The financial ecosystem is experiencing a new trend involving baby boomers. This class of investors born between 1943 and 1965 is losing interest in gold. Now, they are turning to Bitcoin Spot ETFs. This dynamic raises questions for many financial market analysts. Historically, gold is considered an asset that secures wealth against financial risks such as inflation. From this perspective, this evolution represents a significant change in the investment preferences of this cohort of investors. What factors are driving this transition and what are the implications for the future of investments? In this article, we provide an analysis on this issue.

Exchange Traded Fund (ETF)

The sudden surge in retail trading propels VanEck's Bitcoin ETF volumes by 2200%! A big leap for crypto!

The Bitcoin ETF market exploded in 2024, generating record daily volumes surpassing $2 billion!

Could Cardano's price soon reach $1? Here's what crypto analysts are saying.

Ethereum at $2,900: what you need to know about its rise to power. The reasons for its success, challenges, and opportunities ahead.

The Bitcoin ETFs are breaking all records despite the outflows from the GBTC ETF, which could soon intensify due to sales from the Gemini exchange.

Bitcoin is the most significant monetary innovation since the invention of currency. In this article, Edward Snowden explains why.

Bitcoin spot ETFs are seeing spectacular enthusiasm from investors. Fueled by BlackRock's IBIT ETF, they recorded net inflows of $2.2 billion during the week of February 12-16, 2023.

Is the current regulation on Bitcoin ETFs on the verge of a major revision? This is what a group of American banks wishes, as they recently invited the SEC president to review certain measures on the regulation of these assets. Details in the following article.

The comeback of bitcoin, which recently regained the symbolic threshold of $1 trillion market capitalization, whets appetites and revives competition with gold. Fueled by massive capital inflows into bitcoin spot ETFs, the king of cryptos could outshine gold sooner than expected.

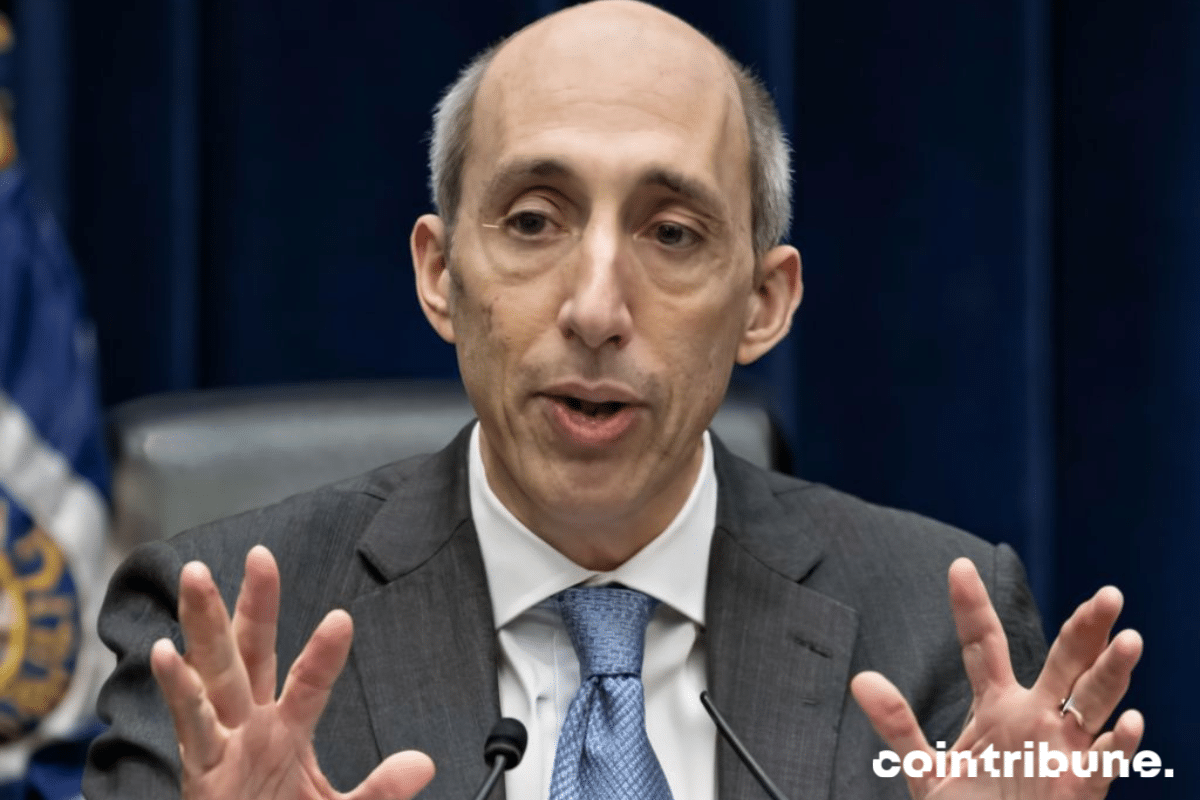

While the debate rages on the legitimacy of bitcoin as a currency, SEC Chairman Gary Gensler recently highlighted distinctions between crypto and fiat currencies like the US dollar. His response once again resonates as a critique of Satoshi's invention.

The Crypto Fear and Greed Index, which measures the sentiment of the crypto market, has reached its highest level since November 2021. This extreme greed reflects investors' optimism in the face of the ongoing price increases, but could also foreshadow an impending correction.

Exactly one year ago, the price of bitcoin (BTC) was around $20,000. Throughout the year 2023, the flagship cryptocurrency made headlines for its remarkable dynamism despite the ups and downs. Today, the asset is valued at over $50,000. A level it had not reached since December 2021. The surge of BTC to reach this level is from this point of view a major event for the crypto industry, whose resurgence in 2024 has been announced by a panel of experts. But how can we reasonably explain that in the space of a week, BTC has increased its valuation by 19% to currently trade around $51,600? This article will provide you with some answers.

A unique alignment of technical and fundamental factors could propel Bitcoin to $100,000 in 2024!

Bitcoin has just regained $50,000 for the first time since 2021 in a much more favorable context than before.

While Bitcoin dominates media attention, institutions are quietly turning to altcoins Ethereum and Cardano!

"Wall Street loves bitcoin. They are buying 12.5 times more bitcoins per day than the network can produce," astutely notes crypto trader Pomp on Twitter. According to him, daily acquisitions far exceed the network's production, reaching up to 12.5 times more. For Michael Saylor of MicroStrategy, Bitcoin spot ETFs have played a crucial role in popularizing cryptocurrency, thus propelling its price to new heights.

The soaring rise of BTC towards $50,000, fueled by increasing institutional adoption and profitable addresses.

Bitcoin ETFs are experiencing massive capital inflows this month, resulting in a spectacular surge in the crypto's price!

FTX, Bitcoin, Super Bowl: One year later, crypto is absent. Kraken prioritizes education. Coinbase, lobbying.

The future of bitcoin (BTC) is currently attracting great interest. Recently, some crypto analysts have expressed their prediction of a profound disruption in the flagship crypto market. As the bitcoin (BTC) halving approaches, they anticipate an exceptional supply "shock". These projections hint at significant implications regarding the price dynamics of the flagship crypto and its ecosystem. In this article, we will attempt to explain the implications of an explosion in the supply of bitcoin (BTC). This will be done through the lens of the current context of the flagship crypto in the crypto market.

Wall Street saw the arrival of Bitcoin ETFs in January 2024. Since then, they have attracted billions of dollars and broken all records.

Despite the recent launch of Bitcoin ETFs in the United States, overall BTC wallet activity is declining!

The SEC delays approval of Ethereum ETFs, while predictions differ on potential future validation.

Genesis liquidation should soon put an end to the recent calm on the Grayscale Bitcoin ETF side.

Bitcoin in pole position: Cathie Wood predicts the end of the gold era.

Two Bitcoin ETFs stood out in January, ranking among the top 10 most popular ETFs in terms of investment flows.

January 10, 2024 is memorable for crypto. This date marks the approval by the Securities and Exchange Commission (SEC) for the creation of a Bitcoin Spot ETF. After months of waiting, the US financial regulator will finally give the green light for a Bitcoin spot ETF. This long-awaited decision by the crypto industry players has confirmed the legitimacy of Bitcoin (BTC) as a financial asset. The scope of this regulatory authorization could have been further reinforced if it had been followed by a green light for options on Bitcoin spot ETFs. For now, regulators hesitate to take the plunge. In this article, we explain why hesitations on this issue could still last a while.

The rise of cryptocurrencies has opened new avenues in the investment world, notably through Bitcoin ETFs. These funds, which replicate Bitcoin's performance while being traded on traditional exchanges, represent a fascinating fusion between digital finance and conventional investment. For investors eager to enter the cryptocurrency universe without the complexities of directly managing these assets, Bitcoin ETFs present an attractive solution. This article provides a comprehensive guide on buying Bitcoin ETFs, covering the platforms where to find them, the key steps to acquire them, and the pitfalls to avoid for a successful investment.

In the financial investment world, the rise of cryptocurrencies, particularly Bitcoin, has captured the attention of investors. Simultaneously, Bitcoin ETFs (Exchange-Traded Funds) have emerged as an attractive option for those looking to invest in this sector without the complexities of directly managing cryptocurrencies. However, a question remains: Is it possible to include these ETFs in a Equity Savings Plan.)? This article explores the rules governing investments in an Equity Savings Plan, examines the compatibility of Bitcoin ETFs with these rules, and proposes alternatives for investors.