Bitcoin (BTC) has left an indelible mark on the crypto industry in 2023. This was achieved through an exceptional dynamic that saw the leading cryptocurrency double its value from the beginning of the year. Will the asset continue on this trajectory in 2024? Let's explore in this article the factors that can influence it in either direction.

Exchange Traded Fund (ETF)

""""""

"Cathie Wood, leader of ARK Invest, predicts a surge in Bitcoin to $1.5 million, supported by the blessing of Bitcoin ETFs."

The Bitcoin ETF has broken all records, but absurd facts have come to spoil the party, preventing Bitcoin from appreciating for now.

"""You must translate each text and preserve the context. Return me only the translated text without explanation or comment. This is the text to translate into language with language Code: "en": """

On January 11, 2024, the price of bitcoin dropped during the highly anticipated launch of the first ETFs. Possible causes analyzed.

The date of January 10, 2024 is now etched in golden letters in the annals of crypto. Indeed, the anticipation of this deadline for months by the crypto and financial community has not been in vain, as it has sanctioned the approval of a Bitcoin spot ETF. The decision of the Securities and Exchange Commission (SEC) was eagerly awaited on this date. And it is favorable. Now, a positive impact is expected on Bitcoin (BTC). But this outlook could also impact the entire crypto industry, including Ethereum. In this context, effects on the Ether (ETH) market, Ethereum's native crypto, are also being considered. That being said, how would ETH react to this new development? Let's see together in this article.

It’s done, the worm is in the fruit. All American and Navarre investment funds will be able to easily invest in bitcoin.

Bitwise has announced its intention to allocate 10% of the profits from its Bitcoin Spot ETF to the financing of open source development for Bitcoin.

"""You are translator in the blockchain field"""

" Bitcoin Spot EFTs have faced several rejections before reaching this stage. "

"en" is already the language code for English. Please provide the text you would like to be translated.

ETF Bitcoin spot approved! The first ARKB ETF by 21Shares will make its stock market debut on Cboe on January 11th.

Ripple transferred 100 million XRP to intermediary accounts. A preparation for the approval of the Bitcoin ETF?

"Bitcoin ETF approvals are imminent (and this time, it's serious). Eric Balchunas shares this excellent news on his X account."

The false approval of the Bitcoin ETF has pushed BTC above $47,000. This situation has benefited Ethereum and other altcoins.

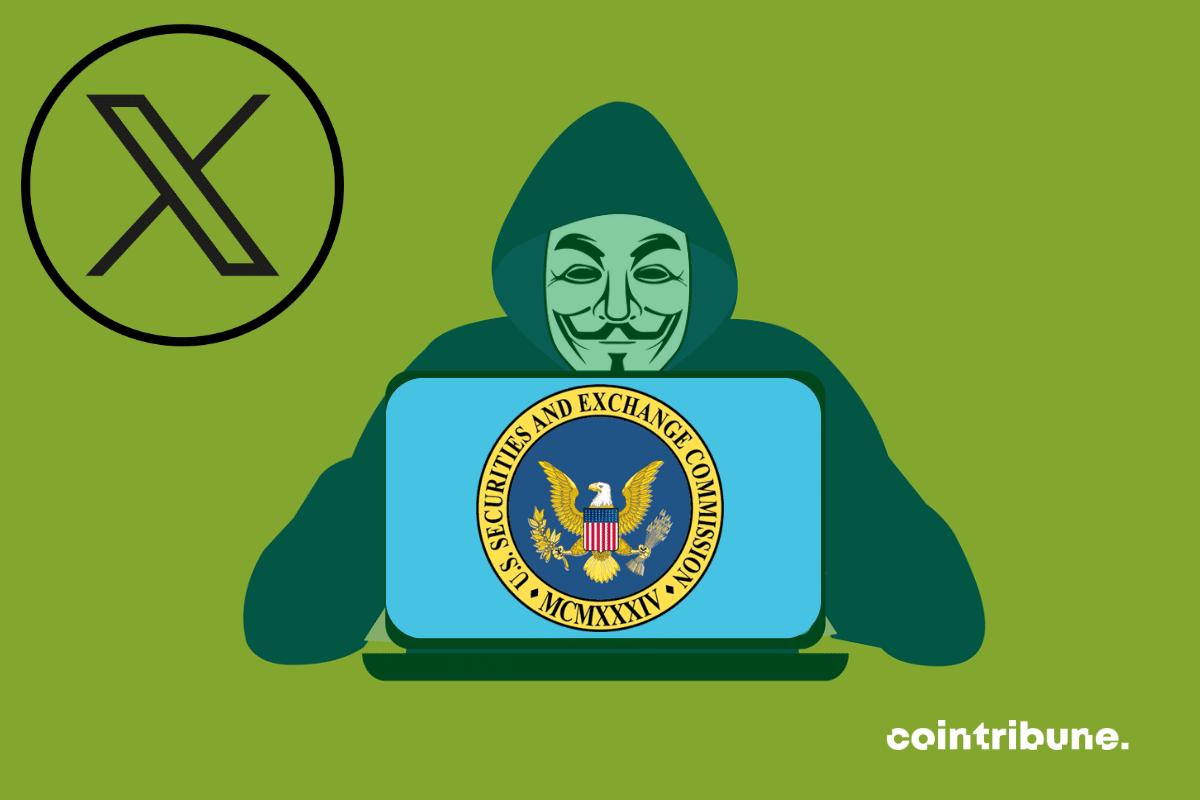

The SEC's Twitter account has been hacked on the eve of its announcements regarding the Bitcoin ETF. A collection of hilarious reactions.

Yesterday, the United States Securities and Exchange Commission released information stating that Bitcoin ETFs had been approved. However, according to recent news, this announcement turns out to be false, even though it was disseminated on the official X account of the financial watchdog. Two hypotheses emerge: either the SEC’s account…

Recently, a twist shocked the crypto community: a fake announcement of a Bitcoin ETF approval by the SEC. But far from being a mere bluff, this incident has revealed the enthusiasm and expectations surrounding this new way of investing in the leading cryptocurrency. Is Bitcoin about to pull off another…

The imminent approval by the SEC of the first Bitcoin cash ETF in the United States could usher in a new era for cryptocurrencies. According to Steve McClurg, Chief Investment Officer at Valkyrie Funds, Ethereum and Ripple ETFs could quickly follow.

The deceptive calm of the Bitcoin market can, in an instant, turn into an unpredictable financial whirlwind. Recently, a malicious tweet set off a powder keg, causing the precarious stability of BTC to wobble. The Twitter account @SECGov was compromised, spreading fake news about the acceptance of Bitcoin spot ETFs. The SEC had to step in to restore the truth, but the damage was done: Bitcoin experienced an hour of speculative frenzy.

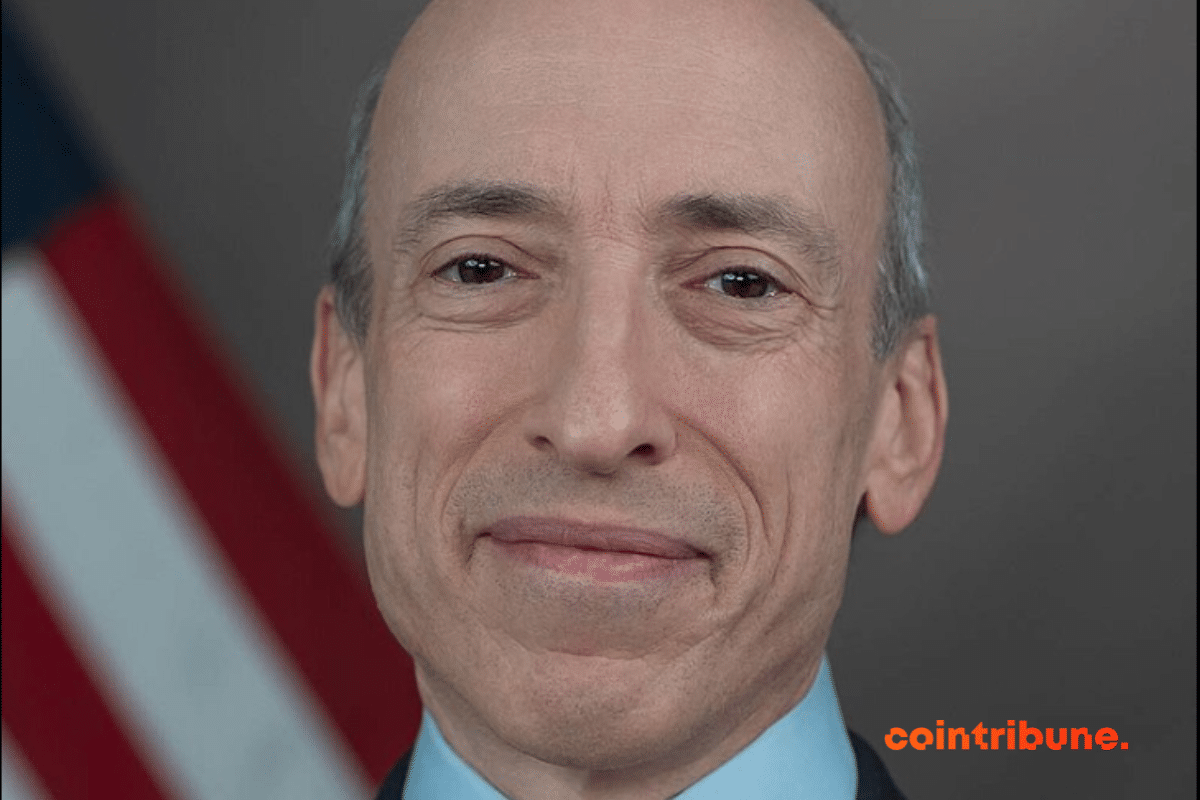

Jay Clayton, the former chairman of the SEC, expresses his belief in the imminent approval of Bitcoin ETFs. Details in this article.

Standard Chartered Bank expects Bitcoin to reach $100,000 this year and $200,000 next year.

The race for Bitcoin ETFs has reached its climax, but Gary Gensler, the big boss of the U.S. Securities and Exchange Commission (SEC), has just issued a serious warning. Yesterday, via his Twitter account, he shared some crucial advice for those considering investing in crypto assets. Stay tuned to find out everything!

As the fateful date of January 10 approaches rapidly, over one billion dollars in Bitcoin have been abruptly withdrawn from the Kraken exchange platform in recent days. These unusually massive transactions, exceeding 900 BTC, have aroused curiosity and sparked numerous speculations within the crypto community.

The SEC is expected to make a long-awaited decision this week on Bitcoin spot ETF applications. Approval seems very close, but is still being awaited. In the event of a green light, ETFs could start trading as early as the following business day.

The SEC's decision on bitcoin ETFs is imminent. Is it an opportunity to sell the news? Or not...

We are now 2 days away from the deadline set by the SEC for the approval of the first Bitcoin Spot ETFs. To date, this regulatory institution has not made a statement regarding these new financial instruments. In case you want to closely follow the progress of the situation, we…

According to analysis, the Bitcoin ETF could attract a colossal influx of $100 billion in 2024, provided that the SEC gives its approval.

As Bitcoin once again takes center stage, a major revelation by Fox Business adds thrilling suspense to the financial saga: The SEC could start signaling its approval for Bitcoin ETF issuers as soon as this Friday, with trading set to begin the following week.