The recent Dencun update has catapulted Ethereum into an unprecedented era. It ushered in a revolution in the crypto universe. Suddenly, Ethereum reached a critical turning point. This update ignited a revolution, marked by an impressive surge in the value transferred. Layer 2 (L2) scaling solutions are at the heart…

Ethereum (ETH)

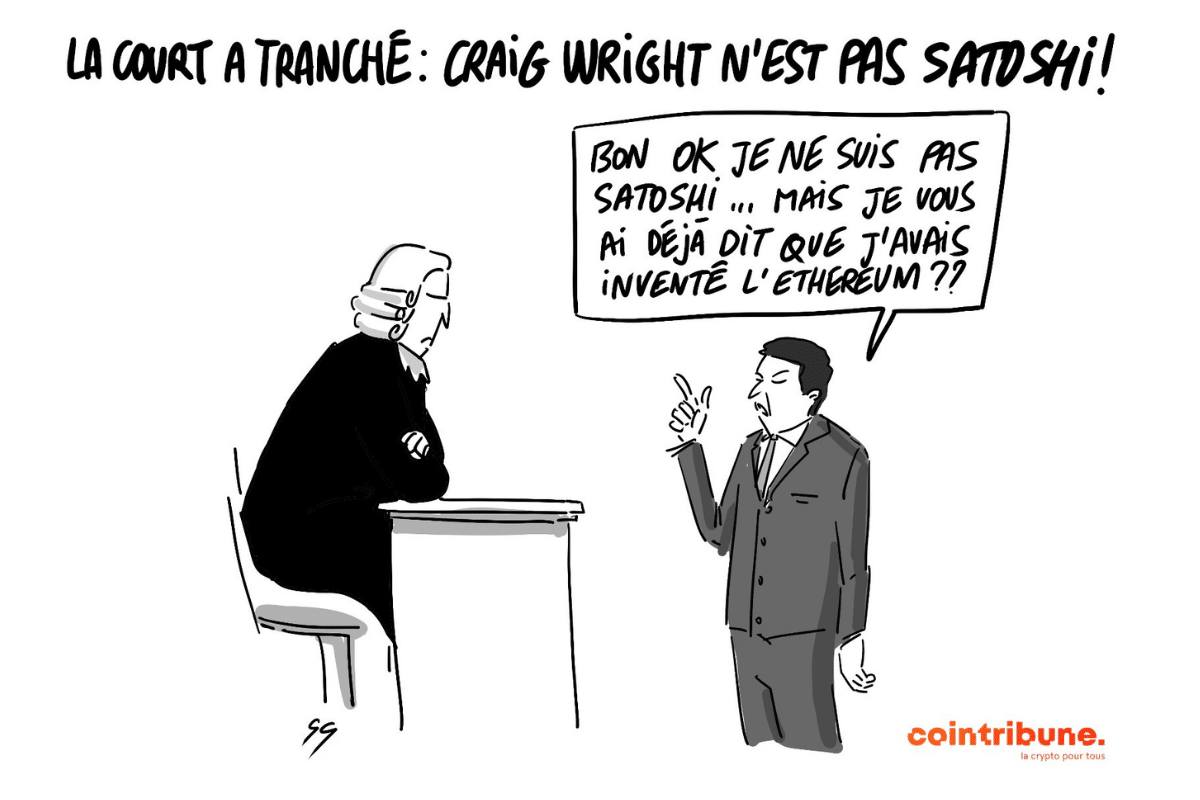

Here is a summary of the most impactful news from the past week surrounding Bitcoin, Ethereum, Solana, etc., a journey into the heart of the innovations and debates that have animated the cryptocurrency sector in recent days.

Solana's success contrasts with the losses of Bitcoin, Ethereum, and Dogecoin, a sign of relative stability.

The United States and Asia lead in cryptocurrency gains. An overview of the national market performances.

Senators Jack Reed and Laphonza Butler, both Democrats, urge SEC Chairman Gary Gensler to stop approving new crypto ETFs. They highlight the risks of fraud and manipulation inherent in these still immature markets.

Dencun did not allow ETH to start a bull run, raising questions among investors.

Rapid rise of XRP, paving the way for speculation about its inclusion in an ETF in the near future.

Explore how Ethereum Dencun and Proto-Danksharding are propelling the crypto towards a nearly fee-less transaction future!

Upgrading Dencun will definitely impact the price of Ethereum crypto. Here's what cryptography experts think!

Ethereum recorded an increase of over 11% last week after crossing the $3,500 threshold. Let’s examine the future outlook for ETH together. State of Ethereum (ETH) After testing the $3,300 zone, the Ethereum price continued its rise, reaching new highs. At the time of writing, one Ether is trading at…

Behind the scenes of the cryptosphere, Solana, nicknamed the "Ethereum Killer," is making noise. Figures reveal its rise to power, surpassing Ethereum on several fronts: daily activities, NFTs, stablecoins, etc. Vitalik Buterin and his team must step up their efforts to not lose their lead against this emerging rival.

While the crypto industry eagerly awaits SEC approval for Ethereum Spot ETFs, Bloomberg's top analyst Eric Balchunas sounds the alarm. The US regulator's silence towards potential fund issuers does not bode well, according to him.

EIP-4844 upgrade on Ethereum promises drastically reduced L2 transaction fees! Facilitating mass adoption!

Faced with the threat of quantum computers, Ethereum is preparing to engage in a decisive battle with a revolutionary hard fork!

From the skyrocketing rise of Bitcoin surpassing $70,000, driven by increased scarcity and massive institutional demand, to Coinbase's critical examination of the viability of AI-linked cryptos, the crypto landscape is constantly evolving. BlackRock is shaking up the investment world by becoming the largest Bitcoin holder, while Ethereum faces challenges with the surge in transaction fees. Bitcoin breaks new records with blocks reaching 3.97 MB and Solana defies expectations with record volumes on DEX.

The sharp analysis of the recent spikes in Ethereum fees foreshadows a real upheaval with the arrival of the Dencun upgrade

Ether (ETH), the second most popular crypto on the market, is attracting investor attention with its outstanding performance. Like bitcoin (BTC) which it follows, it has reached a historic price record of $3,800. Here's how analysts explain this surge in strength.

In the world of cryptocurrencies, highs and lows follow each other, leaving investors in a whirlwind of emotions. Just as we celebrated the peaks reached by Bitcoin, the cryptographic market plunges once again into the abyss of red.

We’re thrilled to announce the beta release of StakeLab, a revolutionary staking platform designed to empower users across hundreds of networks. StakeLab, an infrastructure company dedicated to run validators across Cosmos, Lukso, Ethereum, and other proof-of-stake blockchains, is proud to unveil a cutting-edge staking application that simplifies the staking process…

I'm sorry, but it seems that there is no text provided for translation. Please provide the text that needs to be translated into the specified language.

The SEC (Securities and Exchange Commission) has postponed its decision regarding the approval of BlackRock's Ethereum ETF.

The SEC is undecided on BlackRock's Ethereum ETF, leaving the future of crypto investment uncertain. Details in this article.

Tether surpasses $100 billion, dominating the stablecoin market with record growth.

The past week has been particularly rich in major developments for the crypto sector. From the imminent Bitcoin halving that promises to reshape the mining landscape to the announcement of the successful deployment of the Dencun upgrade on Ethereum's testnets, along with Binance's asset recovery initiatives and Ripple's legal challenges, each event carries the potential to redefine the future of the crypto market. This article provides an overview of the most significant news and gives you an essential insight to understand current dynamics and anticipate future movements in the crypto space.

Propelled by the success of Bitcoin ETFs, Jim Cramer makes a surprising prediction about the future of Ethereum ETFs!

The Ethereum Foundation has just announced the official launch of the Dencun upgrade on the testnets!

The recent Ethereum rally rekindles interest in the altcoin market, according to Bitfinex analysts. The crypto star could be paving the way for a new altcoin season.

Crypto: Explore the reasons behind Ethereum's impressive rally in the DeFi sector, illustrating its rise towards $3,500.

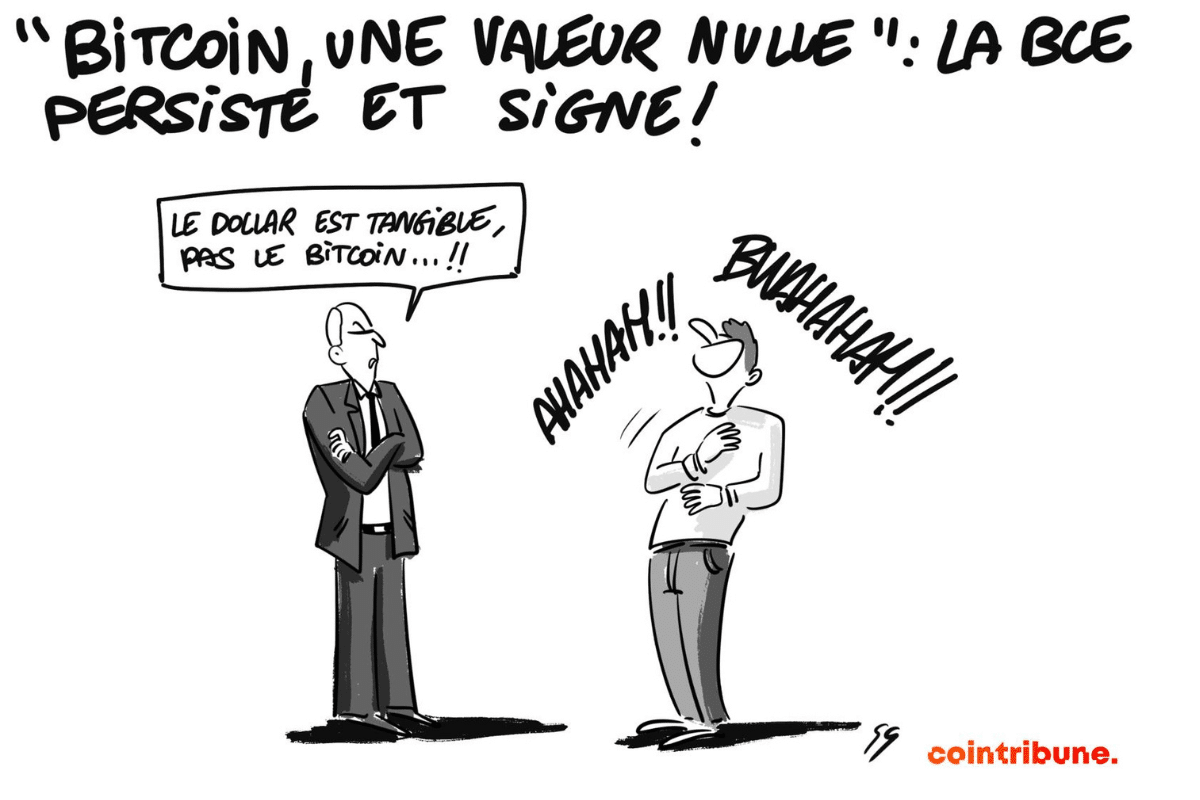

From the European Central Bank's strong stance on Bitcoin to the record fine imposed on Binance, including the innovative initiatives of Brave with Solana and Paris Saint-Germain's historic entry into blockchain validation, not to mention the surprising developments around AI with OpenAI's Sora, the past week has been filled with significant events. Here is your traditional summary of the news that has dominated the sector in recent days!

Currently, Ether (ETH), Ethereum's native cryptocurrency, is on fire. Recently, the second major crypto in the market made headlines when it reached a level it hadn't approached since 2021. But its bullish momentum doesn't seem to want to stop. ETH has broken the $3,000 resistance, greatly aided by operational advancements from Uniswap, a decentralized trading protocol built on Ethereum.