The dominance of the US dollar in international trade is being challenged more than ever. A powerful bloc, the BRICS, is actively seeking to free itself from this by developing an alternative currency. In response to this offensive, Donald Trump, true to his style, does not intend to remain a spectator. The American president is wielding the threat of massive economic sanctions to deter any attempt to undermine the hegemony of the greenback. But can this strategy truly reverse the trend, or is it likely to accelerate the ongoing dynamics?

Theme Event

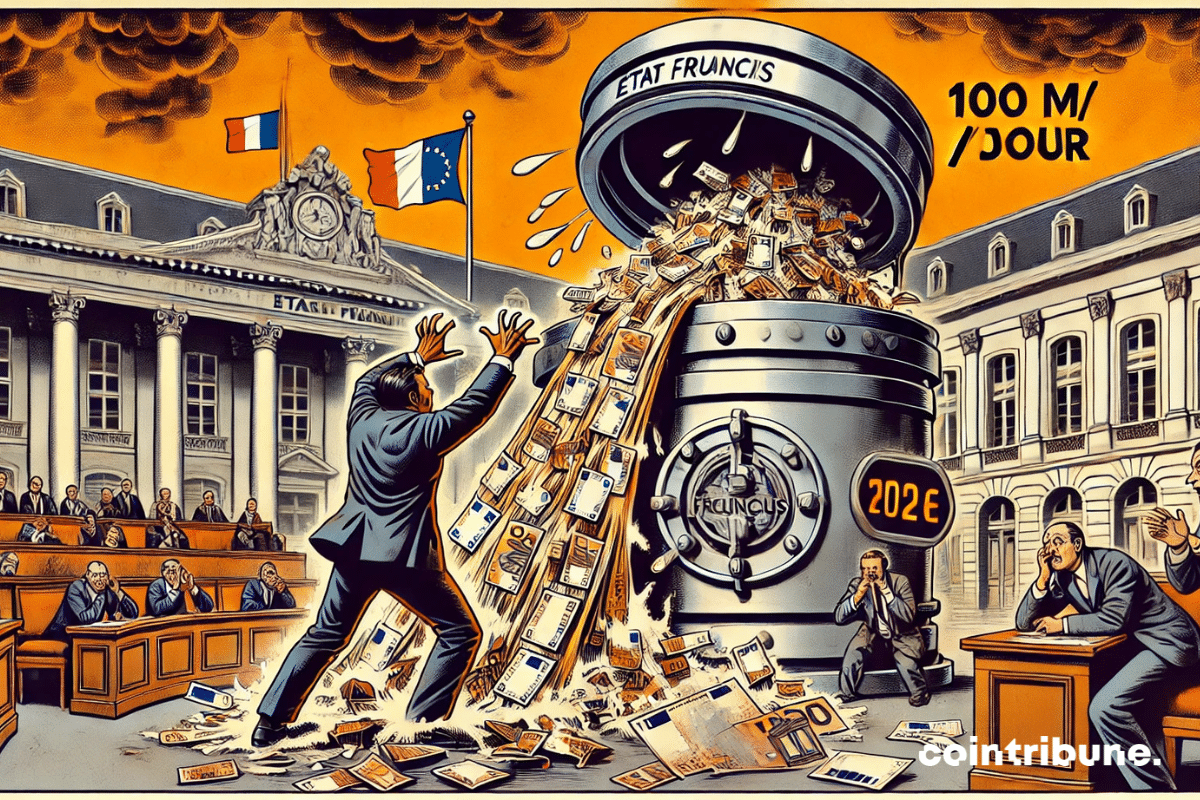

France votes on a budget, the French express distrust: 80% predict collapse, 61% no longer even hope for themselves.

While the Fed hesitates between caution and action, inflation runs rampant, and crypto wavers, poised for a week of financial roller coasters.

European economies are facing a worrying reality: a public debt that keeps rising. While budget stability is supposed to be a priority for governments, several countries in the European Union now show debt levels that far exceed 100% of their GDP. This situation raises questions about macroeconomic risks and the potential consequences for financial markets.

2 million believers shout "Pi Coin!", but Binance remains unyielding, consulting without promising. The cryptocurrency version of democracy: voting for decoration, deciding behind the scenes.

The global geopolitical balance is undergoing significant changes. Russia, which was once a member of the G8 before its exclusion in 2014, is now adopting a radically different stance. In the face of what it perceives as a decline in the influence of Western powers, Moscow now favors the BRICS and the G20, at the expense of a G7 deemed obsolete. This strategic reconfiguration goes beyond a mere diplomatic adjustment; it illustrates a broader shift in power dynamics, where emerging economies are gaining ground against Western-dominated institutions. Through the statements of its ambassador to Canada, Russia confirms its definitive disengagement from the G7 and outlines the contours of a new international order.

Barely born, already dismembered! The token blessed by Milei is undergoing an express massacre: 4 billion evaporated, fleeing initiates, Binance in post-apocalyptic crypto sage mode.

The Russian economy is wobbling under the weight of its own structural flaws and an increasingly hostile international environment. While the Kremlin attempts to project resilience in the face of Western sanctions and geopolitical tensions, the latest reports from the Bank of Russia and the Ministry of Economy paint a much more troubling reality. With the collapse of oil revenues, a skyrocketing budget deficit, and a private sector on the brink of asphyxiation, Russia faces major economic challenges that could profoundly affect its stability in the medium term.

Coinbase is aiming for a digital gold future: $10 trillion on the blockchain with Washington at the forefront. Armstrong: prophet or charlatan?

Like a stock-market phoenix, GameStop is rising again: a simple Bitcoin rumor and the stock soars. Masterful bluff or the beginning of a financial revolution?

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

Bitcoin, long the absolute master, looks helpless as Ethereum steals the spotlight: 793 million injected against 407 million, a Trafalgar blow to the ETP market.

Rumors about a common BRICS currency frequently resurface, fueling speculation about a possible counterweight to the dollar. As several nations seek to reduce their dependence on the greenback, the prospect of a shared currency raises concerns in the United States. Donald Trump has threatened to impose sanctions on countries considering an alternative. However, the Kremlin has just defused the debate: no such project is under discussion. Instead, the bloc prioritizes joint investment platforms, leaving doubt about its true monetary strategy.

Tesla, once the king of electric roads, sees its empire wobble: Europe turns away, Musk slips, and the competition hits the gas. Is the future without him?

While Google drowns AI in a rain of dollars, a small Chinese genius tinkers in his garage and shakes Silicon Valley. Butterfly effect or storm to come?

In an unprecedented turn for American economic policy, Donald Trump has signed a presidential decree that creates a national sovereign wealth fund, a groundbreaking initiative in the United States. This financial instrument aims to stimulate economic growth, fund strategic infrastructure, and potentially enable the acquisition of TikTok. The platform, under scrutiny from Washington for national security reasons, must divest itself of its Chinese shareholders in order to continue operations on American soil. Drawing inspiration from the sovereign wealth fund models of China, Norway, and Singapore, the Trump administration hopes to reduce U.S. dependence on borrowing and enhance its global economic influence. However, the establishment of such a mechanism raises numerous questions: how could a country that is accumulating massive budget deficits finance such a project? What would be the geopolitical implications of a direct intervention in a globally significant technology company? Balancing economic ambition with diplomatic challenges, this sovereign wealth fund represents a major shift that could redefine the role of the American state on the international stage.

As the crypto markets struggle under the shock of Trump’s tariffs, a new player enters the scene: David Sacks, the man who whispers to AI and digital assets. On February 4th, this shadow strategist will unveil Washington’s battle plan to regain control of a space in complete chaos. Between historical…

The deficit is growing, taxes are rising, but Bayrou persists. Clinging to his 49.3 like a castaway to his buoy, he defies the political storm that is looming.

In a constantly changing world, where every political decision redraws the contours of power, a major phenomenon is emerging: the rise of the BRICS. This acronym, once seen as a symbolic grouping of major emerging economies, now asserts itself as a driving force of geopolitical balance. With the recent expansion of this bloc to new influential members, the global landscape is enriched with unprecedented dynamics, challenging the hegemony of Western institutions. While Donald Trump embarks on a second term in the United States, focused on a protectionist and isolationist policy, the rise of the BRICS represents a strategic challenge with profound implications.

Once silent, crypto wallets are stirring: 36 million digital souls are exploring the blockchain, shaking up banks and traditions. The monetary revolution, like a rising tide, seems inexorable.

For several decades, French budget management has been a source of recurring tensions, but the current situation has reached an unprecedented level. In 2025, the censorship of the budget voted by the Senate plunged the country into a major financial crisis, with losses estimated at 100 million euros per day. In the absence of a new text validated by the National Assembly, the budget for 2024 remains in effect, depriving the state of essential revenue and savings measures. Amélie de Montchalin, Minister for Public Accounts, warns about the repercussions of this deadlock and emphasizes both its economic cost and the institutional challenges it reveals.

For several decades, global economic alliances have been evolving due to geopolitical and economic transformations. The BRICS bloc embodies this dynamic through its expansion to new members in order to consolidate its influence on the international stage. In 2023, Saudi Arabia, the world's largest oil exporter, received an official invitation to join this strategic alliance. However, unlike other countries such as Iran or the United Arab Emirates, which quickly accepted, Riyadh is adopting a cautious stance. Faisal Al-Ibrahim, the Saudi Minister of Economy and Planning, emphasized that the kingdom continues to carefully assess the implications of membership. This strategic choice raises questions about Saudi Arabia's true intentions and its future role in this new economic balance.

Between record figures and subtle strategies, BlackRock's Bitcoin ETF charts its course. The shine of the crypto beacon lights up finance.

As artificial intelligence and cryptocurrencies are shaking up the global economy, Donald Trump seized the opportunity at the World Economic Forum in Davos to outline an ambitious vision. The American president declared his intention to make the United States the global leader in these strategic technologies. This announcement fits into a broader desire to re-industrialize the country by leveraging its vast energy resources. However, these promises raise many questions, both about their implementation and the forthcoming economic and geopolitical implications.

Silk Road fades away, but Ulbricht intrigues. Kraken raises funds, while $47 million in BTC floats in limbo.

The global economic landscape is rapidly evolving, driven by alliances that reflect the ambitions of emerging countries to reshape traditional centers of influence. In this context, Nigeria, the largest economic power in Africa, has joined the circle of BRICS partners. This initiative, orchestrated under Brazil's presidency, highlights the bloc's desire to promote enhanced cooperation among the nations of the global South. Although this partnership does not yet confer a decision-making role to Nigeria, it reflects a growing dynamic of economic integration and a shared quest for financial sovereignty in the face of dominant Western models.

"America First" roars Trump, hammering taxes and drilling like a refrain. The Green New Deal expires, the economy trembles, the euro wonders.

In a particularly tense geopolitical context, the World Economic Forum 2025 opened yesterday in Davos, Switzerland. This 54th edition brings together more than 3,000 global leaders to address the major challenges of our time, in a climate marked by Donald Trump's return to the American presidency.

Bayrou, an anxious prophet, portrays a Europe that watches a conquering dollar and a martial Trump, crushing our dreams of independence. The time for denial is over: it's time for a resurgence.

From January 31 to February 2, 2025, Alephium, a next-generation blockchain, will participate in CryptoXR, the second largest crypto conference in France, to organize a large-scale hackathon in partnership with LSW3 (League for Web3 Security). This event promises to make Auxerre the French capital of Web3, attracting over 3,000 visitors, 70 speakers, and innovative projects.