It is now the turn of the rating agency Standard & Poor's to endorse Bitcoin as a store of value.

Theme Geopolitics

As the trade war between the United States and China threatens the global balance, bitcoin is gradually emerging as the next international reserve currency.

Europe believed it had locked down cryptocurrencies with MiCA. ESMA sets the record straight: too many gateways, too many risks. When tokens cough, finance could catch a cold.

Global stock markets regained some stability on Tuesday after three days of historic turbulence, despite worsening trade tensions triggered by Donald Trump's new protectionist measures.

After a bleak week, the CAC 40 fell by 8%, shaken by the trade war, market volatility, and grim economic outlooks, with a rebound still uncertain.

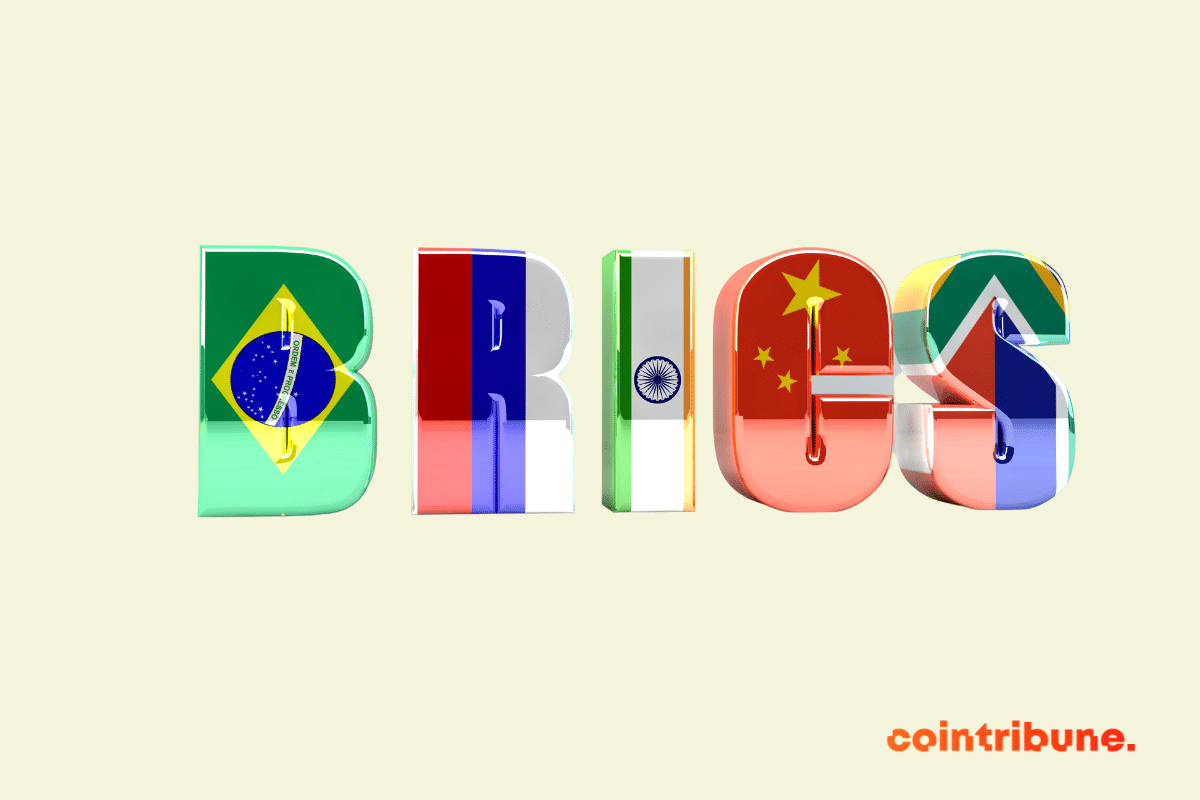

In a geopolitical context undergoing a major reshuffle, two significant initiatives are shaking the hegemony of the dollar. Brazil and China are making a strategic shift by favoring their national currencies for bilateral exchanges. For their part, Russia and Iran are announcing the launch of a new common currency to circumvent Western sanctions. These distinct yet converging movements illustrate a shared desire among influential BRICS members: to build a financial system that is less dependent on the greenback and to assert monetary sovereignty in the face of external pressures.

From Brussels, the message is clear: digital giants will have to account for their actions. The platform X, formerly known as Twitter, is under investigation by the European Union for potential major violations of the Digital Services Act. The focus is on the dissemination of illicit content and the lack of cooperation with authorities. The proposed fine could exceed one billion dollars, a record that could mark a turning point in the enforcement of the new European regulation. Elon Musk, its owner, finds himself at the center of an unprecedented regulatory confrontation.

Trump reheats the old dish of protectionism. Result? The markets are nauseous and Polymarket pulls out the thermometer: 50% of recession fever announced.

The new tariffs imposed by Donald Trump triggered a shockwave across global financial markets, prompting an immediate reaction from investors, economists, and U.S. allies.

The Middle East is currently undergoing a profound reconfiguration of its alliances and historical rivalries. The gradual collapse of the Syrian regime and the weakening of Iran are reshuffling the cards in an already unstable region. This new dynamic is bringing Turkey to the forefront as a regional expansionist power, potentially pushing Israel and certain Arab countries towards an unprecedented alliance.

In the whirlwind of Sino-American tensions, Bitcoin ETFs lost $1.14 billion in two weeks, victim of a geopolitical cataclysm, amid tariff threats and market uncertainty.

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

Gold shines like a sun in the midst of a financial apocalypse, while Bitcoin, that rebellious teen of the market, is still searching for its identity. A nerve-wracking war where the old world takes the lead.

The price of bitcoin has fallen below the $100,000 mark following China's announcement of new tariffs on American imports. This decision, which comes amid increasing trade tensions between the two powers, has caused a shockwave in the markets. Analysts fear a period of heightened volatility if Sino-American negotiations do not progress.

Indonesia, the largest economy in Southeast Asia, officially joined the BRICS bloc in January 2025, marking a major turning point in the reconfiguration of global economic alliances. This membership significantly strengthens the group's weight, which now represents over 51% of the world's population and 40% of global GDP.

New mandate for Trump: an explosive cocktail of a strong economy, with frantic drilling and impactful tariffs. The party begins!

The burger sees red: McDonald's, hit by E. Coli and boycotts, puts on its stock market life jacket.

As the Middle East goes up in flames, Bitcoin stumbles. Gold, on the other hand, sparkles like a Napoleon found under a mattress.

In a tense geopolitical context, the Russian economy demonstrates a persistent dependence on the dollar. Despite currency export bans, 2.3 billion dollars in greenbacks entered Russian territory.

While the price of Bitcoin has been stagnant for several weeks, technical analysts foresee the possibility of a bullish reversal. However, upcoming macroeconomic indicators could heavily influence the short-term trajectory of BTC.

In a significant turnaround from its position, France announced on Friday its support for granting Palestine full membership status as a member state of the United Nations. This decision marks a crucial step in the Palestinians' longstanding quest for international recognition.

Michael Saylor, President of MicroStrategy, believes that the current geopolitical chaos is beneficial for Bitcoin, despite the heavy losses suffered by his company. A perspective that is not unanimous on social networks.

The surprise guest was revealed when American presenter Tucker Carlson announced an upcoming exclusive interview with Russian President Vladimir Putin. Known for his controversial positions, the media personality plans to broadcast the interview via the X platform, which is supported by CEO Elon Musk.

At the 2024 World Economic Forum in Davos, China demonstrated economic strength that shook the foundations of Western forecasts. With an announced economic growth of 5.2%, surpassing the government's target of 5%, China not only defended its position as a global economic power but also implicitly challenged Western economic models.

The World Economic Forum in Davos is in full swing for its 54th edition. Bringing together global political, economic, and intellectual leaders, this annual summit aims to discuss current global challenges and find common solutions.

The BRICS have co-opted several countries this year. A historic geopolitical moment that is expected to continue in 2024. An official from the group of countries revealed that six new countries will join the organization next year.

Entre le tumulte et le déchirement d’un conflit ancien et persistant, le monde observe, souvent impuissant, la dévastation au Proche-Orient. Cependant, dans ce tourbillon de tragédies et de violences, le Bitcoin demeure un roc apparemment inébranlable, dont la résilience interpelle autant qu’elle étonne.

Recently, no fewer than 6 countries joined the BRICS in what is now known as BRICS+. Although the organization has rejected the membership applications of some countries, it seems to be calling on others to join. Such is the case of Indonesia.

The 15th BRICS summit ended on Thursday, August 24, with some big news. That of the creation of BRICS+. An expanded version of the organization's membership. Members that include some of the world's biggest crude oil suppliers. Global geopolitics are potentially no longer the same.

Will the United States default on its debt? Sooner than we think. But to whom? China, Russia…