Solana, the audacious blockchain, humiliated Ethereum in broad daylight: 3.8 billion in 24 hours, leaving its rivals stunned. A memorable slap in the crypto arena.

Ethereum (ETH)

Bitcoin continues its bullish momentum for the seventh consecutive day, settling at $99,513 this Monday, while Ethereum consolidates its position above $3,600. This progress comes amid growing optimism among institutional investors and expectations related to regulatory developments in the United States.

Amid revolutionary announcements, technological developments, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic conflicts. Here is a summary of the most notable news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

XRP, like a reborn phoenix, is now only 83.4% away from surpassing Ethereum. A spectacular rise that disrupts the hierarchy of giants.

In December 2024, exchange-traded funds (ETFs) based on Ether (ETH) saw net inflows exceeding $2.6 billion, marking a significant milestone for these crypto products. This performance reflects a growing interest in Ether ETFs, despite their lag behind Bitcoin ETFs, which closed the year with net inflows of over $35 billion.

Vitalik Buterin recently criticized Elon Musk for his aggressive approach to freedom of speech and his excessive use of the "banhammer" (censorship tool). He calls for moderation in debates and to avoid excessive censorship, highlighting the importance of preserving a healthy and inclusive public discourse.

While Bitcoin revels under golden skies, Ethereum gropes in the shadows, with no trophy in sight for 2025. The crypto revolution hesitates, one foot in the past.

In 2024, Ethereum saw a significant increase in its long-term holders (HODLers), reflecting heightened investor confidence. This trend contrasts with the decline in Bitcoin holders, indicating promising prospects for Ethereum in 2025 and significant implications for the crypto market.

Bitcoin is stagnant, investors are softly dozing. But beware: Trump in January could very well add some spice to this lukewarm crypto soup.

Amid revolutionary announcements, technological advancements, and regulatory turmoil, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic challenges. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Ethereum (ETH) has recently experienced a significant decrease in selling pressure, signaling a possible market recovery. Here are the four main reasons identified that explain this trend, and what it could mean for the future of the Ethereum cryptocurrency.

In a blockchain sleight of hand, Akridge allegedly emptied his ex-wife's crypto wallet. A crypto-marital tragedy with a scent of millions!

In the tumultuous arena of crypto, the bloodless Bitcoin ETFs find an unexpected resurgence after Christmas, like a benevolent wink from Santa Claus.

In the crypto arena, XRP stands out as a flamboyant gladiator, ready to jump by 65%, leaving Bitcoin and Ethereum in the shadows. Guaranteed suspense, according to an admiring expert.

Crypto, AI, and hybrid worlds: Buterin, like a digital alchemist, presents us with a vision where blockchain and biotechnology intersect to ward off threats from another century.

At the dawn of 2025, Ethereum is poised to undergo a major transformation that could redefine its role within the crypto ecosystem. Following a lackluster performance in 2024, the signs of a resurgence are intensifying. Experts emphasize the decisive impact of several technical innovations and a rapidly evolving regulatory context, all of which could propel Ethereum into a new era of dominance. Driven by ambitious updates like Pectra, the network aims to overcome its current scalability limitations and enhance user experience through advancements in interoperability and account abstraction. Additionally, the arrival of a pro-crypto administration in the United States, along with the growing adoption of stablecoins, tokenization, and AI-based smart agents, opens up unprecedented opportunities. In this context, Ethereum could become the central engine of a rapidly changing ecosystem that attracts investors, institutions, and developers.

Under the spotlight of speculation, memecoins attract and terrify. Solana leads the dance, Coinbase follows, while traders oscillate between golden dreams and cold sweats.

A crypto analyst, Michael van de Poppe, predicts that Ethereum (ETH) could surpass Bitcoin (BTC) in January 2025. This prediction is based on a key factor, which could trigger an "altcoin run" and attract more investments into the Ethereum ecosystem.

Solana, like a Phoenix, rises from the ashes of FTX. With a 2,000% increase, it makes Bitcoin and Ethereum look outdated, showing record volumes and spectacular inflows.

In December, Solana continued to outperform Ethereum in the decentralized exchange (DEX) industry for the third consecutive month. Thanks to the growing popularity of memecoins, Solana recorded record transaction volumes, thereby consolidating its position against crypto giants like Ethereum.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic disputes. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Ethereum-based NFTs have reached an impressive weekly sales volume of 304 million dollars, marking a significant increase compared to the previous week. This performance highlights the growing importance of NFTs in the world of digital assets and the heightened interest from investors in these unique collections.

In 2025, the Ethereum ETF, with its staggering figures and staked returns, could very well overshadow Bitcoin. A crypto duel where surprise mingles with the vertigo of speculators.

Some investments attract more attention than others in the crypto universe. This is the case with World Liberty Financial (WLFI), a project backed by members of the Trump family, which has just made a strong move with a $2.5 million investment in Ethereum via Cow Protocol. Beyond the simple purchase, this operation highlights a bold strategy and renewed confidence in the potential of the Ethereum ecosystem.

The crypto market continues to show signs of growth and adoption, particularly with the significant increase in demand for stablecoins on Ethereum's layer 2 networks. According to a recent report, Ethereum's layer 2 networks now hold over 13.5 billion dollars in stablecoins, a new historical record.

Ethereum, this giant with feet of gas, launches: fees falling, but stability wavering. The future? A leap into the unknown.

On December 18, 2024, Kraken, one of the largest crypto exchange platforms, announced the launch of its level 2 blockchain, Ink, on the Ethereum mainnet. This launch, initially planned for early 2025, was moved up due to the enthusiasm of the community and the rapid progress made by the development team.

In the arena of public blockchains, Deutsche Bank chooses Ethereum and ZKsync for its innovative response to compliance challenges, a test that could disrupt the standards of global finance.

In the ocean of cryptos, Ethereum dances. Whales are gorging themselves at 57%, and the song of analysts heralds a triumphant rise. Dark game or masterful bet?

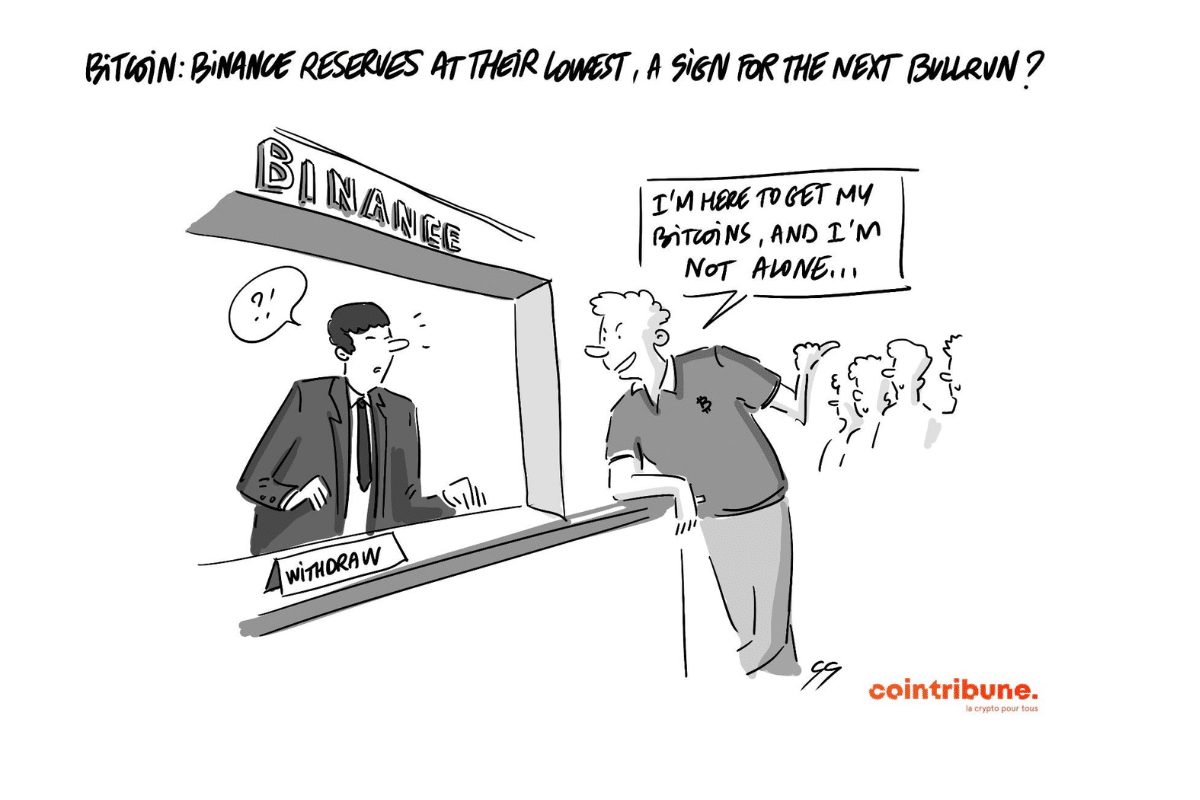

Investor exodus hits Grayscale Bitcoin Trust: 21 billion dollars evaporated in one year. The details in this article!