Risk bet! Reddit reveals to have invested a portion of its treasury in crypto. This includes Bitcoin and Ethereum!

Ethereum (ETH)

The second most popular crypto on the market is at the center of interest of an Ethereum whale. In recent days, this large investor has engaged in a frenzied activity of acquiring ethers. A trend that has not escaped the crypto community as the ether market experiences a remarkable surge.

It seems like there is no text provided for translation. Could you please provide the text you would like me to translate into the specified language with the language code "en"?

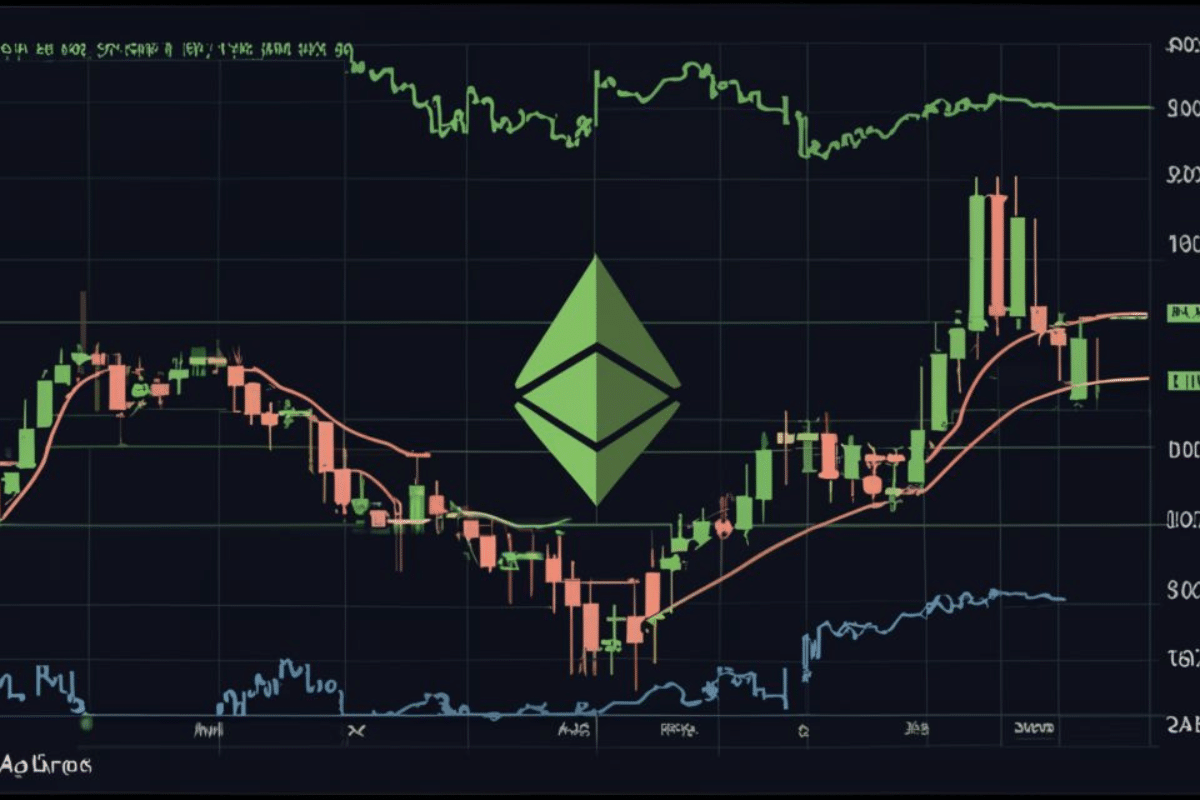

Ethereum has reached a new peak, breaking through the psychological threshold of $3,000. Let's examine the future outlook for ETH together.

The crypto project team Shiba Inu (SHIB) recently announced the launch of its latest collection of non-fungible tokens (NFTs), named "SHEboshis". This initiative marks a significant milestone for the project as it introduces the use of the ERC-404 standard, a first in the Ethereum ecosystem. The Ethereum ERC-404 standard promises to bring increased fluidity and promote the fractionalization of NFTs, thus opening up new opportunities for holders and investors. In this article, we will explore the implications of this advancement.

Dive into the world of staking: AXS, FLOKI, USDT, and other cryptocurrencies promise lucrative dividends.

In this article, discover the most promising initiatives in the field of blockchain and crypto.

Recently, Ether (ETH), the native cryptocurrency of Ethereum, has been experiencing significant momentum. The cryptocurrency is currently flirting with the $3,000 mark, sparking hope among crypto enthusiasts for the continuation of this trend with a positive effect on altcoins. A question that clearly divides analysts and experts.

Sora, OpenAI's text-to-video AI, propels AI cryptocurrencies that see their numbers rise following the announcement.

Ethereum at $2,900: what you need to know about its rise to power. The reasons for its success, challenges, and opportunities ahead.

The crypto market as a whole once again surpasses the symbolic threshold of $2 trillion in market capitalization. A sign of a strong comeback!

Vitalik Buterin, the co-founder of Ethereum, the world's second-largest blockchain, expressed enthusiasm for the advancements of "Verkle trees" on the network. This groundbreaking technology is shaping up to revolutionize staking on Ethereum.

The year 2024 is distinguished by significant developments in the cryptocurrency sector. Between Bitcoin's halving, Ripple's expansion in crypto custody, and strategic collaborations such as Solana and Filecoin, the crypto landscape is experiencing unprecedented dynamics. These developments, along with Bitcoin's rise in the global asset rankings and increased commitment from Ethereum, as well as calls for appropriate regulation of Bitcoin ETFs by U.S. banks, reflect a growing maturity and integration of cryptocurrencies into the global financial system. Here is a summary of the most notable news from the past week.

Coin Metrics conducted a study on attacks against Bitcoin and Ethereum. The result: these cryptocurrencies are immune.

The Total Value Locked (TVL) in the context of decentralized finance (DeFi) defines the total value of assets locked in DeFi protocols and smart contracts. In other words, it measures the total amount of locked and utilized cryptocurrencies in various decentralized financial services, including liquidity pools, borrowing and lending protocols, decentralized exchange (DEX) platforms, among others. TVL is often seen as an indicator of the popularity and adoption of different DeFi protocols. It acts as a barometer of this crypto ecosystem. Indeed, according to recent data, the TVL of DeFi is in its best shape thanks to the dynamism of Ethereum. This article explains the ins and outs of this trend.

In the particularly thriving context of the crypto market lately, choosing wisely to position oneself on Bitcoin or Ethereum can be quite a dilemma. These two crypto ecosystems are market leaders. But they are distinct from each other in terms of functionalities and advantages. Understanding this divergence can be crucial for crypto investment choices.

The amount of Ether (ETH) locked in smart contracts on Ethereum has reached a new record, surpassing 35% of the total supply. This strong demand reflects the increasing utility of the Ethereum network.

The ERC-404 represents a key evolution in terms of Ethereum tokens. It offers developers and investors the opportunity to create and market tokens that combine both the fungibility of ERC-20 and the uniqueness of ERC-721. This potential of the Ethereum crypto platform has been exploited by a trader who managed to generate $59,000 using this method.

From the spectacular rise of Bitcoin, reaching almost $50,000, to innovative collaborations breaking the boundaries between the traditional web and the decentralized web, the cryptocurrency ecosystem continues to demonstrate its ability to evolve and adapt to regulatory, technical, and economic challenges. Here is a summary of the most significant crypto news of the week!

The soaring rise of BTC towards $50,000, fueled by increasing institutional adoption and profitable addresses.

The crypto industry has been booming since the advent of registrations. These digital data open up new perspectives for the Bitcoin network and other platforms. On one side, there are Bitcoin Ordinal registrations that bring a new dynamic to the pioneering blockchain. On the other side, registrations on EVM-compatible blockchains like Ethereum have seen rapid growth followed by stabilization. Although their future remains uncertain, registrations are a promising track for extension to a wide range of blockchains. In this article, based on a Binance report, we explore the landscape of registrations, analyzing their impact on the Bitcoin network and EVM-compatible blockchains. This is done with a focus on platforms active in this field.

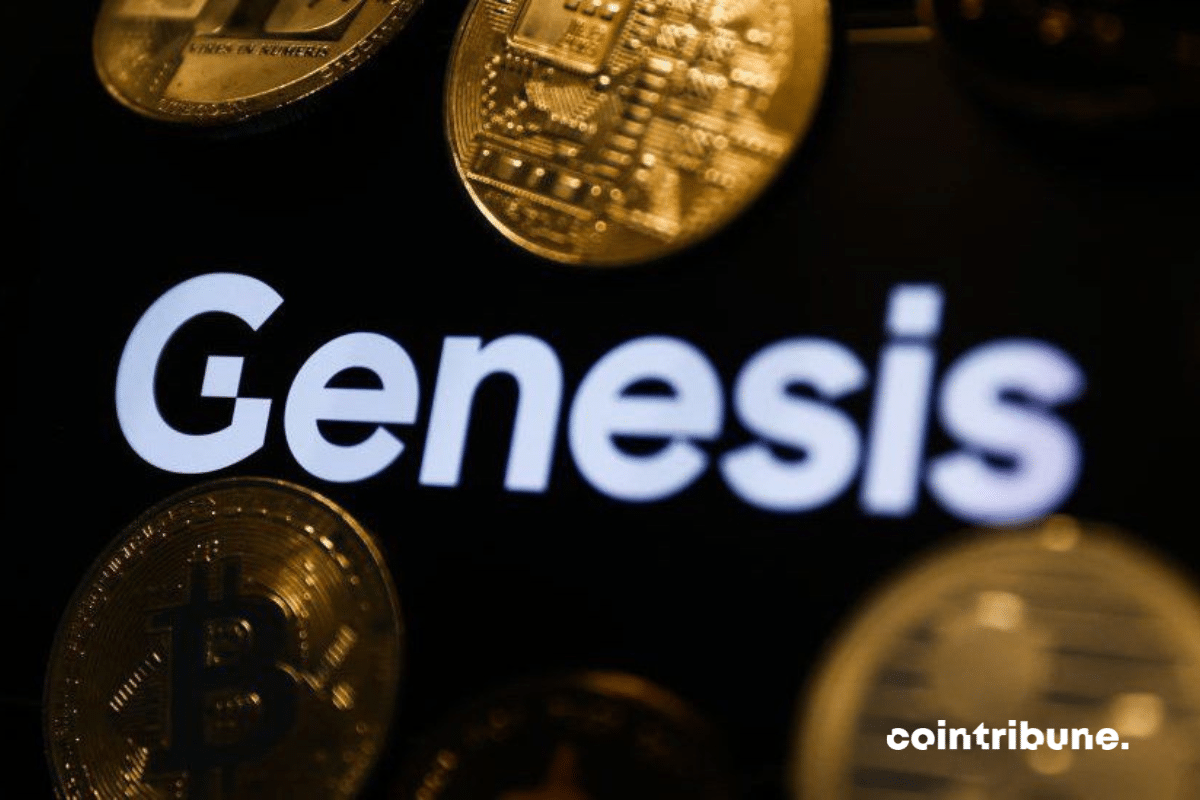

"A new massive sale of bitcoins deposited in Grayscale's GBTC ETF is looming following the resolution of the case involving bankrupt Genesis and Gemini Exchange."

Geth, acronym for Go Ethereum, is an open-source software client for the Ethereum network. It is a crucial tool for Ethereum developers, miners, validators, and users. It is in high demand due to the many crypto advantages it offers. However, excessive reliance on this tool can be harmful, according to warnings from several analysts.

Ethereum, the pioneering blockchain recognized for its crypto innovation and flexibility, has reached a historic milestone: that of 2 million daily active users. This unprecedented event not only underscores the platform's rapid growth but also heralds dizzying developmental prospects for the years to come.

The concept of Ethereum's hybrid ERC-404 token, combining fungibility and non-fungibility, paves the way for a major innovation in NFTs.

The Ethereum developers have set the date for the Dencun hard fork to March 13, 2024! This will bring major technical changes to the network.

Ethereum is facing a major challenge. The majority of its validators depend on a single software, Geth. This raises concerns.

Dencun, the Ethereum upgrade, promises more efficient data management and network costs.

The SEC delays approval of Ethereum ETFs, while predictions differ on potential future validation.

ENS and GoDaddy are revolutionizing digital identity with an unprecedented partnership, making it easier to integrate .eth and .com domains.