As Bitcoin approaches new highs, the prospects for an Ethereum ETF are dimming, underscoring the persistent regulatory challenges.

Ethereum (ETH)

The Ethereum Foundation wants to once again modify the monetary policy of Ethereum. The growing number of validators is the issue at hand.

Ethereum shows spectacular growth in the first quarter of 2024, tripling its profits and earning $1.2 billion in revenue from transaction fees. The network appears to be thriving despite high usage costs for crypto users.

The Securities and Exchange Commission (SEC) decision on Ethereum spot ETF applications is expected to come in May. In the meantime, the regulator is following the procedure of considering public opinions and concerns before making a decision. This was notably the case for Bitcoin Spot ETFs.

Restaking is a new evolution of staking in decentralized finance (DeFi). This new form of staking allows users to reuse their already staked cryptos to secure other decentralized protocols and products. This emerging trend offers not only opportunities but also significant risks for Ethereum.

Explore the 5 major crypto events in April 2024 that will make the markets more volatile than ever!

A deep dive into Vitalik Buterin's statements on Layer 3 and lighter alternatives for the Ethereum ecosystem.

Investors are rushing towards memecoins as major cryptocurrencies face financial difficulties.

Bitcoin is plagued by uncertainty as Ether gains strength in the turmoil of the cryptocurrency market.

The spectacular rise in the valuation of ether (ETH), the native crypto of Ethereum, is not the only positive trend of the platform in recent months. According to the latest data, there is an increase in the total number of Ethereum wallets. Their number has reached a historic record.

The bold statements by Nick White, COO of Celestia, about Solana's potential to dethrone Ethereum are making waves in the crypto universe. Let's revisit the strengths that make Solana a strong competitor in the race for the most efficient blockchain.

Ethereum is facing a dilemma with the growing number of validators, highlighting security issues.

A new trend of crypto data registration on Ethereum is causing an unexpected surge in storage costs via blobs.

After the successful launch of the Bitcoin ETF, Fidelity files for an Ethereum ETF with the crypto regulator

After hitting a low point at $3,050, Ethereum recorded a 20% increase. Let's examine together the future prospects for ETH.

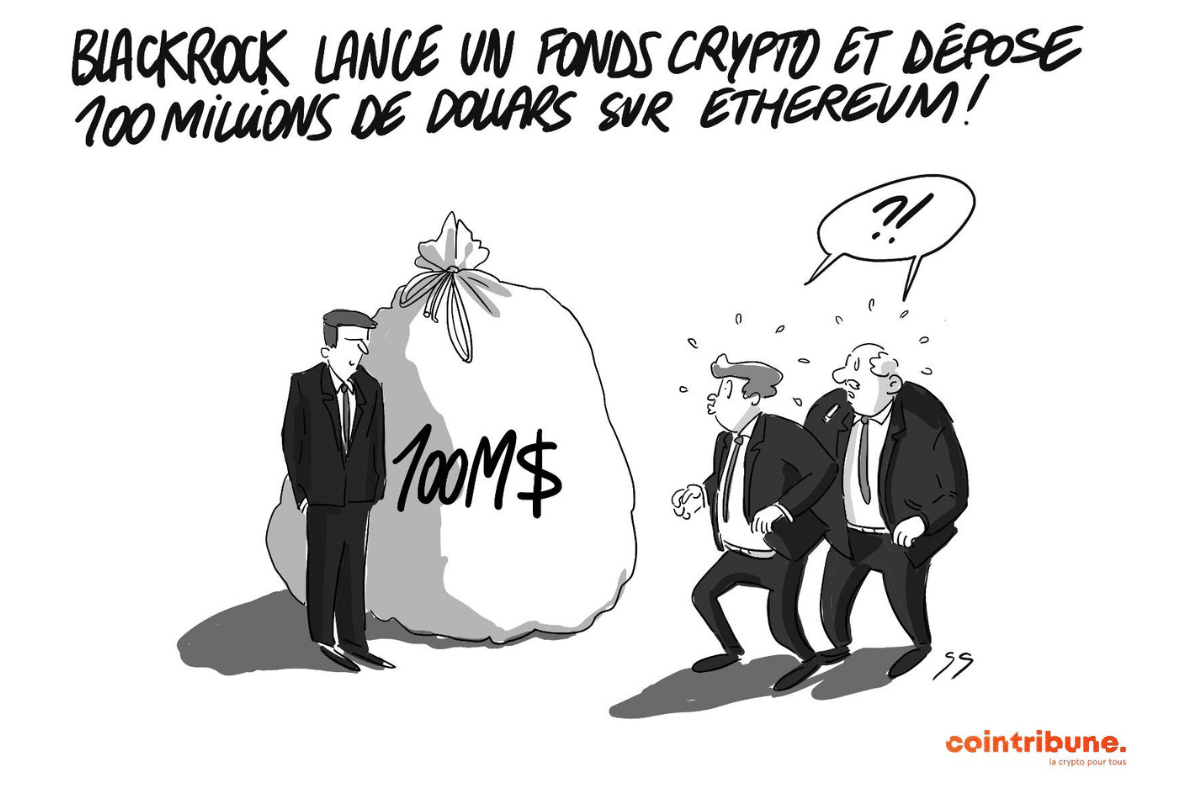

The asset management giant BlackRock is making a notable entry into the tokenization sector with the launch of its first fund on the Ethereum blockchain. A decision that could well accelerate the institutional adoption of digital assets.

Solana took the lead in the crypto ranking in terms of weekly stablecoin transfer volume, surpassing Ethereum and other major blockchains. This remarkable performance is driven by the growing interest in memecoins, DeFi, and the widespread adoption of USDC.

In finance, crypto has become an indispensable player, pushing back the traditional boundaries of investment and paving the way for unprecedented innovations. At the heart of this revolution, Ether exchange-traded funds (ETFs) are garnering attention, embodying both hope and challenge in the face of regulators. Grayscale, a pioneer in the field of crypto investment, boldly positions itself against the hesitations of the U.S. SEC, carrying the torch of optimism for the future of Ether ETFs.

In the crypto markets, the battle between Bitcoin and Altcoins is raging this week. While BTC consolidates, Altcoins are gaining ground in the market. Are we on the cusp of the famous altcoin season?

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic challenges. Here is a summary of the most impactful news of the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

Despite price volatility, Solana is experiencing exponential network growth, defying expectations.

The SEC is taking a very close look at the Ethereum foundation and appears determined to categorize it as a "security," which would jeopardize ETF hopes.

The price of Ethereum (ETH) jumps by more than 10%, surpassing $3,400. Here is an analysis of the key resistances and supports to watch.

A mysterious state authority targets the Ethereum Foundation, challenging the very principle of crypto decentralization!

After reaching the $4,000 threshold, Ethereum has entered a corrective phase of 25%. Let’s examine the future outlook for ETH together. Situation of Ethereum (ETH) After marking a high at $4,100, the price of Ethereum has begun a downward movement, countering its last bullish phase active since $2,100. Indeed, the…

As the crypto market experiences a plunge, investors who have been actively positioned in ether are cashing out their gains. In this context, a trend towards selling is being observed among several large investors. This dynamic is fueling speculation about the prospects of the crypto.

BlackRock makes a smashing entry into the world of digital assets by launching a revolutionary crypto fund!

The collapse of cryptocurrencies highlights the fragility of the market, prompting caution and prudence.

Solana is gearing up to challenge Ethereum after surpassing Binance Coin. Tight competition in the crypto world.

The SEC could approve Ethereum Spot ETFs in May, according to a crypto analysis by My Betting Edge. Details in this article.