Cryptocurrencies are taking off: Google displays crypto wallet balances and ENS simplifies addresses. Details!

Theme Event

The price of Bitcoin has experienced a significant resurgence, gaining nearly 10% since its recent low at $60,800. However, key resistances stand in the way of BTC's return to above $70,000. Let's analyze the market outlook.

Capital flows in Bitcoin ETFs experience ups and downs, while SEC delays in approving Ethereum ETFs elicit mixed reactions. Meanwhile, BlackRock is exploring new avenues with a tokenized asset fund.

Nvidia's announcement of launching its new AI superchip, Blackwell, has captivated global market attention. This innovation not only promises to redefine the capabilities of artificial intelligence but also to mark a turning point in the tech industry, with potentially significant repercussions on the stock market.

MEMECON, the first-ever meme coin conference, is scheduled to take place in Lisbon from May 28th to 30th. This historical event, in partnership with Non Fungible Conference, the second-largest NFT conference in Europe, is set to bring together the most skilled & degenerate minds of crypto.

The collapse of cryptocurrencies highlights the fragility of the market, prompting caution and prudence.

Former Binance CEO Changpeng Zhao (CZ) unveils his new crypto project called Giggle Academy. This gamified and free educational platform aims to make education accessible to everyone without generating revenue.

The spot Bitcoin ETFs have seen significant outflows in recent days, with the Grayscale Bitcoin Trust (GBTC) experiencing a record loss of $642.5 million in a single day. However, analysts remain optimistic about the future of these innovative financial products.

Solana is gearing up to challenge Ethereum after surpassing Binance Coin. Tight competition in the crypto world.

The recent Dencun update has catapulted Ethereum into an unprecedented era. It ushered in a revolution in the crypto universe. Suddenly, Ethereum reached a critical turning point. This update ignited a revolution, marked by an impressive surge in the value transferred. Layer 2 (L2) scaling solutions are at the heart…

On March 14, the Bitcoin mining difficulty reached a record level of 83.95 trillion hashes, reflecting increased competition among miners. Paradoxically, on the same day, the price of BTC experienced a massive drop after reaching a historical high of $73,835.

I'm sorry, but there is no text provided for translation. If you could provide the text you want to be translated, I would be more than happy to assist you.

The UEFA, the governing body of European football, has taken a significant step towards cryptocurrency. The organization is looking to attract sponsors from the Exchange industry for the 2024-2027 period of the prestigious Champions League. This serves as a strong signal for a promising union between crypto and sports.

In an era where Bitcoin is breaking records by crossing the $73,500 mark, Mike Novogratz throws a spanner in the works by announcing that Bitcoin will never fall below $55,000 again. A declaration that raises as much hope as it does questions.

"The 'voice budgeting,' a viral phenomenon on TikTok, could well change the game in terms of financial management this year. Breaking taboos around money and boldly asserting savings goals makes it possible to more serenely achieve financial goals and to financially empower, especially for women."

Are we on the threshold of a new era for bitcoin? With the poise of a marathon runner preparing for the final sprint, BTC seems ready to offer us a spectacle worthy of its name. A March Towards Explosive Growth The recent fluctuations in the bitcoin…

I'm sorry, but it seems like there is no text to be translated in your request. Please provide the text that needs to be translated into the specified language, and I will be happy to assist you.

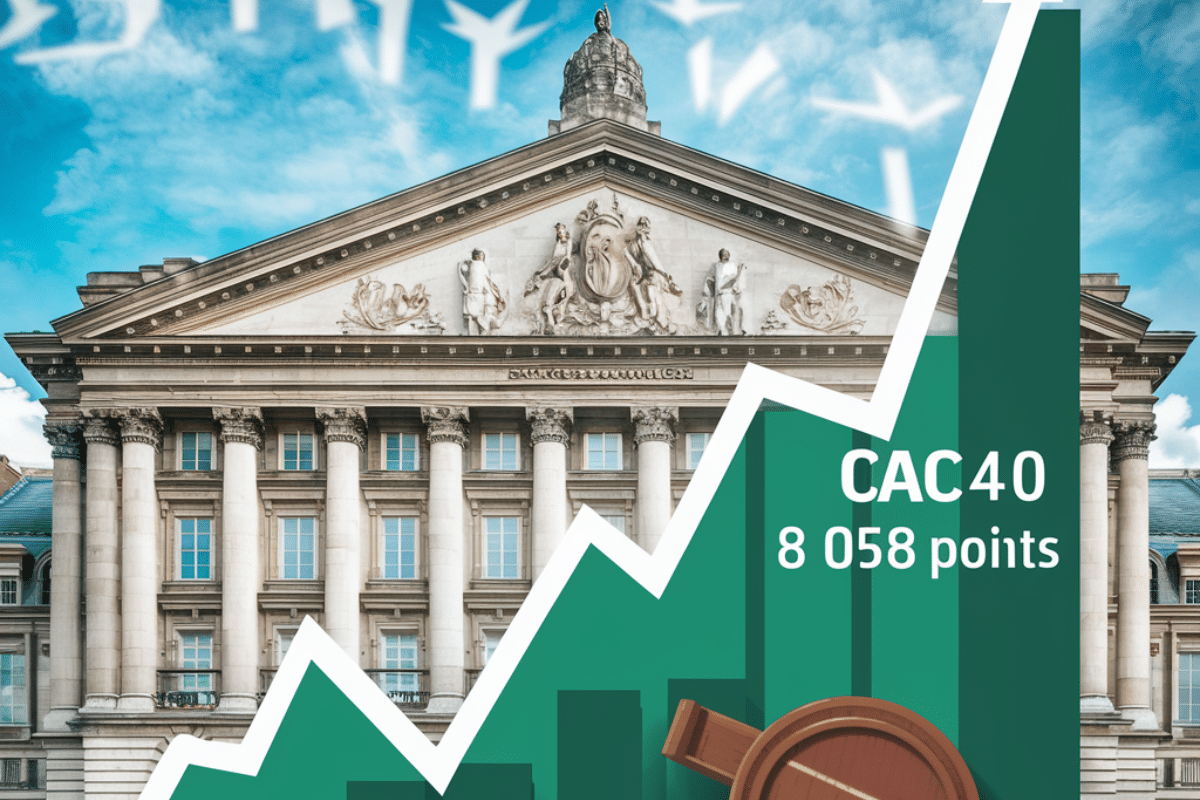

This Tuesday morning, the CAC40 reached a new historical peak at 8,058 points right at the opening. Despite a slight moderation towards the end of the morning, the flagship index of the Paris stock exchange remains in positive territory.

A titanic battle is brewing, featuring a bold strategy that could redefine the Bitcoin investment landscape. VanEck, in a masterstroke, is directly challenging BlackRock by introducing a game-changing product: a fee-free Bitcoin ETF. Innovation or Bluff? The Stakes of a Fee-Free ETF VanEck’s announcement to temporarily abolish management fees for…

While the crypto industry eagerly awaits SEC approval for Ethereum Spot ETFs, Bloomberg's top analyst Eric Balchunas sounds the alarm. The US regulator's silence towards potential fund issuers does not bode well, according to him.

Bitcoin continues to surprise. It breaks the $71,000 mark and surpasses silver, rising to the 8th rank among financial assets.

Cathie Wood, CEO of ARK Invest, has stated that the price of Bitcoin could exceed $1 million before 2030, revising her asset management company's previous forecasts. This announcement comes as the launch of the first Bitcoin Spot ETFs in the United States sparks renewed interest from institutional investors.

ICP launches DocuTrack, a communication system that revolutionizes privacy in the crypto ecosystem!

Discover the impact of the SEC's postponement of its decision on BlackRock's Bitcoin ETF options. A dive into the future of crypto.

Discover Fet, Render, Akt, Rune, and Flow, the crypto stars of the day revolutionizing AI, virtual reality, and decentralized finance.

Explore the explosive potential of a high-risk crypto rally like altcoins, fueled by the surge of Bitcoin!

The CAC 40 is enacting a scene that seems pulled straight from a Greek tragedy. Instead of ascending to Olympian heights, the flagship index of the Paris stock exchange is plunging once again into hellish meanders, a descent orchestrated to the tune of the global economy’s uncertain heartbeat. Teleperformance: The…

Zama has successfully raised a record financing of $73 million to develop cutting-edge crypto applications

The highly anticipated Blockchain Life Forum 2024 is set to take place in the vibrant city of Dubai on April 15-16. Welcoming industry professionals and crypto enthusiasts from around the world, this legendary event promises to be an unforgettable experience. This time the central topic of the forum will be…

"Blockchain technology has the potential to revolutionize the way we conduct business and exchange value."