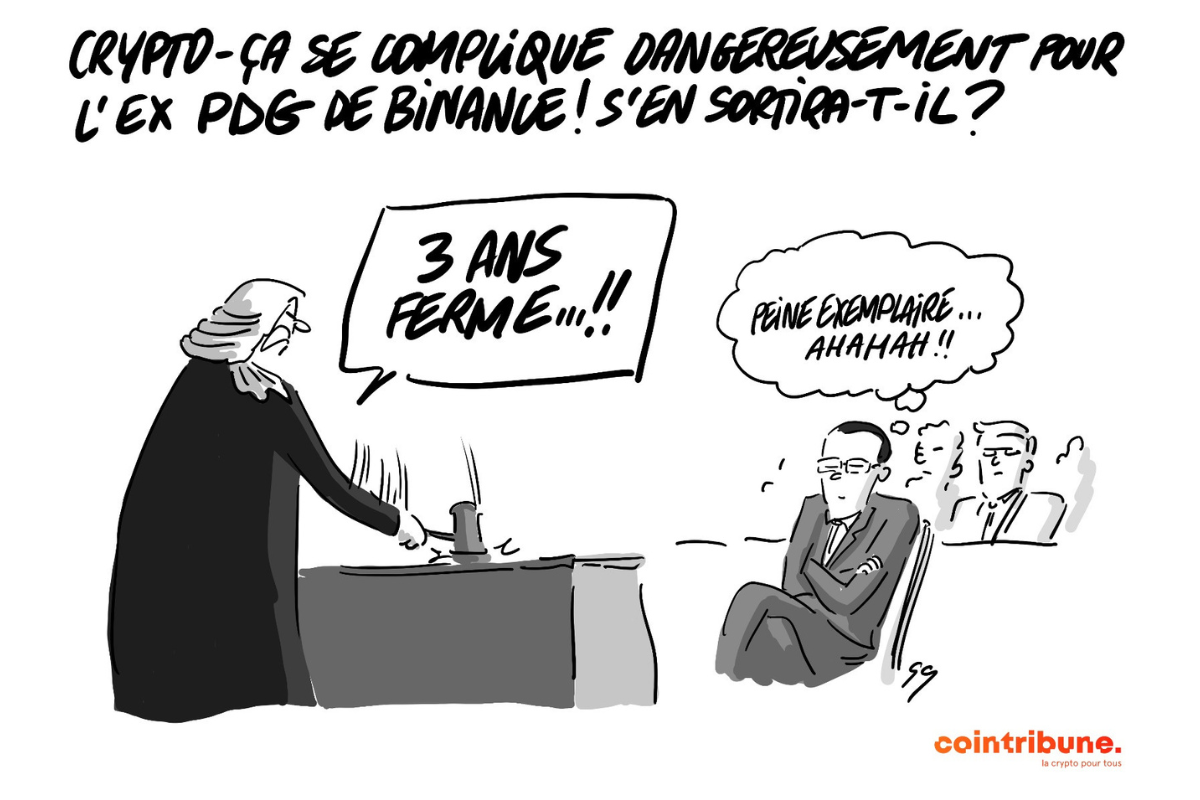

Changpeng Zhao, founder of the crypto exchange Binance, narrowly avoided a heavy prison sentence despite prosecutors' severity.

Over a weekend glance, Bitcoin took a 5.6% dive, landing at an altitude of around $62,500 after toying with $62,243 during the previous week. The Causes of Bitcoin’s Fall The sharp drop in Bitcoin isn’t just a stumble. According to the oracles at Crypto Banter, this descent into hell is…

A study conducted by a Canadian firm reveals that the interest of Canadian institutional investors in cryptocurrencies has seen a significant surge over the past two years. Estimated at 29% in 2021, the proportion of institutional investors exposed to cryptocurrencies in Canada has increased to 75% in 2023. The executives of the firm present the factors that justify this trend.

Justin Sun from TRON: A sharp look into the future of Ethereum ETFs and relations with regulators.

Exposed to geopolitical, economic, and fiscal pressures throughout the month of April, Bitcoin once again proves its resilience as an asset. While one could have expected a more rapid decline in its price, the cryptocurrency closes the month of April with only a 10% decrease. Details in the following.

The yen collapses against bitcoin, which has appreciated by over 150% over the past year.

Explore Peter Brandt's analysis on the future of Bitcoin, predicting a possible rise to $160,000 by 2025.

Stock markets are soaring ahead of a crucial Fed meeting, reflecting a renewed confidence in the financial markets.

Between Jerome Powell and the markets, bitcoin feels like it's in therapy: a complicated love story in the digital age.

Explore in depth the perspectives surrounding the bitcoin reaccumulation phase, paving the way for a historic bullish rally!

Ripple's XRP crypto corrected to $0.50 on Monday morning, losing all its gains from the past seven days. This drop comes as the XRP community questions the impact of the ETHgate controversy on the ongoing lawsuit between Ripple and the SEC.

"""

Between revolutionary announcements, technological advancements, and regulatory tumult, the crypto ecosystem continues to prove that it is both a territory of boundless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

As the crazy growth of the US debt of over 34,600 billion dollars continues to worry, the BRICS deliver a new blow to the greenback. China and Russia, two founding members of the alliance, have planned 260 billion dollars of commercial exchanges without using any US dollars. Only Russian ruble, Chinese yuan, and some euros. Other members of the coalition are expected to follow suit soon. Perceiving the immediacy of the threat, the USA react by combining threats and diplomacy. Details.

For the past few months, the Bitcoin blockchain has been expanding its functionalities and attracting interest through a clear evolution of its utility. Elevated to the status of a digital store of value by the ecosystem, it had recently faced significant constraints related to script language. The development of tokens, NFTs, and smart contracts was absolutely impracticable. In fact, it was on this major weakness that competitors such as Ethereum, Solana, Cardano, Polkadot, etc., had built their business models and reputation. But things have changed. The Bitcoin network now supports BRC-20 tokens, competitors to Ethereum's ERC-20 tokens, NFTs, and even houses a Bitcoin DeFi ecosystem. Witness the evolution of a network undergoing a complete overhaul.

Massa launches an ambitious incentive program with 7 million Massa tokens. The goal is to enrich its ecosystem and boost participation.

"Translation not provided"

Biden's tax reform: a strategic maneuver or a real willingness to redistribute wealth?

Mark Yusko, CEO of Morgan Creek Capital, the $1.5 billion hedge fund, is adamant. A flood of fiat is expected to pour into the crypto markets in the coming months. The expert predicts a growing interest in Bitcoin ETFs from American baby boomers, the generation born between 1946 and 1964. These individuals are expected to transfer their funds currently held in retirement accounts to the crypto markets soon. He expects at least $300 billion to flow into the crypto markets in the coming months. This was during an interview with the podcast The Wolf of All Streets. Clarifications.

Meta and Nvidia technology values have seen over $750 billion in market capitalization evaporate from their recent highs. This massive correction is shaking up the markets and raising concerns about the strength of the tech sector, which has so far been driving the upward trend.

The altcoin market is already reacting to Bitcoin's halving. The quadrennial event known to be a major trigger in the markets occurred last weekend. Just six days later, some tokens are experiencing exceptional growth rates. Among them, the cryptocurrency PEPE. Review of the current trends of the token.