The fall of the Michel Barnier government marks a political and economic turning point in France. While the adoption of the 2025 budget remains pending, uncertainty threatens to weigh heavily on households, businesses, and market confidence.

France

As economic and climate challenges redefine political priorities, the French Senate is making its mark on the state's budget for 2025. Between measures to revive a stagnant real estate market and tax adjustments in favor of the environment, these decisions crystallize political and economic tensions.

Despite the uncertainties surrounding the global context, the French economy surprises with its ability to maintain a precarious balance. While the projected zero growth for the end of the year could have heralded dark days, several indicators suggest an unexpected resilience. However, this picture is neither black nor rosy, according to the words of the Governor of the Bank of France, François Villeroy de Galhau.

Real estate taxation, already complex, is once again a topic of discussion. This time, it is property owners who find themselves at the center of a significant tax controversy. A technical error in the issuance of tax notices has led many property owners to be wrongly taxed on properties declared vacant. This unexpected situation, which affects an as yet undetermined number of taxpayers, sheds more light on the challenges related to data management and compliance with reporting obligations.

The European Union is about to sign a historic agreement with Mercosur, leaving France on the sidelines. Despite protests from Paris, the European machine seems to be moving at full speed. But what is really happening behind the closed doors of Brussels? When Europe ignores French protests France says no,…

The Bank of France, like a warrior of old, demands order over the chaos of cryptocurrencies, calling for Esma for support.

Property owners in France see their administrative horizon darken with the update of the real estate declaration. While this procedure, which became mandatory in 2023, had already caused confusion, an amendment has just been voted, promising to make the process even more complex. This news has gained increased importance as hundreds of thousands of households have recently faced administrative errors, shaking their confidence in the system. Thus, this new requirement raises more questions about the management of personal information and administrative simplification in the tax field.

The cryptocurrency market capitalization reaches unprecedented levels of 3.1 trillion dollars, now nearing the GDP of France. This meteoric rise, fueled by Bitcoin approaching 90,000 dollars, reshapes the contours of global finance and disrupts traditional economic hierarchies.

The National Gaming Authority (ANJ) plans to block access to the cryptocurrency betting platform Polymarket in France. This decision comes after record betting during the American presidential election, notably a spectacular gain of 47 million dollars made by a French trader on Donald Trump's victory.

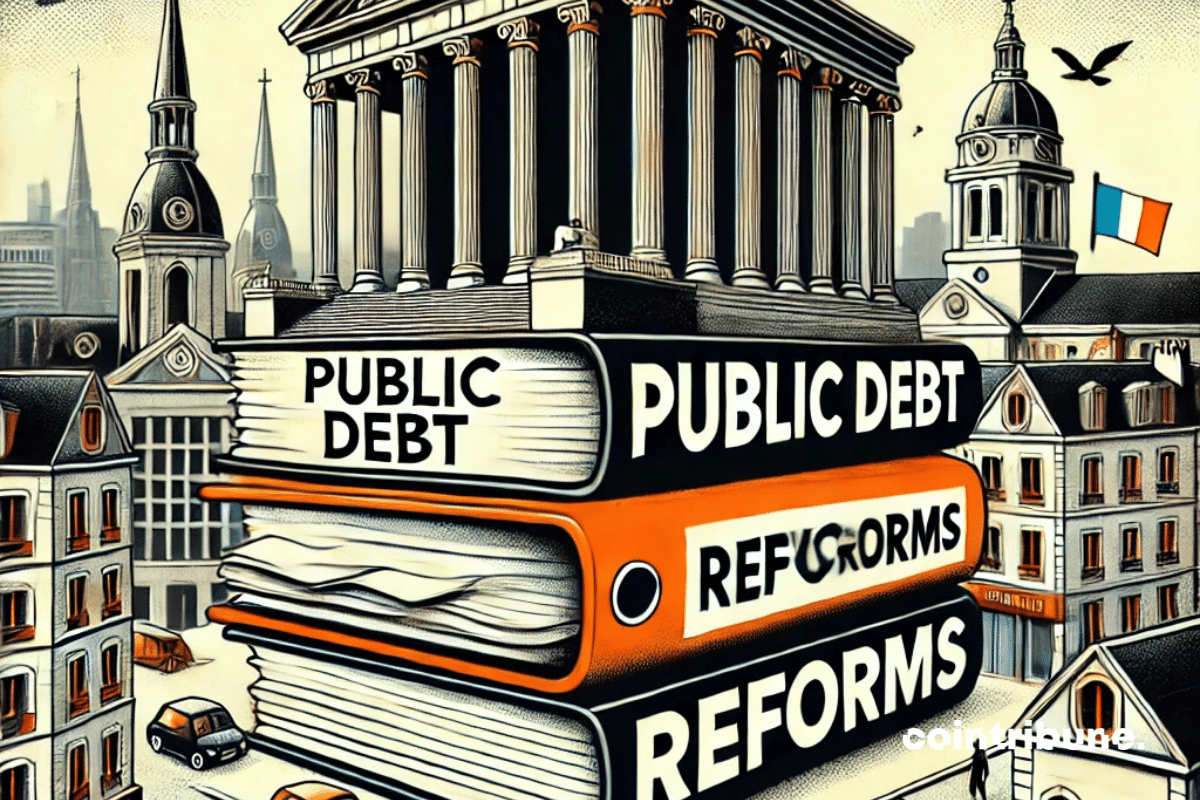

France's budget deficit, now reaching 173.78 billion euros, has become a critical issue as it highlights the growing challenges the country faces in maintaining its financial commitments. With the end of the Covid-19 pandemic and the support measures, efforts to restore public finances seem to have encountered major obstacles. This budget gap exceeds forecasts and demands ambitious but controversial revisions. In this context, the government is striving to convince both European institutions and internal political actors of the viability of its austerity plan to avoid a lasting decline in state finances.

The 2025 finance bill has sparked heated debate and reveals tensions surrounding taxation applied to the highest incomes in France. At the heart of the controversy is an amendment aimed at exempting certain categories of income from the new "differential contribution on high incomes" (CDHR), introduced to limit tax avoidance practices among the wealthiest taxpayers. This amendment, intended to maintain an attractive tax policy for investors in innovation, was rejected by the National Assembly, marking a defeat for the government and a victory for the opposition advocating for an expansion of this contribution.

In 2023, the removal of the residence tax on primary residences eased the burden for many households, but this measure also created a financial shortfall of nearly 20 billion euros in local government coffers. Today, faced with significant budget deficits and an increase in property tax that is no longer sufficient, the government is considering a "universal territorial contribution" (UTC). Supported by certain political figures, this measure aims to rebalance local resources through contributions from both homeowners and tenants.

As the debate over budgetary receipts rages on and tensions mount, a new tax of 40 billion euros could further destabilize France's already fragile economy. In a statement this Sunday, October 27, Pierre Lellouche, former minister, sounded the alarm: "the French economy will suffer a shock that will bring it to a halt at the worst possible moment." This heavy statement comes in a context where economic recovery is more necessary than ever, but where room for maneuver is shrinking day by day.

Doliprane, the star medication against fever and pain, is making headlines due to its controversial sale to an American investment fund. The affair has sparked an outcry, particularly because of a one-time bonus of 200 million euros paid to its CEO.

The online prediction market has never been under so much pressure, and this time, Polymarket finds itself at the center of an intriguing affair. The betting platform on political events has discovered that a single French trader, operating under multiple pseudonyms, is behind a significant volume of bets on Donald Trump's election chances. This situation has raised suspicions of market manipulation. So, what is really going on behind these large-scale bets?

The French real estate market is on the brink of undergoing a major upheaval. With the finance bill for 2025 currently under discussion, property owners find themselves at the center of significant tax reforms that could reshape the way real estate is taxed. Traditional tax deductions for capital gains, exemptions on primary residences, and other tax advantages that have benefitted investors in recent decades are now under scrutiny. These changes, which come amid a tense economic context and a sluggish real estate market, raise the question: how will property owners adapt to these new measures?

In the face of increasing economic challenges, the Ministry of Economy presents a 2025 budget marked by a dual ambition: reduction of public spending and acceleration of the environmental transition. A balancing act that raises questions about French economic growth.

CAC 40 in difficulty: the real estate crisis in China hampers growth. How does the Paris stock exchange react?

The French deficit is exploding! A parliamentary investigation committee is examining the causes of this slip-up. While France seems to be sinking into an unprecedented spiral of debt, Macron appears to be the sole responsible for this ruin.

The OFCE sounds the alarm: the restrictive budget planned for 2025 is likely to seriously hamper the growth of the French economy and the purchasing power of households. These gloomy prospects, linked to budgetary choices, could affect financial markets, which are already under pressure.

This case is just one piece of the vast puzzle of economic sanctions against Russia, but it highlights the difficulty of tracking and seizing assets acquired through sophisticated financial arrangements. As French justice intensifies its efforts, international pressure for greater financial transparency is mounting. The next steps in this investigation, and those to come, could redefine the tools for combating transnational financial crime. Thus, the implications for Russian oligarchs and their networks in Europe are immense, and such actions could inspire other jurisdictions to act.

France is undergoing an unprecedented budget crisis. The deficit is likely to exceed 6% in 2024. France now risks bankruptcy, which would plunge the entire euro area into the abyss.

Here is a budget! Barnier sizes, cuts, siphons... and the French grumble louder than ever.

This Wednesday, October 9, 2024, François Villeroy de Galhau, Governor of the Bank of France, made a direct call: "It is time for everyone to make an effort." In a context where public finances are spiraling out of control, with a deficit that has widened by 100 billion euros since January, this statement leaves no room for ambiguity. Every economic actor, from citizens to businesses and local authorities, must accept sacrifices to avoid a budgetary collapse.

France is facing an unprecedented financial deadlock, with public debt estimated at 110.6% of GDP and a deficit well beyond European criteria. Indeed, the era of half-measures seems to be over, and the Montaigne Institute, an influential Parisian think tank, is sounding the alarm with a bold report titled "Public Finances: The End of Illusions." This document proposes ambitious reforms aimed at saving nearly 150 billion euros by 2050.

As the Livret A softens, the ECB adjusts its glasses. Verdict in 2025: it's going to sting!

France, with a deficit nearing 6%, is fighting against stagnation in its economy and promises a return to normal by 2029.

French public finance is in the spotlight with debt reaching historic highs. But where does the Hexagon really stand compared to other nations?

Generalized algorithmic surveillance in France! Enhanced security at the expense of individual freedoms?

The Paris Stock Exchange is starting to decline this Tuesday, marked by notable caution in anticipation of major political and economic events. The CAC 40 index, a barometer of the Paris market, is down 0.38% in the early morning, further accentuating the downward trend that began the day before. This…