Bitcoin continues to surprise. It breaks the $71,000 mark and surpasses silver, rising to the 8th rank among financial assets.

Exchange Traded Fund (ETF)

The British regulator FCA gives the green light to Crypto ETNs! And this, for institutional investors!

Cathie Wood, CEO of ARK Invest, has stated that the price of Bitcoin could exceed $1 million before 2030, revising her asset management company's previous forecasts. This announcement comes as the launch of the first Bitcoin Spot ETFs in the United States sparks renewed interest from institutional investors.

Matt Hougan, Bitwise's Chief Investment Officer, predicts a massive influx of institutional capital into Bitcoin in 2024!

The iShares Bitcoin Trust (IBTC) from BlackRock is showing remarkable performance in the market for Bitcoin spot ETFs. In a context where demand for Bitcoin spot ETFs is exploding, BlackRock has embarked on a diversification policy to address this. Hence its request to purchase ETFs from the US financial regulator.

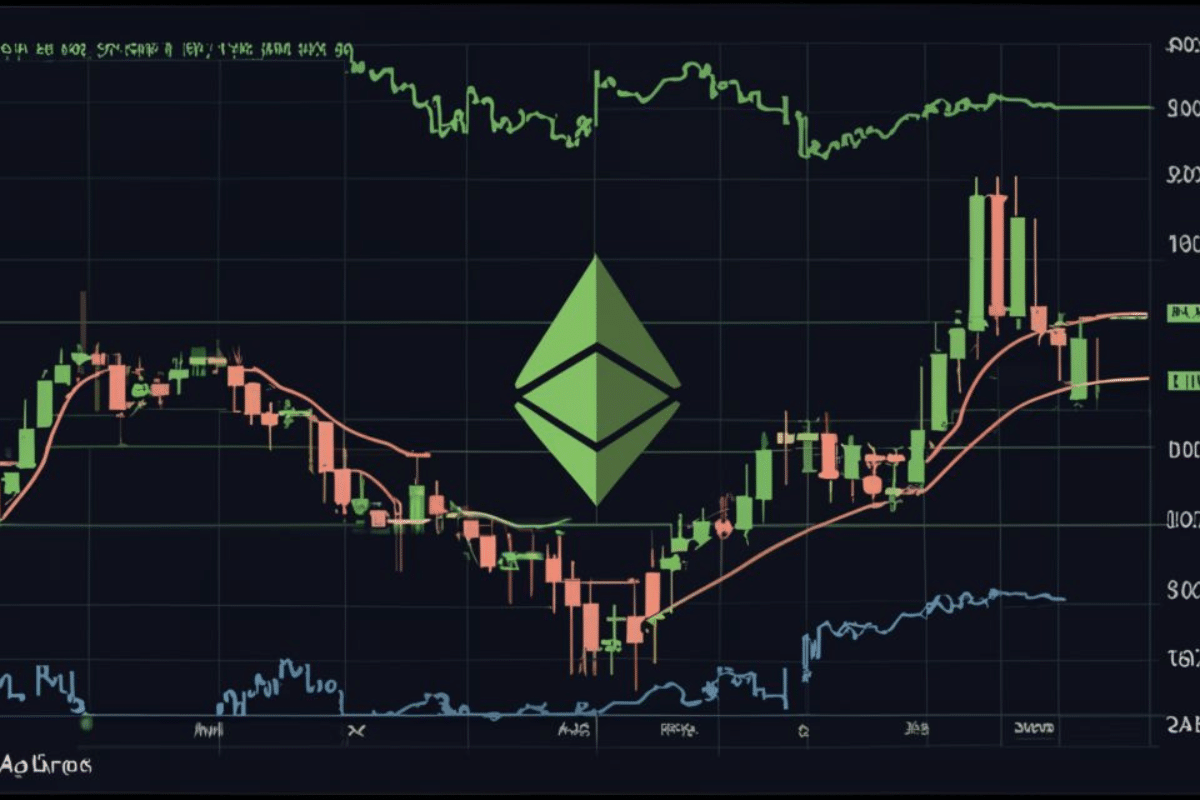

Ether (ETH), the second most popular crypto on the market, is attracting investor attention with its outstanding performance. Like bitcoin (BTC) which it follows, it has reached a historic price record of $3,800. Here's how analysts explain this surge in strength.

Bitcoin (BTC) is on fire and Bitcoin Spot ETFs as well. Yesterday, the flagship cryptocurrency reached its highest price level since its previous 2021 record. Meanwhile, the Bitcoin Spot ETF market has demonstrated remarkable performance in daily transactions.

Bitcoin has reached a historic peak, opening a new chapter in the history of cryptocurrencies. Here are our predictions!

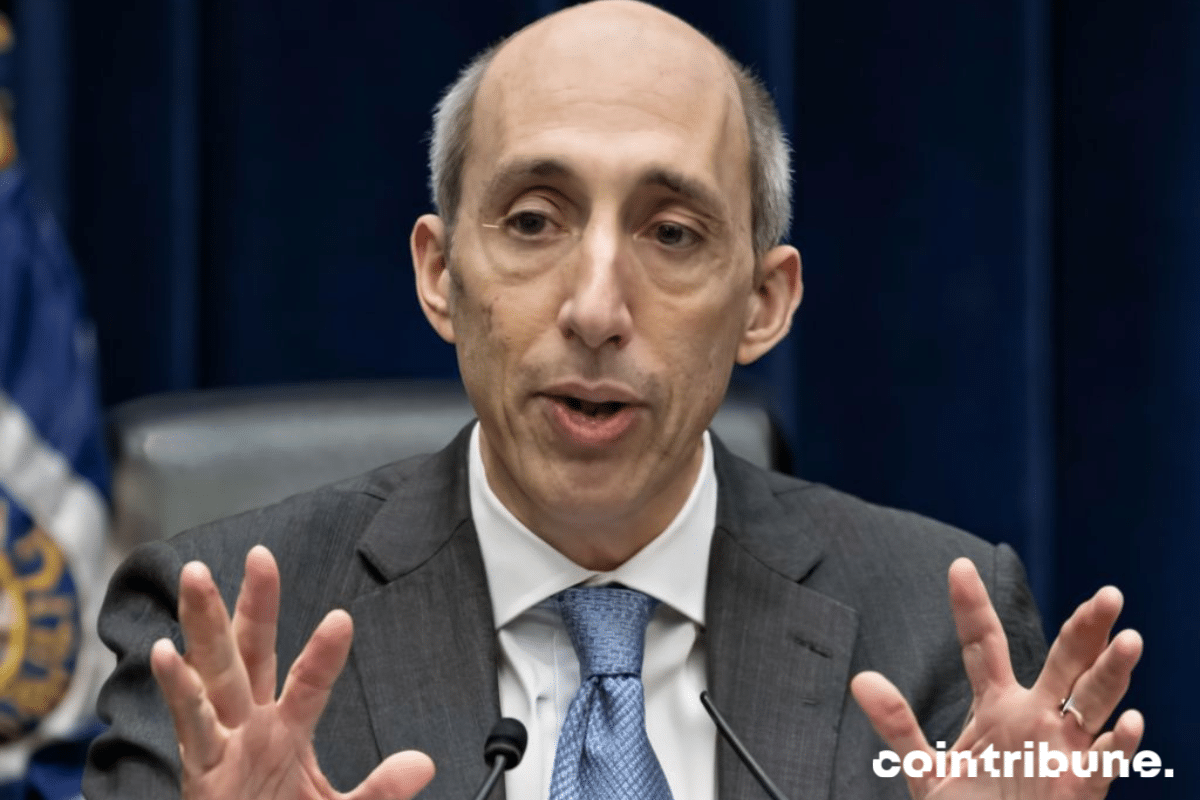

The SEC is undecided on BlackRock's Ethereum ETF, leaving the future of crypto investment uncertain. Details in this article.

It appears that the outflows from the GBTC ETF related to Genesis' asset liquidation have started. Hence the halt in Bitcoin.

Bitcoin is approaching $64,000, recalling its recent high of $69,000. Bitcoin ETFs are challenging Gold ETFs.

Artificial intelligence (AI) is booming, and investors are increasingly betting on exchange-traded funds (ETFs) focused on this promising sector. Given the exponential growth prospects of AI, specialized ETFs are poised for a bright future.

The price of bitcoin has exceeded $60,000 for the first time in over two years. It is at the all-time high against the euro.

Propelled by the success of Bitcoin ETFs, Jim Cramer makes a surprising prediction about the future of Ethereum ETFs!

Like a financial rollercoaster, Bitcoin dangerously fluctuates, flirting with 60,000 dollars.

Bitcoin (BTC) is not the only one attracting attention from the crypto community. Several cash-settled ETFs linked to the leading crypto are also gaining traction through their trading volumes. In the past 24 hours, they have seen a remarkable surge. Here is exactly what happened.

The recent Ethereum rally rekindles interest in the altcoin market, according to Bitfinex analysts. The crypto star could be paving the way for a new altcoin season.

The SEC could soon allow options trading for Bitcoin ETFs, sparking growing interest in the cryptocurrency.

Fueled by the recent surge in prices, trading on Bitcoin Spot ETFs has just reached a historic record. The cumulative volume of the 10 largest trackers now hovers around 50 billion dollars.

The financial ecosystem is experiencing a new trend involving baby boomers. This class of investors born between 1943 and 1965 is losing interest in gold. Now, they are turning to Bitcoin Spot ETFs. This dynamic raises questions for many financial market analysts. Historically, gold is considered an asset that secures wealth against financial risks such as inflation. From this perspective, this evolution represents a significant change in the investment preferences of this cohort of investors. What factors are driving this transition and what are the implications for the future of investments? In this article, we provide an analysis on this issue.

The sudden surge in retail trading propels VanEck's Bitcoin ETF volumes by 2200%! A big leap for crypto!

The Bitcoin ETF market exploded in 2024, generating record daily volumes surpassing $2 billion!

Could Cardano's price soon reach $1? Here's what crypto analysts are saying.

Ethereum at $2,900: what you need to know about its rise to power. The reasons for its success, challenges, and opportunities ahead.

The Bitcoin ETFs are breaking all records despite the outflows from the GBTC ETF, which could soon intensify due to sales from the Gemini exchange.

Bitcoin is the most significant monetary innovation since the invention of currency. In this article, Edward Snowden explains why.

Bitcoin spot ETFs are seeing spectacular enthusiasm from investors. Fueled by BlackRock's IBIT ETF, they recorded net inflows of $2.2 billion during the week of February 12-16, 2023.

Is the current regulation on Bitcoin ETFs on the verge of a major revision? This is what a group of American banks wishes, as they recently invited the SEC president to review certain measures on the regulation of these assets. Details in the following article.

The comeback of bitcoin, which recently regained the symbolic threshold of $1 trillion market capitalization, whets appetites and revives competition with gold. Fueled by massive capital inflows into bitcoin spot ETFs, the king of cryptos could outshine gold sooner than expected.

While the debate rages on the legitimacy of bitcoin as a currency, SEC Chairman Gary Gensler recently highlighted distinctions between crypto and fiat currencies like the US dollar. His response once again resonates as a critique of Satoshi's invention.